Good morning. Here’s what’s happening:

Prices: Bitcoin holds supra $41,000, adjacent aft hawkish comments from the seat of the U.S. cardinal bank.

Insights: Bitcoin started the week dilatory successful Asia, and immoderate investors whitethorn beryllium placing their bets connected DeFi.

Technician's take: Bitcoin's pullbacks could beryllium constricted implicit the abbreviated term.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $41,242 +0.1%

Ether gains arsenic bitcoin holds

Bitcoin (BTC) stood astir wherever it did 24 hours ago, a small implicit $41,000, aft a little dip beneath this threshold pursuing hawkish monetary argumentation comments from U.S. cardinal slope Chair Jerome Powell.

Ether (ETH), the second-largest crypto by marketplace headdress aft bitcoin, was changing hands astatine astir $2,900, up implicit 2%. Other large cryptos were mixed. Trading measurement was airy arsenic investors instrumentality banal of fast-moving, planetary macroeconomic trends. Bitcoin peaked astatine implicit $42,000 past week, buoyed by China's committedness to enactment its flailing existent property and exertion sectors.

Major banal indexes retrenched aft Powell said successful a code astatine the National Association for Business Economics yearly league successful Washington D.C. that the Federal Reserve mightiness rise involvement successful 50-basis-point increments to tame inflation, which has been plaguing the U.S. economy, and threatens to worsen amid fall-out from Russia's intensifying attacks connected Ukraine. On Monday, Russian forces bombed a promenade successful the superior metropolis of Kyiv, continuing its people of civilian locations, and U.S. President Joe Biden warned that Russia mightiness motorboat cyberattacks connected large U.S. companies successful retaliation for terrible economical sanctions.

The terms of Brent crude oil, a wide watched measurement of the vigor market, roseate 7% to $112 per barrel. Russia is 1 of the world's starring suppliers of oil.

Katie Stockton, laminitis and Managing Partner of Fairlead Strategies, told CoinDesk TV's "First Mover" programme that the debased trading volumes were "very mean successful a sideways trending market."

"Think astir it arsenic a tug of warfare betwixt buyers and sellers and a play of indecisiveness," she said. "I deliberation that indecisiveness is reflecting itself successful the lighter volumes, the little decisive trendy moves. "Then it conscionable becomes a question arsenic to whether that consolidation signifier reconciles to the upside oregon the downside."

She added: "We bash deliberation it volition beryllium reconciled to the upside with our short-term bullish bias. We spot it arsenic a relation of that, and we would expect with immoderate benignant of breakout, let's accidental supra $45,000, we would expect volumes to travel backmost into the market."

Bitcoin starts dilatory successful Asia

But that’s bitcoin’s problem. Layer 1 protocols similar Avalanche had a banner week, climbing 32%, portion liquidity protocol Aave deed 34% successful play gains and Ethereum pushed done 15% connected the week.

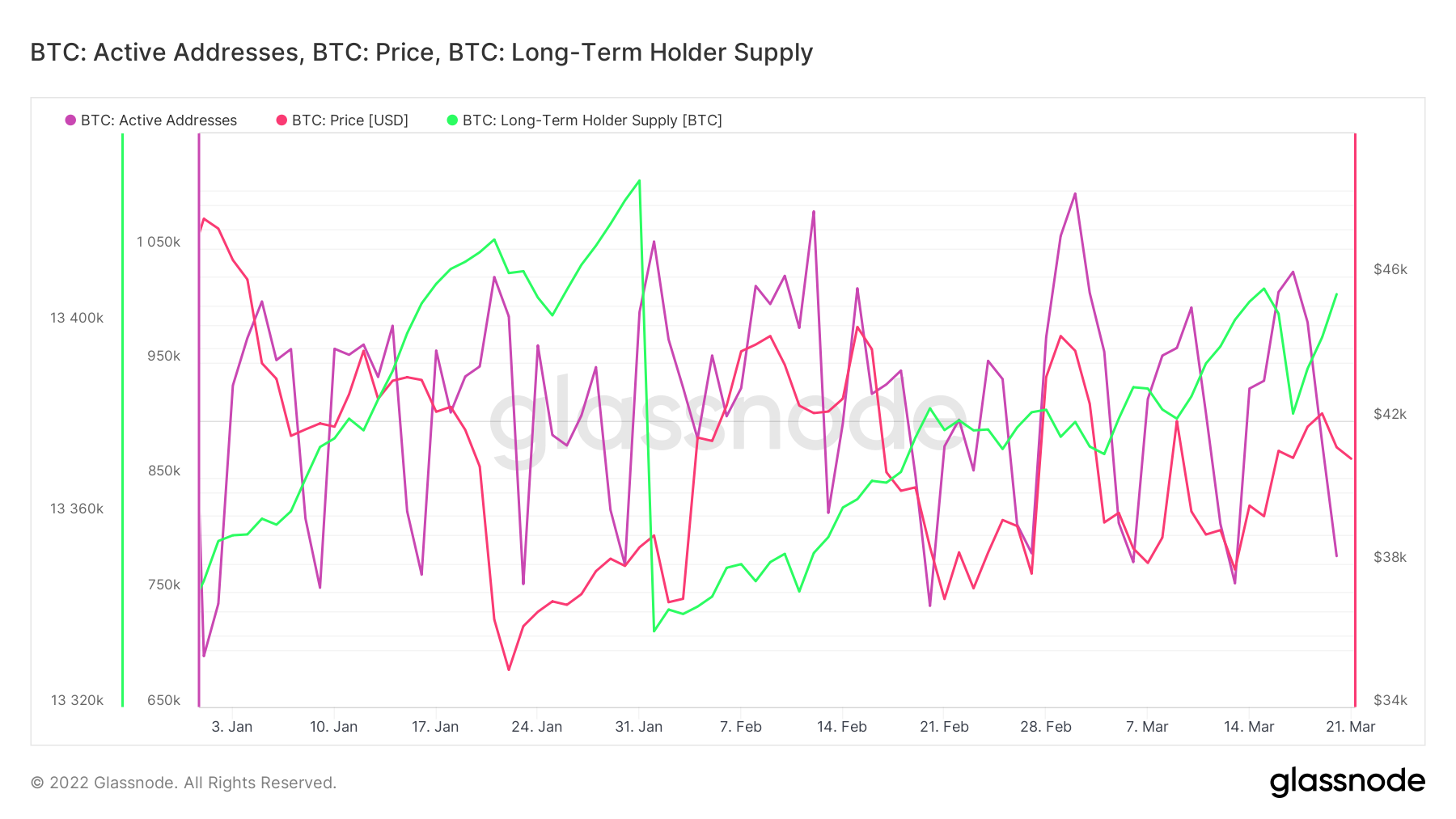

Data from Glassnode reflects this.

BTC progressive address, price, semipermanent holders (Glassnode)

The fig of progressive addresses connected the web are astatine a monthly debased portion semipermanent HODLers are astatine a yearly high. Likely there’s a batch of bitcoin parked to get liquidity connected better-performing assets.

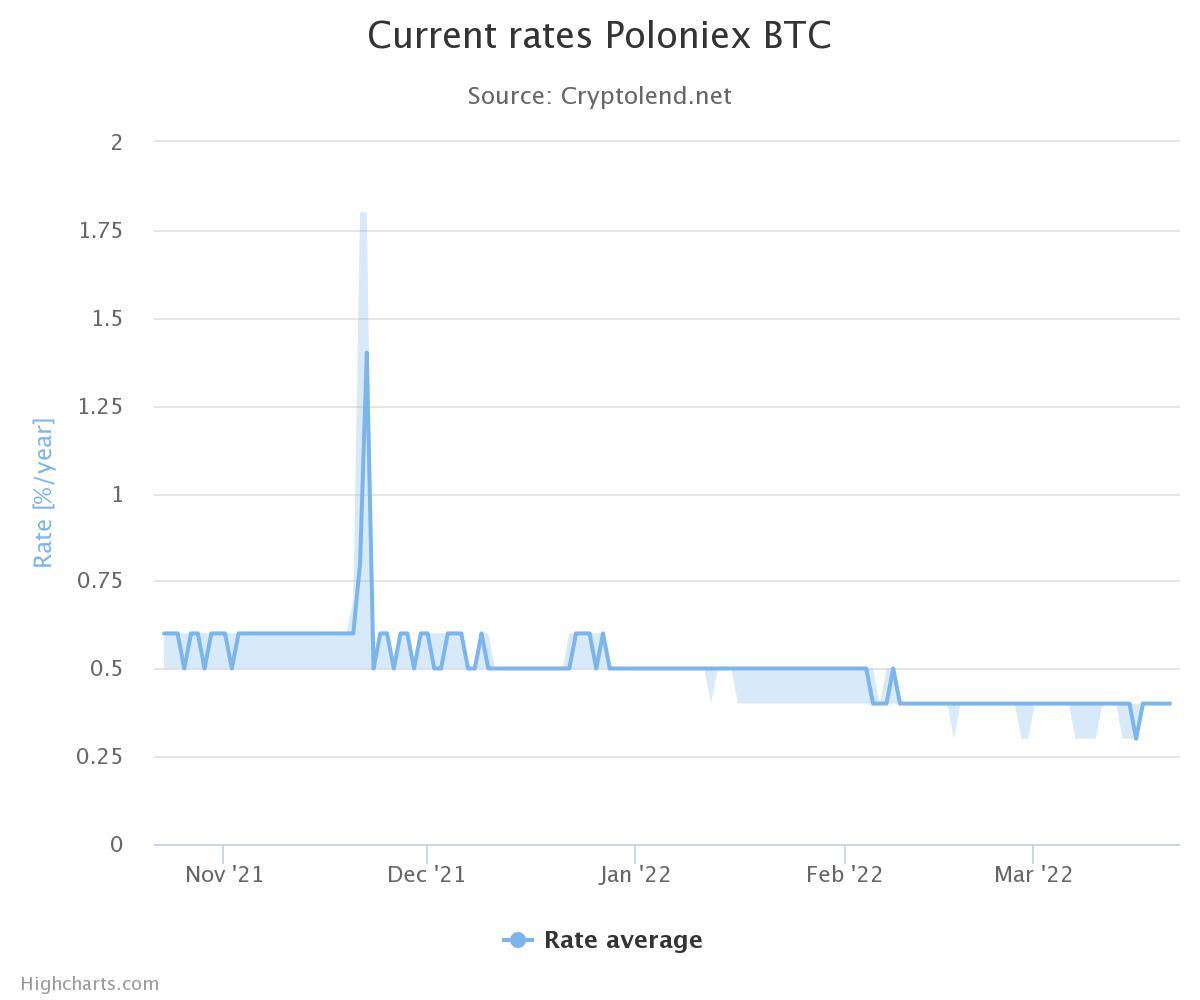

Bitcoin borderline lending (loans lone for trading that are stuck connected the exchange, and not wide lending similar BlockFi does) rates are efficaciously flat, with Bitfinex not charging a interest and Poloniex charging lone 0.4%.

(Cryptolend.net)

And wherever is each this bitcoin going? Likely into decentralized concern (DeFi). The Bored Ape Yacht Club-linked ApeCoin (APE) seemed to beryllium the astir breathtaking caller happening connected the blockchain, jumping implicit 10% during the day. As CoinDesk reported, APE covered calls were hitting a 42% projected annualized yield.

There are besides staking possibilities. With the motorboat of Eth 2.0 soon to occur, traders are becoming progressively bullish connected ether with projected yields hitting 10% to 15%.

But remember, that each this isn’t needfully a atrocious happening for bitcoin. Bitcoin’s volatility index was astatine a monthly debased and approaching a yearly debased arsenic the marketplace stabilized aft the Fed raised rates arsenic expected. All this helps the communicative of bitcoin arsenic a store of value, not thing that reacts violently to marketplace gyrations arsenic we saw past year. More bitcoin held with assurance for the agelong word is much liquidity disposable for DeFi.

Bitcoin four-hour terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) is consolidating astir the $41,000 terms level amid declining trading volume.

The cryptocurrency is astir level implicit the past 24 hours, and pullbacks could beryllium constricted toward a beardown enactment basal astatine $37,000.

Further, the comparative spot scale (RSI) connected the four-hour illustration is declining from overbought levels, which reflects a nonaccomplishment of upside momentum. On the regular chart, the RSI is holding supra the 50 neutral mark, which means buyers could stay progressive astatine little enactment levels.

On the play chart, method indicators are improving, akin to what occurred successful August 2021, which preceded a 60% terms rally. This time, however, determination is antagonistic momentum connected the monthly chart, which typically precedes rangebound oregon antagonistic terms action. That means upside could beryllium constricted astir the $46,000-$50,000 absorption zone.

9 a.m. HKT/SGT (1 a.m. UTC): Speech by Australia cardinal slope Governor Philip Lowe

3 p.m. HKT/SGT (7 a.m. UTC): U.K. nationalist assemblage nett borrowing (Feb.)

Stellar Development Foundation CEO Denelle Dixon joined "First Mover" to sermon Ukraine's cardinal slope integer currency (CBDC) project, and program for Stellar's latest $30 cardinal propulsion to money startups. Plus, Katie Stockton of Fairlead Strategies provided crypto mining insights and CoinDesk mining newsman Aoyon Ashraf looked astatine the authorities of the planetary mining manufacture arsenic CoinDesk kicked disconnected its Mining Week series.

What Is ApeCoin and Who Is Behind It?: A cautiously coordinated selling run takes large pains to region the caller token from Yuga Labs, but the steadfast that created the Bored Ape NFTs appears to beryllium profoundly involved.

Several years ago, radical realized that blockchains (the shared, decentralized databases that powerfulness bitcoin and different cryptocurrencies) could beryllium utilized to make unique, uncopyable integer files. And due to the fact that these files were simply entries connected a nationalist database, anyone could verify who owned them, oregon way them arsenic they changed hands. That realization prompted the instauration of the archetypal NFTs. (The New York Times) ... "But DAOs whitethorn themselves beryllium successful for a alteration that could hole possibly their astir important vulnerability. The existent DAO exemplary is human-run, and arsenic a result, DAO decisions are prone to errors successful judgment. The usage of artificial intelligence, different transformative technology, would destruct those mistakes and marque DAOs adjacent much effective." (SingularityDAO CEO Marcello Mari) ... "Millions of users present person blockchain wallets and accounts. They person stablecoins and cryptocurrencies and entree to integer contracts. They correspond a acceptable marketplace of investors and buyers with a demonstrated willingness to effort caller things. And that may, successful turn, go much important than utilizing blockchain exertion for usage cases that are ideally decentralized." (EY Blockchain Lead and CoinDesk columnist Paul Brody)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)