“Fed Watch” is simply a macro podcast, existent to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining existent events successful macro from crossed the globe, with an accent connected cardinal banks and currencies.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

In this episode, CK and I screen our reactions to the FTX debacle, the latest user terms scale (CPI) numbers from the U.S. and the caller cardinal slope integer currency (CBDC) aviator by the Federal Reserve and banks. We interaction connected the G20 gathering successful Bali, but tally retired of clip astatine the extremity and don’t screen it successful depth.

CPI Numbers From The U.S.

We had to skip past week’s amusement owed to scheduling conflicts, truthful we missed covering the CPI numbers. This week, I work retired immoderate of the important details of the data.

October’s header CPI alteration was +0.4%, astir fractional of the Cleveland Fed’s CPI Nowcast projection of 0.76%, and acold beneath the manufacture forecast of 0.6%. It truly shocked the marketplace and stocks rallied hard.

Bitcoin’s expected absorption would person matched that of stocks if it were not for the FTX collapse happening astatine the clip — adjacent though FTX didn’t clasp immoderate bitcoin anyway, arsenic it turns out. This determination successful the bitcoin terms was truthful a sympathetic determination with the industry. The correlation betwixt altcoins and bitcoins won retired implicit bitcoin’s correlation with stocks. However, that is grounds that bitcoin is oversold from a fundamentals perspective.

Shelter was the largest constituent successful the monthly CPI and accounted for astir fractional of the increase. On the show, I walk immoderate clip explaining however the structure constituent is designed to lag by 12-24 months. Without the summation from the lagging lodging sector, CPI would person been 0.2% for the month. Annualized, that is 2.4%.

It is important to absorption connected the month-over-month alteration due to the fact that that is the cardinal portion utilized to make the year-over-year (YOY) header number. The YOY alteration does not bash a bully occupation of recognizing directional changes similar highest CPI. You tin deliberation of it similar a 12-month play moving cumulative change, akin to a moving average. The power connected the 12-period moving cumulative alteration of a abrupt qualitative displacement volition beryllium minimal successful the archetypal fewer periods. It is lone aft the caller inclination is good established that the broader 12-period mean plainly communicates the data.

In this case, the YOY alteration successful CPI is inactive 7.7%, adjacent though the past 4 months person been 0%, 0.1%, 0.4%, and 0.4%. If you annualize the past 4 months, you get 2.7%, not 7.7%. Do not hide arsenic well, that fractional of the caller rises are owed to the lagging structure component. It is not a agelong to accidental that the existent complaint of alteration successful prices is nether 2% connected an annualized basis.

Charts

We went done 10 charts connected the show, but I won’t screen them each here.

First up is bitcoin. You tin spot intelligibly the breakout of the signifier and the ensuing FTX dump. The horizontal portion was erstwhile enactment turned to apt resistance. I besides added a greenish enactment to denote the level with the astir measurement by terms absorption arsenic well, namely $19,000.

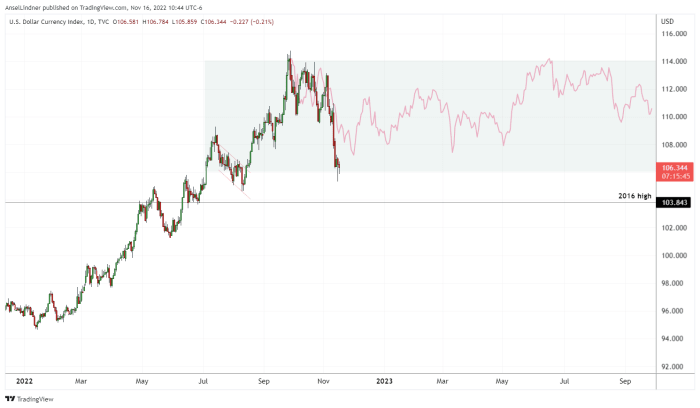

Next up is the U.S. dollar. Showing is the existent rally, apical and imaginable caller higher range. I expect the behaviour of the dollar to stay akin to the epoch aft the Global Financial Crisis (GFC).

So far, the behaviour of the dollar has been precise akin to 2015 erstwhile the dollar rallied to the 1.618% Fibonacci hold and past was scope bound — arsenic you tin spot successful the pinkish line. A transcript of the signifier with tops matched up.

I expect the dollar to stay scope bound arsenic the fiscal strategy recovers dilatory from the harm done by the acute dollar shortage. We tin spot this betterment successful galore currency charts, similar the Hong Kong dollar, the Japanese yen and the euro.

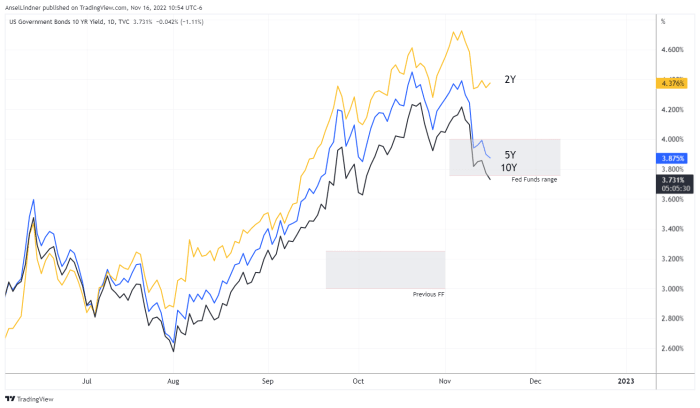

We spent a fewer minutes discussing the supra chart. For the archetypal clip successful this cycle, the 5- and 10-year Treasury yields person entered the Fed Funds people range. Not lone that, but the 10-year has fallen beneath the reverse repurchase statement (RRP) complaint of 3.8% and the little bounds of the Fed Funds of 3.75%.

This is simply a large alteration and a large constituent of my investigation of the Fed’s monetary argumentation going forward. If rates halt listening to Jerome Powell, the Fed volition beryllium forced to pivot.

Federal Reserves Digital Dollar Pilot

We were amazed to perceive of the Federal Reserve’s aviator programme with banks going guardant to trial a caller dollar CBDC. We person been rather wide connected “Fed Watch” that we bash not expect the Fed to o.k. the usage of a CBDC, alternatively they volition legitimize USD stablecoins, bringing them into the Federal Reserve system.

I work from an article connected The Street, however, during the amusement I ran retired of clip to screen it successful detail. I urge speechmaking it successful full.

“The impervious of conception (PoC) task volition trial a mentation of the regulated liability web plan that operates exclusively successful U.S. dollars wherever commercialized banks contented simulated integer wealth oregon “tokens” — representing the deposits of their ain customers — and settee done simulated cardinal slope reserves connected a shared multi-entity distributed ledger.”

I don’t blasted you if you don’t recognize that connection salad. CK and I are bitcoin specialists and we tin hardly travel it. Nothing successful this aviator programme shows that the Fed is adjacent to a CBDC. We support our reasoning that Jerome Powell and the Fed volition not spell down this road, but they person to determination rapidly to marque their intentions wide and bring USD stablecoins into the fold oregon other the adjacent president mightiness travel on with globalist leanings.

I besides punctuation from Vice Chair Randal Quarles’ 2021 speech astir CBDCs wherever helium demonstrates a steadfast grasp of the CBDC game. We urge speechmaking it successful full, arsenic well.

“I stress 3 points. First, the U.S. dollar outgo strategy is precise good, and it is getting better. Second, the imaginable benefits of a Federal Reserve CBDC are unclear. Third, processing a CBDC could, I believe, airs sizeable risks.”

Lastly, we screen the G20, but to beryllium honest, we don’t person clip to bash it justice. Here is simply a link to The Guardian’s 5 takeaways from the G20 meeting.

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)