On Jan. 17, 2023, FTX Trading Ltd. and affiliated debtors updated the nationalist and elaborate that the firm’s existent administrators person discovered $5.5 cardinal of liquid assets to date. Top-level executives, including the caller FTX CEO and main restructuring officer, John J. Ray III, met with the bankruptcy case’s committee of unsecured creditors to stock the news.

FTX Uncovers $5.5 Billion successful Liquid Assets Through ‘Herculean Investigative Effort’

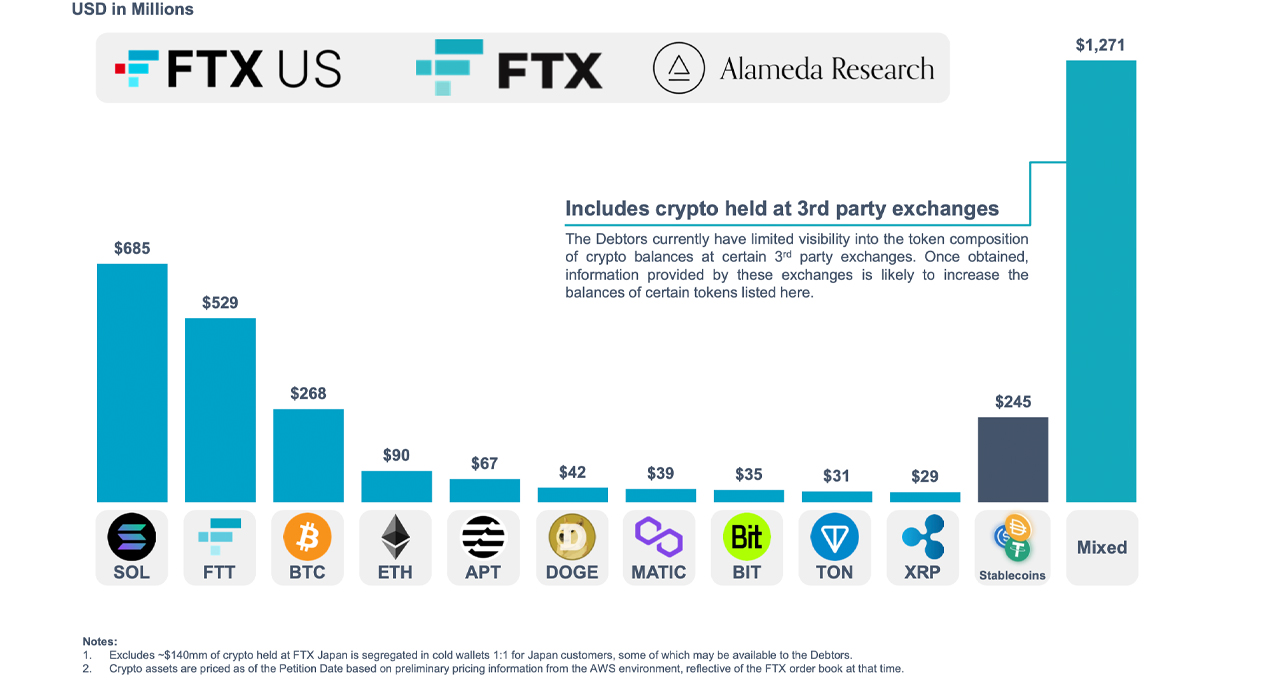

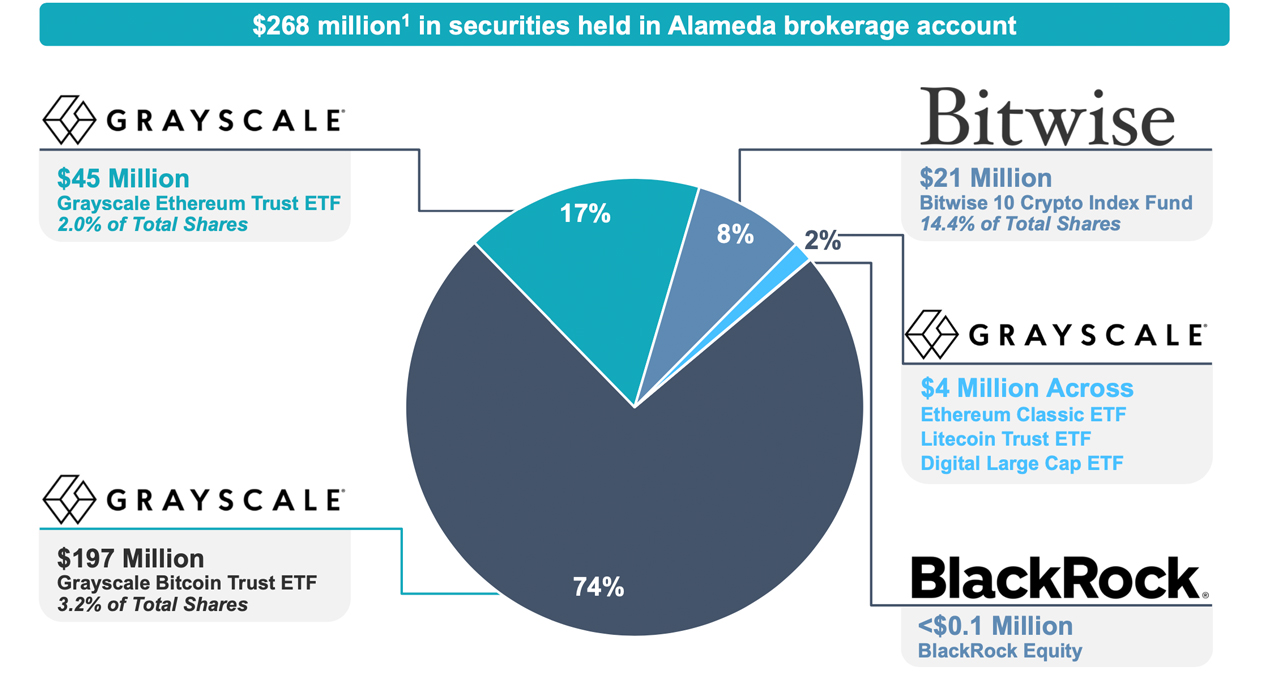

FTX has discovered $5.5 cardinal successful liquid assets, according to a property connection released astatine 2:40 p.m. Eastern Time, Tuesday. The debtors, including FTX CEO John J. Ray III, announced that the squad identified the funds done a “herculean investigative effort.” The company’s property merchandise details that the squad recovered $3.5 cardinal successful cryptocurrency assets, $1.7 cardinal successful currency deposits and astir $3 cardinal successful securities.

The caller FTX CEO and main restructuring serviceman John J. Ray III.

The caller FTX CEO and main restructuring serviceman John J. Ray III.The property merchandise further noted that the FTX squad discovered $323 cardinal was mislaid to unauthorized third-party transfers earlier the Chapter 11 bankruptcy filing was registered connected Nov. 11, 2022. Furthermore, $426 cardinal “was transferred to acold retention nether the power of the Securities Commission of The Bahamas,” the debtors’ connection details.

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.FTX debtors disclose that crypto assets presently held by FTX executives and the restructuring teams are besides held successful acold storage. “We are making important advancement successful our efforts to maximize recoveries, and it has taken a Herculean investigative effort from our squad to uncover this preliminary information,” Ray explained successful the update. “We inquire our stakeholders to recognize that this accusation is inactive preliminary and taxable to change. We volition supply further accusation arsenic soon arsenic we are capable to bash so.”

FTX Debtors Investigate Historical Transactions, Including Voyager and Blockfi Deals, and $93M successful Political Donations

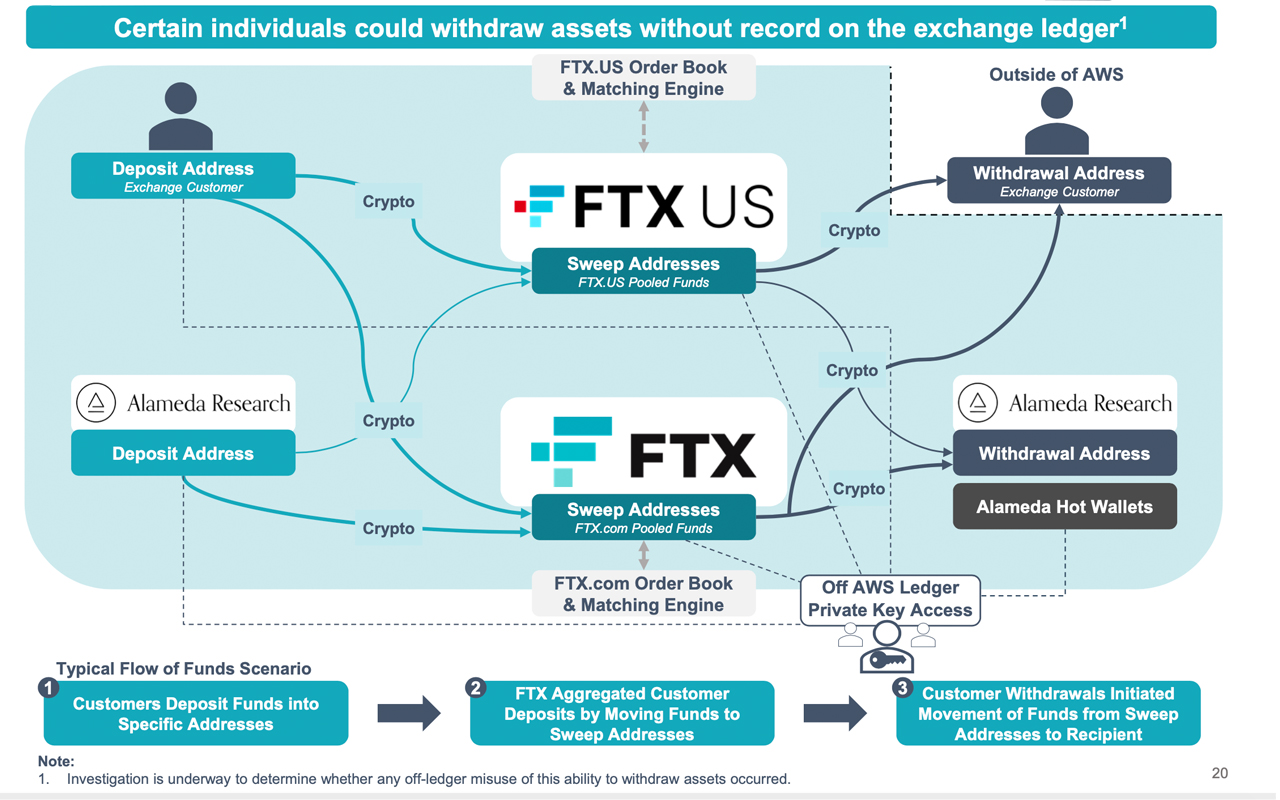

The presumption shared with the committee of unsecured creditors is besides attached to the FTX property release, and it notes that an probe “confirmed shortfalls astatine some planetary and U.S. exchanges.” Furthermore, the probe “uncovered the mechanics down however Alameda Research had the quality to get without collateral efficaciously unlimited amounts from customers.” The debtors’ study insists that a “small radical of individuals” had the quality to region assets from FTX without it ever being “recorded connected the speech ledger.”

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.In summation to the recovered $5.5 billion, FTX debtors are exploring aggregate facets to maximize the betterment process done the “potential sale” of 4 subsidiaries. The squad is exploring ways to monetize the hundreds of investments made that presently clasp a publication worth of astir “$4.6 billion.”

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.FTX debtors privation to maximize betterment by “marketing existent property successful the Bahamas,” and investigators purpose to probe “all humanities transactions” related to the business.

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.The existent property owned by the interior ellipse is worthy astir $205.5 million, stretched crossed 27 antithetic properties located successful The Bahamas. The humanities transactions being investigated impact the Voyager and Blockfi deals, alongside $93 cardinal worthy of governmental donations FTX executives made betwixt March 2020 and November 2022.

“Hundreds of [mergers and acquisitions] M&A and different transactions nether review,” the presumption explains. The presumption besides gives a elaborate ocular representation of however the interior circle, mostly Alameda Research, could “withdraw assets without [a] grounds connected the speech ledger.”

Tags successful this story

Alameda Research, bahamas, Bankruptcy, book value, Cash Deposits, Chapter 11 Bankruptcy, collateral, Cryptocurrency Assets, Customers, debtors, FTX Bankruptcy, FTX collapse, FTX debtors, FTX Trading, historical transactions, Inner Circle, Investments, John J. Ray III, liquid assets, M&A, political donations, Real estate, recovery, restructuring, Securities, subsidiaries, unauthorized third-party transfers, unlimited amounts

What are your thoughts connected FTX’s efforts to maximize betterment and uncover the information down the unauthorized transfers and humanities transactions? Share your insights successful the comments below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photograph credit: Poetra.RH / Shutterstock.com

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)