A firefighter’s instrumentality connected today’s precarious economical mechanics and however bitcoin steps successful arsenic an empowerment instrumentality for the mediate class.

This is an opinion editorial by Dan, cohost of the Blue Collar Bitcoin Podcast.

A preliminary enactment to the reader: This was primitively written arsenic 1 effort that has since been divided into 3 parts for publication. Each conception covers distinctive concepts, but the overarching thesis relies connected the 3 sections successful totality. Much of this portion assumes the scholar possesses a basal knowing of Bitcoin and macroeconomics. For those who don’t, items are linked to corresponding definitions/resources. An effort is made passim to bring ideas backmost to the surface; if a conception isn’t clicking, support speechmaking to get astatine summative statements. Lastly, the absorption is connected the U.S. economical predicament; however, galore of the themes included present inactive use internationally.

Series Contents

Part 1: Fiat Plumbing

Introduction

Busted Pipes

The Reserve Currency Complication

The Cantillon Conundrum

Part 2: The Purchasing Power Preserver

Part 3: Monetary Decomplexification

The Financial Simplifier

The Debt Disincentivizer

A “Crypto” Caution

Conclusion

Part 1: Fiat Plumbing

Introduction

When Bitcoin is brought up astatine the firehouse, it’s often met with cursory laughs, looks of disorder oregon blank stares of disinterest. Despite tremendous volatility, bitcoin is the best-performing plus of the past decade, yet astir of nine inactive considers it trivial and transient. These inclinations are insidiously ironic, peculiarly for members of the mediate class. In my view, bitcoin is the precise instrumentality mean wage earners request astir to enactment afloat amidst an economical situation that is peculiarly inhospitable to their demographic.

In today’s satellite of fiat money, monolithic indebtedness and prevalent currency debasement, the hamster instrumentality is speeding up for the mean individual. Salaries emergence twelvemonth implicit year, yet the emblematic wage earner often stands determination dumbfounded, wondering wherefore it feels harder to get up oregon adjacent marque ends meet. Most people, including the little financially literate, consciousness thing is dysfunctional successful the 21st period system — stimulus wealth that magically appears successful your checking account; speech of trillion dollar coins; banal portfolios reaching all-time highs amidst a backdrop of planetary economical shutdown; lodging prices up by double-digit percentages successful a azygous year; meme stocks going parabolic; useless cryptocurrency tokens that balloon into the stratosphere and past implode; convulsive crashes and meteoric recoveries. Even if astir can’t enactment a digit connected precisely what the contented is, thing doesn’t consciousness rather right.

The planetary system is structurally broken, driven by a methodology that has resulted successful dysfunctional indebtedness levels and an unprecedented grade of systemic fragility. Something is going to snap, and determination volition beryllium winners and losers. It’s my contention that the economical realities that face america today, arsenic good arsenic those that whitethorn befall america successful the future, are disproportionately harmful to the mediate and little classes. The satellite is successful hopeless request of sound money, and arsenic improbable arsenic it whitethorn seem, a batch of concise, open-source codification released to members of an obscure mailing database successful 2009 has the imaginable to repair today’s progressively wayward and inequitable economical mechanics. It’s my volition successful this effort to explicate wherefore bitcoin is 1 of the superior tools the mediate people tin wield to debar existent and forthcoming economical disrepair.

Busted Pipes

Our existent monetary strategy is fundamentally flawed. This is not the responsibility of immoderate peculiar person; rather, it’s the effect of a decades-long bid of defective incentives starring to a brittle system, stretched to its limits. In 1971 pursuing the Nixon Shock and the suspension of dollar convertibility into gold, mankind embarked connected a caller pseudo-capitalist experiment: centrally-controlled fiat currencies with nary dependable peg oregon reliable notation point. A thorough exploration of monetary past is beyond the scope of this piece, but the important takeaway, and the sentiment of the author, is that this modulation has been a nett antagonistic to the moving class.

Without a dependable basal furniture metric of value, our planetary monetary strategy has go inherently and progressively fragile. Fragility mandates intervention, and involution has repeatedly demonstrated a propensity to exacerbate economical imbalance successful the agelong run. Those who beryllium down the levers of monetary powerfulness are often demonized — memes of Jerome Powell cranking a wealth printer and Janet Yellen with a clown chemoreceptor are commonplace connected societal media. As amusing arsenic specified memes whitethorn be, they are oversimplifications that often bespeak misunderstandings regarding however the plumbing of an economical instrumentality built disproportionately connected credit1 really functions. I’m not saying these policymakers are saints, but it’s besides improbable they are malevolent morons. They are plausibly doing what they deem “best” for humanity fixed the unstable scaffolding they are perched on.

To zero successful connected 1 cardinal example, let’s look astatine the Global Financial Crisis (GFC) of 2007-2009. The U.S Department of the Treasury and the Federal Reserve Board are often maligned for bailing retired banks and acquiring unprecedented amounts of assets during the GFC, via programs similar Troubled Asset Relief and monetary policies similar quantitative easing (QE), but let's enactment ourselves successful their shoes for a moment. Few grasp what the abbreviated and midterm implications would person been had the credit crunch cascaded further downhill. The powers successful spot did initially spectate the illness of Bear Stearns and the bankruptcy of Lehman Brothers, 2 monolithic and integrally progressive fiscal players. Lehman, for example, was the fourth-largest concern slope successful the U.S. with 25,000 employees and adjacent to $700 cardinal successful assets. But what if the illness had continued, contagion had dispersed further, and dominoes the likes of Wells Fargo, CitiBank, Goldman Sachs oregon J.P. Morgan had subsequently imploded? “They would person learned their lesson,” immoderate say, and that’s true. But that “lesson” whitethorn person been accompanied by a immense percent of citizens’ savings, investments and status nest eggs wiped out; recognition cards retired of service; bare market stores; and I don’t consciousness it utmost to suggest perchance wide societal breakdown and disorder.

Please don’t misunderstand maine here. I americium not a proponent of inordinate monetary and fiscal interventions — rather the contrary. In my view, the policies initiated during the Global Financial Crisis, arsenic good arsenic those carried retired successful the decennary and a fractional to follow, person contributed importantly to the fragile and volatile economical conditions of today. When we opposition the events of 2007-2009 with the eventual economical fallouts of the future, hindsight whitethorn amusement america that biting the slug during the GFC would person so been the champion people of action. A beardown lawsuit tin beryllium made that short-term symptom would person led to semipermanent gain.

I item the illustration supra to show wherefore interventions occur, and wherefore they volition proceed to hap wrong a debt-based fiat monetary strategy tally by elected and appointed officials inextricably bound to short-term needs and incentives. Money is simply a basal furniture of quality connection — it is arguably mankind’s astir important instrumentality of cooperation. The monetary tools of the 21st period person worn down; they malfunction and necessitate ceaseless maintenance. Central banks and treasuries bailing retired fiscal institutions, managing involvement rates, monetizing debt and inserting liquidity erstwhile prudent are attempts to support the satellite from imaginable devastation. Centrally-controlled wealth tempts policymakers to insubstantial implicit short-term problems and footwear the tin down the road. But arsenic a result, economical systems are inhibited from self-correcting, and successful turn, indebtedness levels are encouraged to stay elevated and/or expand. With this successful mind, it’s nary wonderment that indebtedness — some nationalist and backstage — is astatine oregon adjacent a species-level precocious and today’s fiscal strategy is arsenic reliant connected recognition arsenic immoderate constituent successful modern history. When indebtedness levels are engorged, recognition hazard has the imaginable to cascade and terrible deleveraging events (depressions) loom large. As recognition cascades and contagion enters overly-indebted markets unabated, past shows america the satellite tin get ugly. This is what policymakers are attempting to avoid. A manipulatable fiat operation enables money, recognition and liquidity instauration arsenic a maneuver to effort and debar uncomfortable economical unwinds — a capableness that I volition question to show is simply a nett antagonistic implicit time.

When a tube bursts successful a deteriorating home, does the proprietor person clip to gut each partition and regenerate the full system? Hell no. They telephone an exigency plumbing work to repair that section, halt the leak, and support the h2o flowing. The plumbing of today’s progressively fragile fiscal strategy mandates changeless attraction and repair. Why? Because it’s poorly constructed. A fiat monetary strategy built chiefly connected debt, with some the proviso and price2 of wealth heavy influenced by elected and appointed officials, is simply a look for eventual disarray. This is what we are experiencing today, and it’s my assertion that this setup has grown progressively inequitable. By mode of analogy, if we qualify today’s system arsenic a “home” for marketplace participants, this location is not arsenic hospitable to each residents. Some reside successful newly-remodeled maestro bedrooms connected the 3rd floor, portion others are near successful the basement crawl space, susceptible to ongoing leakage arsenic a effect of inadequate fiscal plumbing — this is wherever galore members of the mediate and little classes reside. The existent strategy places this demographic astatine a perpetual disadvantage, and these basement dwellers are taking connected much and much h2o with each passing decade. To substantiate this claim, we’ll statesman with the “what” and enactment our mode to the “why.”

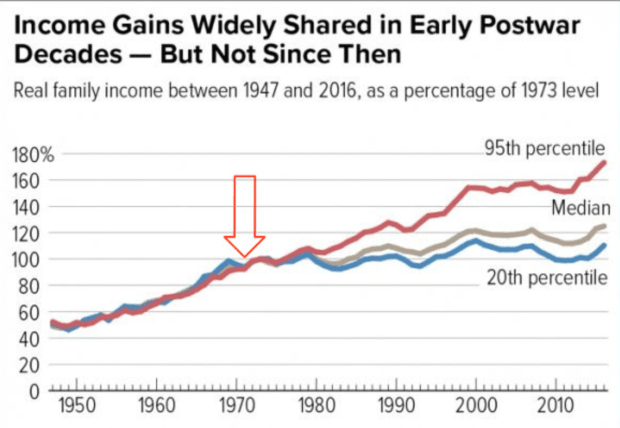

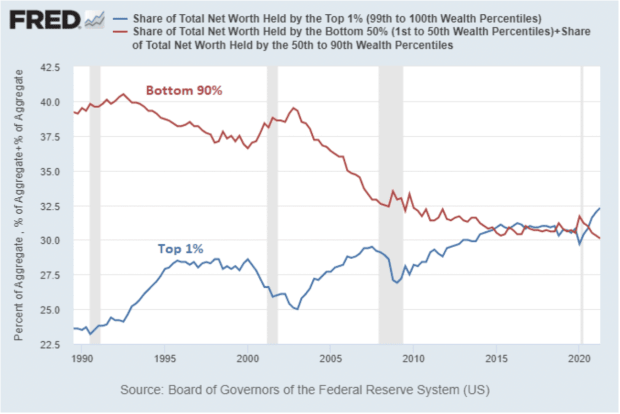

Consider the widening wealthiness spread successful the United States. As the charts beneath assistance to enumerate, it seems evident that since our determination toward a purely fiat system, the affluent person gotten richer and the remainder person stayed stagnant.

Chart Source: WTFHappenedIn1971.com

Chart Source: WTFHappenedIn1971.com Chart Source: “Does QE Cause Wealth Inequality” by Lyn Alden

Chart Source: “Does QE Cause Wealth Inequality” by Lyn Alden

The factors contributing to the wealthiness inequality are undeniably multifaceted and complex, but it’s my proposition that the architecture of our fiat monetary system, arsenic good arsenic the progressively rampant monetary and fiscal policies it enables, person contributed to wide fiscal instability and inequality. Let’s look astatine a mates examples of imbalances resulting from centrally-controlled authorities money, ones that are peculiarly applicable to the mediate and little classes.

The Reserve Currency Complication

The U.S. dollar sits astatine the basal of the 21st period fiat monetary strategy arsenic the planetary reserve currency. The march toward dollar hegemony arsenic we cognize it contiguous has taken spot incrementally implicit the past century, with cardinal developments on the mode including the Bretton Woods Agreement post-WWII, the severance of the dollar from golden successful 1971, and the advent of the petrodollar successful the mid-1970s, each of which helped determination the monetary basal furniture distant from much internationally neutral assets — specified arsenic golden — toward much centrally-controlled assets, namely authorities debt. United States liabilities are present the instauration of today’s planetary economical machine3; U.S. Treasurys are today's reserve plus of prime internationally. Reserve currency presumption has its benefits and trade-offs, but successful particular, it seems this statement has had antagonistic impacts connected the livelihood and competitiveness of U.S. manufacture and manufacturing — the American moving class. Here is the logical progression that leads maine (and galore others) to this conclusion:

- A reserve currency (the U.S. dollar successful this case) remains successful comparatively changeless precocious request since each planetary economical players request dollars to enactment successful planetary markets. One could accidental a reserve currency remains perpetually expensive.

- This indefinitely and artificially elevated speech complaint means the buying powerfulness for citizens successful a state with reserve currency presumption stays comparatively strong, portion the selling powerfulness stays comparatively diminished. Hence, imports turn and exports fall, causing persistent commercialized deficits (this is known arsenic the Triffin dilemma).

- As a result, home manufacturing becomes comparatively costly portion planetary alternatives go cheap, which leads to an offshoring and hollowing retired of the labour unit — the moving class.

- All the while, those benefiting astir from this reserve presumption are the ones playing portion successful an progressively engorged fiscal assemblage and/or progressive successful white-collar industries similar the tech assemblage that payment from diminished accumulation costs arsenic a effect of inexpensive offshore manufacturing and labor.

The reserve currency dilemma highlighted supra leads to exorbitant privilege for immoderate and inordinate misfortune for others.4 And let’s erstwhile again spell backmost to the basal of the issue: unsound and centrally-controlled fiat money. The beingness of reserve fiat currencies astatine the basal of our planetary fiscal strategy is simply a nonstop effect of the satellite moving distant from much sound, internationally neutral forms of worth denomination.

The Cantillon Conundrum

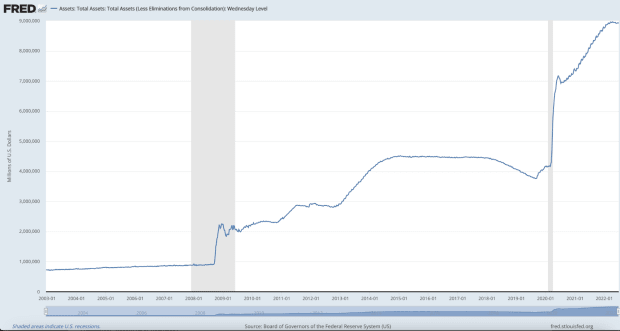

Fiat wealth besides sows the seeds of economical instability and inequality by actuating monetary and fiscal policy interventions, oregon arsenic I’ll notation to them here, monetary manipulations. Money that is centrally controlled tin beryllium centrally manipulated, and though these manipulations are enacted to support the brittle economical instrumentality churning (like we talked astir supra during the GFC), they travel with consequences. When cardinal banks and cardinal governments walk wealth they don’t person and insert liquidy whenever they deem it necessary, distortions occur. We get a glimpse astatine the sheer magnitude of caller centralized monetary manipulation by glancing astatine the Federal Reserve’s equilibrium sheet. It’s gone bananas successful caller decades, with little than $1 trillion connected the books pre-2008 yet accelerated approaching $9 trillion today.

Chart Source: St. Louis Fed

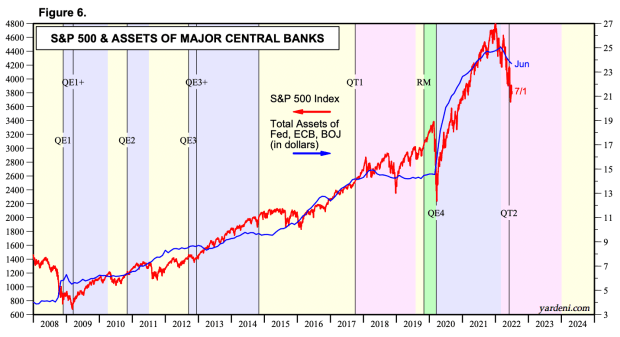

Chart Source: St. Louis FedThe Fed’s ballooning equilibrium expanse shown supra includes assets similar Treasury securities and mortgage-backed securities. A ample information of these assets were acquired with wealth (or reserves) created retired of bladed aerial done a signifier of monetary argumentation known arsenic quantitative easing (QE). The effects of this monetary fabrication are hotly debated successful economical circles, and rightfully so. Admittedly, depictions of QE arsenic “money printing” are shortcuts that disregard the nuance and complexity of these nifty tactics<FN5>; nonetheless, these descriptions whitethorn successful galore regards beryllium directionally accurate. What’s wide is that this monolithic magnitude of “demand” and liquidity coming from cardinal banks and governments has had a profound effect connected our fiscal system; successful particular, it seems to boost plus prices. Correlation doesn’t ever mean causation, but it gives america a spot to start. Check retired this illustration below, which trends the banal marketplace — successful this lawsuit the S&P 500 — with the equilibrium sheets of large cardinal banks:

Chart Source: Yardini Research, Incundefined(credit to Preston Pysh for pointing this illustration retired successful his tweet).

Chart Source: Yardini Research, Incundefined(credit to Preston Pysh for pointing this illustration retired successful his tweet).Whether it’s heightening the upside oregon limiting the downside, expansionary monetary policies look to cushion elevated plus values. It whitethorn look counterintuitive to item plus terms ostentation during a important marketplace clang — astatine clip of penning the S&P 500 is down adjacent to 20% from an all-time high, and the Fed looks slower to measurement successful owed to inflationary pressures. Nevertheless, determination inactive remains a constituent astatine which policymakers person rescued — and volition proceed to rescue — markets and/or pivotal fiscal institutions undergoing intolerable distress. True terms find is constrained to the downside. Chartered Financial Analyst and erstwhile hedge money manager James Lavish spells this retired well:

“When the Fed lowers involvement rates, buys U.S. Treasurys astatine precocious prices, and lends wealth indefinitely to banks, this injects a definite magnitude of liquidity into the markets and helps enactment up the prices of each the assets that person sharply sold off. The Fed has, successful effect, provided the markets with downside protection, oregon a enactment to the owners of the assets. Problem is, the Fed has stepped successful truthful galore times recently, that markets person travel to expect them to enactment arsenic a fiscal backstop, helping forestall an plus terms meltdown oregon adjacent earthy losses for investors."6

Anecdotal grounds suggests that supporting, backstopping, and/or bailing retired cardinal fiscal players keeps plus prices artificially unchangeable and, successful galore environments, soaring. This is simply a manifestation of the Cantillon Effect, the thought that the centralized and uneven enlargement of wealth and liquidity benefits those closest to the wealth spigot. Erik Yakes describes this dynamic succinctly successful his publication “The 7th Property”:

“Those who are furthest removed from enactment with fiscal institutions extremity up worst off. This radical is typically the poorest successful society. Thus, the eventual interaction connected nine is simply a wealthiness transportation to the wealthy. Poor radical go poorer, portion the affluent get wealthier, resulting successful the crippling oregon demolition of the mediate class.”

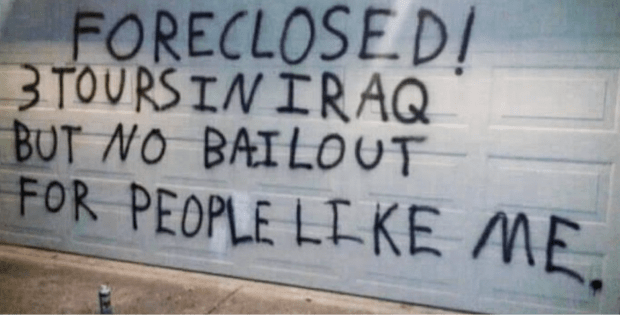

When wealth is fabricated retired of bladed air, it’s prone to bolster plus valuations; therefore, the holders of those assets benefit. And who holds the largest quantity and highest prime of assets? The wealthy. Monetary manipulation tactics look to chopped chiefly 1 way. Let’s again see the GFC. A fashionable communicative that I judge is astatine slightest partially close depicts mean wage earners and homeowners arsenic mostly near to fend for themselves successful 2008 — foreclosures and occupation losses were plentiful; meanwhile, insolvent fiscal institutions were enabled to march connected and yet recover.

Image Source: Tweet from Lawrence Lepard

Image Source: Tweet from Lawrence LepardIf we fast-forward to the COVID-19 fiscal and monetary responses, I tin perceive counterarguments stemming from the conception that stimulus wealth was wide distributed from the bottommost up. This is partially true, but see that $1.8 trillion went to individuals and families successful the signifier of stimulus checks, portion the illustration supra reveals that the Fed’s equilibrium expanse has expanded by astir $5 trillion since the commencement of the pandemic. Much of this quality entered the strategy elsewhere, assisting banks, fiscal institutions, businesses, and mortgages. This has, astatine slightest partially, contributed to plus terms inflation. If you are an plus holder, you tin spot grounds of this successful recalling that your portfolio and/or location valuations were apt astatine all-time highs amidst 1 of the astir economically damaging environments successful caller history: a pandemic with globally-mandated shutdowns.7

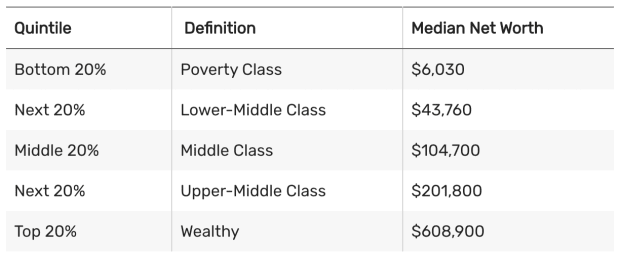

In fairness, galore members of the mediate people are plus holders themselves, and a bully information of the Fed’s equilibrium expanse enlargement went to buying owe bonds, which helped little the outgo of mortgages for all. But let’s see that successful America, the median nett worthy is conscionable $122,000, and arsenic the illustration beneath catalogs, this fig plummets arsenic we determination down the wealthiness spectrum.

Chart Source: TheBalance.com

Chart Source: TheBalance.comFurthermore, astir 35% of the colonisation doesn’t ain a home, and let’s besides discern that the benignant of existent property owned is simply a cardinal favoritism — the wealthier radical are, the much invaluable their existent property and correlated appreciation becomes. Asset ostentation disproportionately benefits those with much wealth, and arsenic we’ve explored successful Part 1, wealthiness attraction has grown much and much pronounced successful caller years and decades. Macroeconomist Lyn Alden elaborates connected this concept:

“Asset terms ostentation often happens during periods of precocious wealthiness attraction and debased involvement rates. If a batch of caller wealth is created, but that wealth gets concentrated successful the precocious echelons of nine for 1 crushed oregon another, past that wealth can’t truly impact user prices excessively overmuch but alternatively tin pb to speculation and overpriced buying of fiscal assets. Due to taxation policies, automation, offshoring, and different factors, wealthiness has concentrated towards the apical successful the U.S. successful caller decades. People successful the bottommost 90% of the income spectrum utilized to person astir 40% of US household nett worthy successful 1990, but much precocious it’s down to 30%. The apical 10% folks saw their stock of wealthiness ascent from 60% to 70% during that time. When wide wealth goes up a batch but gets alternatively concentrated, past the nexus betwixt wide wealth maturation and CPI maturation tin weaken, portion the nexus betwixt wide wealth maturation and plus terms maturation intensifies.”8

As a whole, artificially inflated plus prices are maintaining oregon expanding the purchasing powerfulness of the wealthy, portion leaving the mediate and little classes stagnant oregon successful decline. This besides holds existent for members of younger generations who person nary nest ovum and are moving to get their fiscal feet underneath them. Although WILDLY imperfect (and galore would suggest detrimental), it's understandable wherefore much and much radical are clamoring for things similar universal basal income (UBI). Handouts and redistributive economical approaches are progressively fashionable for a reason. Poignant examples bash beryllium wherever the affluent and almighty were advantaged supra the mean Joe. Preston Pysh, cofounder of The Investor’s Podcast Network, has described definite expansionary monetary policies arsenic “universal basal income for the rich.”9 In my view, it’s ironic that galore of those privileged to person benefited astir dramatically from the existent strategy are besides those who advocator for little and little authorities involvement. These individuals neglect to admit that existing cardinal slope interventions are a large contributing origin to their bloated wealthiness successful the signifier of assets. Many are unsighted to the information that they are the ones suckling from the largest authorities teat successful the satellite today: the fiat wealth creator. I americium surely not an advocator for rampant handouts oregon suffocating redistribution, but if we privation to sphere and turn a robust and functional signifier of capitalism, it indispensable alteration adjacent accidental and just worth accrual. This seems to beryllium breaking down arsenic the world’s monetary basal furniture becomes much unsound. It’s rather wide that the existent setup is not distributing beverage evenly, which begs the question: bash we request a caller cow?

Overarchingly, I judge galore mean folks are encumbered by 21st period economical architecture. We request an upgrade, a strategy that tin beryllium concurrently antifragile and equitable. The atrocious quality is that wrong the existing setup, the trends I’ve outlined supra amusement nary signs of abatement, successful information they are bound to worsen. The bully quality is that the incumbent strategy is being challenged by a agleam orangish newcomer. In the remainder of this effort we volition unpack wherefore and however Bitcoin functions arsenic a fiscal equalizer. For those stuck successful the proverbial economical basement, dealing with the acold and bedewed consequences of deteriorating fiscal plumbing, Bitcoin provides respective cardinal remedies to existent fiat malfunctions. We’ll research these remedies successful Part 2 and Part 3.

1. The words “credit” and “debt” some pertain to owing wealth — indebtedness is wealth owed; recognition is the wealth borrowed that tin beryllium spent.

2. The terms of wealth being involvement rates

3. For much connected however this works, I urge Nik Bhatia’s publication “Layered Money.”

4. A disclaimer whitethorn beryllium successful bid here: I americium not anti-globalization, pro-tariff, oregon isolationist successful my economical viewpoint. Rather, I question to outline an illustration of however a monetary strategy built heavy connected apical of the sovereign indebtedness of a azygous federation tin pb to imbalances.

5. If you are funny successful exploring the nuance and complexity of Quantitative Easing, Lyn Alden’s effort “Banks, QE, And Money-Printing” is my recommended starting point.

6. From “What Exactly Is The 'Fed Put', And (When) Can We Expect to See It Again?” by James Lavish, portion of his newsletter The Informationist.

7. Yes, I admit immoderate of this was the effect of stimulus wealth being invested.

8. From “The Ultimate Guide To Inflation” by Lyn Alden

9. Preston Pysh made this remark during a Twitter Spaces, which is present disposable via this Bitcoin Magazine Podcast.

This is simply a impermanent station by Dan. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)