Good morning. Here’s what’s happening:

Prices: Bitcoin and different cryptocurrencies roseate again.

Insights: Many economical powers successful the Asia Pacific portion stay assured astir T-bills and golden arsenic investments.

Technician's take: BTC's momentum turned affirmative for the archetypal clip since July, though a important terms rally could beryllium delayed.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $47,551 +1.9%

Bitcoin continues climbing; cracks 2022 $47.2K break-even point

Bitcoin continued its upward march, rising for the seventh consecutive time adjacent arsenic equity markets tread h2o and macroeconomic uncertainty continued.

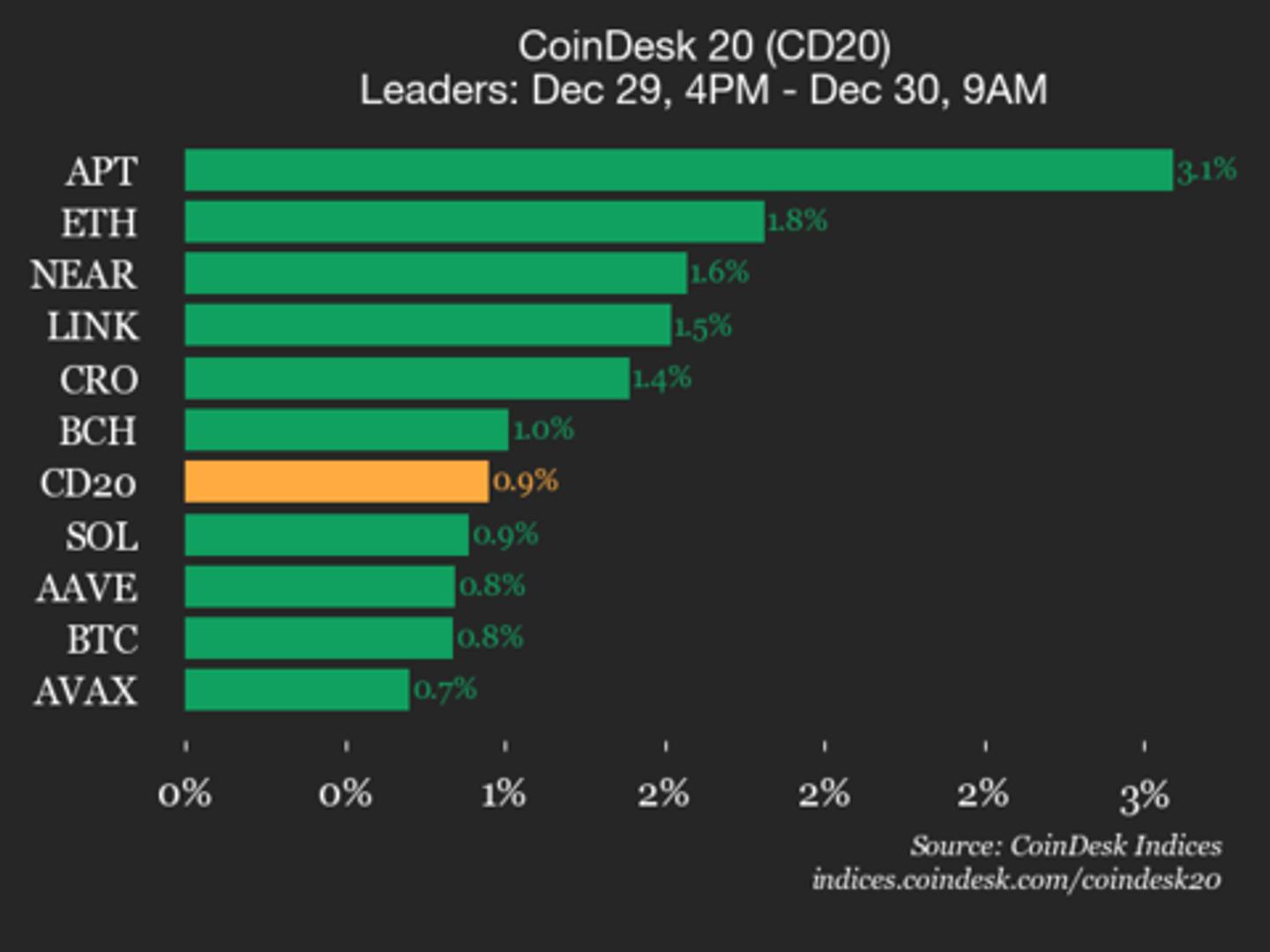

The largest cryptocurrency by marketplace capitalization was precocious trading conscionable nether $47,650, a astir 2% summation implicit the past 24 hours. Ether, the second-largest crypto was changing hands nether $3,400, a astir 3% summation for the aforesaid period. Almost different large cryptos successful the CoinDesk apical 20 for marketplace headdress spent overmuch of Monday good into the green.

Bitcoin cracked the 2022 yearly break-even constituent of $47,201 aboriginal day Asia time, and has risen much than 15% implicit the past week. Ether is up much than 16% for the aforesaid timeframe.

"What we're looking astatine fundamentally is simply a wide betterment successful marketplace sentiment," Noelle Acheson, caput of marketplace insights astatine Genesis Global Trading, told CoinDesk TV's "First Mover" program, adding that the integer currency premier broker's trading desks started seeing "a much bullish tone" past week.

"Some derivative marketplace metrics started flashing immoderate signals," she said. Genesis, similar CoinDesk, is owned by Digital Currency Group.

The play terms spike among bitcoin and different cryptos had puzzled immoderate observers. Stocks successful U.S. markets, whose gains person correlated with those of crypto prices successful caller months, person been astir level implicit the past 2 trading days. The tech-focused Nasdaq roseate 1.3% connected Monday. The S&P 500 and DJIA accrued by little than a percent point.

Acheson noted that rising involvement among organization investors implicit the past 2 weeks, including fiscal work giants BlackRock (BLK) and Goldman Sachs (GS), has buoyed crypto markets. They person made statements "that crypto markets are worthy dedicating much resources to," she said.

She highlighted the acquisition implicit the past six days of $1.3 cardinal successful bitcoin by the Singapore non-profit Luna Foundation Guard (LFG) arsenic a reserve asset. The instauration is delivering connected its month-old committedness to adhd BTC arsenic an further furniture of information for UST, which is Terra's decentralized dollar-pegged stablecoin. LFG has committed to purchasing astatine slightest $3 cardinal successful bitcoin arsenic reserves.

Acheson besides spoke of a increasing consciousness – spurred partially by the ongoing struggle successful Ukraine – of bitcoin arsenic a "seizure-resistant store of value." "What we are seeing successful our headlines astir each time present (is) cases erstwhile this does substance to people," she said.

Intrigued by bitcoin but inactive assured successful T-bills, gold

El Salvador’s "Bitcoin Bond" was expected to beryllium the archetypal section of the adjacent epoch of sovereign finance.

Bitcoin was marketed arsenic the adjacent large plus people for the equilibrium expanse of the sovereign due to the fact that of the questions surrounding the longevity of U.S. hegemony and the petrodollar that powers it.

Meanwhile, nations are inactive expressing assurance successful U.S. Treasury bills arsenic stores of worth for their treasury. Some countries are adjacent opting for these T-bill implicit gold, adjacent portion protesting against a U.S.-led, globalized world.

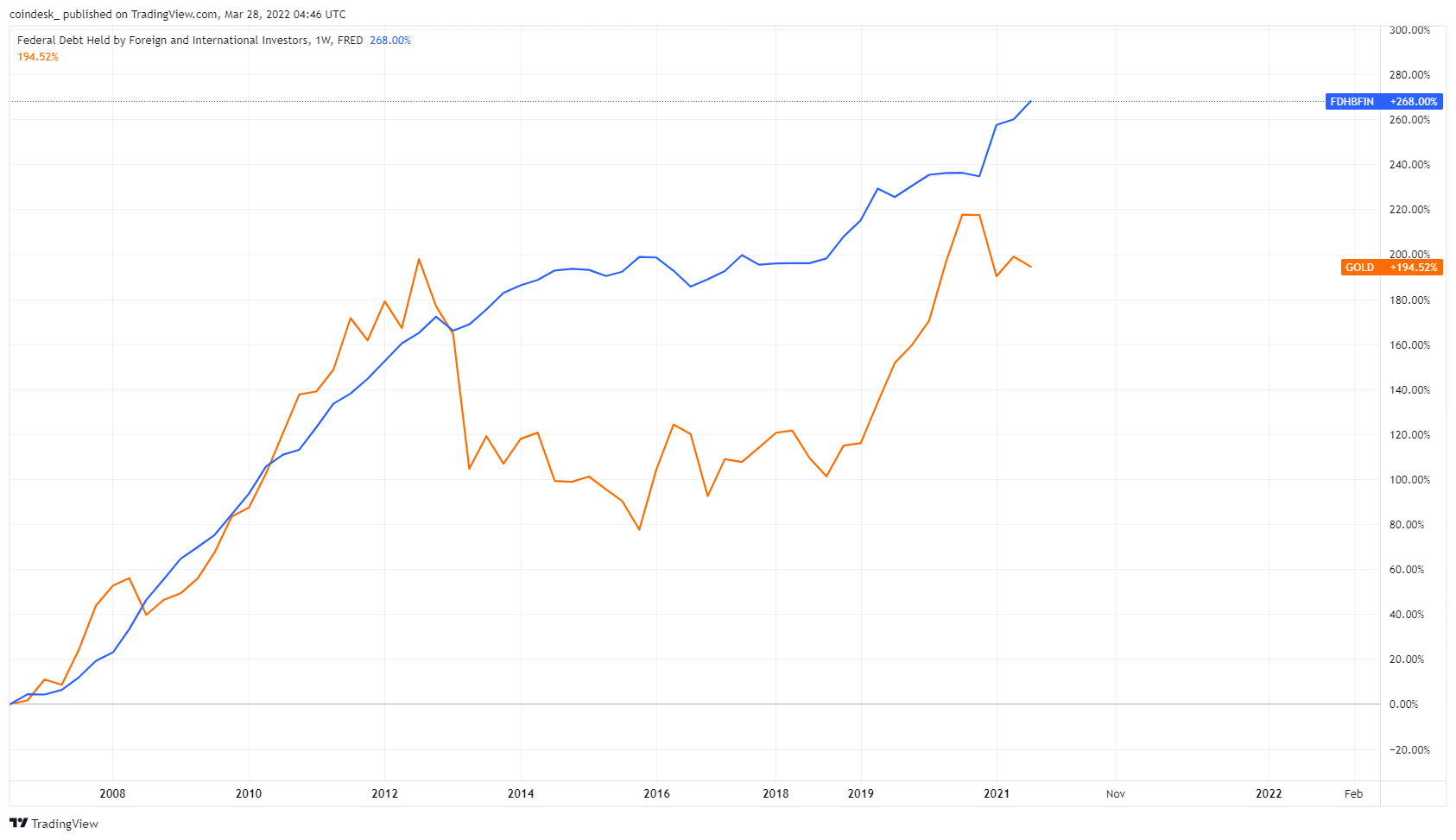

Data shows that since 2008, national indebtedness held by overseas and planetary investors has outpaced the terms of gold. While determination was a slowdown during the mid-2010s, it climbed backmost up arsenic the decennary came to a adjacent and skyrocketed during Covid.

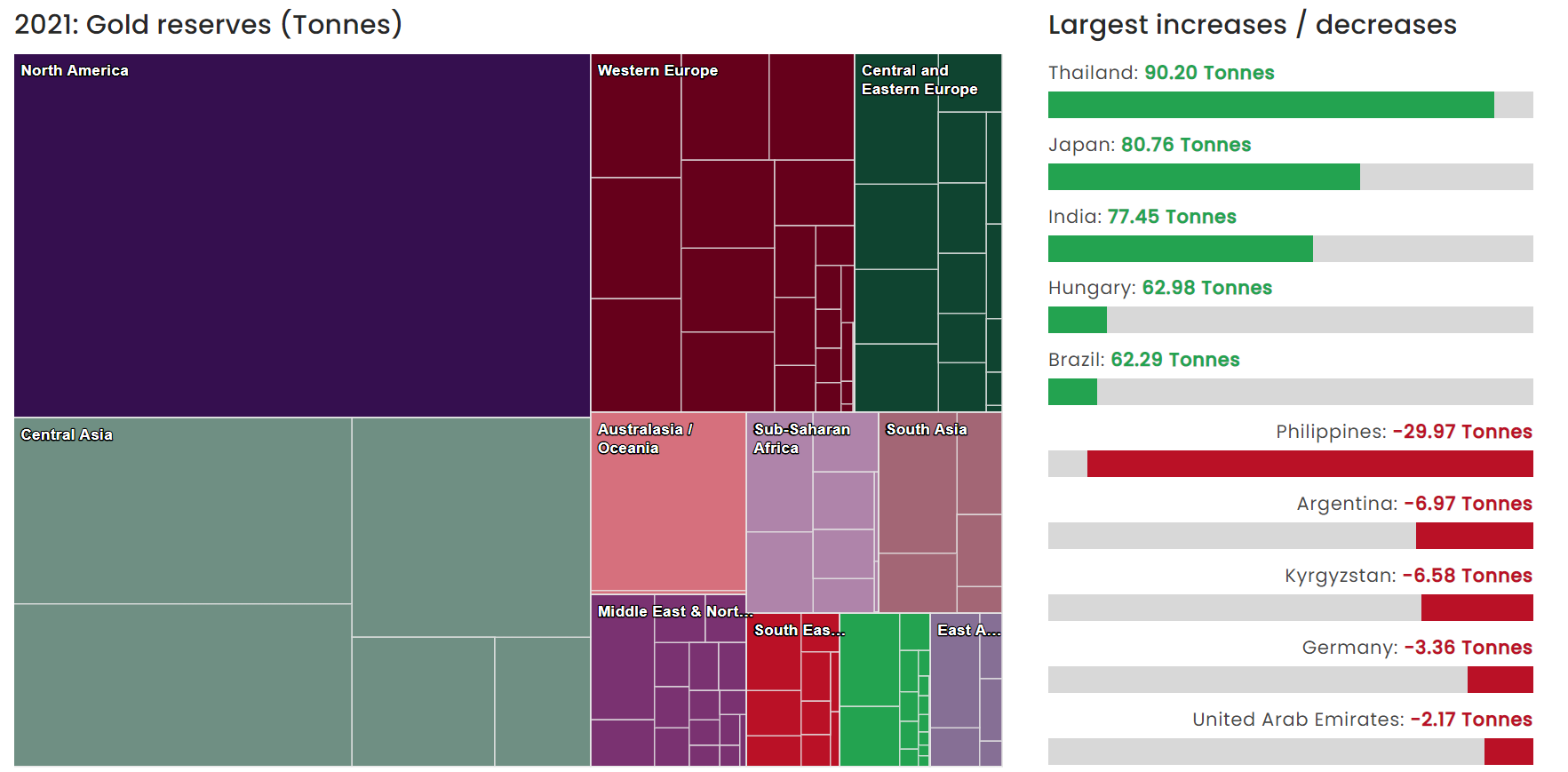

It’s not to accidental that galore countries did not person an involvement successful gold. Far from it, galore states deed hard by COVID-19 lined their equilibrium sheets with the precious metal. Thailand, Japan and India each had double-digit increases of their golden holdings passim 2021.

El Salvador’s enactment claimed the bitcoin enslaved would supply the state a caller mode to concern indebtedness that wasn’t tied to the International Monetary Fund and dollars. It would besides beryllium an plus that grows successful worth connected the equilibrium sheet, allowing for ambitious projects similar a metropolis powered by a volcano’s geothermal power. All this is possible, provided that bitcoin hits $1 million wrong the adjacent 5 years.

And there’s 1 much caveat. The enslaved itself volition not beryllium issued by the El Salvadorian government, but by LaGeo, a subsidiary of the state-owned energy institution CEL. El Salvador says this is lone a technicality; it’s inactive a indebtedness of the sovereign.

With each the complications progressive and bitcoin’s fragile price, this has been a unspeakable income transportation for different nations. The world is, information suggests nations don't truly privation thing speech from what they already have: low-yielding but harmless Treasury bills, and immoderate gold. Even China, which ever threatens to dump its holdings, keeps a healthy supply connected the books contempt trimming the count.

Nayib Bukele’s program to make an alternate to state-level financing, bypassing the IMF via bitcoin, isn’t without its merits. The IMF has agelong been criticized arsenic a planetary indebtedness shark and a lender of past resort. If the program works, Bukele gets financing astatine a complaint preferential to the IMF. Bitcoin-washing debt, similar the greenish washing of the past, mightiness beryllium the hep caller happening for processing countries if there truly is $500 million successful commitments already lined up.

But states are blimpish creatures. Especially successful Asia, wherever bureaucracies tin beryllium slow-moving, and the representation of the Asian fiscal situation is inactive fresh. Despite the dollar doomers and those that deliberation America is connected the verge of shattering into 50 pieces, Treasury bills are inactive successful request – and not adjacent golden tin usurp it. Good luck to bitcoin.

Bitcoin Breaks Above $46K, Resistance astatine $48K-$51K

Bitcoin regular terms illustration shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) buying enactment accelerated implicit the play arsenic momentum signals turned positive.

The cryptocurrency broke supra archetypal resistance astatine $46,000, though stronger absorption astatine the 200-day moving average, which is present astatine $48,289, could stall the alleviation rally.

The comparative spot scale (RSI) connected the regular illustration is approaching overbought territory, akin to what occurred successful October, which preceded a sell-off. This time, however, buyers look to beryllium targeting a 50% reversal of the four-month-long downtrend, which would output further upside toward $50,966.

Momentum signals connected the play illustration person importantly improved, which was antecedently seen astatine astir the July debased of $29,400. Still, momentum remains antagonistic connected the monthly chart, which could hold a important terms rally successful the abbreviated term.

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Australia retail income (Feb. MoM)

2:45 p.m. HKT/SGT(6:45 a.m. UTC): France user assurance (March)

4:30 p.m. HKT/SGT(8:30 a.m. UTC): U.K. M4 wealth proviso (Feb. MoM/YoY)

9 p.m. HKT/SGT (1 p.m. UTC): Speech by New York Federal Reserve President John Williams

Shiba inu (SHIB) and solana (SOL) tokens led gains arsenic bitcoin hovered implicit $47,000. Noelle Acheson of Genesis Global Trading provided markets insights arsenic investors eyed bitcoin's adjacent enactment and absorption levels. Cyberattacks were successful absorption arsenic the Russia-Ukraine warfare rages on, and Dyma Budorin of Hacken shared insights into the Ukrainian government's telephone for integer endowment to combat connected the cyber front. Plus, Samir Kerbage of Hashdex provided insights connected the authorities of DeFi successful Brazil.

Crypto Privacy Positions Harden Ahead of Crunch EU Vote: Lawmakers don’t look swayed by crypto manufacture claims arsenic they see applying anti-laundering recognition rules to the sector, but immoderate reason the EU plans are unworkable oregon unlawful.

"I knew I’d ne'er get answers to those questions oregon find retired whether the connection was a morganatic telephone for assistance oregon immoderate benignant of con. But that didn’t halt maine from being struck by the pathos of what I’d read. In the midst of a brutal war, Bitcoin’s immutable ledger had offered idiosyncratic a means of asserting their humanity, a tiny but important enactment of defiance against an authoritarian authorities hell-bent connected denying it." (CoinDesk Director of Content Michael Casey) ... "While immoderate constituent to c credits arsenic a pragmatic solution to the planet’s clime woes, others accidental they marque the occupation worse – giving polluters escaped rein to emit much than they would otherwise." (CoinDesk newsman Sam Kessler)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)