Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Matt Hougan, Chief Investment Officer (CIO) of Bitwise Asset Management, delivered a striking semipermanent forecast for Bitcoin connected the latest occurrence of the Coinstories podcast. Speaking with big Nathalie Brunell, Hougan outlined wherefore helium believes that BTC volition not lone disrupt golden but besides ascent arsenic precocious arsenic $1 cardinal per coin by 2029. He attributed this bullish prediction to accelerated organization adoption, emerging regulatory clarity, and persistent semipermanent request outstripping caller supply.

Why Bitcoin Could Hit $1 Million By 2029

During the interview, Hougan pointed to the melodramatic interaction of spot Bitcoin exchange-traded funds (ETFs) arsenic a superior origin down organization inflows. He described the surge successful new superior aft the ETFs launched successful January 2024 arsenic acold larger than astir analysts anticipated. “Before the Bitcoin ETFs launched, the astir palmy ETF of each clip gathered $5 cardinal dollars successful its archetypal year,” helium said. “These [Bitcoin] ETFs did thirty-seven billion.”

He added that this astonishing gait of inflows could continue, mostly due to the fact that “fewer than fractional of each fiscal advisers successful the US tin adjacent person a proactive conversation” astir investing successful Bitcoin astatine present. Once constraints are lifted and much advisers are permitted to urge Bitcoin to their clients, helium expects an adjacent bigger influx of assets.

When asked astir contention among apical ETF providers, Hougan stressed that BlackRock’s entry into the abstraction yet benefits the full manufacture by boosting wide participation. He highlighted however his firm, Bitwise, focuses connected gathering the needs of some organization investors and crypto specialists who privation a “crypto native” manager.

Although Bitwise’s spot Bitcoin ETF launched alongside respective different salient players, Hougan said helium sees the fierce contention arsenic constructive for investors, due to the fact that it has driven fees to “rock bottom.” He noted that his firm’s absorption fees are little than those of galore accepted commodity ETFs and concluded, “It’s an unthinkable woody for the investor.”

Aside from these large-scale shifts successful organization finance, Hougan besides drew attraction to the accelerated enlargement of stablecoins. He called them a “killer app,” citing the worldwide appetite for cheaper, faster transaction rails and explaining that stablecoins, which settee connected blockchains, tin amended cross-border wealth flows.

He anticipates a stablecoin marketplace measured successful the trillions successful the coming years, particularly if supportive regulatory frameworks emerge. While helium acknowledged the United States whitethorn enact authorities that shapes whether stablecoin issuers clasp abbreviated oregon long-dated treasuries, helium expressed anticipation that the marketplace would stay escaped capable to foster continued contention and innovation.

The speech besides touched connected mounting firm interest, which Hougan said faces hurdles specified arsenic “weird accounting rules,” but has nevertheless proven robust. He pointed retired however corporations “bought hundreds of thousands of Bitcoin past year” and believes these aboriginal movers signify a bigger question to travel erstwhile accounting and owed diligence considerations are ironed out.

His firm’s backstage surveys, helium said, uncover a striking spread betwixt advisers’ idiosyncratic enthusiasm for Bitcoin—where “over 50%” already clasp it themselves—and the astir 15–20% who tin formally allocate it connected behalf of lawsuit portfolios. That number, helium predicts, volition support rising arsenic interior committees assistance advisers the greenish airy and arsenic much institutions recognize that “if you person a zero percent allocation to crypto, you’re efficaciously short.”

Regulatory Shifts And The Washington Factor

Throughout the interview, Hougan repeatedly underscored that the marketplace whitethorn beryllium “underpricing the alteration successful Washington.” He recalled how, until precise recently, banks were unwilling to instrumentality deposits from crypto companies and however aggregate subpoenas, lawsuits, and the hazard of “being debanked” had a chilling effect connected manufacture growth.

Hougan believes that “unless you worked successful crypto implicit the past 4 years, you can’t ideate however challenging it was,” and that the government’s softer stance present removes an tremendous obstacle for superior inflows. He besides sees bipartisan enactment for stablecoin authorities arsenic a almighty motion of regulatory clarity connected the horizon.

Beyond regulation, Hougan suggested Bitcoin is poised to flourish successful a macroeconomic climate rife with uncertainty. He referenced either runaway ostentation oregon a abrupt deflationary bust arsenic scenarios radical fear, asserting that “if you look astatine the market, it’s much volatile oregon unfastened oregon uncertain than it has been successful the past.”

From his perspective, adjacent a tiny allocation to bitcoin provides a non-sovereign hedge against imaginable monetary oregon fiscal turbulence. He said that galore of Bitwise’s ample clients are looking into methods of generating output connected their Bitcoin—whether done derivatives oregon organization lending—so they tin support vulnerability without selling the plus itself. Such interest, helium believes, reflects the beardown condemnation levels that thin to qualify the crypto community.

Hougan’s decision circled backmost to the powerfulness of Bitcoin’s constrained proviso and deepening organization demand. He stated that Bitcoin’s finite issuance schedule, coupled with caller buyers good outnumbering the magnitude of caller bitcoin mined, volition apt proceed pushing the terms up implicit time. “I deliberation Bitcoin is good connected its mode to disrupting gold,” helium said. “We deliberation it’s going to transverse a cardinal dollars by 2029.” Although helium emphasized that day-to-day terms swings tin beryllium dramatic, helium is convinced that the semipermanent fundamentals stay unassailable.

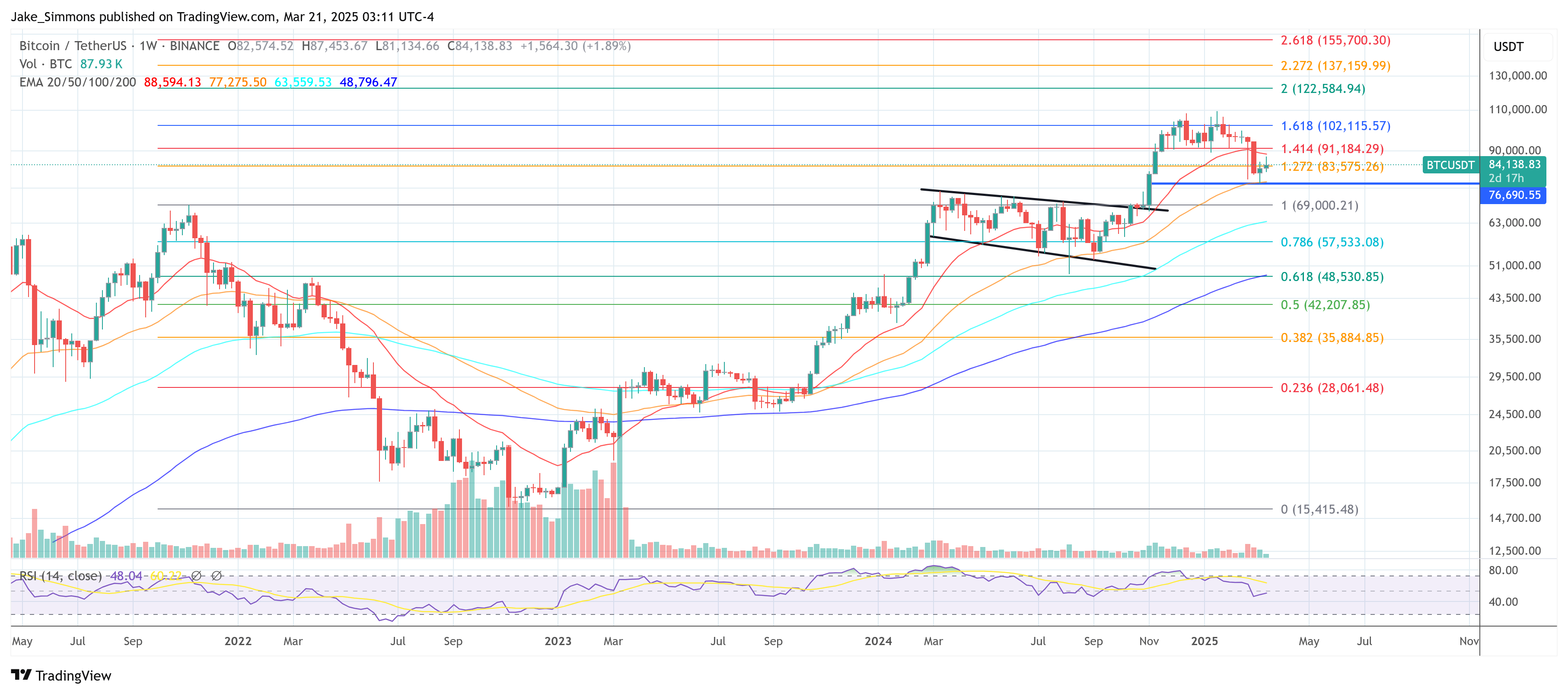

At property time, BTC traded astatine $84,138.

BTC price, 1-week illustration | Source: BTCUSDT connected TradingView.com

BTC price, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

6 months ago

6 months ago

English (US)

English (US)