The organisation of Bitcoin’s proviso crossed assorted cohorts — shrimps, crabs, fish, sharks, and whales — tin assistance america recognize however each marketplace conception behaves. Shifts successful Bitcoin’s proviso among these groups are heavy correlated with terms movements and broader marketplace trends, which is wherefore knowing them is indispensable erstwhile analyzing the market.

Shrimps correspond retail investors holding little than 1 BTC, a measurement of grassroots information successful the Bitcoin market. Crabs encompass retail-sized investors with holdings betwixt 1 and 10 BTC, often regarded arsenic informed, semipermanent holders.

Fish to sharks see higher-net-worth individuals and organization investors with holdings ranging from 10 to 1,000 BTC, a class that reflects some aboriginal adopters and nonrecreational trading operations.

Lastly, whales clasp betwixt 1,000 and 10,000 BTC, whose movements are intimately watched owed to their important marketplace impact.

Tracking the proviso organisation changes crossed these cohorts provides invaluable insights into Bitcoin’s liquidity and strategical positioning of antithetic capitalist classes.

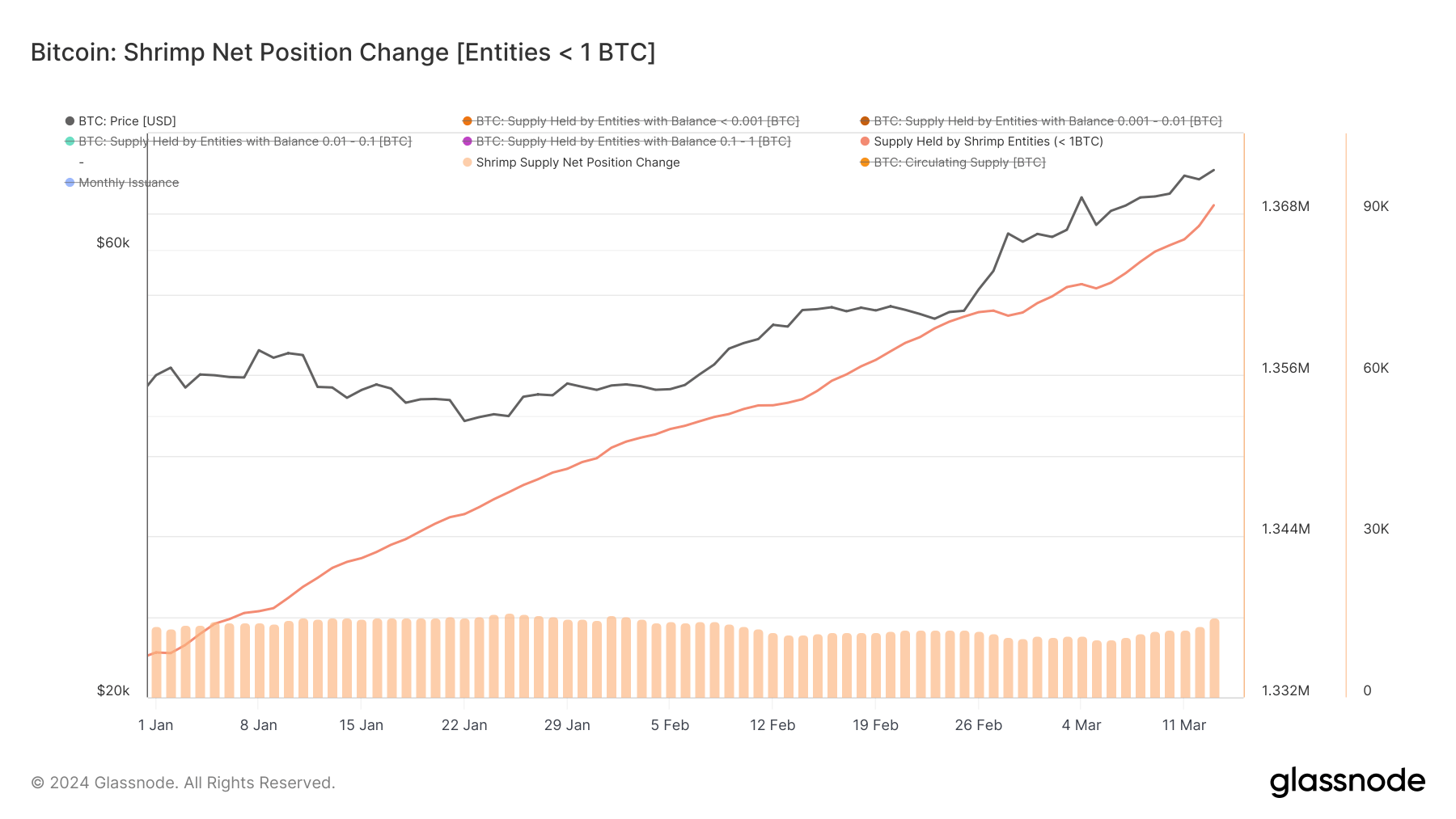

From Jan. 1 to March 13, shrimps person accrued their Bitcoin holdings from 1.335 cardinal BTC to 1.368 million. This accordant growth, contempt terms volatility, suggests a dollar-cost averaging strategy, wherever small, regular purchases are made careless of the asset’s price.

This behaviour indicates a deep-rooted content successful Bitcoin’s semipermanent worth among retail investors, seen done their continued concern contempt marketplace uncertainties.

Graph showing the Bitcoin proviso and nett presumption alteration held by shrimps from Jan. 1 to Mar. 13, 2024 (Source: Glassnode)

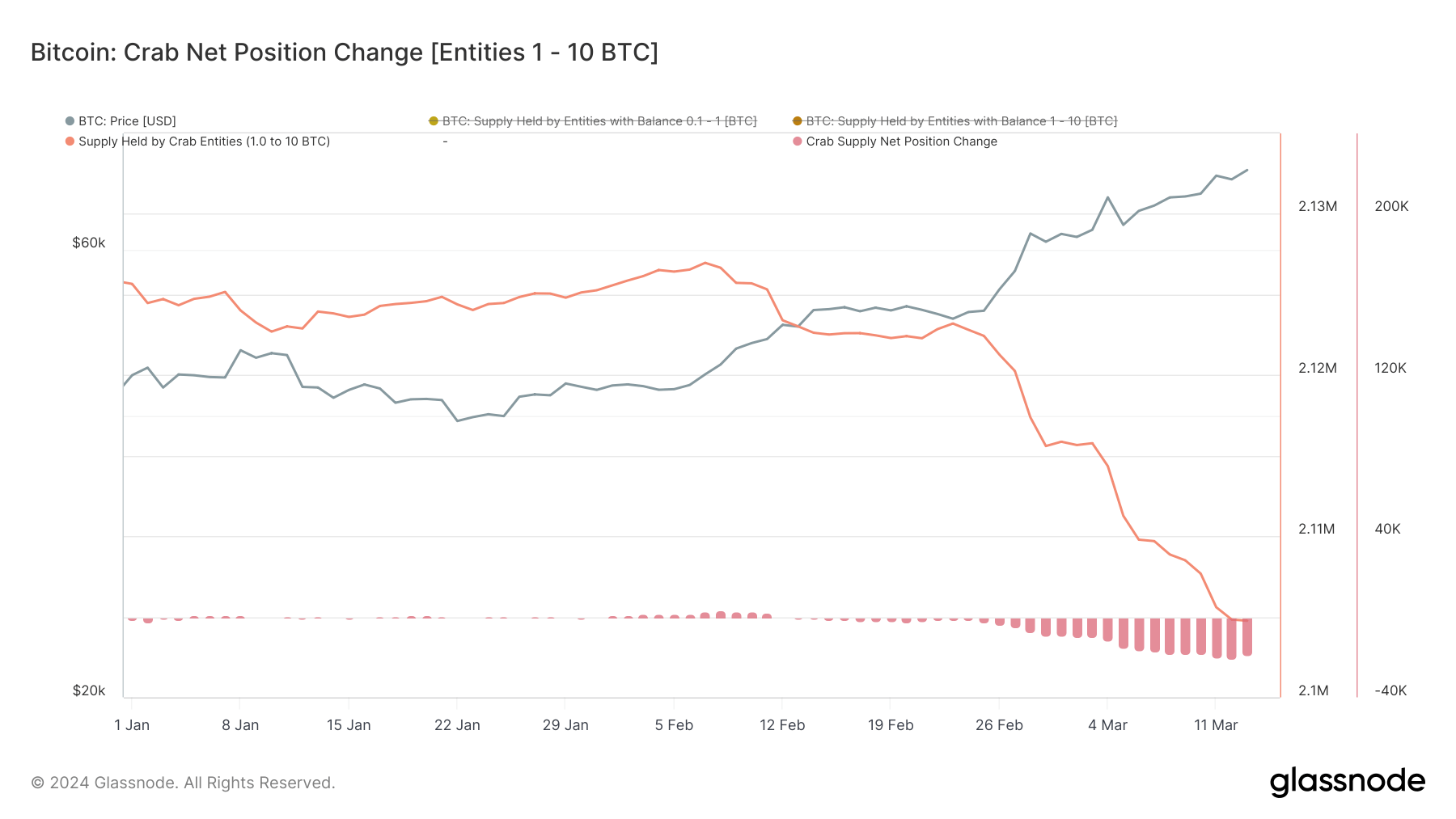

Graph showing the Bitcoin proviso and nett presumption alteration held by shrimps from Jan. 1 to Mar. 13, 2024 (Source: Glassnode)The crab cohort — typically retail investors with much important superior oregon those who person been accumulating implicit clip — saw their holdings somewhat alteration from 2.125 cardinal BTC to 2.104 cardinal BTC.

The reduction, notably astir March 12, shows a absorption to terms volatility, perchance taking profits oregon minimizing losses. It suggests that portion crabs are committed to their Bitcoin investments, they stay delicate to marketplace fluctuations, acceptable to set their positions successful effect to perceived risks.

Graph showing the Bitcoin proviso and nett presumption alteration held by crabs from Jan. 1 to Mar. 13, 2024 (Source: Glassnode)

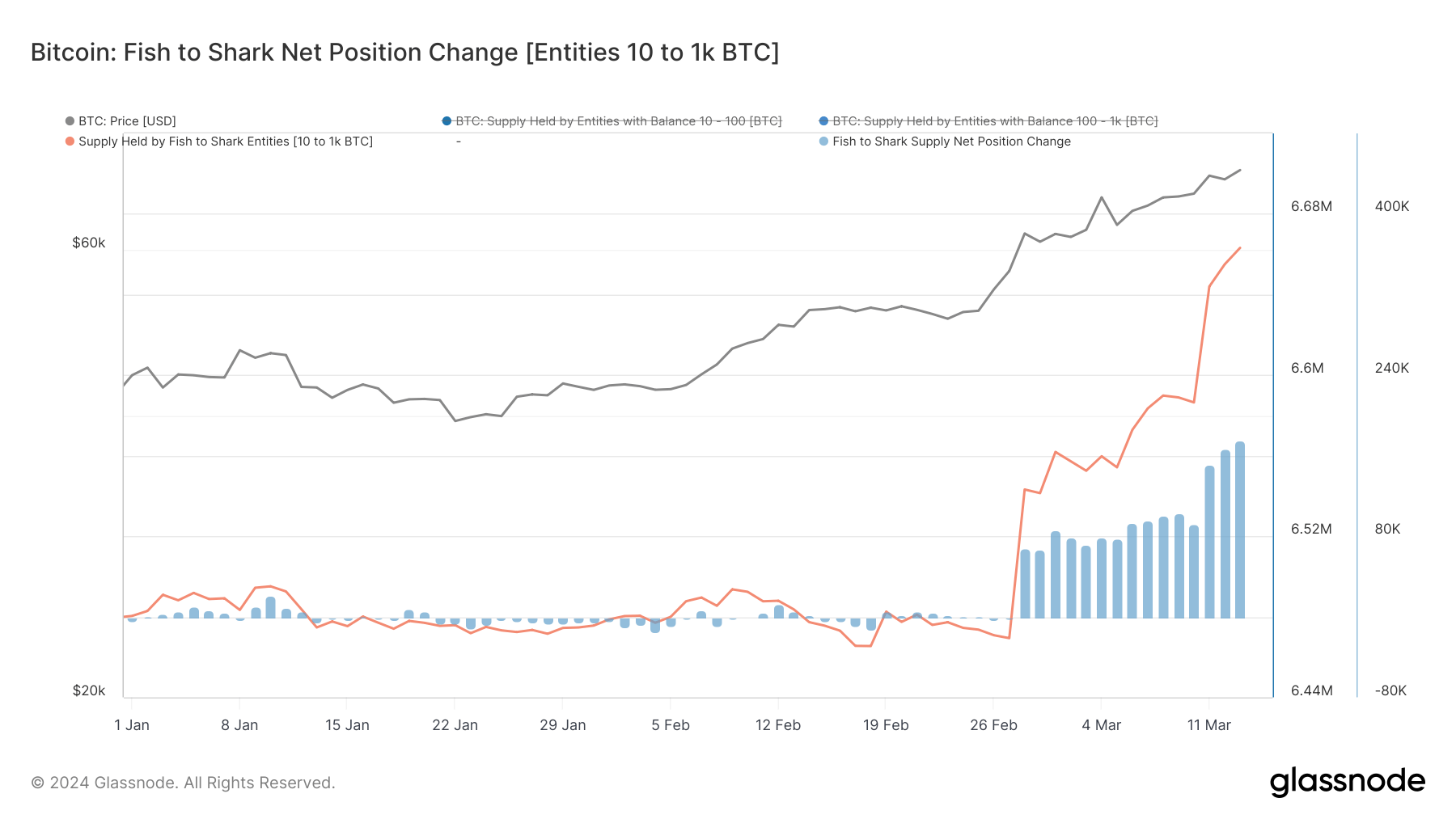

Graph showing the Bitcoin proviso and nett presumption alteration held by crabs from Jan. 1 to Mar. 13, 2024 (Source: Glassnode)The fish-to-shark cohort saw an summation successful holdings from 6.480 cardinal BTC connected Jan. 1 to 6.663 cardinal BTC by March 13, with a important affirmative alteration during the month.

This indicates strategical accumulation by higher-net-worth individuals and institutions, perchance leveraging the spot Bitcoin ETFs’ instauration and anticipated marketplace growth. This group’s behaviour reflects the actions of financially important players whose assurance tin sway the market.

Graph showing the Bitcoin proviso and nett presumption alteration held by food and sharks from Jan. 1 to Mar. 13, 2024 (Source: Glassnode)

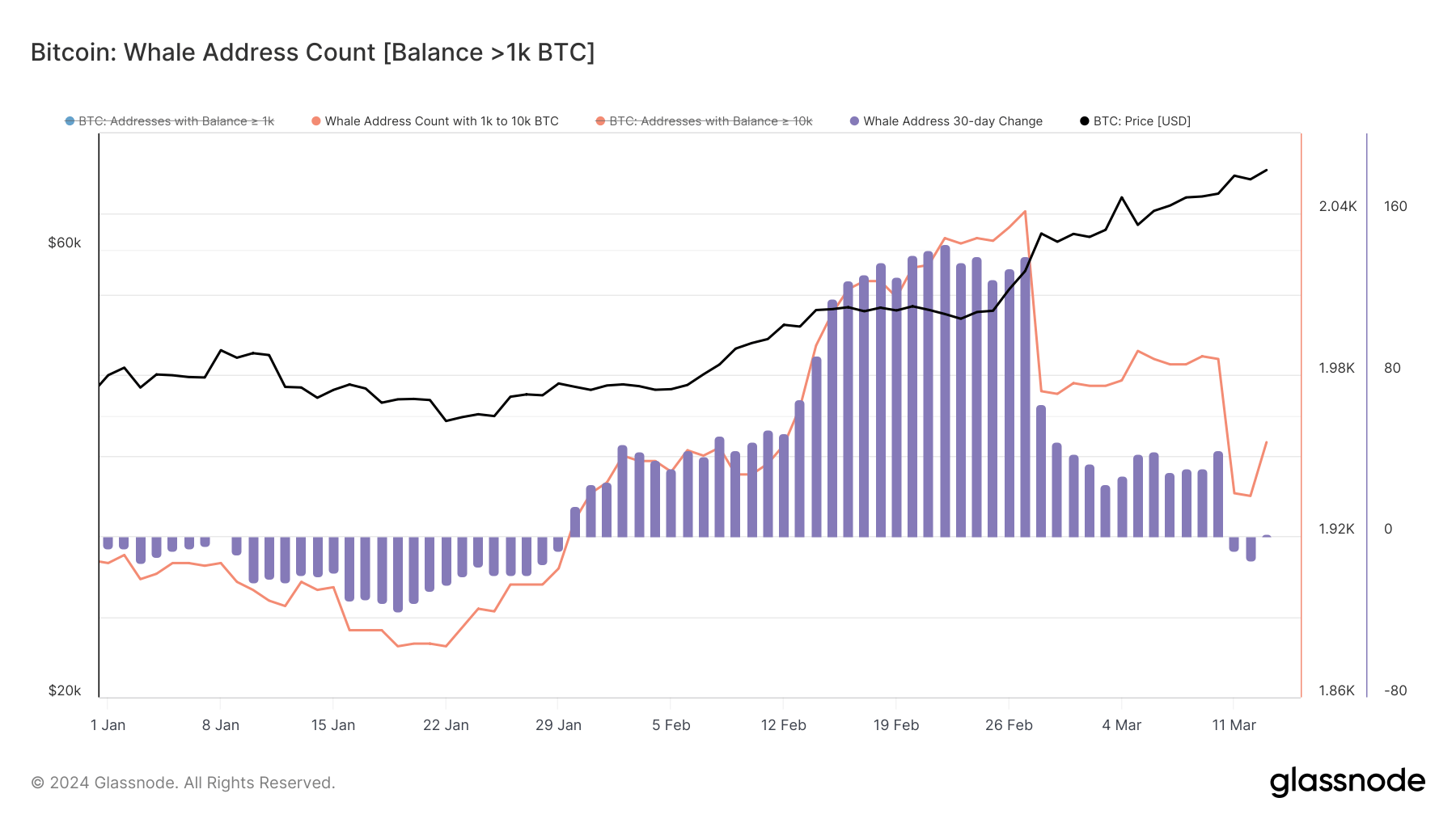

Graph showing the Bitcoin proviso and nett presumption alteration held by food and sharks from Jan. 1 to Mar. 13, 2024 (Source: Glassnode)Whale entities saw their numbers fluctuate, peaking astatine 2,041 successful February earlier dropping to 1,955 by March 13. This alteration suggests profit-taking oregon portfolio adjustments successful airy of the bullish marketplace trend.

Whales’ movements are important to marketplace direction, fixed their important holdings and the power they wield connected marketplace liquidity and sentiment.

Graph showing the full fig and nett presumption alteration of whale addresses from Jan. 1 to Mar. 13, 2024 (Source: Glassnode)

Graph showing the full fig and nett presumption alteration of whale addresses from Jan. 1 to Mar. 13, 2024 (Source: Glassnode)Data from Glassnode showed chiseled strategies crossed these cohorts, showing their varying perceptions of risk, concern horizon, and effect to marketplace movements.

Surprisingly, shrimps demonstrated unwavering content successful Bitcoin, persistently expanding their holdings. Meanwhile, Crabs, who are mostly steady, showed a readiness to respond to marketplace signals, adjusting the size of their positions successful effect to terms movements.

Fish and sharks look to person been the cohort that capitalized the astir connected the motorboat of spot ETFs successful the US. The marketplace optimism that followed the long-awaited trading merchandise importantly altered the size of the proviso held by these cohorts, showing the increasing assurance institutions and high-net-worth individuals person successful Bitcoin.

Meanwhile, whales showed diagnostic strategical flexibility, with the flimsy alteration successful their numbers pointing to a cautious attack successful a bullish scenario.

The station From shrimps to whales: Who’s buying and selling during this rally? appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)