Bitcoin velocity measures the complaint astatine which coins are circulating wrong the market. It is calculated by dividing the trailing 1-year estimated transaction volume—or the cumulative sum of transferred tokens—by the existent proviso of Bitcoin. Velocity is an important metric due to the fact that it indicates the level of economical enactment successful the network. A higher velocity means that coins are moving much frequently, suggesting higher transactional activity. In contrast, little velocity implies that coins are idle, perchance reflecting a semipermanent holding mentality.

CryptoSlate’s investigation recovered that Bitcoin’s velocity saw a notable uptick successful September. This short-term summation follows a prolonged play of diminution that began successful mid-March. To recognize the value of this uptick, we indispensable analyse some the caller spike and the semipermanent downward inclination successful velocity.

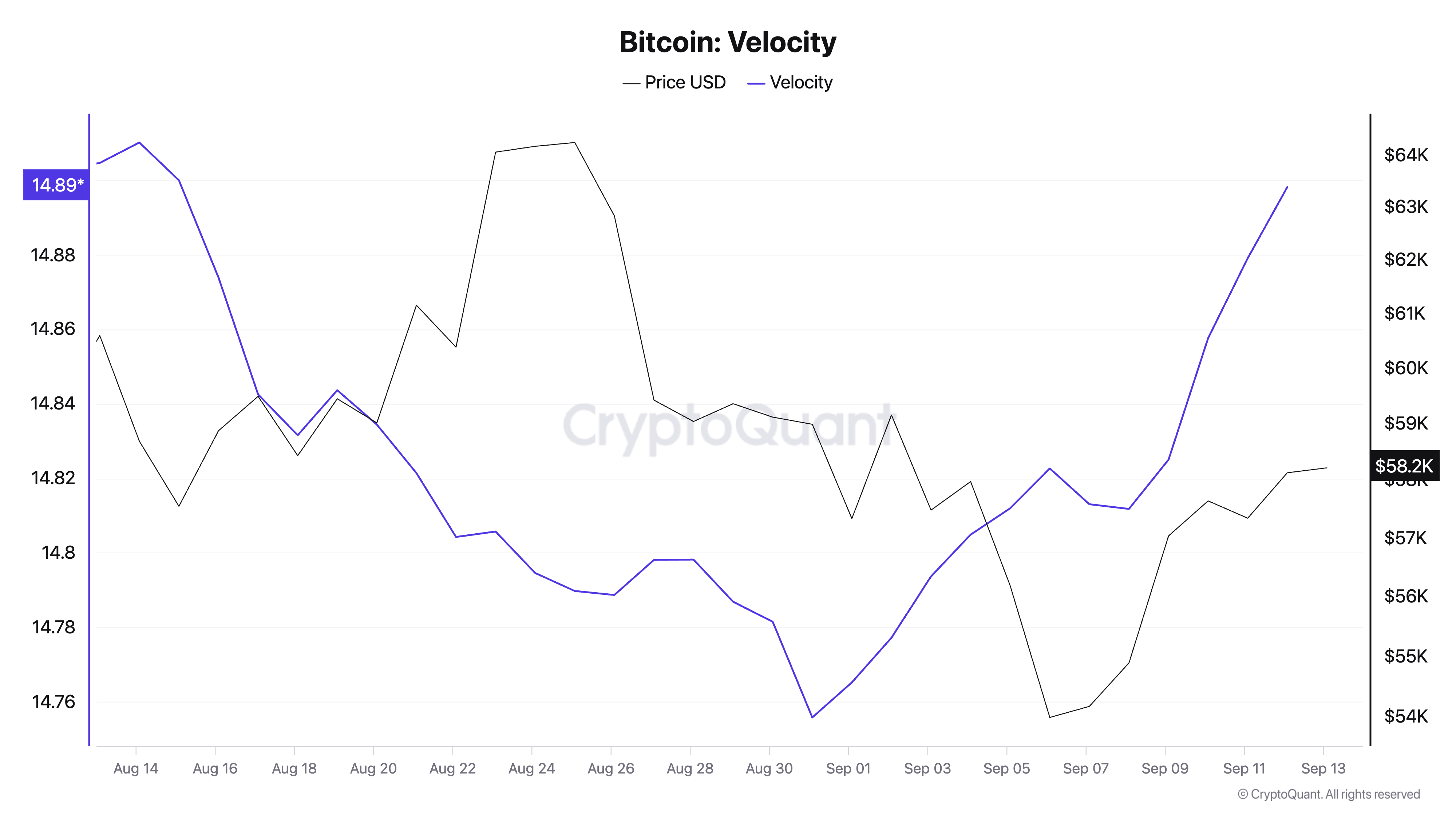

Graph showing Bitcoin’s velocity from Aug. 13 to Sep. 13, 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s velocity from Aug. 13 to Sep. 13, 2024 (Source: CryptoQuant)Bitcoin velocity began to summation aft months of dependable diminution astatine the extremity of August 2024. This short-term summation suggests a renewed question of marketplace activity. While the uptick is not important successful implicit terms, it marks the archetypal notable emergence successful Bitcoin velocity successful months. This suggests that aft a play of consolidation, the marketplace could beryllium preparing for much progressive participation.

Spurred by outer developments and expectations of further terms movements, traders person begun to determination their holdings again. This could beryllium owed to assorted factors, but it usually boils down to volatility—when prices determination significantly, trading enactment spikes arsenic the marketplace races to seizure nett oregon chopped losses from the terms swings, expanding transaction measurement and velocity.

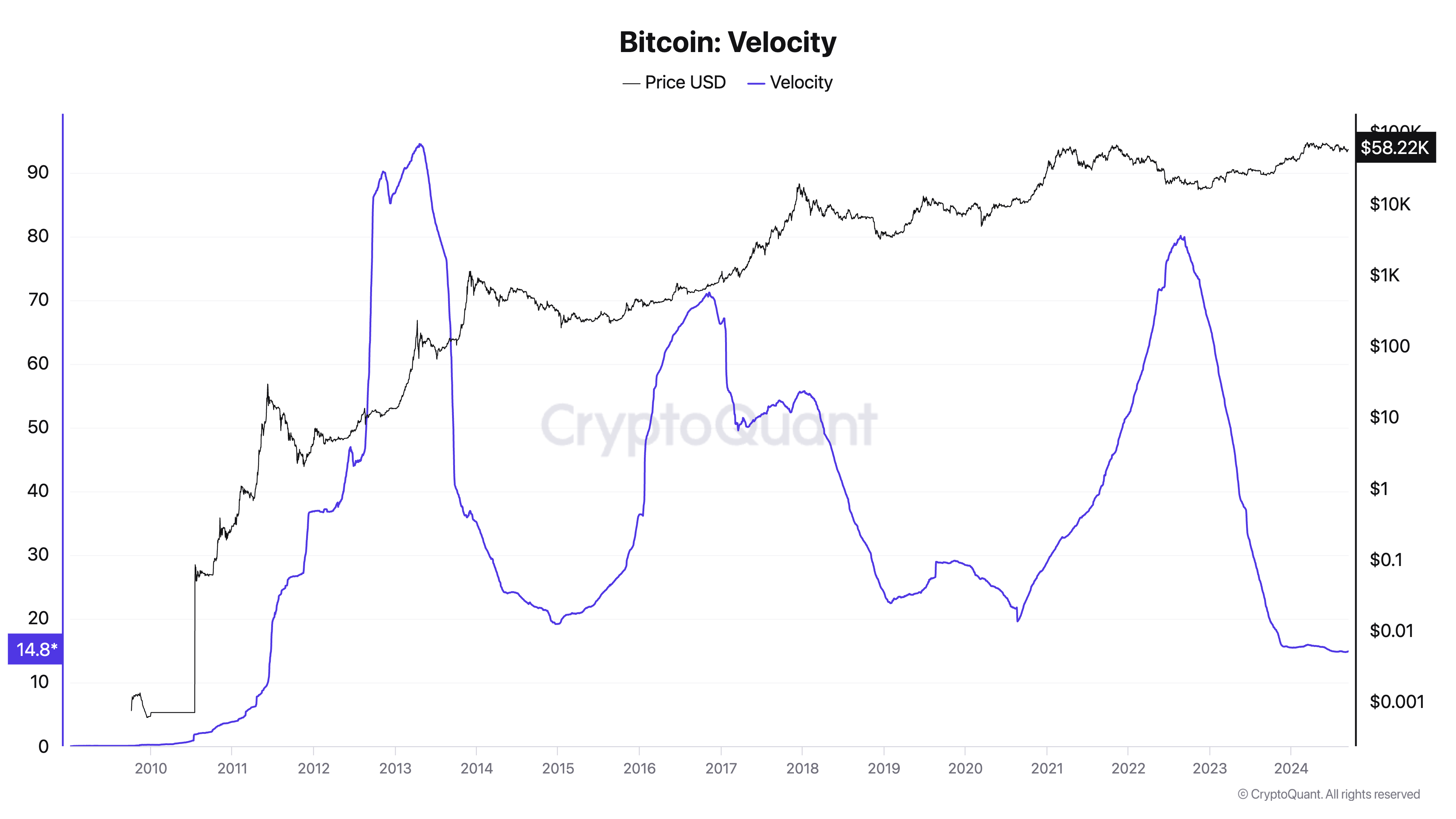

However, this short-term spike stands successful stark opposition to the broader trend. Historically, Bitcoin’s velocity has been connected a dependable decline. After reaching its highest during the 2013 bull market, velocity has declined significantly. While determination were notable spikes successful 2017 and 2021, corresponding with Bitcoin’s historical bull runs, velocity rapidly dropped disconnected afterward, returning to little levels. This prolonged diminution reflects a important displacement successful however Bitcoin is utilized wrong the market.

Graph showing Bitcoin’s velocity from 2009 to 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s velocity from 2009 to 2024 (Source: CryptoQuant)Over time, Bitcoin has progressively been perceived arsenic a store of worth alternatively than a mean of exchange. Long-term holders thin to accumulate Bitcoin with the anticipation of aboriginal appreciation, reducing the request for predominant transactions. As organization adoption has grown, truthful has the semipermanent accumulation trend.

Large organization players thin to determination Bitcoin successful larger but little predominant transactions. This behaviour contributes to the little wide velocity, arsenic institutions are mostly little funny successful predominant trading than retail participants. This has go particularly evident successful 2024 with the spike successful organization request from spot Bitcoin ETFs.

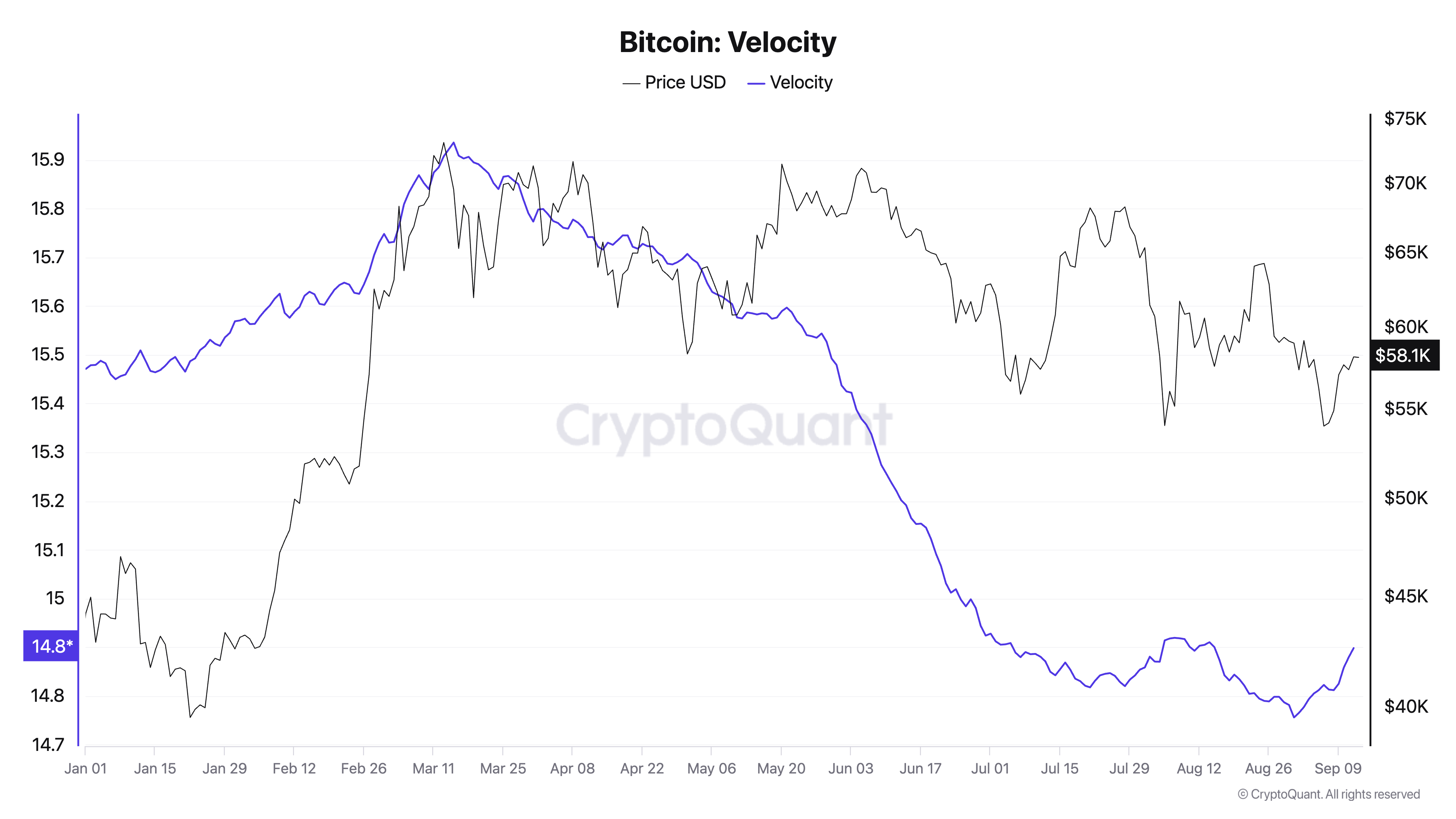

While the spike successful velocity we’ve seen since the opening of September is important successful the abbreviated word erstwhile considering the market, it’s inactive minuscule compared to the wide downward inclination successful 2024.

Graph showing Bitcoin’s velocity from Jan. 1 to Sep. 13, 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s velocity from Jan. 1 to Sep. 13, 2024 (Source: CryptoQuant)The existent uptick successful velocity suggests that the marketplace whitethorn beryllium entering a much progressive signifier aft a agelong play of consolidation. It could beryllium an aboriginal indicator of renewed involvement and speculative activity, perchance signaling a bullish outlook.

The broader marketplace continues to beryllium dominated by semipermanent holders, with HODLing and organization engagement contributing to the wide diminution successful velocity. Unless this caller uptick is accompanied by sustained terms appreciation and broader marketplace activity, it’s improbable to pb to a semipermanent reversal of the declining velocity trend.

The station First important emergence successful Bitcoin velocity since March shows spike successful trading appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)