Two days ago, bankruptcy administrators and FTX debtors published an update for unsecured creditors claiming the find of $5.5 cardinal successful liquid assets. Roughly $3.5 cardinal of these funds are cryptocurrency assets, with 11 antithetic integer currencies classified arsenic “liquid assets.” However, 2 of the firm’s apical cryptocurrency caches are not liquid arsenic the company’s 47.51 cardinal SOL tokens are locked and the firm’s FTT equilibrium distorts the realization of existent liquidity owed to FTX’s power of much than 80% of the supply.

Locked Solana and Illiquid FTT Assets to Complicate FTX’s Bankruptcy Process

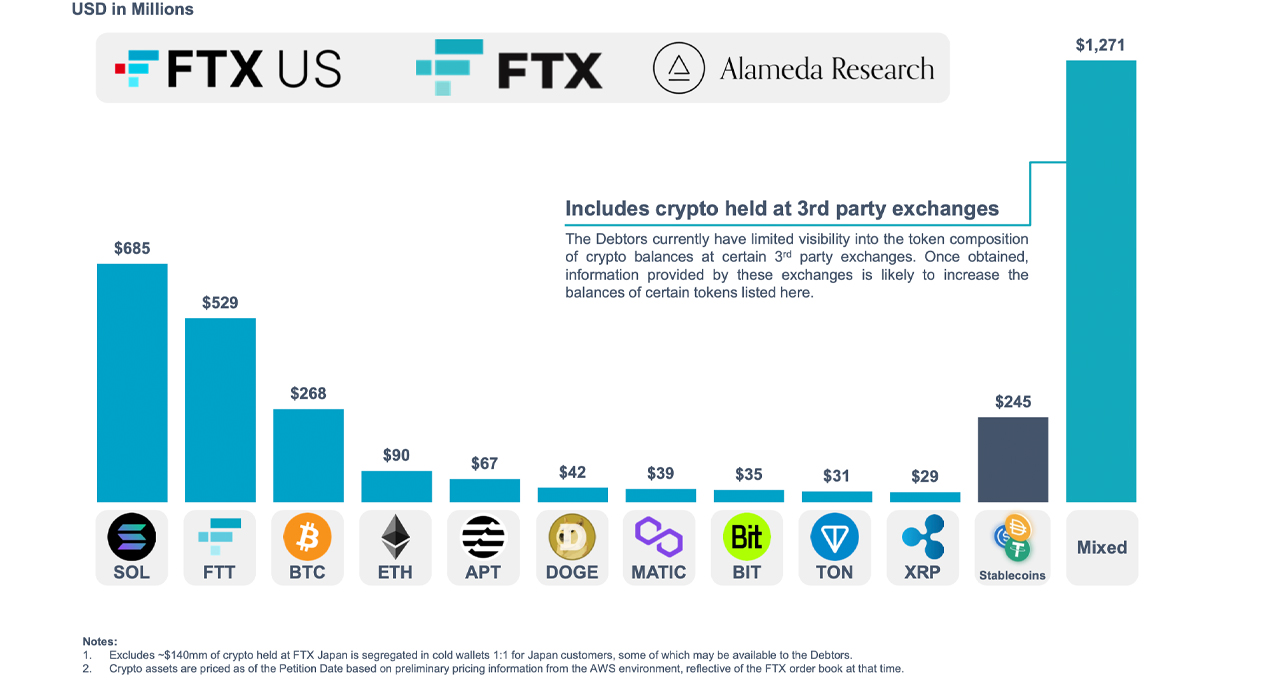

On Jan. 17, 2023, FTX debtors published a property merchandise and ocular presumption of assets discovered since the institution filed for Chapter 11 bankruptcy extortion connected Nov. 11, 2022. The FTX debtors assertion to person recovered $5.5 cardinal via a “herculean investigative effort,” with $3.5 cardinal reportedly being crypto assets. The ocular presumption explains that FTX controls astir $685 cardinal successful solana (SOL) tokens, astir 47,511,173 SOL, and utilizing today’s SOL speech rate, that cache is worthy overmuch much than $685 million.

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.

Screenshot of the FTX debtors’ presumption to the committee of unsecured creditors.However, the SOL owned by FTX debtors is locked and this facet is not mentioned successful the ocular presumption shown to unsecured creditors. It has been reported that FTX/Alameda managed to acquisition 16% of the SOL proviso from the Solana Foundation, but determination is simply a lockup schedule. The existent stash of 47.51 cardinal SOL equates to 8.82% of the full proviso the Solana web volition yet contented implicit time. Presently, determination is lone 370,992,365 SOL successful circulation and that does not relationship for the 47.51 cardinal locked SOL owned by the liquidators.

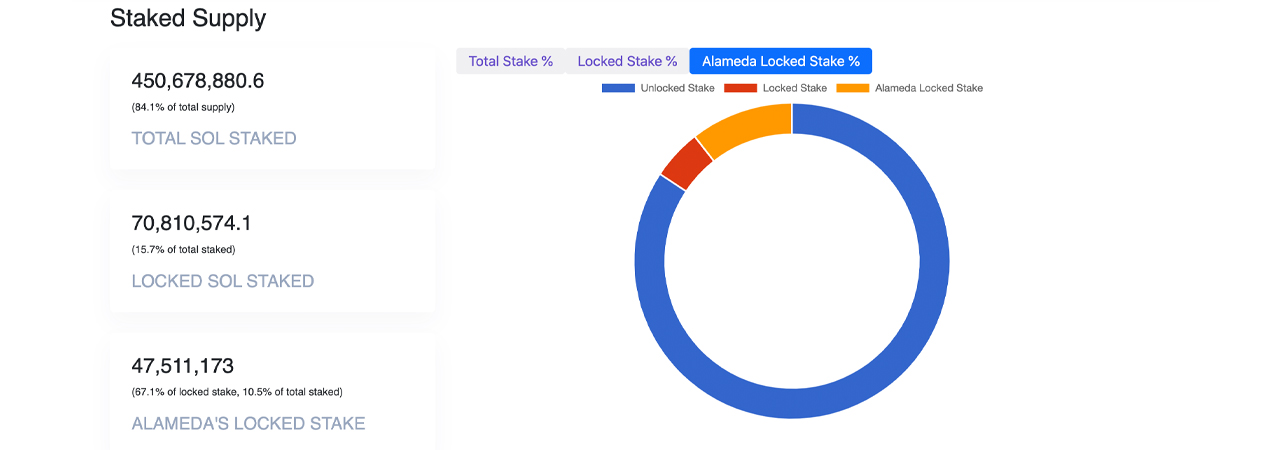

The fig of Alameda Research’s locked solana (SOL) stake, according to solanacompass.com stats.

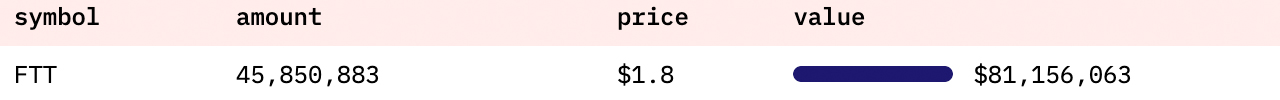

The fig of Alameda Research’s locked solana (SOL) stake, according to solanacompass.com stats.The occupation with calling this cache of SOL liquid is that it is locked and taxable to linear vesting done 2025-2027, and it could instrumentality years earlier the funds tin beryllium accessed. Additionally, the debtors’ cache of ftx token (FTT), a coin primitively created by the halfway FTX team, is besides not liquid due to the fact that FTX controls much than 80% of the full supply. For example, the Ethereum (ETH) code “0x97f” controls 45,850,883 FTT, worthy much than $1.8 cardinal utilizing today’s speech rates. The FTX debtors’ presumption shows the FTT arsenic being worthy $529 cardinal worthy of FTT tokens.

The locked Solana contented and the information that FTX owns astir of the FTT successful circulation puts these tokens much connected the broadside of being illiquid. This could complicate the bankruptcy process and payments to creditors due to the fact that it would beryllium hard to person these assets into currency oregon different crypto assets without importantly impacting the marketplace price.

The liquidators’ wallet that holds 45.85 cardinal ftx tokens (FTT).

The liquidators’ wallet that holds 45.85 cardinal ftx tokens (FTT).Even if the SOL were unlocked, dumping 47.51 cardinal SOL connected the marketplace would origin disruptions. Additionally, FTT suffers from debased trading volume, constricted speech listings, fewer usage cases, and the institution controls astir of the FTT supply. Because FTX holds a important magnitude of the full FTT supply, it tin easy impact the quality to commercialized it. Calling these caches of SOL and FTT tokens “liquid” is questionable arsenic information does not enactment that definition.

Tags successful this story

Assets, Bankruptcy, bankruptcy administrators, Cash, Chapter 11, conversion, Court Filing, creditors, creditors' meeting, crypto assets, Crypto Funds, crypto holders, crypto market, crypto trading, crypto transactions, Cryptocurrency, cryptocurrency market, debt, Digital Assets, Digital Currencies, discharge, Exchange Listings, financial assets, FTT, FTX debtors, Large Holders, linear vesting, liquid assets, Liquidation, Liquidity, Market Price, Ownership, payments to creditors, petitions, plan, Protection, reorganization, reorganization plan, SOL, Solana, Trading Volume, Trustee, use cases

What are your thoughts connected FTX’s find of $5.5 cardinal successful liquid assets, contempt the beingness of locked SOL and illiquid FTT holdings? How bash you deliberation this volition interaction the bankruptcy process and payments to creditors? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)