Good morning. Here’s what’s happening:

Insights: The renminbi is connected the rise; the eCNY face-plants astatine the Winter Olympics. Cryptos tumble implicit the weekend.

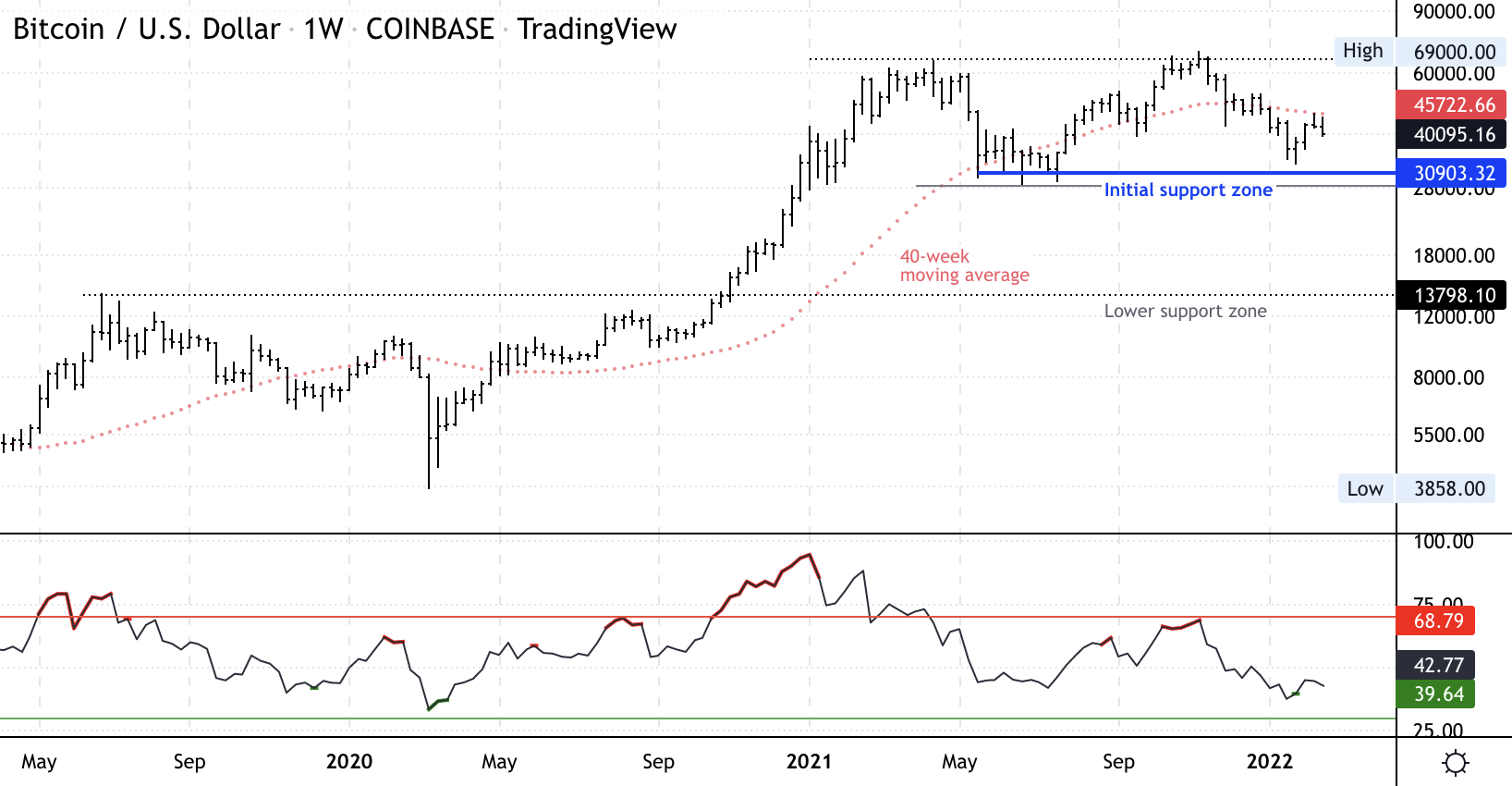

Technician's take: BTC momentum signals stay negative, indicating accordant selling unit implicit the past month.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $38,724 -3.3%

Ether (ETH): $2,649 -3.8%

Bitcoin tumbled beneath $40,000 successful the aboriginal play hours and kept dipping amid rising tensions connected the Ukraine-Russia borderline and continued inflationary fears. Ether and astir each different large cryptos besides dropped.

A imaginable exploit of OpenSea, the starring NFT platform, whitethorn person further frightened investors distant from crypto.

All these factors whitethorn person "led investors to risk-off from crypto," said Joe DiPasquale, the CEO of money manager BitBull Capital.

At the clip of publication, bitcoin was trading astatine astir $38,700, a 3.3% driblet implicit the past 24 hours and its lowest level since Feb. 3. Ether, the 2nd largest cryptocurrency by marketplace capitalization, was changing hands astatine somewhat implicit $2,600, disconnected astir 4% and its lowest constituent since the archetypal week of the month.

The declines came arsenic U.S. quality reported that Russia had already decided to invade Ukraine. On Sunday, U.S. Secretary of State Antony Blinken told CNN's State of the Union speech amusement that “everything starring up to the existent penetration appears to beryllium taking place. All of these false-flag operations, each these provocations to make justifications — each that is already successful train.” Meanwhile, investors were gearing for the archetypal of what is expected to beryllium respective Federal Reserve involvement complaint hikes.

Separately, successful a precocious Saturday tweet, OpenSea CEO Devin Finzer wrote that “32 users frankincense acold person signed a malicious payload from an attacker, and immoderate of their NFTs were stolen.” Finzer suggested that a fraudulent website whitethorn beryllium to blame. OpenSea said successful a abstracted tweet that it was investigating the incident.

DiPasquale sees the adjacent Bitcoin enactment enactment astatine astir $35,000.

He noted that Solana was the lone altcoin among the apical 20 by marketplace headdress connected the CoinDesk terms leafage to emergence implicit the weekend, reflecting "some spot from investors owed to being a Proof of Stake protocol." But DiPasquale called that summation "simply terms recovery" due to the fact that Solana had fallen much sharply than Bitcoin and different altcoins. "While Bitcoin is mostly level for February, Solana is inactive down, truthful its betterment simply returns it person to parity of gains and losses for different crypto assets."

PetroYuan, Digital Yuan, More Like One Big Yawn!

As past week came to a adjacent successful Asia, Chinese authorities media reported that China’s currency, the renminbi, was connected the rise. Citing information from SWIFT, accepted finance's closed ledger for interbank money transfer, China media said the worth of RMB payments accrued by 10.85% compared with December. Now, the RMB accounts for 3.2% of each transactions worldwide, up from 2% successful November. Meanwhile, Britain’s lb accounts for 6.3% of planetary transactions.

In galore ways, this is the capstone of 2 different RMB-related stories from the week: a reiteration of an announcement that state shaper Gazprom Neft volition judge the RMB alternatively of dollars for fueling Russian airplanes astatine China’s airports, and China’s cardinal slope integer currency (CBDC), the eCNY, made its Winter Olympics debut wrong the games’ closed loop.

But neither of these stories are arsenic earth-shattering arsenic Beijing mightiness person hoped.

Inbound flights into China sank to astir 500 per week from 10,000 pre-coronavirus pandemic; lone a fraction of these are from Russia. Oil is inactive priced globally successful U.S. dollars (USD).

As for the eCNY, the Olympics were expected to beryllium its coming-out party, wherever overseas tourists would speech their greenbacks oregon euros for immoderate saccharine reminbi issued connected a integer ledger. But the borders are inactive closed. No overseas tourists are invited. Locals that were capable to be the games utilized eCNY astatine venues — currency was barred — portion the fewer foreigners successful attendance utilized Visa, the authoritative recognition paper spouse of the games.

Foreigners astatine the games, arsenic The Wall Street Journal reported, preferred to usage Visa. “What’s the quality from utilizing my Visa paper then?” 1 asked erstwhile they were told they could load their overseas currency onto a integrative eCNY paper oregon hardware wallet. And for the much distant venues that didn’t person a eCNY scholar earlier they were sealed disconnected from the extracurricular satellite arsenic portion of the Olympic bubble, it was backmost to AliPay oregon WeChat Pay, the favourite outgo mechanics for galore successful China.

All of this is simply a micro illustration of a macro occupation for China. When it comes to integer currency, the USD is inactive king. In 2020, Chainalysis reported that $50 cardinal successful superior flowed retired from China successful crypto and mostly successful dollar-pegged tether.

As Bloomberg commodity strategist Mike McGlone has pointed out, the champion happening for the dollar is crypto.

“Despite the shrinking U.S. information of the world’s GDP, the dollar progressively dominates, notably successful the integer ecosystem,” McGlone wrote successful April 2021. “There appears to beryllium small to halt the astir accordant trends successful crypto assets: rising trading measurement and the proliferation of stablecoins tracking the dollar.”

And these stablecoins presently person a marketplace headdress of $183 billion, according to CoinGecko, with tether dominating by a ample margin. You person to scroll down to the eighteenth presumption to find a non-USD oregon golden stablecoin, and that’s tether paired with the euro with a measly marketplace headdress of $234 million.

The fewer yuan that are allowed to permission the state person a circumstantial pathway to the extracurricular satellite via Hong Kong’s immense "offshore" RMB liquidity pools wherever they extremity up being converted to the freely convertible Hong Kong dollar, the archetypal "stablecoin" with its USD peg.

“I wouldn’t privation to instrumentality Chinese integer currency anymore than I’d privation to instrumentality renminbi,” helium said. “If you digitize [the] renminbi, you are inactive stuck with astir of the problems that you person with existent governmental currency, with fiat currency.”

Bitcoin play illustration shows support/resistance with RSI connected bottommost (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) remains successful its short-term downtrend begun successful November, presently disconnected 40% from its all-time precocious adjacent $69,000. The cryptocurrency tested archetypal enactment astatine $40,000 connected Friday, though stronger enactment is seen astatine $30,000, which was astir the bottommost of 2021's sell-off.

Momentum signals stay negative, indicating accordant selling unit implicit the past month. Further, BTC was incapable to interruption supra its 40-week moving mean astatine $45,724, which presents a bearish bias.

Still, the comparative spot scale (RSI) connected the play illustration is rising from its astir oversold level since March 2020. That could support short-term buyers progressive truthful agelong arsenic the $30,000 enactment level holds.

If the $28,000-$30,000 scope is broken, prices could acquisition further downside, akin to the 80% peak-to-trough diminution during the 2018 carnivore market.

8:15 a.m. HKT/SGT (12:15 a.m. UTC): Markit Economics/France manufacturing purchasing managers scale (Feb. preliminary)

8:30 a.m. HKT/SGT (12:30 a.m. UTC): Markit Economics/Germany manufacturing purchasing managers scale (Feb. preliminary)

9 a.m. HKT/SGT (1 a.m. UTC): Markit Economics/Eurozone manufacturing purchasing managers scale (Feb. preliminary)

11:50 p.m. HKT/SGT (3:50 UTC): Japan firm work terms scale (Jan. YoY)

Live from ETHDenver, "First Mover" big Christine Lee had highlights from the large Ethereum conference, including an interrogation with Polkadot pb developer Shawn Tabrizi. Also, Bitstamp USA CEO Bobby Zagotta joined Christine and co-host Lawrence Lewitinn to sermon crypto markets and lessons learned from large speech hacks. Zagotta was besides joined by Immortals CEO Jordan Sherman to sermon their caller esports partnership. Plus, Sergey Gorbunov of Axelar discussed the caller backing circular that gave them unicorn status.

"Our leadership, engineering, and information teams are communicating with affected users to stitchery details. We proceed to judge that this is simply a phishing onslaught that originated extracurricular of http://opensea.io. (OpenSea/Twitter) ... "Maybe crypto’s full marketplace headdress settling determination betwixt $1.5 trillion and $3.0 trillion for the past twelvemonth oregon truthful changed minds astatine BlackRock. Maybe it was Jump Trading yet diving into crypto successful September. Maybe capable Zoomers pestered their high-net-worth parents astir cryptocurrencies astatine meal tables until it deed a tipping point. Whatever the catalyst, I deliberation the quality is acold much important than radical are giving it recognition for. BlackRock wouldn’t research thing if determination wasn’t request for it." (CoinDesk columnist George Kaloudis) ... “Everything starring up to the existent penetration appears to beryllium taking place. All of these false-flag operations, each these provocations to make justifications — each that is already successful train.” (U.S. Secretary of State Antony J. Blinken/CNN’s “State of the Union)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)