In the aftermath of the FTX fallout, Bitcoin saw its terms driblet to a two-year debased of $15,000, the exchange’s autochthonal token is connected its mode to becoming fundamentally worthless, and stablecoins crossed the marketplace person been struggling to support their peg.

However, the autumn of Sam Bankman-Fried’s empire is acold from over. The contagion and second-order effects are yet to beryllium felt and could propulsion the marketplace deeper into the red.

But, what caused the fallout that could acceptable the crypto manufacture respective years back?

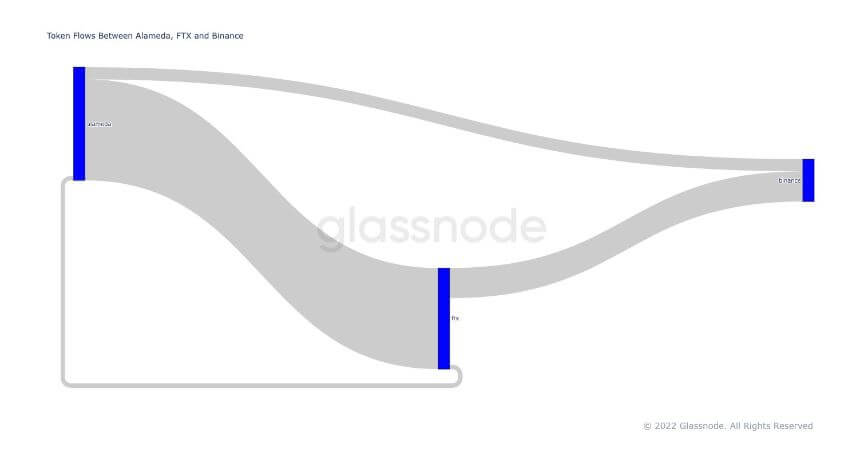

CryptoSlate’s in-depth investigation of on-chain information reveals the narration betwixt FTX and Alameda and however the 2 companies siphoned wealth disconnected of each different utilizing Binance arsenic an unsuspecting intermediary.

Alameda and FTX — 2 sides of the aforesaid coin

To recognize the scope of Alameda’s ties to FTX we indispensable excavation heavy into some companies’ token flows.

As the bulk of their holdings laic successful assorted stablecoins and altcoins, emitting Bitcoin (BTC) and Ethereum (ETH) from the information paints a overmuch clearer representation arsenic to however the 2 transacted.

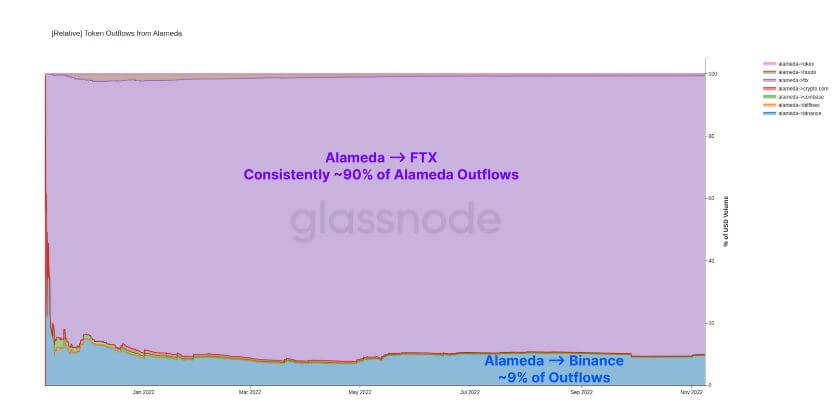

Data analyzed by CryptoSlate showed that, successful the past year, implicit 90% of tokens from wallets associated with Alameda ended up astatine FTX. Around 9% of each outflows from Alameda ended up astatine Binance.

Graph showing token flows from Alameda from November 2021 to November 2022 (Source: Glassnode)

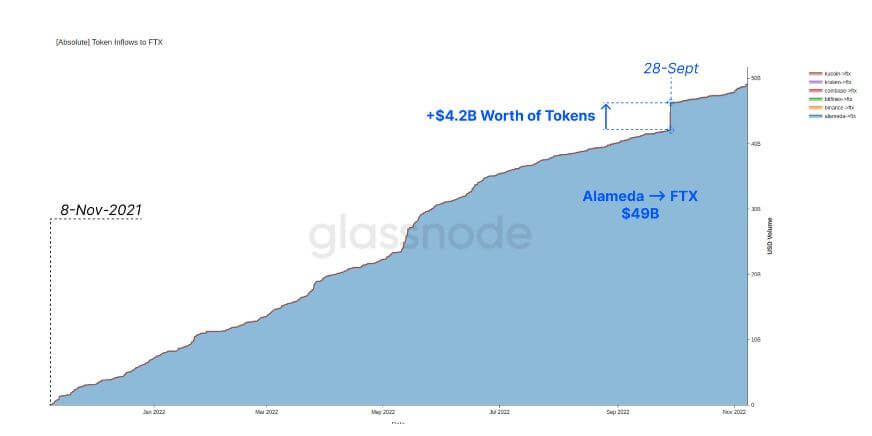

Graph showing token flows from Alameda from November 2021 to November 2022 (Source: Glassnode)Looking astatine inflows to FTX reveals the scope of Alameda’s domination. In the play betwixt November 2021 and November 2022, $49 cardinal worthy of assorted tokens were transferred from Alameda to FTX. The inflows were expanding period connected period and saw a vertical leap astatine the extremity of September 2022 erstwhile implicit $4.2 cardinal worthy of tokens were sent to FTX.

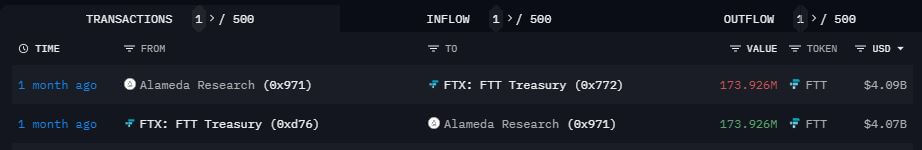

Arkham Intelligence, a cryptocurrency investigation firm, confirmed the inflow successful its ain reports. The company’s scanner shows an inflow of astir $4 cardinal worthy of FTT into the exchange.

Graph showing token inflows to FTX from November 2021 to November 2022 (Source: Glassnode)

Graph showing token inflows to FTX from November 2021 to November 2022 (Source: Glassnode) Table showing the $4 cardinal FTT inflow to FTX successful September 2022 (Source: Arkham Intelligence)

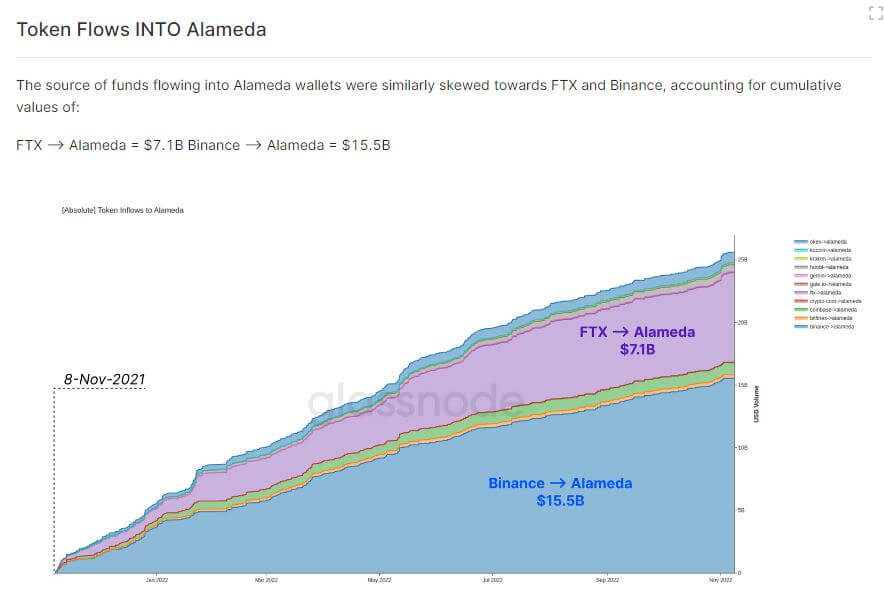

Table showing the $4 cardinal FTT inflow to FTX successful September 2022 (Source: Arkham Intelligence)And portion astir of the wealth going retired of Alameda ended up astatine FTX, it looks similar the bulk of the wealth that went backmost into the trading steadfast came from Binance. Since past November, astir $25 cardinal worthy of assorted altcoins and stablecoins went into Alameda. Out of the $25 billion, $7.1 cardinal came from FTX wallets, portion implicit $15.5 cardinal came from Binance wallets.

The inflows from Binance and FTX dwarf inflows from different exchanges, arsenic shown successful the graph below.

Graph showing the token flows into Alameda from November 2021 to November 2022 (Source: Glassnode)

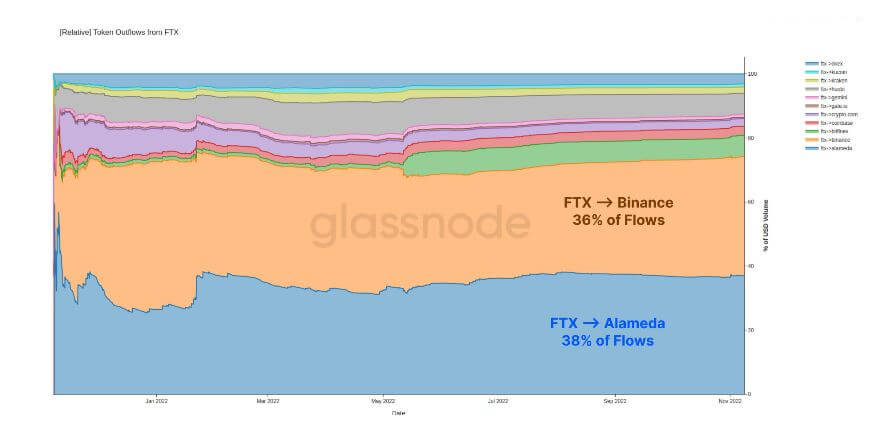

Graph showing the token flows into Alameda from November 2021 to November 2022 (Source: Glassnode)The trifecta of Alameda, FTX, and Binance is further evident erstwhile looking astatine outflows from FTX. Since past November, the speech saw an astir adjacent divided of outflows betwixt Binance and Alameda. Glassnode information analyzed by CryptoSlate showed that astir 38% of token outflows from FTX went to Alameda, portion 36% went to Binance wallets. Only 26% of the funds exiting FTX went to wallets associated with different companies and exchanges.

Graph showing the token outflows from FTX from November 2021 to November 2022 (Source: Glassnode)

Graph showing the token outflows from FTX from November 2021 to November 2022 (Source: Glassnode)Fingers pointed astatine the middleman

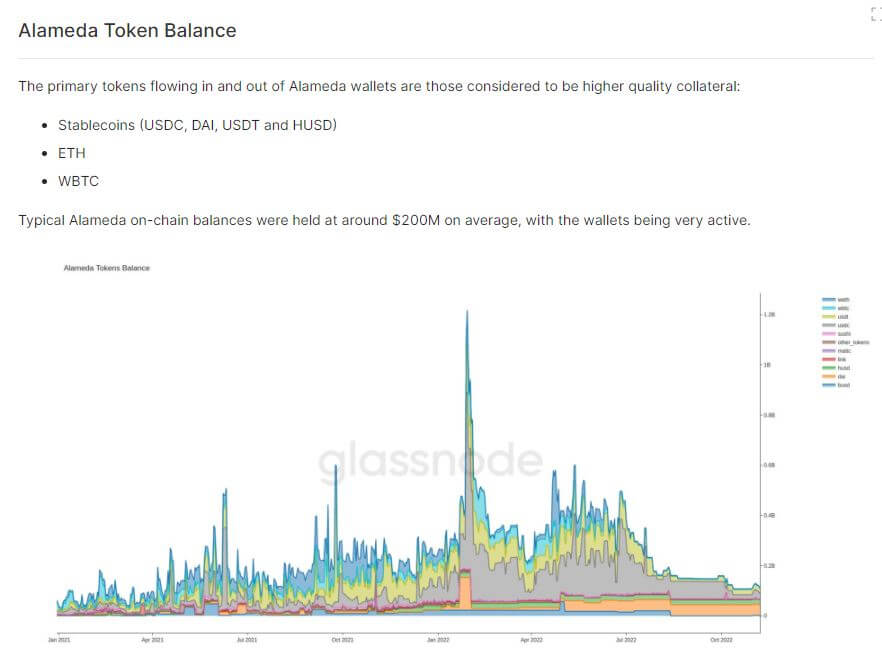

A heavy look astatine wallets associated with Alameda shows that the institution kept a steadfast equilibrium of a handbasket of assorted tokens passim 2021. On average, the institution held astir $200 cardinal worthy of USDT, USDT, DAI, HUSD, ETH, and WBTC — each considered to beryllium high-quality collateral.

The November bull tally pushed Alameda’s balances done the roof, culminating successful January 2022 astatine $1.2 billion.

Luna’s illness successful May this twelvemonth caused a monolithic dent successful Alameda’s balances. It took astir 2 months earlier the dent was shown, with the biggest driblet felt successful August. The institution hasn’t managed to retrieve since and has seen its balances driblet continually arsenic it entered the 4th quarter.

Graph showing Alameda’s token equilibrium from January 2021 to November 2022 (Source: Glassnode)

Graph showing Alameda’s token equilibrium from January 2021 to November 2022 (Source: Glassnode)It’s unclear what caused the driblet successful Alameda’s balances. The manufacture has been ripe with rumors astir the institution panic selling its reserves to screen the losses it incurred aft the Luna collapse.

Those that don’t judge this was panic selling enactment that Alameda could person sold its reserves to instrumentality the funds backmost to FTX. The company’s existent equilibrium expanse problems besides marque selling for nett highly unlikely.

Further probe into Alameda’s and FTX’s transactions is needed to recognize the afloat scope of the situation they caused. However, the information analyzed truthful acold shows an undeniable enslaved betwixt Alameda and FTX. The 2 deepened their ties done Binance, which they mightiness person utilized arsenic an unsuspecting middleman successful their year-long escapade.

The station FTX, Alameda utilized Binance arsenic intermediary for their parasitic relationship appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)