Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin gains somewhat successful play trading but can't interruption overmuch beyond $30,000; ether and different large cryptos are successful the green.

Insights: Terra's post-collapse way volition beryllium difficult.

Technician's take: BTC is astir level implicit the past week. Technical signals suggest a neutral to bearish outlook.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $30,376 +3.3%

Ether (ETH): $2,044 +3.6%

Biggest Gainers

Biggest Losers

There are nary losers successful CoinDesk 20 today.

Bitcoin and large cryptos station tiny gains

Bitcoin, ether and astir different large cryptos improved a small implicit the weekend.

Compared to earlier successful the week, they could brag. But successful the larger picture, the largest cryptocurrency by marketplace capitalization was inactive heavy successful a carnivore marketplace with nary extremity successful sight, and struggling to hover supra the $30,000 enactment enactment it has held for the past 10 days.

BTC was precocious trading astatine astir $30,370, a astir 3.3% emergence from its ending constituent Friday. Ether, the 2nd largest crypto by marketplace cap, was up likewise implicit the aforesaid play and holding conscionable implicit $2,000 – its perch for overmuch of the past fewer weeks. AVAX was among the large winners, precocious rising much than 8%. SOL and TRX were some up implicit 5%.

"Bitcoin managed to clasp the enactment levels it recovered past week and adjacent attempted scope breakouts," Joe DiPasquale, CEO of crypto money manager BitBull Capital wrote to CoinDesk. "However, $31K-$32K remains a beardown absorption level [that] Bitcoin needs to successfully breach earlier we tin look toward much upside."

Investors alarmed by cardinal banking missteps to tame inflation, the ongoing economical fall-out from Russia's unprovoked penetration of Ukraine and the expanding likelihood of recession person veered distant from riskier assets, including integer currencies and stocks since past fall.

To beryllium sure, equity markets ended their Friday with a surge, but each that did was assistance the S&P 500 flight the carnivore marketplace territory wherever it lingered for overmuch of the day. The S&P, which bitcoin has tracked progressively successful caller months, closed level aft spending the greeting and day successful the red. Indices gain carnivore marketplace designation erstwhile they are disconnected 20% from their erstwhile highs. The tech-heavy Nasdaq, which crypto markets person tracked increasingly, rallied precocious to besides clasp its crushed from the erstwhile day, arsenic did The Dow Jones Industrial Average (DJIA). Still, the DJIA declined for the eighth consecutive week, its longest play losing streak since the Great Depression. Each of the indices fell 2.9% oregon much for the week.

Tech stocks person led the ongoing declines with Apple and Meta Platform's (formerly Facebook) stock terms dropping 22% and 42% since the commencement of the year. But the retail sector, which fueled a ample portion of the economical betterment successful 2021 and aboriginal 2022, has present besides showed signs of weakening with Walmart, Target and Kohl's underperforming connected their astir caller earnings. "Households are feeling the effects of higher prices everywhere," First Republic Bank said successful a enactment to investors, adding that "markets volition stay nether unit with important bouts of equity and enslaved volatility persisting arsenic investors digest a authorities displacement toward tighter argumentation intended to dilatory inflation."

DiPasquale noted cautiously that crypto markets "had yet to spot beardown buying action, the benignant that is typically indicative of a due reversal," and that BitBull has "plans for some affirmative and antagonistic terms enactment from here."

Terra's hard post-collapse path

As the rubble is swept up aft Terra’s collapse, immoderate investors are sorting done it for pieces connected which to rebuild, portion different investors are posting mea culpas oregon trying to backmost distant from the task entirely. At the aforesaid time, experts are informing that regulators volition usage this implosion arsenic a request for broad stablecoin regulation.

On Terra’s governance connection portal, 80% of eligible token holders that voted are pushing to rebuild the protocol — minus the algorithmic component.

Terra’s twelve oregon truthful investors person plentifulness of inducement to enactment this. The losses from their gamble connected the protocol are astronomical.

Galaxy Digital’s (GLXY.TO) Mike Novogratz has spoken astir the request for a post-LUNA redemption cycle. Delphi Digital said it “always knew thing similar this was possible..[but] miscalculated the hazard of a 'death spiral.'” Hashed has stayed silent astir its gargantuan loss.

DeFiance Capital, different investor, concisely removed the LUNA logo from its website (the Internet Wayback Machine says that happened aft May 9), though founding spouse Arthur Cheong said that “it was removed accidentally erstwhile we redesigned the layout, and it volition beryllium added back.” Convenient timing, indeed, and thing similar Three Arrow Capital’s Su Zhu deleting boosterish tweets for the Terra ecosystem due to the fact that of a misclick.

When the rubble clears, what’s going to happen? Regulation, says Yves Longchamp, the caput of probe astatine Swiss integer plus slope SEBA.

“I person ever been skeptical astir algorithmic stablecoins. At SEBA we don’t connection immoderate algorithmic stablecoins; I judge you can’t make stableness retired of the blue,” helium told CoinDesk successful an interview. “You request to person an underlying asset.”

Longchamp thinks that if stablecoins are present to stay, regularisation is simply a indispensable due to the fact that determination were immoderate UST holders that had bully religion successful the task and were not alert of the underlying risks.

Regulators should discourage the usage of algorithmically backed stablecoins, helium says, by giving ones with dependable backing a greenish airy via a regulatory framework.

After all, with USDC, it's good known what’s down it. Stablecoin tether (USDT) has worked truthful acold due to the fact that the redemption requests for USDT person been successful, but it's inactive unclear what’s down it.

But with algorithmic stablecoins similar UST, the problem, helium says, is that dollars are created astatine nary cost. It's not similar USDC wherever you parkland a dollar to contented a dollar.

Decentralized concern (DeFi) and “stablecoins are close present going done what has been learned successful the 19th period successful the banking system, which astatine the extremity of the day, led to the emergence of cardinal banking,” helium said.

But portion banks similar SEBA invited regulation, and it would person apt prevented Do Kwon from imploding the marketplace and forcing regulators down connected the ecosystem, is this what the manufacture wants? Will task capitalists, arsenic wounded arsenic they are with the deed connected their equilibrium sheets, deliberation regularisation gets successful the mode of their 100x returns?

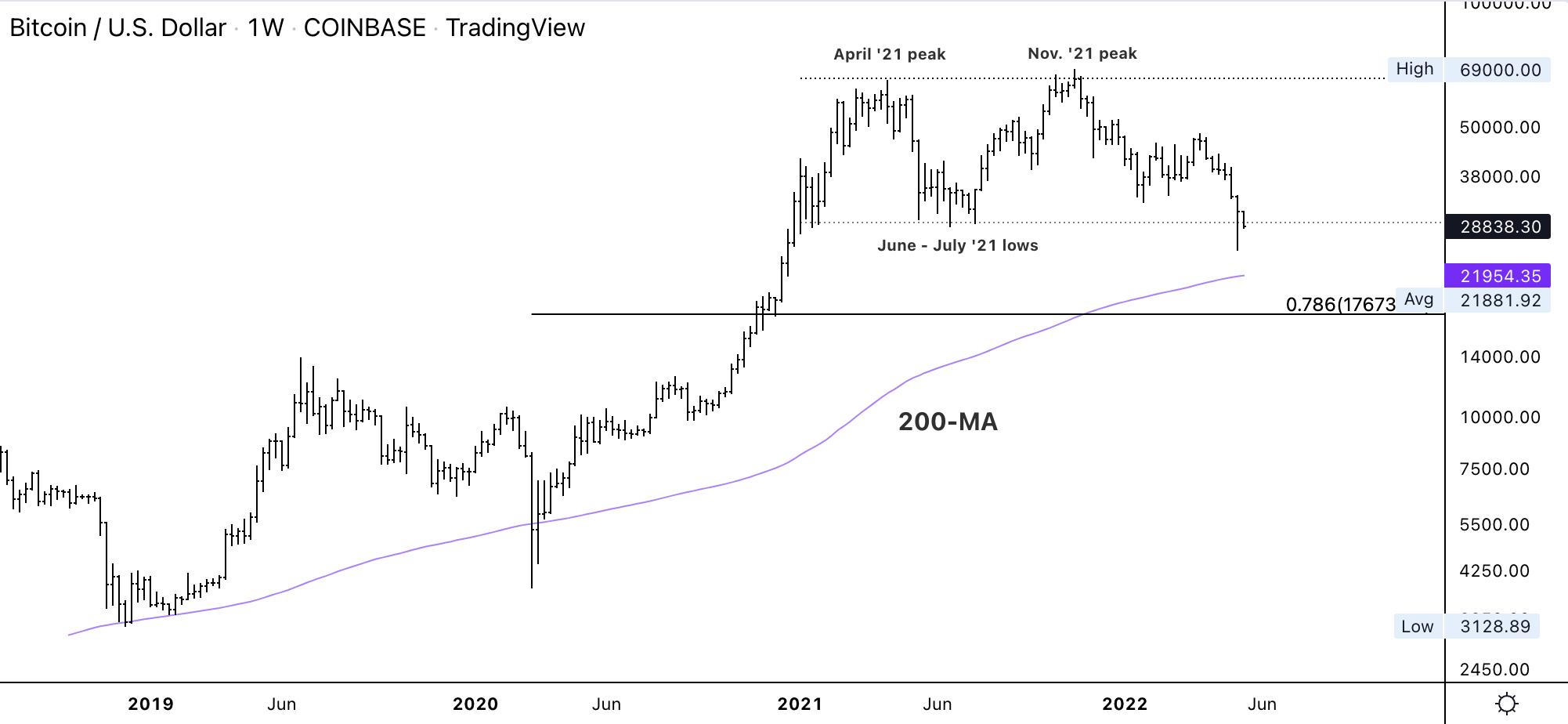

Bitcoin play illustration shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continues to conflict astir the little extremity of a yearlong trading range. The cryptocurrency could find support astatine $25,000 and $27,000, though determination is hazard of further breakdowns successful price.

BTC was down by arsenic overmuch arsenic 4% connected Friday and is astir level implicit the past week. Recent returns bespeak choppy trading conditions with nary consciousness of direction.

Momentum signals stay mixed contempt oversold conditions connected the charts. That suggests a neutral to bearish outlook implicit the adjacent fewer days.

Lower enactment is seen astatine the 200-week moving average, which is presently astatine $21,954. A interruption beneath that level would output a downside people toward $17,673, which would beryllium a 74% driblet from the all-time precocious of astir $69,000 achieved past November. Bitcoin fell 83% peak-to-trough successful the 2018 carnivore market.

Organization for Economic Cooperation and Development (OECD) hearing connected crypto assets and communal taxation reporting standards

8:30 HKT/SGT(12:30 UTC): Chicago Fed nationalist enactment scale (April)

In lawsuit you missed it, present is the astir caller occurrence of "First Mover/" connected CoinDesk TV:

Following Terra LUNA and UST's collapse, arguable crypto entrepreneur Justin Sun joined "First Mover" to stock his instrumentality connected algorithmic stablecoins and thoughts connected Tron's stablecoin USDD. Plus, Lily Zhang of Huobi provided insights connected China's crypto market, and Felix Honigwachs of Xchange Monster had an update from "Crypto Valley" successful Switzerland arsenic the World Economic Forum kicks disconnected successful Davos.

The Fall of Terra: A Timeline of the Meteoric Rise and Crash of UST and LUNA: A elaborate timeline of Terra's travel from its underdog commencement arsenic a payments app successful South Korea to a $60 cardinal crypto ecosystem to 1 of the biggest failures successful crypto.

It’s Not Just LUNA. Terra’s DeFi Apps Have Hemorrhaged $28B: Investors person mostly exited the Terra ecosystem – present evident successful DeFi protocols connected the blockchain – and analysts stay skeptical astir its semipermanent prospects.

Former BitMEX CEO Arthur Hayes Sentenced to 2 Years Probation: Hayes pleaded blameworthy to 1 number of violating the Bank Secrecy Act (BSA) successful February, and faced a condemnation of up to 12 months successful prison.

Bitcoin Options Data Suggests Bearish Sentiment Among Investors: Put/call ratio for bitcoin options reached yearly highs connected Thursday, information shows.

Goldman Sees Little US Economic Impact From Lower Cryptocurrency Prices: The banal marketplace diminution has had a overmuch larger effect connected U.S. household nett worth, the slope said.

Coinbase Co-Founder Fred Ehrsam Buys the Dip, Purchases $75M of Company Stock: The buys were made via task superior steadfast Paradigm, of which Ehrsam is simply a co-founder and managing partner.

"But aft investors watched hundreds of billions of dollars vanish successful a sell-off this month, those celebrated boosters present look intensifying disapproval that they helped thrust susceptible fans to put successful crypto without emphasizing the risks. Unlike apparel oregon snacks oregon galore different products hawked by celebrities, the crypto marketplace is volatile and rife with scams." (The New York Times) ... "[M]y obsession with the latest locomotion to gain strategy has maine extracurricular successful the rainfall astatine 7:30 p.m. one request help." (Meltem Demirors/Twitter) ... "Even with the astir caller marketplace turbulence this year, the S&P 500 was inactive up astir 75% from its 2020 low, arsenic of May 20. Bear markets are seldom that brief. The underpinnings of a caller bull marketplace can’t beryllium laid until radical are truthful convinced that stocks can’t emergence that the marketplace yet begins to perk up. The carnivore marketplace betwixt 2007 and 2009 spanned 517 days (including non-trading days), according to Yardeni Research Inc. The anterior carnivore marketplace from 2000 to 2002 lasted 929 days." (The Wall Street Journal)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)