Ethereum, the world’s second-largest cryptocurrency by marketplace cap, finds itself successful a funny position. While the terms struggles for direction, its underlying web is experiencing a surge successful activity.

Ethereum Network Sees Increase In New Users

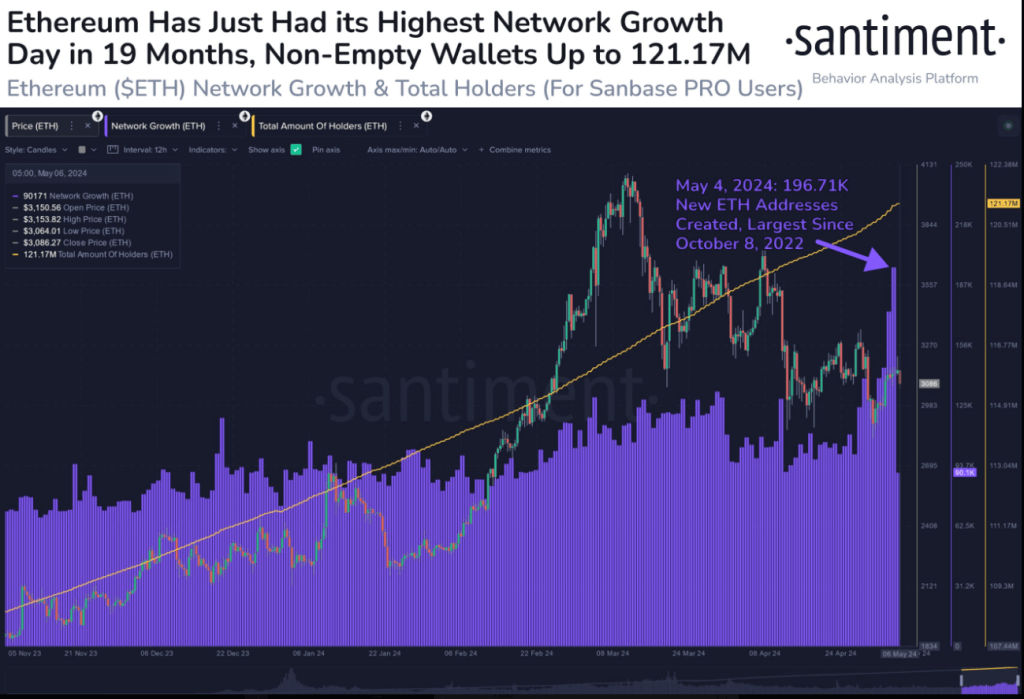

According to crypto information steadfast Santiment, May 4th saw a whopping 200,000 caller Ethereum addresses created, marking the highest single-day maturation successful astir 2 years.

This surge suggests a renewed involvement successful the Ethereum ecosystem, perchance driven by factors similar the burgeoning Decentralized Finance (DeFi) abstraction and the ever-evolving satellite of Non-Fungible Tokens (NFTs).

📈 #Ethereum rebounded backmost supra $3,200 this weekend, and saw monolithic web growth. 196.71K caller addresses were created connected the $ETH web connected May 4, 2024, the largest azygous time of maturation since October 8, 2022. This should beryllium viewed arsenic a #bullish sign. https://t.co/l9iFVWCJpE pic.twitter.com/MlHQTvKKN0

— Santiment (@santimentfeed) May 6, 2024

This web maturation is simply a bullish signal, and indicates beardown and expanding involvement successful Ethereum, which could construe to important superior inflows erstwhile macroeconomic conditions go much favorable.

Is The Price Dip A Buying Opportunity?

While the web thrives, Ethereum’s terms presently sits astatine $2,995, a 1.8% diminution successful the past 24 hours. This puts it precariously adjacent to falling beneath its 200-day Exponential Moving Average (EMA), a method indicator often interpreted arsenic a motion of bearish momentum.

However, a person look reveals a perchance bullish twist. The terms diminution is accompanied by a driblet successful trading volume, which could bespeak that selling unit is waning. Historically, specified a script has sometimes preceded a terms reversal, wherever buyers re-enter the market, pushing prices upwards.

Investor Optimism Buoyed By Potential Fed Pivot

The caller weakness successful the US economy, highlighted by a disappointing jobs report, has sparked speculation that the Federal Reserve mightiness see easing involvement rates. This could inject caller liquidity into the market, perchance benefiting riskier assets similar cryptocurrencies.

According to analysts, a dovish pivot from the Federal Reserve could beryllium a game-changer for Ethereum. Lower involvement rates mostly marque holding cryptocurrencies much charismatic compared to accepted fixed-income investments.

Ether seven-day terms action. Source: CoinMarketCap

Ether seven-day terms action. Source: CoinMarketCap

The aboriginal way of Ethereum remains uncertain. While the network’s fundamentals look robust, the terms faces contiguous challenges. Navigating this analyzable script volition necessitate investors to cautiously see some the on-chain enactment and the broader economical landscape.

Regulation and Innovation: Key Factors to Watch

Regulatory clarity astir cryptocurrencies volition undoubtedly play a important relation successful attracting organization investors, a imaginable catalyst for important terms growth.

Related Reading: Cardano (ADA) Trading Activity Goes Quiet: Will This Drag Down The Price?

Featured representation from Book My Flight, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)