Investors should attraction astir idiosyncratic privacy, if lone due to the fact that it’s becoming a inclination that is already having an interaction connected the market.

To beryllium sure, immoderate of the astir successful, profitable and impactful companies successful the satellite person thrived acknowledgment to a chiseled deficiency of privacy. Those are companies similar Google (now Alphabet) and Facebook (now Meta Platforms) that usage the immense magnitude of user information disposable to them to cherry-pick advertisements to nudge you to bargain thing you don’t request but really, truly want. That’s made imaginable by consumers giving up their privateness to supply that data.

For a while, fewer consumers seemed to mind, and the marketplace rewarded those companies. Facebook made its debut connected Nasdaq with a $60 cardinal marketplace capitalization successful 2012, and past marched that fig up to much than $1 trillion by past August. Google had a akin trajectory, starting with a $23 cardinal marketplace capitalization successful 2004 and peaking conscionable shy of $2 trillion precocious past year. They some did that by monetizing user data.

The Economist successful 2017 said information was the astir valuable assets successful the world, implicit oil, harkening backmost to the information scientists’ rallying outcry that “data is the caller oil.” Now, however, consumers are opening to caput that their accusation is getting pumped retired of them. As a result, that information is getting harder to cod and use.

The paradigm is shifting toward much privacy.

“Your phone’s not listening to you,” Tsukuyama says. “But what’s scary is that [companies] don’t person to listen. They tin infer who you’re hanging retired with, clip of day, if you’re looking for stuff, your age, each these kinds of things, from your hunt history. They don’t request to perceive to you – they conscionable cognize anyway.”

Enter Apple, which past twelvemonth made a propulsion to advertise improved privateness for its users. In short, Apple made it harder for apps to way information due to the fact that users could take to opt out. As an Android idiosyncratic who typically opts retired of sharing information with apps, I regarded this arsenic a nonevent. That was until Mark Zuckerberg, laminitis and CEO of Facebook/Meta, said this connected the company’s astir caller net league call:

“With Apple’s iOS changes and caller regularisation successful Europe, there’s a wide inclination wherever little information is disposable to present personalized ads… So we’re rebuilding a batch of our ads infrastructure truthful we tin proceed to turn and present high-quality personalized ads.”

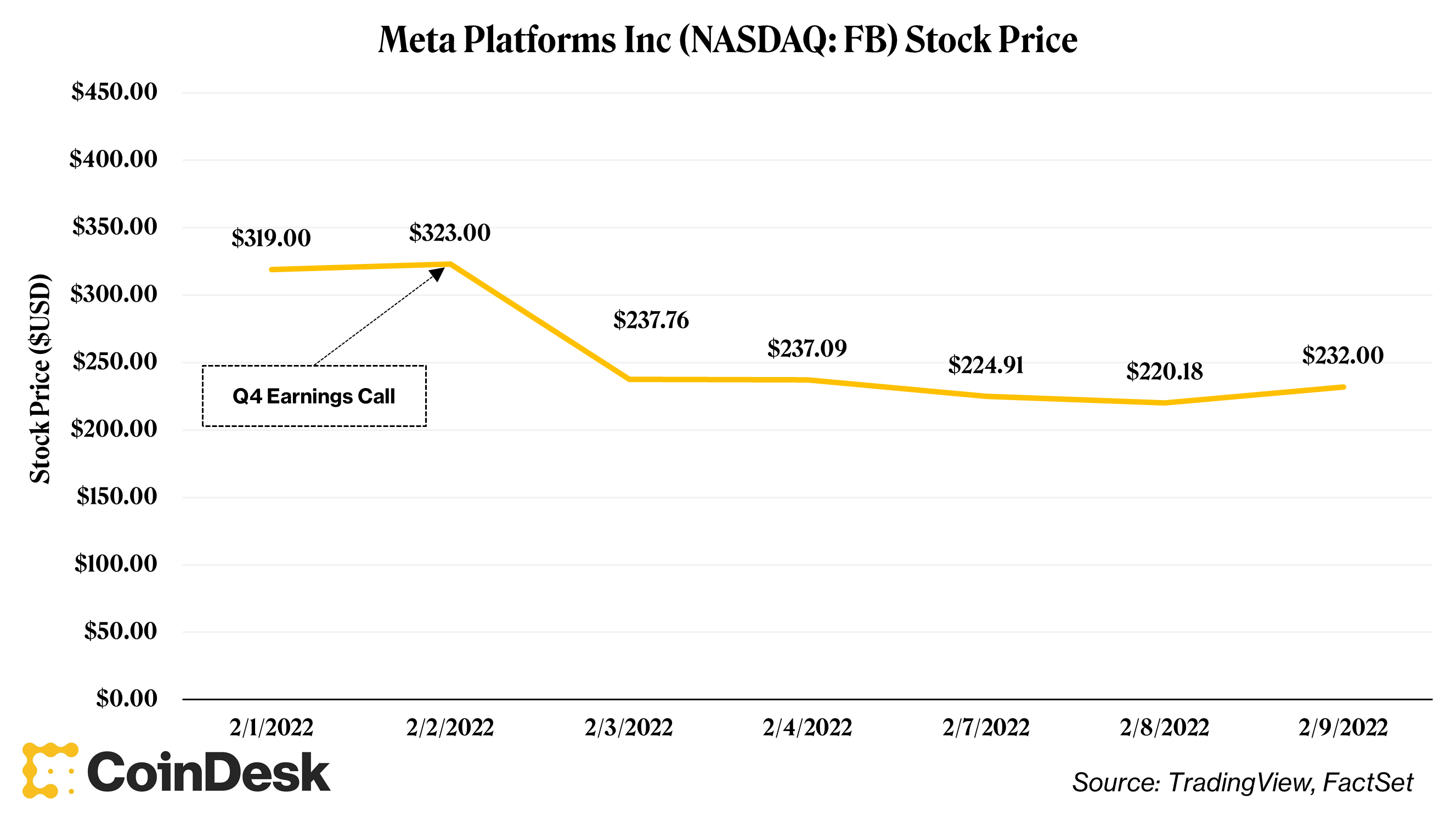

That was connected Feb. 2. Meta’s banal fell 26% connected the adjacent day. Apple’s propulsion for privateness was truthful good received by its users that 1 of the astir invaluable companies successful the satellite mislaid billions of dollars of marketplace value.

NASDAQ: FB; Source: TradingView, FactSet

Apple knows its users privation privacy. Unlike Apple’s precocious laminitis Steve Jobs, Tim Cook, the existent CEO, is simply a concern schoolhouse postgraduate who understands the worth of marketplace probe (Jobs didn’t rely connected marketplace research due to the fact that helium believed customers didn’t cognize what they wanted until Apple told them). As Zuckerberg’s comments bring to light, the privateness pendulum is swinging distant from “we’ll stock everything” to “hey, we privation our privateness back.”

Privacy is thing I’m obsessed with close now. And I’m taken aback by a deficiency of easy-to-use privateness successful cryptocurrency, including bitcoin, adjacent though privateness is 1 of the halfway tenets of Bitcoin arsenic a peer-to-peer integer cash.

Whether it’s Canada (where COVID-19 vaccine mandate protestors had bank accounts frozen), oregon it’s the alleged Bitfinex wealth launderers getting caught (even though they tried to cover their tracks), oregon adjacent the imaginable doxxing of the Ethereum DAO hacker (even though helium utilized a bitcoin mixer to obfuscate his trail), cryptocurrency is conscionable not large for privacy, particularly erstwhile it comes to converting crypto into currency for usage successful the “real world.”

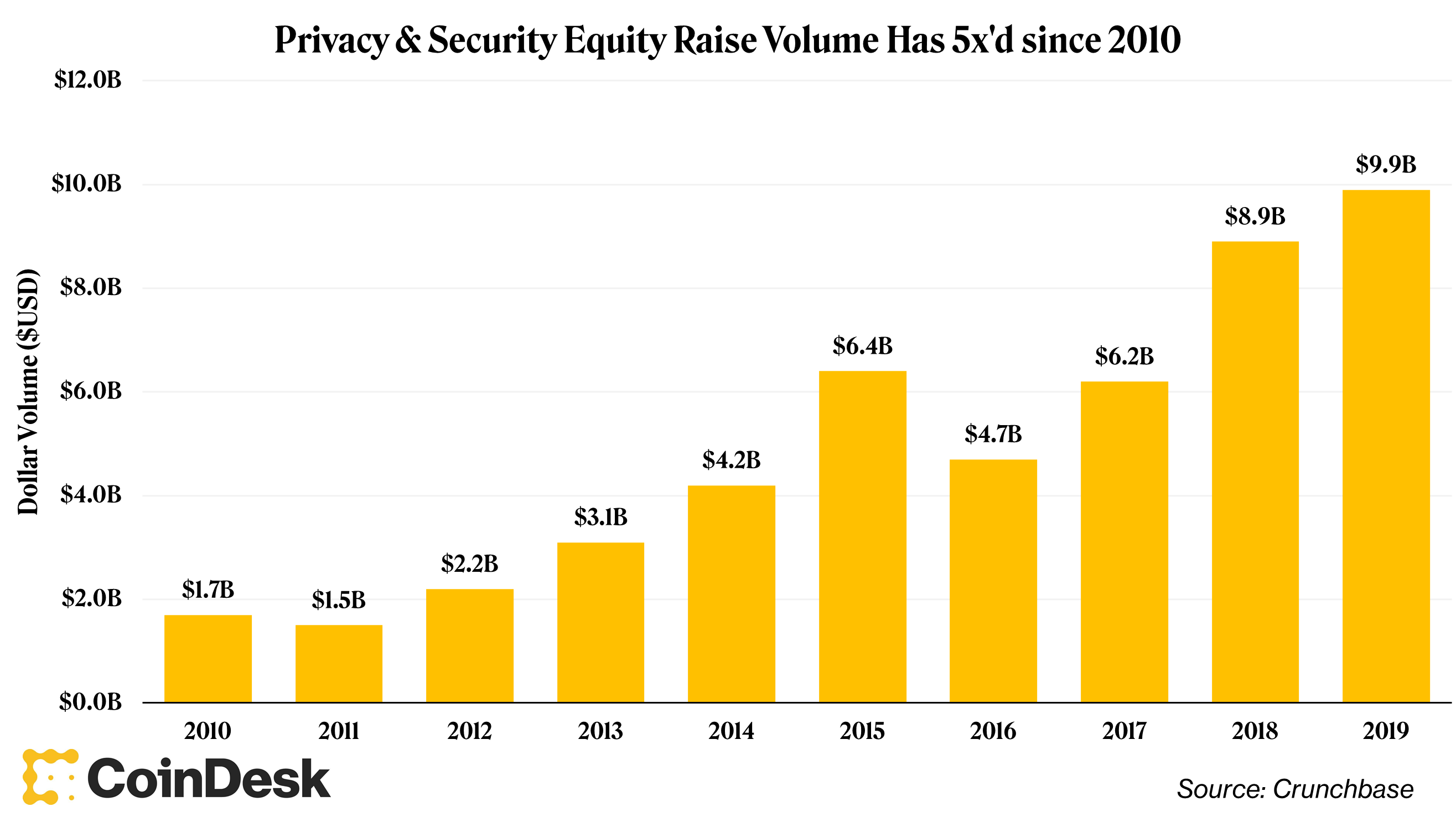

From an investor’s perspective, there’s a meaningful speech to beryllium had astir privacy-enabled technologies, due to the fact that wherever determination is capable demand, determination is wealth to beryllium made. We person seen this involvement materialize, with equity rise volumes successful privateness and cybersecurity companies hitting astir $10 cardinal successful 2019. With this renewed involvement successful privacy, we could expect much to come.

Source: Crunchbase

Whether that means concern needs to beryllium made successful Bitcoin infrastructure successful bid to alteration a “circular bitcoin economy” (which would alteration much privateness since off-ramps are arguably wherever privateness is compromised the most), oregon successful the improvement of privateness crypto coins similar Zcash oregon Monero, oregon successful thing other is up to the investor. Pick your spots.

TL;DR: Investors should attraction astir privateness due to the fact that consumers attraction astir privacy.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)