Perpetual futures are a benignant of derivatives declaration unsocial to the crypto market. Unlike accepted futures, which person a acceptable expiration date, perpetual futures ne'er expire, allowing traders to clasp their positions indefinitely.

To marque this benignant of declaration financially viable, the marketplace employs a mechanics called the backing rate. Funding rates are periodic payments that either agelong oregon abbreviated traders wage to 1 different to support the terms of the perpetual futures declaration successful enactment with the underlying spot terms of the asset.

If the backing complaint is positive, agelong traders wage abbreviated traders, which indicates that the request to bargain is stronger than the request to sell. A antagonistic backing complaint means that abbreviated traders wage agelong traders, showing a bearish sentiment wherever the unit to merchantability outweighs the involvement successful buying.

This indispensable diagnostic of perpetual futures makes them peculiarly delicate to short-term marketplace movements and a precise utile instrumentality for knowing marketplace sentiment and trader behavior. A speedy and crisp alteration successful backing rates comes with aggravated volatility. The change’s strength and longevity tin assistance america gauge however a precise blase and liquid portion of the marketplace is handling it.

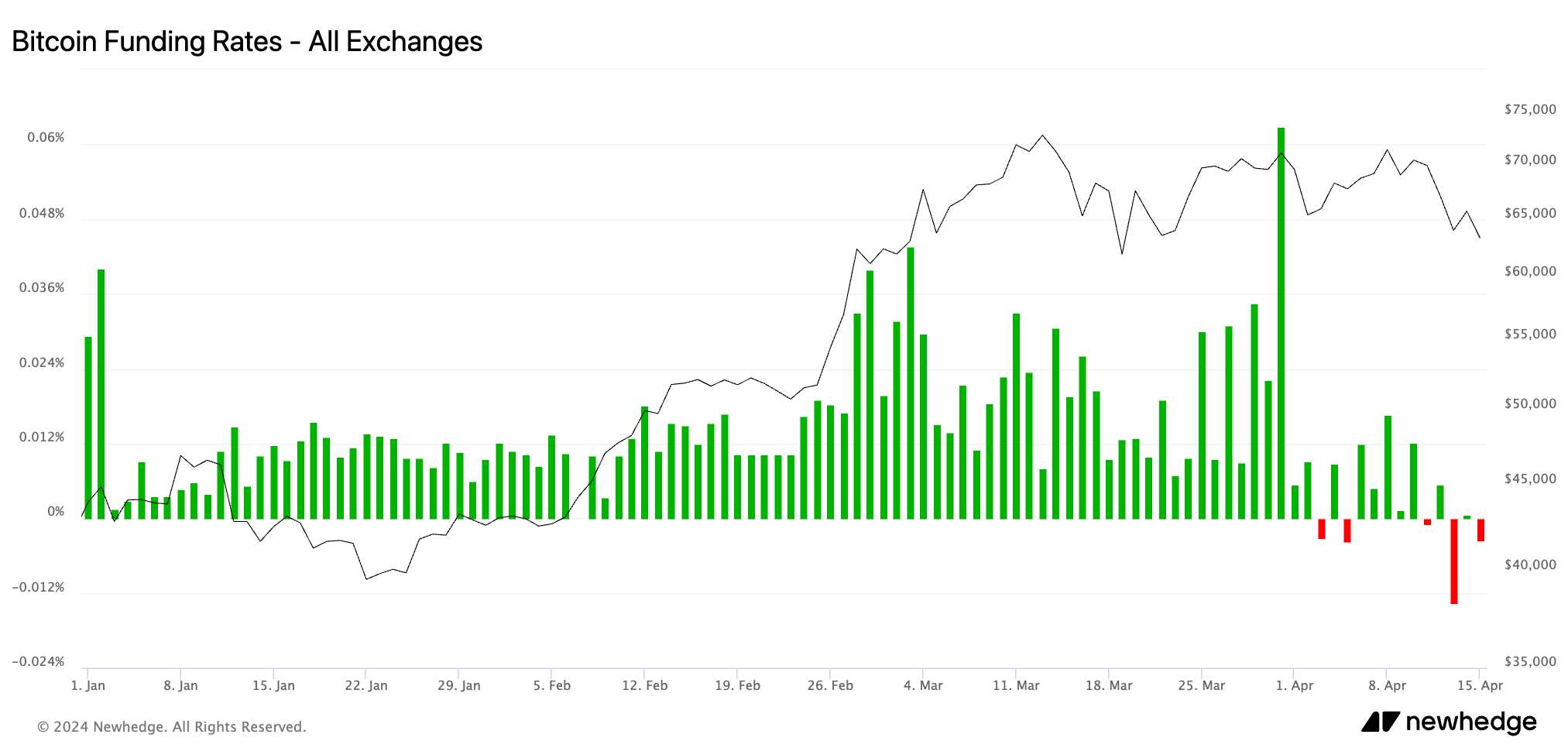

After implicit a twelvemonth of consistently affirmative Bitcoin backing rates, they turned antagonistic connected April 13, dropping from 0.00546% to -0.01351%. It concisely flipped affirmative connected April 14 but reverted to antagonistic connected April 15, lasting astatine -0.00358%.

Chart showing the backing complaint for Bitcoin perpetual futures from Jan. 1 to Apr. 15, 2024 (Source: Newhedge)

Chart showing the backing complaint for Bitcoin perpetual futures from Jan. 1 to Apr. 15, 2024 (Source: Newhedge)This crisp driblet successful backing rates followed important volatility successful Bitcoin’s price. Ongoing geopolitical turmoil successful the Middle East shocked the marketplace during the weekend, pushing BTC beneath $70,000. This driblet brought an uncharacteristic bearish sentiment to the market, which has been flying precocious successful the past 2 months arsenic Bitcoin broke caller all-time highs.

While the driblet successful backing complaint betwixt April 12 and April 15 mightiness not look that significant, it represents a monolithic alteration from the three-year precocious of 0.06294% it established connected March 31. The highest successful backing rates the marketplace saw astatine the extremity of March was a culmination of the bullish sentiment that has been ascendant since February.

Buyer assurance was high, accumulation was seen among each cohorts, and determination was small downward volatility successful prices. However, specified a crisp plunge into antagonistic territory signals an assertive plunge towards a bearish sentiment.

The presently antagonistic backing complaint shows sellers are expecting further terms declines and are consenting to wage to support their positions.

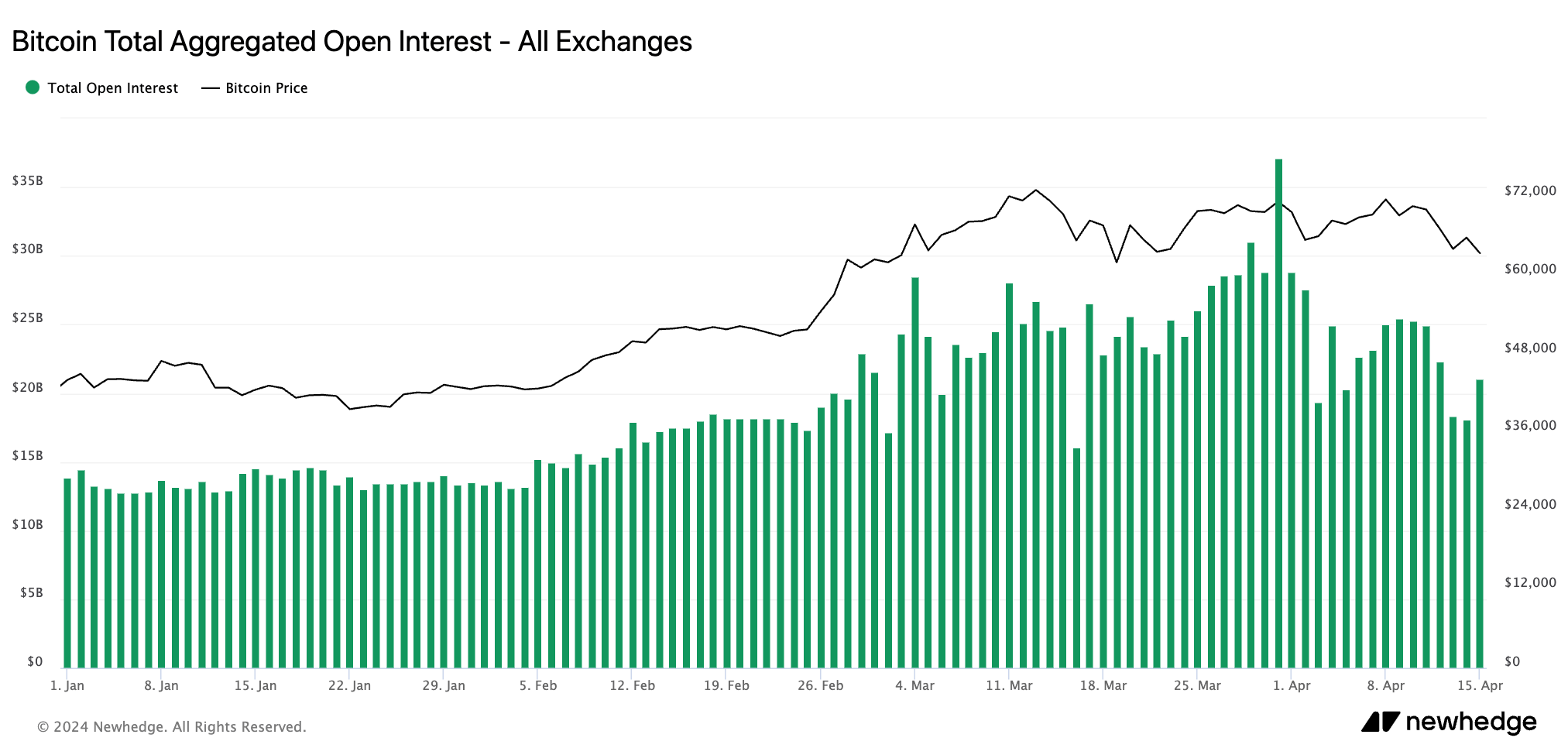

This bearish crook was besides seen successful unfastened interest. Open interest, representing the full fig of outstanding derivative contracts that person not been settled, dropped importantly from $37.112 cardinal connected Mar. 31 to $21.047 cardinal connected Apr. 15.

Chart showing the aggregated worth of some coin-margined and stablecoin-margined contracts connected Bitcoin futures from Jan. 1 to Apr. 15, 2024 (Source: Newhedge)

Chart showing the aggregated worth of some coin-margined and stablecoin-margined contracts connected Bitcoin futures from Jan. 1 to Apr. 15, 2024 (Source: Newhedge)A alteration successful unfastened involvement alongside falling prices and antagonistic backing rates typically indicates that traders are closing their positions either to chopped losses oregon instrumentality profits, starring to reduced liquidity and accrued volatility.

The station Funding complaint turns antagonistic arsenic Bitcoin drops beneath $64k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)