After the FTX collapse, investors are moving ample amounts of Bitcoin (BTC) to their self-custody wallets and exiting Ethereum (ETH) to put successful stablecoins, according to information analyzed by CryptoSlate.

Bitcoin retreats to aforesaid custody

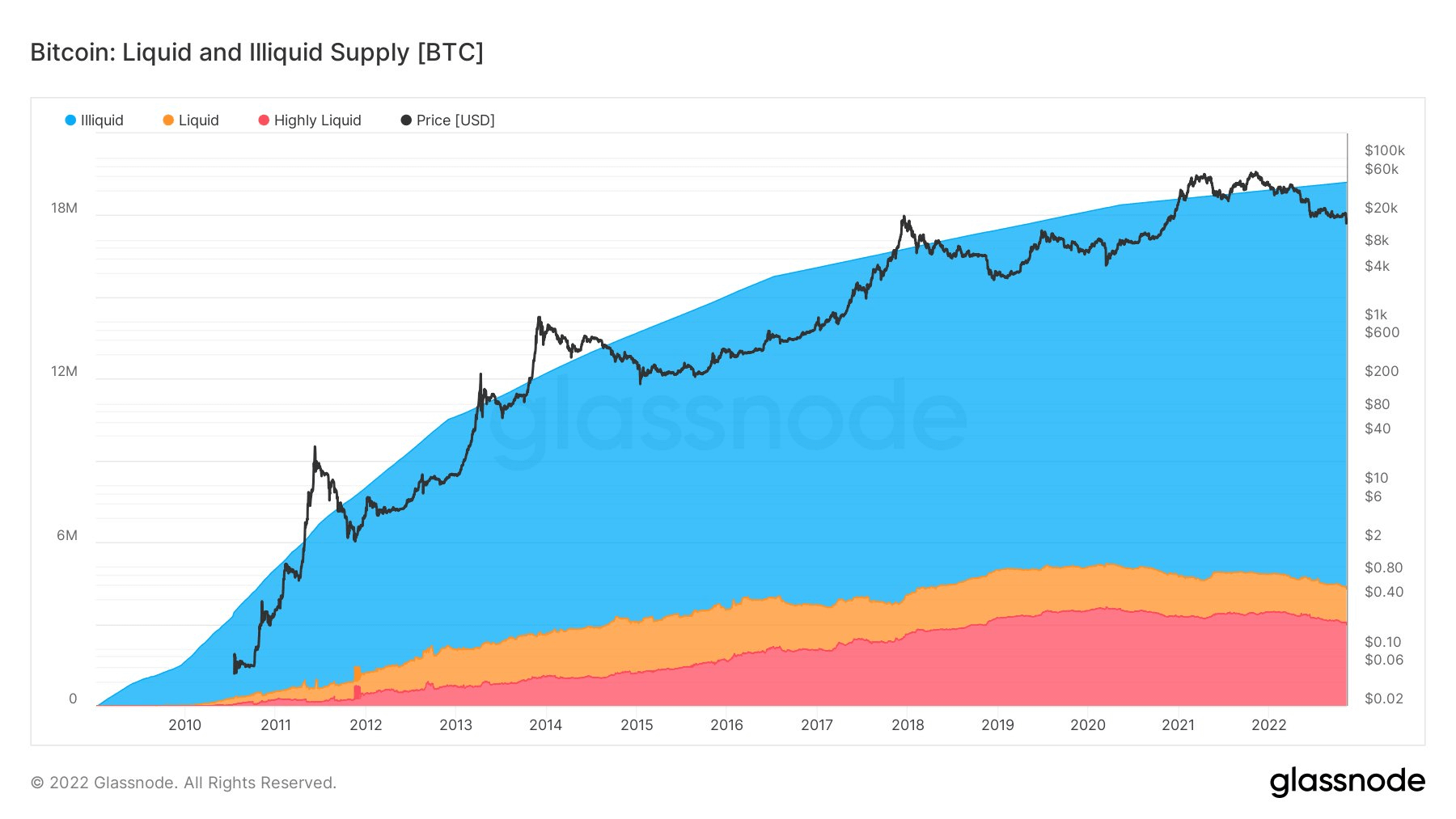

The illustration beneath demonstrates the magnitude of liquid, illiquid, and highly liquid Bitcoins since 2008.

As of November 2022, the magnitude of Bitcoins held successful self-custody wallets astir reached 15 million. Out of the existent circulating proviso of 19,204,000, this fig shows that 78% of each Bitcoin is held successful self-custody.

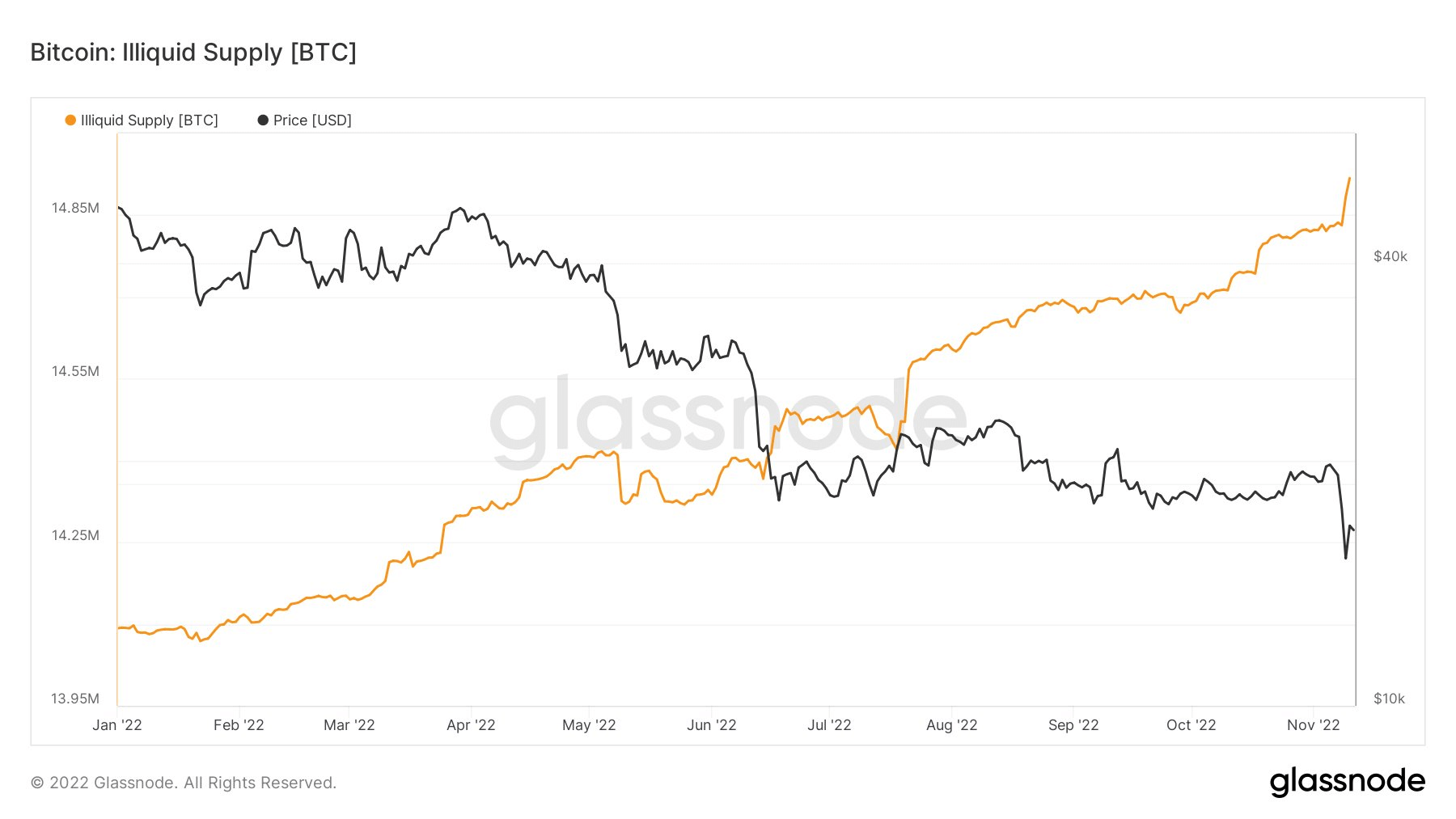

The illustration beneath shows the illiquid Bitcoin proviso successful much item since the opening of the year, and it shows that a crisp summation was recorded this week.

This crisp summation mightiness beryllium the effect of the invaluable lessons the assemblage learned from the caller events with respect to FTX’s liquidity crisis. Even though FTX precocious committed to doing everything it tin to supply liquidity, it inactive abstained from making immoderate promises.

Stablecoins implicit Ethereum

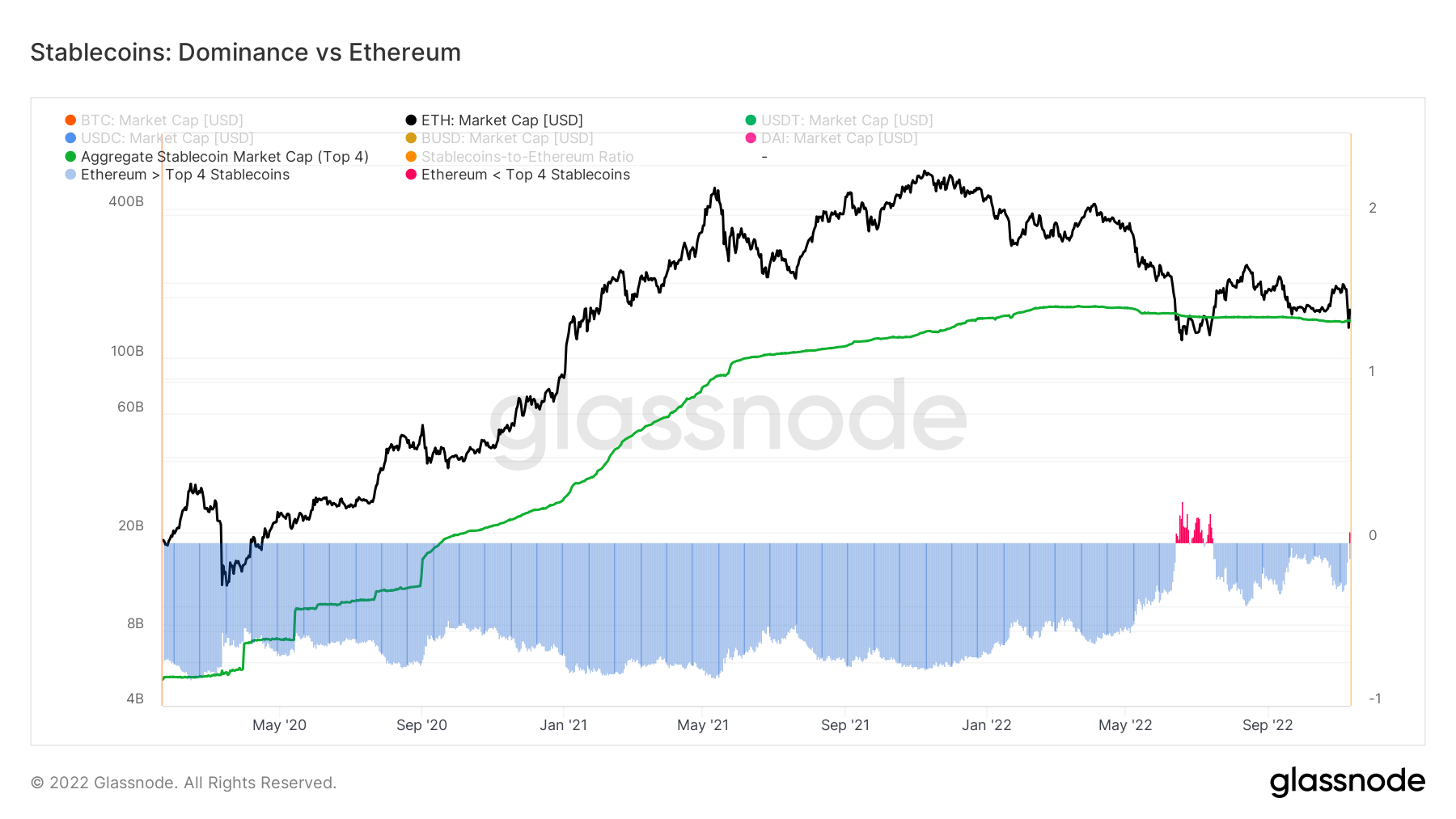

The illustration beneath collects the supplies of the apical 4 stablecoins – Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI)- that are connected antithetic blockchains and compares them with the Ethereum Market Cap.

The information shows that stablecoin dominance triumphed implicit Ethereum dominance arsenic of Nov. 11. This lone happened erstwhile earlier successful the past of crypto during June 2022, and is simply a beardown indicator showing that investors are moving ample funds into stablecoins arsenic Ethereum marketplace headdress drops.

The station FTX clang pushes Bitcoin to self-custody; Ethereum switched for stablecoins appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)