Despite concerns implicit web congestion and precocious state fees, Ethereum remains bullish successful the agelong term, according to borovik.eth–a spouse astatine Rollbit, who posted connected X connected December 26. The cardinal factors driving the affirmative outlook are pointing to Ethereum’s developer ecosystem, its relation successful the broader blockchain ecosystem, and the motorboat of galore Layer-2 solutions (L2s).

Will Layer-2 Activity Drive ETH To New Highs?

Borovik.eth remained deviant and optimistic astir ETH, adjacent with Solana (OSL) and different layer-1 coins similar Cardano (ADA) soaring successful 2023. In the analyst’s view, Ethereum’s scaling challenges are manageable, believing that developers volition find ways of “resolving this interest permanently implicit the agelong term.”

Based connected this optimism, the Rollbit spouse believes that ETH volition apt retrieve powerfully successful the coming sessions considering the level of development, particularly of layer-2 scaling options meant for the pioneer astute declaration platform. According to Borovik.eth, the improvement of layer-2 off-chain options backed by monolithic companies, for instance, Coinbase, a crypto exchange, and task capitalists (VCs), positions Ethereum (ETH) favorably for a bull run.

As of December 26, ETH remains successful an uptrend but is cooling disconnected aft coagulated gains successful Q4 2023. At spot rates, ETH is underperforming astir layer-1 platforms similar Injective Protocol (INJ) and Solana (SOL), whose prices rallied, reaching caller 2023 highs. ETH prices are inactive trending beneath $2,400, a captious absorption level. If bulls flooded this line, ETH whitethorn alert towards $3,500 oregon amended successful the months ahead.

The spike successful SOL’s valuation, particularly successful H2 2023, has led to a examination with ETH. Even so, astir traders are optimistic. Arthur Hayes precocious stated that users should statesman rotating funds from SOL to ETH, an endorsement of the 2nd astir invaluable coin by marketplace cap.

Ethereum Layer-2s Manage Over $18.8 Billion

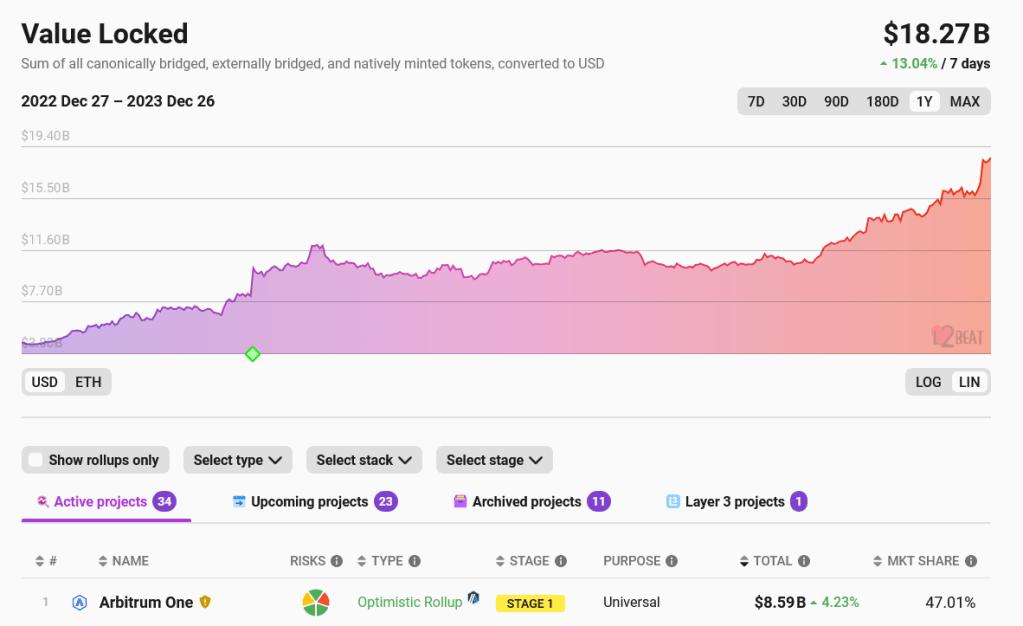

While Ethereum faces challenges astir on-chain scaling, developers person been moving hard to resoluteness this issue. The merchandise of layer-2 off-chain options utilizing rollups has been cardinal successful this drive. Most of these solutions, including Arbitrum and Optimism, person been captious successful alleviating unit from the mainnet, frankincense reducing state fees. According to L2Beat, layer-2 protocols negociate implicit $18 cardinal arsenic full worth locked (TVL). There are besides 34 progressive projects, with 23 much being developed.

Ethereum layer-2 TVL | Source: L2Beat

Ethereum layer-2 TVL | Source: L2BeatAmong the large companies hitching the layer-2 thrust is Coinbase, wherever done Base, users tin transact cheaply portion relying connected the Ethereum mainnet for security. According to Borovik.eth, implicit 60% of Base’s gross is from rollup fees charged, highlighting the value of their scaling solution and the relation Ethereum plays successful each this.

Related Reading: Shiba Inu Whale Moves $45 Million In SHIB, Bullish?

The upcoming Dencun Upgrade acceptable for integration adjacent twelvemonth volition further slash layer-2 fees. Developers program to merchandise this update successful the Goerli trial web arsenic aboriginal arsenic mid-January 2024.

Feature representation from Canva, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)