The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

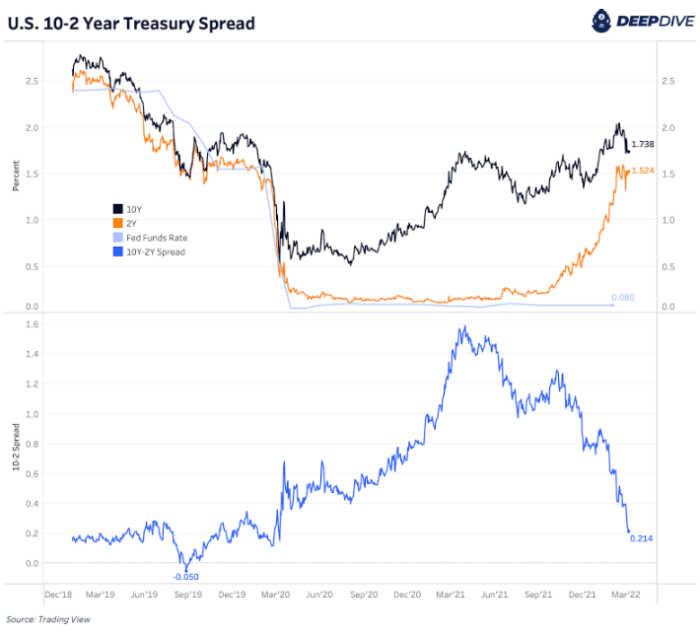

The meltdown successful equity and recognition markets is occurring portion the output curve (10-year U.S. Treasury output minus two-year U.S. Treasury yield) is flattening successful a melodramatic way:

The output curve is of large value successful the fiscal strategy owed to the mode that lending is conducted. Most creditors get abbreviated to lend agelong (i.e., instrumentality connected short-dated liabilities and get long-dated assets), truthful erstwhile the output curve inverts, it means that creditors are much incentivized to clasp short-dated authorities insubstantial than they are to lend retired for duration. The implications of short-dated yields being higher than long-dated means it is besides little risky to clasp currency than it is to put successful hazard assets (even with antagonistic existent yields) that merchantability disconnected with anemic economical activity.

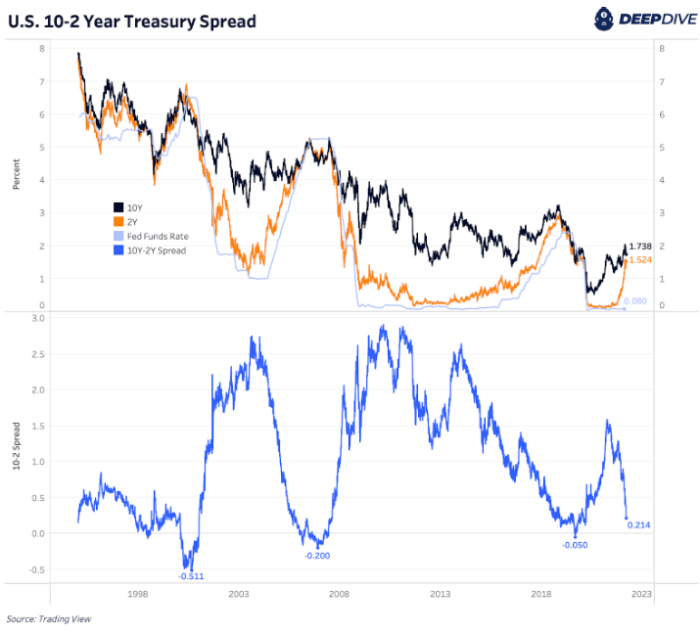

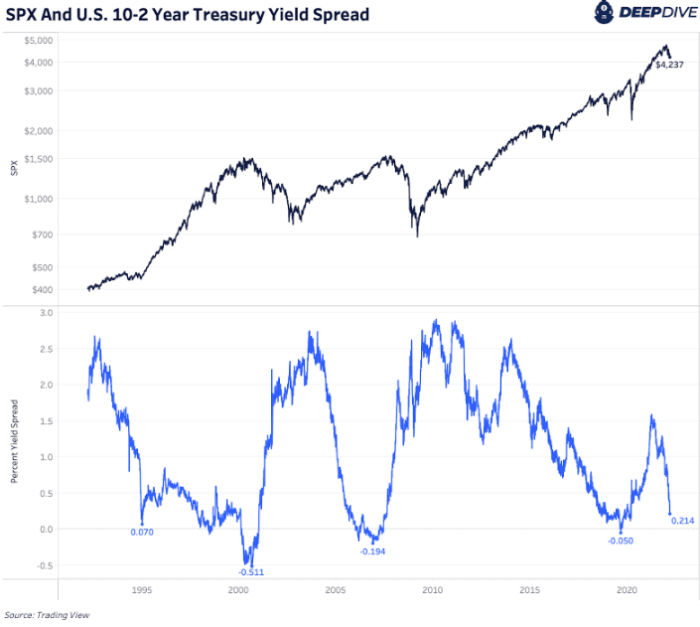

This leads to liquidity issues successful the economical strategy and it is wherefore a output curve inversion has predated each recession successful the United States since the 1960s.

Yield curve inversion has predated each recession successful the U.S. since the 1960s. Source: Trading View.

The astir jarring facet of the existent situation is the world that the Fed funds complaint is inactive adjacent 0%, with recession indicators flashing agleam red.

It would beryllium omniscient to pass our readers that contempt being highly bullish connected bitcoin’s prospects implicit the agelong term, the existent macroeconomic outlooks looks highly weak. Any excessive leverage contiguous successful your portfolio should beryllium evaluated.

Bitcoin successful your acold retention is perfectly harmless portion mark-to-market leverage is not. For consenting and diligent accumulators of bitcoin, the existent and imaginable aboriginal terms enactment should beryllium viewed arsenic a monolithic opportunity.

If a liquidity situation is to play out, indiscriminate selling of bitcoin volition hap (along with each different asset) successful a unreserved to dollars. What is occurring during this clip is fundamentally a abbreviated compression of dollars.

The effect volition beryllium a deflationary cascade crossed fiscal markets and planetary recession if this is to unfold.

This is wherefore we similar to support a multi-year (multi-decade even) outlook connected bitcoin, arsenic it is our content that the effect to this lawsuit volition beryllium lone 1 viable “solution”: much stimulus.

This volition apt travel successful the signifier of output curve control, wherever the Federal Reserve monetizes immoderate magnitude of indebtedness securities crossed assorted durations astatine a definite level of yield.

Quantitative easing is simply a fixed magnitude of wealth printing astatine immoderate price. Yield curve power is successful mentation an unlimited magnitude of printing to support a definite price. This is wherever the strategy is headed successful our view.

And this is wherefore we ain bitcoin.

3 years ago

3 years ago

English (US)

English (US)