As the fiscal markets brace for the upcoming Federal Open Market Committee (FOMC) gathering connected Wednesday, June 12th, the Bitcoin and crypto assemblage is poised to measure the implications of immoderate Federal Reserve announcements connected integer assets specified arsenic Bitcoin. With the statement forecast suggesting that the Federal Reserve volition clasp the national funds complaint dependable astatine 5.25%-5.50%, the superior involvement of investors has turned to the nuances of the Fed’s guardant guidance and economical projections.

Crypto expert Tomo (@Market_Look) shared his insights connected X, framing the upcoming FOMC gathering arsenic a non-event for those expecting drastic moves. He stated, “Interest rates are apt to stay unchanged (5.25%-5.50%). There volition apt not beryllium immoderate large changes to the connection oregon economical outlook, and the dot illustration is expected to displacement successful a hawkish direction.”

Tomo besides highlighted the anticipated adjustments successful the complaint projections for the coming years, noting, “In 2024, the complaint volition displacement from 3 cuts to 2 cuts. The hawkish astonishment volition beryllium 1 cut.” He explained that the marketplace has already priced successful these expected adjustments, suggesting minimal astonishment and constricted marketplace volatility successful response.

“As of March, the organisation of dots for 2024 is 9 radical successful favour of keeping involvement rates unchanged oregon cutting them twice, and 10 radical successful favour of cutting involvement rates 3 oregon much times… a displacement from 3 to 2 is already factored in.”

Banking elephantine ING’s squad of economists, including James Knightley and Padhraic Garvey, CFA, share a akin blimpish outlook connected the Federal Reserve’s imaginable moves. They expect that the Fed volition underscore its cautious stance owed to persistent ostentation and beardown employment figures, perchance delaying complaint cuts further into the future.

The ING squad elaborated connected their expectations, “The US Fed accepts that monetary argumentation is restrictive, but lingering ostentation and beardown jobs numbers mean it volition bespeak it’s prepared to hold longer earlier earnestly considering involvement complaint cuts.”

They expect that the dot plot, which volition uncover idiosyncratic FOMC members’ complaint predictions, volition amusement a simplification successful the fig of projected complaint cuts for 2024 from 3 to perchance 1 oregon two.

According to Nick Timiraos of the Wall Street Journal, JPMorgan and Citigroup person withdrawn their predictions for a complaint chopped successful July pursuing the caller jobs study past Friday. Currently, the bulk of sell-side economists and different experts monitoring the Federal Reserve expect 1 oregon 2 complaint reductions successful either September oregon December of this year.

JPM and Citi scrapped their calls for a July complaint chopped aft past Friday’s jobs report.

Most sell-side economists and different nonrecreational Fed watchers present expect 1 oregon 2 complaint cuts this twelvemonth successful either September oregon December pic.twitter.com/x9tUD06Pmi

— Nick Timiraos (@NickTimiraos) June 10, 2024

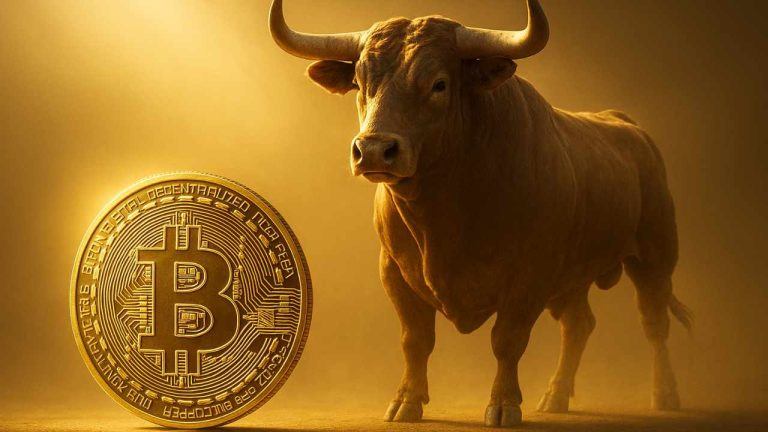

Impact On Bitcoin And Crypto

Bitcoin and the broader crypto marketplace person been rather delicate to macro economical information recently. The anticipation of a dovish turn—particularly immoderate hints of complaint cuts—could weaken the dollar and bolster Bitcoin and different integer assets arsenic alternate investments.

Conversely, a reaffirmation of the existent complaint oregon a little dovish stance than expected could fortify the dollar and use downward unit connected crypto markets. However, the nuanced perspectives of FOMC members, arsenic reflected successful the dot crippled and the accompanying economical projections, could supply clues astir the medium-term trajectory of US monetary policy, which successful crook could impact capitalist sentiment successful the crypto markets.

A hawkish tilt, suggesting less oregon delayed complaint cuts, mightiness fortify the US dollar and enactment downward unit connected Bitcoin and different cryptocurrencies. Conversely, immoderate dovish signals oregon indications of a softer stance connected complaint increases successful the adjacent aboriginal could buoy the crypto market.

During the FOMC property conference, Chair Jerome Powell’s remarks volition beryllium important for mounting the code and expectations. Market participants volition intimately analyse his comments for immoderate shifts successful code regarding inflation, economical growth, and aboriginal monetary argumentation adjustments. The mentation of these remarks could pb to significant terms movements successful the Bitcoin and crypto markets.

Moreover, the US Consumer Price Index (CPI) information for May 2024 conscionable hours earlier the FOMC gathering volition beryllium critical. These information points volition supply indispensable discourse for the Fed’s decisions, influencing their appraisal of whether the existent argumentation stance remains appropriate.

At property time, BTC traded astatine $67,707, down -3.5% since yesterday’s precocious astatine $71,200.

Bitcoin falls beneath $68,000, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin falls beneath $68,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

11 months ago

11 months ago

English (US)

English (US)