Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin and different large cryptos spot green, but marketplace sentiment remains bearish.

Insights: Investors alteration their stablecoin preferences.

Technician's take: BTC is connected way to registry a affirmative momentum awesome connected the regular chart.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $30,466 +1.6%

Ether (ETH): $2,092 +3.1%

Biggest Gainers

Biggest Losers

There are nary losers successful CoinDesk 20 today.

Bitcoin and different large cryptos spot green

Bitcoin and different large cryptos were mostly successful the greenish precocious Tuesday arsenic the marketplace continued to solidify, but the tiny surge seemed much a impermanent reprieve than oversea alteration successful bearish sentiment that intensified past week during terraUSD stablecoin (UST) implosion.

The largest cryptocurrency by marketplace capitalization was precocious trading implicit $30,400, a much than 1% summation implicit the past 24 hours. Ether was up astir 3% during the aforesaid period, maintaining its astir frequent, caller perch supra $2,000. ALGO and MATIC each roseate implicit 7%. SOL, CRO and ADA recovered from midday drops and were up astir 4%.

"The clang of [Terra’s] UST stablecoin has heralded the extremity of a momentous bull run," Yield App CEO and laminitis Tim Frost wrote successful an email. "The marketplace is 54% below" its "all-time precocious and won’t beryllium climbing acold immoderate clip soon arsenic we look what looks acceptable to beryllium a painfully prolonged carnivore market."

Cryptos traced equity markets, which roseate amid encouraging U.S. retail spending and concern accumulation reports and cautiously optimistic remarks by U.S. cardinal slope Chair Jerome Powell. The tech-focused Nasdaq jumped 2.7%, portion the the S&P 500 and Dow Jones Industrial Average roseate 2% and 1.3%, respectively.

The U.S. Commerce Department said connected Tuesday that retail income had risen 0.9% successful April, the 4th consecutive monthly summation and grounds that surging ostentation has not wholly dampened consumers' appetites for goods and services. The study noted accrued spending connected electronics, cars and clothing, adjacent arsenic consumers spent little connected gas, which has been a superior root of the caller months' outgo run-ups. Meanwhile, the Federal Reserve said that Industrial accumulation roseate 1.1% successful April, besides its 4th consecutive monthly gain.

In remarks astatine The Wall Street Journal's Future of Everything Festival connected Tuesday, Powell called “restoring terms stableness a nonnegotiable need." "It is thing we person to do," helium said, adding that helium was hopeful the Fed could tame ostentation without triggering immense increases successful unemployment oregon a heavy recession. "It is simply a challenging task, made much challenging the past mates months due to the fact that of planetary events,” Powell said. “It is challenging due to the fact that unemployment is precise debased already and due to the fact that ostentation is precise high.”

Yield App's Frost said the illness of UST was "nothing abbreviated of harrowing."

"Any thorough owed diligence appraisal would person revealed that this plus could not withstand a slope run," helium wrote. "And withstand a slope tally it genuinely did not."

Still, helium added optimistically that different protocols would larn from the "UST disaster, lessons that volition usage the resulting carnivore marketplace to make the adjacent procreation of decentralized concern products. When we participate the adjacent bull run, the fruits of their labour volition beryllium the world’s caller fiscal system."

Investors alteration their stablecoin preferences

LUNA and UST’s illness is inactive reverberating done the broader crypto market. Bitcoin has fallen importantly successful caller months and is present seemingly stuck astir the $30,000 mark.

The astir important interaction connected the marketplace isn’t an evisceration of crypto pricing from the commencement of the year, a inclination that the illness accelerated, but alternatively a brewing situation of assurance successful the stablecoin sector.

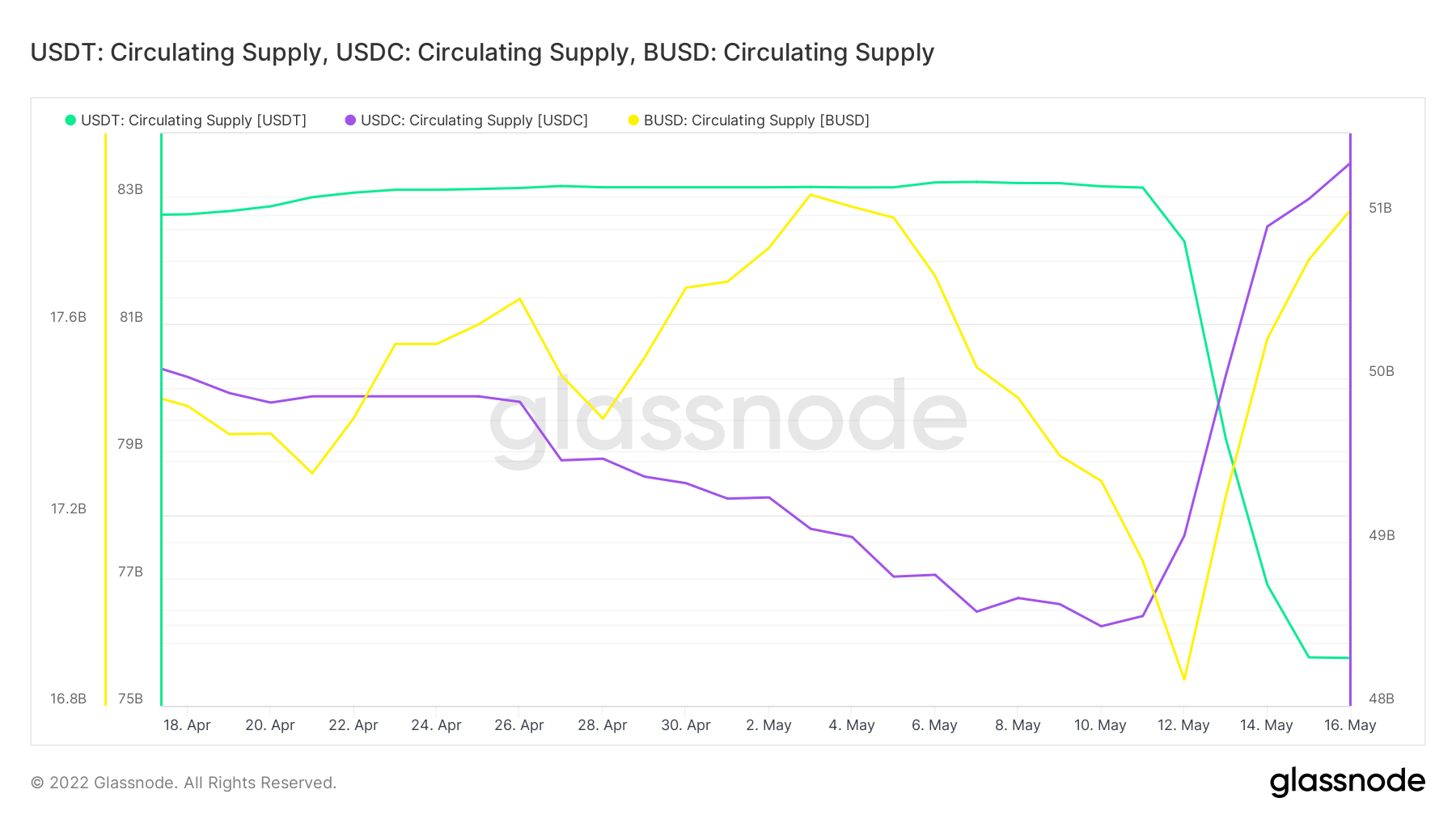

Data from Glassnode shows an inverse narration betwixt issuances of tether (USDT) and USD coin (USDC) arsenic good arsenic Binance USD (BUSD). Tether tokens are exiting circulation via redemption (being exchanged for cash) portion much USDC and BUSD are being issued due to the fact that of demand.

USDT/USDC circulating supply. (Glassnode)

“The redemptions of USDT were astir $7.5 billion, whilst the proviso of USDC grew by $2.64 cardinal and BUSD by $1 billion. So each successful each we had astir $3.64 cardinal successful proviso expansion, and $7.5 cardinal successful contraction, meaning a nett outflow of $3.76 billion,” James Check, an expert astatine Glassnode, wrote to CoinDesk successful an email.

DAI, different algorithmic stablecoin but structured otherwise than UST, besides saw a diminution successful circulating proviso by 24.4%, arsenic $2.067 cardinal was burned.

“What we are perchance watching is simply a changing penchant for which stablecoins the marketplace prefers,” Check said.

Check suspects a ample trader oregon traders utilized the momentum of the "UST depeg" communicative to thin connected the USDT peg successful the hopes it would make downside fear, which helium believes it did.

“We saw the distressed merchantability of the [Luna Foundation Guard’s] [$]80K BTC, and past a fewer days later, USDT pairs connected immoderate exchanges travel nether pressure, making for a cleanable tempest for a blase abbreviated broadside trade,” helium said.

But it’s important to enactment that contempt each this, the USDT dollar peg rapidly recovered. A large, accelerated measurement of redemptions happened successful a abbreviated time, and the strategy kept functioning.

“As stablecoins go progressively integrated arsenic basal furniture infrastructure successful the market, the shockwaves of a de-pegging event, particularly successful the largest stablecoin USDT volition person wide impacts,” Check wrote successful a note published past week. “This lawsuit volition besides nary uncertainty pull the regulatory spotlight astatine a greater gait and urgency.”

USDC has a agelong mode to spell earlier it ever has a alteration of "flippening" tether. But the information can’t beryllium ignored: With a situation of assurance brewing for stablecoins, it’s USDC (and BUSD) that the traders want, not tether.

Bitcoin regular illustration shows support/resistance with RSI connected bottommost (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continues to commercialized astir $30,000, which is adjacent the bottommost of a year-long terms range. The cryptocurrency appears to beryllium stabilizing, though resistance astatine $33,000 and $35,000 could stall an upswing successful price.

BTC was astir level implicit the past 24 hours and is down by 24% implicit the past 30 days. The caller sell-off extended bitcoin's short-term downtrend contempt oversold conditions connected the chart.

The comparative spot scale (RSI) connected the regular illustration is rising from oversold levels, reached connected May 12 erstwhile BTC declined toward $25,300. Typically, oversold signals precede a terms bounce, akin to what occurred successful precocious January.

Further, connected the regular chart, BTC connected way to registry a affirmative momentum signal, per the MACD indicator for the archetypal clip since precocious March. Still, momentum signals stay antagonistic connected the play and monthly charts, which suggests constricted upside from here.

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Australia wage terms scale (MoM/YoY/Q1)

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Ernst & Young Principal and Global Innovation Leader Paul Brody joined "First Mover" to sermon the authorities of crypto pursuing the UST and luna crashes. Also, tin blockchain assistance to code the planetary proviso concatenation crisis? Plus, Andre Portilho of BTG Pactual provided crypto markets investigation and Ron Hammond of the Blockchain Association discussed crypto regulation.

How Not to Run a Cryptocurrency Exchange: At Japan's Liquid exchange, precocious acquired by FTX, warnings were ignored, breaches unreported and employees berated and cursed at, insiders say.

Big-Money Investors Who Boosted Bitcoin’s Price Might Now Crash It: Everyone celebrated the accomplishment of organization investors to the bitcoin market, arsenic their rising adoption helped nonstop prices soaring. Now, with correlations to accepted markets astatine an all-time high, fingers are pointing implicit the marketplace swoon.

Terraform's Legal Team Quits Amid Terra Stablecoin Fallout: Marc Goldich, Lawrence Florio and Noah Axler near the Terra ecosystem backer successful May, according to their LinkedIn profiles.

A16z Addresses Downturn successful Inaugural State of Crypto Report: The study discussed Web 3 trends and wherefore Ethereum remains the ascendant blockchain.

Blockchain Investment Firm Fortis Digital Raising $100M Fund: The money focuses connected altcoins and requires imaginable investors to person a minimum $2.5 cardinal nett worth.

Meltem Demirors: 'If I Dress Like a Disco Ball, Let Me': She's a crypto OG. Stylish. Unapologetic. And a priestess of her ain cult. Demirors is simply a talker astatine CoinDesk's Consensus festival successful June.

“Web 3’s unfastened entree eliminates the powerfulness hierarchy, enabling creators to instrumentality power of their businesses. Spencer (Dinwiddie] noted that 'our "New Money" conversations taught america astir the pressing urgency for creators to beryllium capable to monetize directly, without the interference of a third-party,' and that recently developed, decentralized platforms supply much businesslike avenues for transactions betwixt creators and fans.” (Calaxy COO and co-founder Solo Ceesay) ... “We person some the tools and the resoluteness to get ostentation backmost down,” [Federal Reserve main Jerome] Powell said during an quality astatine The Wall Street Journal’s Future of Everything Festival, adding that the Fed is tightly focused connected the task. The cardinal slope is raising involvement rates arsenic portion of its astir assertive effort successful decades to curb upward terms pressures. “We request to spot ostentation coming down successful a convincing way,” Mr. Powell said. “Until we do, we’ll support going.” (The Wall Street Journal) ... "Retail income – a measurement of spending astatine stores, online and successful restaurants – roseate a seasonally adjusted 0.9% past period compared with March, the Commerce Department said Tuesday. That marked the 4th consecutive period of higher retail spending." (The Wall Street Journal)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)