While bitcoin’s terms mightiness beryllium “down,” the metrics that bespeak the maturation of Bitcoin are connected a existent people to the positive.

This is an sentiment editorial by Mickey Koss, a West Point postgraduate with a grade successful economics. He spent 4 years successful the Infantry earlier transitioning to the Finance Corps.

Sorry guys. Time to battalion it up. Bitcoin died again.

Just kidding. And for Peter Schiff, I’ll conscionable permission the golden 10-year illustration beneath for fun. Pretty chaotic thrust for a 17% summation implicit the past decade. I thought these golden guys were expected to beryllium debased clip preference?

(Source: Macro Trends)

(Source: Macro Trends)In my original article, I discussed the quality betwixt awesome and sound and however wide media incentivizes clicks done misleading headlines. I decided to constitute a follow-up to sermon the Bitcoin worth awesome I’ve seen implicit the past week oregon so.

As each the normies suffer their minds implicit the caller marketplace clang beneath the erstwhile all-time high, I’m trying to stay nonsubjective by identifying worth signals hidden done the fearfulness articles littered passim the internet.

Price Versus Market Cap

Doing a small probe connected Coin Market Cap, you tin intelligibly spot bitcoin’s terms breaking the erstwhile all-time precocious amid monolithic capitulation, liquidation and wide bearish sentiment selling.

(Coin Market Cap BTC Price Chart)

(Coin Market Cap BTC Price Chart)If you alteration the illustration to marketplace headdress alternatively of price, it paints a somewhat antithetic picture.

(Coin Market Cap BTC Market Cap Chart)

(Coin Market Cap BTC Market Cap Chart)While the shapes are akin successful appearance, if you excavation into the numbers you tin spot the quality much clearly. In 2017, Bitcoin peaked astatine a $296 cardinal marketplace headdress with $14 cardinal successful 24-hour volume. As of June 19, 2022, Bitcoin has bottomed (for now) astatine a marketplace headdress of $367 cardinal with $44 cardinal successful 24-hour volume.

Had you dollar-cost averaged implicit this period, you would person not lone captured a larger stock of a credibly enforced, digitally scarce network, you would besides person entree to a much liquid worth web had you had the unthinkable impulse to merchantability your hard-earned coin.

Wallets, HODLers, And Hash Rate Oh My

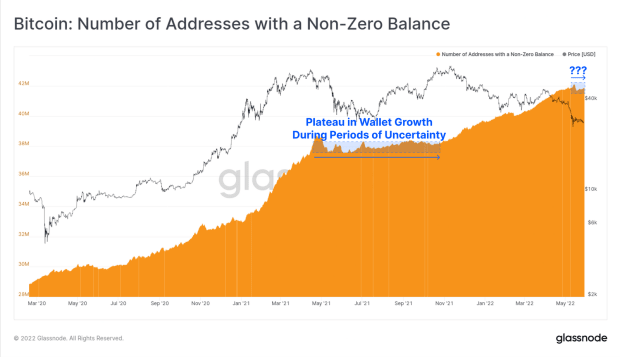

(Source: Glassnode Insights)

(Source: Glassnode Insights)Wallet maturation besides appears to beryllium connected the rise. With a small blip of sound connected the close tail, the inclination is evidently up and to the right, experiencing a astir 45% summation implicit the past 2 years.

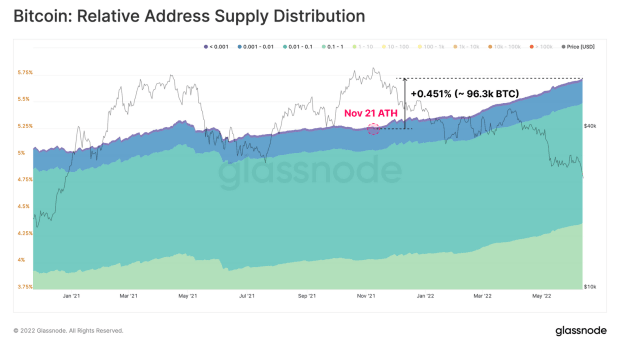

(Source: Glassnode Insights)

(Source: Glassnode Insights)In summation to nonzero wallet growth, wallets with 0.1 to 1 BTC person been connected the emergence since July 2021. In my eyes this indicates the dependable maturation of the superior pleb-level investor, alternatively than a signifier of panicked tourists leaving the market. Perhaps tegument successful the crippled incentivizes the impervious of enactment required to larn the worth of bitcoin alternatively than focusing connected terms alone.

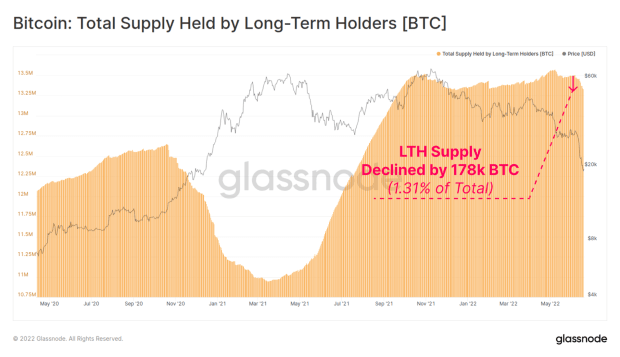

(Source: Glassnode Twitter)

(Source: Glassnode Twitter)In presumption of HODLers, the magnitude of bitcoin held by semipermanent holders accrued by astir 20% since April 2021 and has remained comparatively constant, adjacent with the dilatory grind down from the all-time precocious past fall. This doesn’t look precise bearish to me. The ones who sold hardly made a dent successful semipermanent holder supply.

Last successful the chute is hash rate. There are sensational articles abound astir a shrinking hash rate and miner capitulation. If you really work the nonfiction though, it’s not rather arsenic shocking. Hash complaint has dipped to lows not seen for nearly… 4 full months. Shocking, scandalous.

Will Clemente paints a darker picture, yet my decision is inactive the same. If I retrieve correctly, Bitcoin was inactive unafraid 2 years agone and was capable to debar onslaught and exploitation. As miners autumn disconnected the network, trouble should set downwards implicit the coming weeks, making it much profitable for those who are capable to bent successful there. It’s a self-correcting system.

Bitcoin is not conscionable secured by a partition of axenic vigor done the miners. It is besides secured by a monolithic service of scarce and costly computing equipment; The instrumentality is scarce arsenic well.

Even if you miraculously had the electrical infrastructure to onslaught the network, bully luck getting your hands connected the computing power. I deliberation we’ll beryllium conscionable fine.

Even with the caller downturn successful hash rate, the macro inclination is inactive up and to the right. As Nico from Simply Bitcoin likes to say, incentives are stronger than coercion. Incentives instrumentality clip to play out. Don’t fto the short-term sound scare you retired of your position.

Stop Feeding The Whales

“We few, we blessed few, we set of brothers; For helium to-day that [HODLs their stack] with maine Shall beryllium my brother” — King Henry V connected Bitcoin, circa 1599

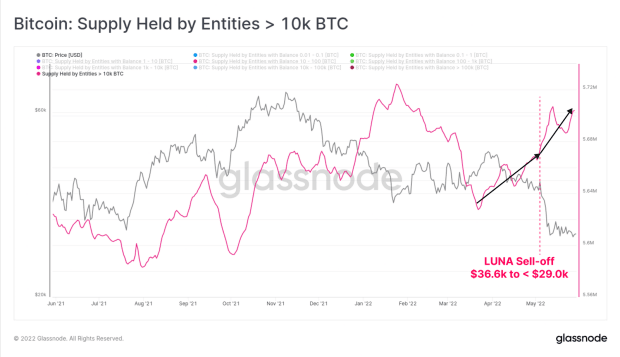

(Source: Glassnode Insights)

(Source: Glassnode Insights)Stop feeding the whales. As traders and tourists panic merchantability and get their stacks liquidated, the whales are opening to feast. What bash they cognize that you don’t? They’re watching adoption turn astir each day.

Warren Buffet says to beryllium fearful erstwhile others are greedy, to beryllium greedy erstwhile others are fearful. How astir this: dollar-cost mean and beryllium greedy careless of what different radical deliberation oregon feel. (Maybe a small other greedy erstwhile everyone is freaking out, similar close now).

Never hide the changeless devaluation of your dollars. Stake your assertion of perfectly scarce integer existent property earlier the large boys commencement to truly fig it out. I cognize that’s what I’ll beryllium doing. When successful doubt, support calm, zoom retired and stack sats.

This is simply a impermanent station by Mickey Koss. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)