Good morning. Here’s what’s happening:

Prices: Bitcoin and ether proceed falling; different large cryptos are mixed.

Insights: The holdings of HSBC's Metaverse Fund for Hong Kong and Singapore backstage banking clients stay unclear, underscoring a cardinal interest astir specified products.

Technician's take: The existent pullback appears to beryllium impermanent up of seasonal strength.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $42,330 -0.4%

Ether (ETH): $3,226 -0.5%

Bitcoin spent overmuch of its play successful the doldrums.

The largest cryptocurrency by marketplace capitalization ignored a little Sunday surge to settee beneath $42,500 level wherever it ended Friday amid increasing economical uncertainty tied to Russia's unprovoked penetration of Ukraine and looming involvement complaint hikes by the U.S. cardinal bank. The crypto had started the week trading adjacent $47,000 aft a precocious March jump, fueled by hopefulness astir a sooner-than-later extremity to the Ukraine conflict.

"While immoderate alleviation came implicit the weekend, volumes person been debased and until a large propulsion drives the terms supra $48K, BTC is apt to stay nether unit and conflict to aged $40K successful the coming weeks," said Joe DiPasquale, the CEO of money manager Bitbull successful an email to CoinDesk.

Bitcoin was precocious trading astatine astir $42,300 down somewhat implicit the past 24 hours. Ether, the 2nd largest crypto by marketplace cap, followed a akin play signifier and was besides disconnected a fraction astatine astir $3,200. Other large cryptos were mixed. AXS and Terra's luna token had precocious fallen astir 1.5% and 2%, respectively. But fashionable meme token DOGE was up astir 5%. Trading was light.

Cryptos' show lately has mostly dovetailed with large equity markets, which person besides fallen. The tech-focused Nasdaq closed Friday trading down implicit a percent point. The S&P 500 and Dow Jones Industrial Average were besides disconnected arsenic investors continued to process an historical swirl of events that could nonstop the planetary system into recession.

Over the weekend, Ukraine simultaneously girded for a caller Russian violative connected cities successful the southeastern portion of the state portion attempting to evacuate civilians, whom Russian forces person been targeting. E.U. countries continued to sermon banning Russian lipid and gas, though the continent's largest economy, Germany, has opposed the measure, saying that it would nonstop shockwaves done its economy. The terms of Brent crude oil, a wide regarded measurement of vigor pricing trends, continued hovering good implicit $100 per barrel, up implicit 40% from the commencement of the year.

In its April 8 play reappraisal of planetary economical trends, First Republic Bank said that "the macroeconomic backdrop is apt to deteriorate earlier it improves."

The slope noted that vigor terms increases stemming from the invasion, had "affected prices successful astir each sectors of the economy," and did not expect U.S. President Joe Biden caller determination to merchandise lipid from the U.S.'s strategical reserve "to alleviate precocious vigor prices."

"Given rising costs and geopolitical conflict, we judge ostentation volition emergence higher successful upcoming months," the slope wrote.

BitBull's DiPasquale said that wider concerns could measurement down cryptos good beneath the $40,000 threshold. "We should spot a absorption astir $37K and $32K, but BTC is successful request of a catalyst to prolong immoderate bullish momentum up of macro concerns, specified arsenic much involvement complaint hikes and monetary argumentation changes."

The holdings of HSBC's Metaverse Fund stay a mystery

Last week HSBC (HSBC) announced a Metaverse Fund for its backstage banking clients successful Hong Kong and Singapore. To the outsider, this has each the makings of a FOMO narrative: accredited investors only, investors successful Hong Kong and Singapore lone – wherever much breathtaking concern opportunities are disposable – and yet the metaverse, which Citi claims volition beryllium a $13 trillion accidental by 2030.

But what precisely is this fund? What does it hold? Nobody knows. The authoritative effect from HSBC is boilerplate and the institution declined to spell into specifics. “The portfolio is actively managed and focuses connected investing successful companies wrong the metaverse ecosystem, with 5 cardinal segments, namely Infrastructure, Computing, Virtualization, Experience and Discovery, and Human Interface.”

The fund, which is said to beryllium based successful London, targets investors successful Hong Kong and Singapore, but determination doesn’t look to beryllium a registration with regulators yet (CoinDesk checked FCA, MAS, and SFC directories), which suggests the money is inactive successful improvement and hasn’t been officially listed. So we’re near guessing what’s wrong it.

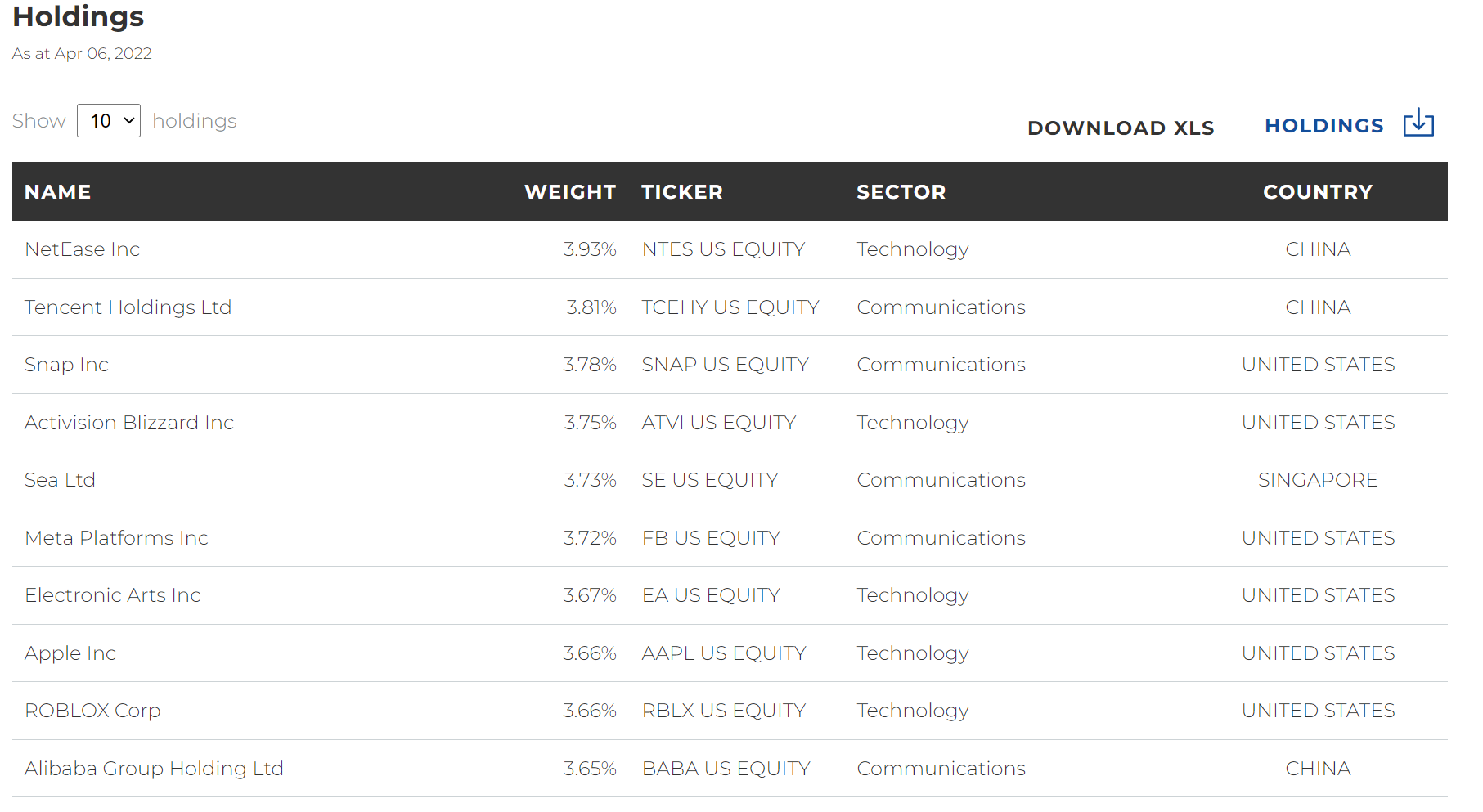

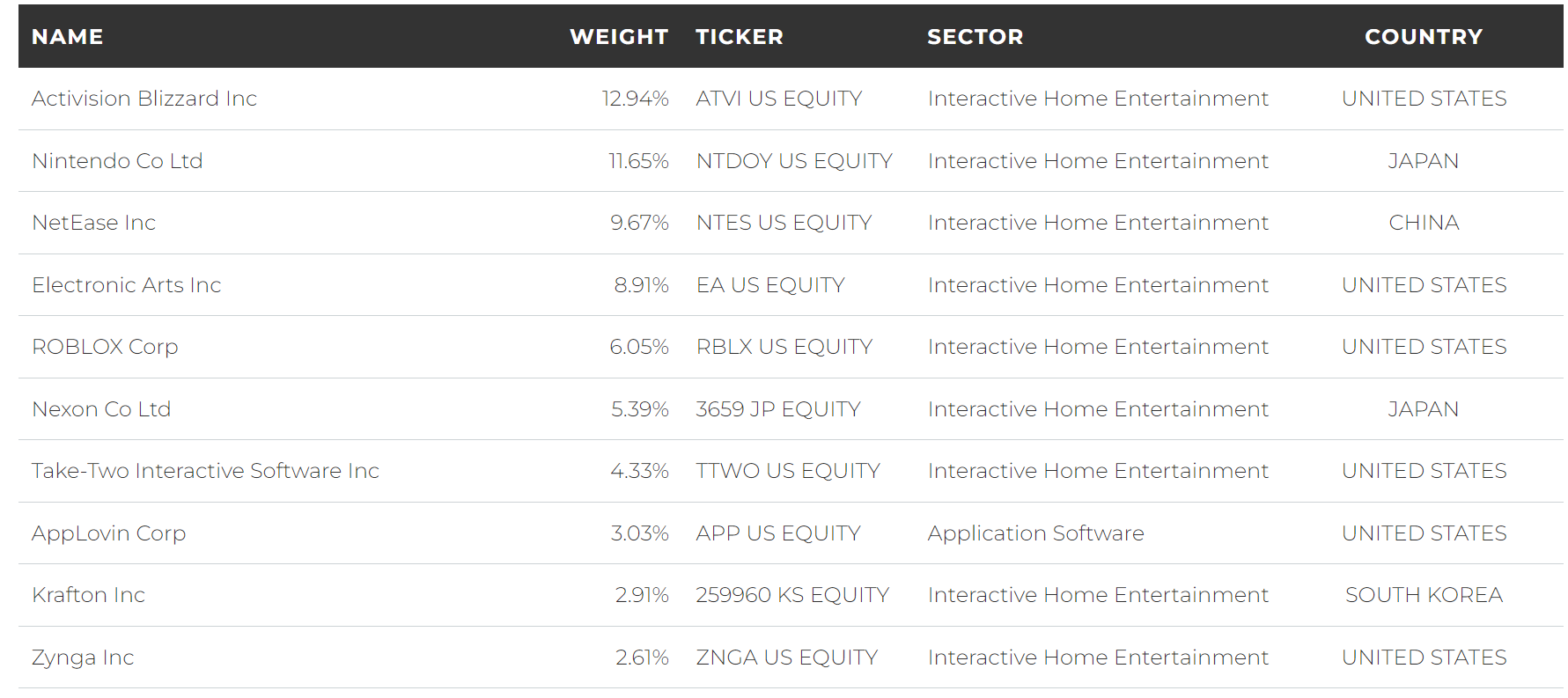

Prior metaverse funds person been a substance of gaming and tech companies.

Evolve Metaverse ETF

This isn’t needfully a atrocious thing. Rather, it's simply a merchandise of what the metaverse is: gaming and tech. At its core, the metaverse is simply a gaming experience, truthful the question remains wherefore you would request a circumstantial money for this.

After all, the aforesaid companies that powerfulness gaming experiences, similar Unity and Unreal, which marque crippled engines, oregon EA and Activision, which marque the games themselves, would person a akin spot and value successful a axenic gaming fund.

In fact, if you comparison a gaming money to a metaverse money they are astir the same.

[chart gaming germinate sourcehttps://evolveetfs.com/product/hero#tab-content-portfolio/]

Every fewer years investors and the tech manufacture indispensable invent caller terms, and metaverse seems to beryllium 1 of them. It’s simply gaming, rebranded. The imagination of an interoperable gaming satellite bound unneurotic by non-fungible tokens (NFT) and blockchain, specified arsenic successful Ready Player One, isn’t going to hap arsenic intelligence spot (IP) rights holders similar Nintendo would get tense astir what mightiness hap if their characters crossed implicit to antithetic gaming worlds and beyond their power .(It could beryllium vulgar.)

If you privation to find a existent metaverse, it would beryllium an online gaming work similar Xbox Live oregon Steam, which person been astir for 20 years. Your integer individuality is portable betwixt games; online peers tin spot your sanction and scorecard. But that’s it. Each crippled is simply a abstracted satellite – thing is transposable.

Gaming is simply a immense market, accelerated by stay-at-home orders during the coronavirus pandemic. This is the existent $13 trillion opportunity.

The “metaverse” arsenic it exists for the crypto industry? Not truthful much.

Remember, major crypto metaverse platforms similar The Sandbox oregon Decentraland person an progressive idiosyncratic basal counted successful the hundreds oregon debased thousands. The tokens affiliated with the platforms person had large year-to-date losses. Would you adjacent privation to clasp them?

Given that HSBC’s money is lone unfastened to accredited investors, 1 mightiness expect its contents to beryllium much exciting. The money is improbable to clasp tokens directly, and if it did, specified a holding would beryllium earth-shattering. HSBC brass has antecedently declined to let its wealthiest clients to get vulnerability to integer assets, dissimilar different banks.

There are a fewer privately held gaming companies retired there, including Valve, which is down the Steam platform, but this is a well-established firm, not a startup; it’s improbable that HSBC would request to adjacent disconnected the money to anyone but accredited investors.

So what is wrong this fund? Is it conscionable a postulation of publically listed gaming and exertion companies wrapped down the word "metaverse" and the allure of being restricted to accredited investors only?

Bitcoin play terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) is stuck successful a choky range, albeit with occasional terms swings. The cryptocurrency is approaching a support portion betwixt $40,000 and $43,000, which could stabilize the pullback.

Resistance astatine $48,000 and $50,000 person capped terms rallies implicit the past 4 months, which means sellers are successful control. Meanwhile, determination has been a important nonaccomplishment of downside momentum, suggesting that buyers could stay progressive astatine little enactment levels.

On the play chart, the comparative spot scale (RSI) dipped beneath the 50 neutral level. That reflects a flimsy nonaccomplishment of upside momentum since BTC's breakout supra $40,000 connected March 28.

Still, the existent pullback appears to beryllium temporary, akin to what occurred successful September of past year. This time, however, speculative assets specified arsenic stocks and cryptos are entering a seasonally beardown period successful April and May, which could pull short-term buyers.

9 a.m. HKT/SGT(1 a.m. UTC): Bank of Japan Governor Haruhiko Kuroda speech

9:30 a.m. HKT/SGT(1:30 a.m. UTC): China user terms scale (MoM/YoY March)

9:30 a.m. HKT/SGT(1:30 a.m. UTC): China shaper terms scale (March)

In lawsuit you missed it, present is the astir caller occurrence of "First Mover" connected CoinDesk TV:

Following what whitethorn beryllium the largest DeFi exploit successful history, Sky Mavis raised $150 cardinal successful a circular led by Binance to reimburse the victims. Sky Mavis Chief Operating oficer and co-founder Aleksander Larsen discussed the lawsuit and the motorboat of a caller project. Treasury Secretary Janet Yellen called for the aforesaid rules for accepted fiscal strategy to beryllium applied to the crypto industry. Chen Arad of Solidus Labs shared his take. Plus, Don Kaufman of TheoTrade, provided crypto marketplace analysis.

Ethereum Gas Usage Rose successful March arsenic Ether Ran to $3.5K: ERC-20 token procreation past period was 125% supra February's levels, adjacent arsenic developers proceed to physique caller projects connected different blockchains.

Top US Bank Watchdog Warns of Stablecoins' 'Lack of Interoperability': The OCC's acting main argues the saltation crossed tokens could make walled gardens.

A Censorship-Resistant Inflation Index Is Being Built connected Chainlink: Truflation presently measures a 13.3% ostentation rate, arsenic opposed to the 7.9% measured by the Consumer Price Index successful March.

How the Play-to-Earn Industry Can Rebuild Better After the Ronin Attack: Now is the clip for Axie Infinity enactment and solidarity from the competitory crypto gaming industry, CoinDesk columnist Leah Callon-Butler writes.

"Almost instantly aft it was unveiled extracurricular the Miami Beach Convention Center connected Monday, kicking disconnected the archetypal time of the planetary Bitcoin 2022 conference, observers noted the robotic totem with hooves and horns lacked that 1 important anatomical detail. Its creator, Furio Tedeschi, hadn’t intended for the bull to beryllium a steer." (CoinDesk Assistant Opinion Editor Daniel Kuhn) ... "Credit wherever it’s due, the Journal does adhd immoderate extent to the story, peculiarly by talking to meme coin traders directly. But the study reaches the aforesaid decision that we did past month: “Nearly each analysts hold that information [in meme coin trading] is fundamentally a signifier of gambling.” (CoinDesk columnist David Z. Morris) ... "The lack of nutrient from [Ukraine, nether onslaught by Russia] is besides lifting the prices of commodities produced elsewhere arsenic countries and companies question alternatives to their accustomed supplies. Higher atom prices successful peculiar besides endanger a knock-on interaction connected beef and different nutrient arsenic producers trust heavy connected atom to provender livestock and poultry. The higher costs mean immoderate of the largest nutrient companies successful the U.S. volition apt proceed to rise prices connected consumers for products from cereal to deli meat, analysts say." (The Wall Street Journal) ... "Yet immoderate swift decisions connected lipid sanctions look large governmental obstacles. With EU subordinate states divided connected the issue, Brussels officials accidental determination volition beryllium nary decisions connected Monday and that adjacent the presumption of circumstantial proposals could beryllium weeks away. Germany, Europe’s biggest economy, is starring the absorption to sanctioning imports of Russian lipid oregon gas, and has truthful acold resisted calls from Eastern European countries specified arsenic Poland for stronger vigor sanctions." (The Wall Street Journal)

2 years ago

2 years ago

English (US)

English (US)