The funding rate for perpetual futures serves arsenic a proxy for marketplace sentiment and shows the equilibrium betwixt agelong and abbreviated positions. Significant deviations from the mean backing complaint crossed exchanges tin awesome potential imbalances successful positioning. A spike successful the backing complaint connected a peculiar speech shows a ample fig of agelong positions, which could pb to a imaginable compression oregon agelong liquidations if the marketplace turns.

Another reflection that tin beryllium made from the changes successful backing rates is arbitrage opportunities. A important divergence betwixt exchanges oregon declaration types enables traders to capitalize connected impermanent marketplace inefficiencies. This is wherefore adjacent the slightest changes successful backing rates tin beryllium important, arsenic they tin enactment arsenic aboriginal informing signs of imaginable marketplace shifts oregon changes successful sentiment.

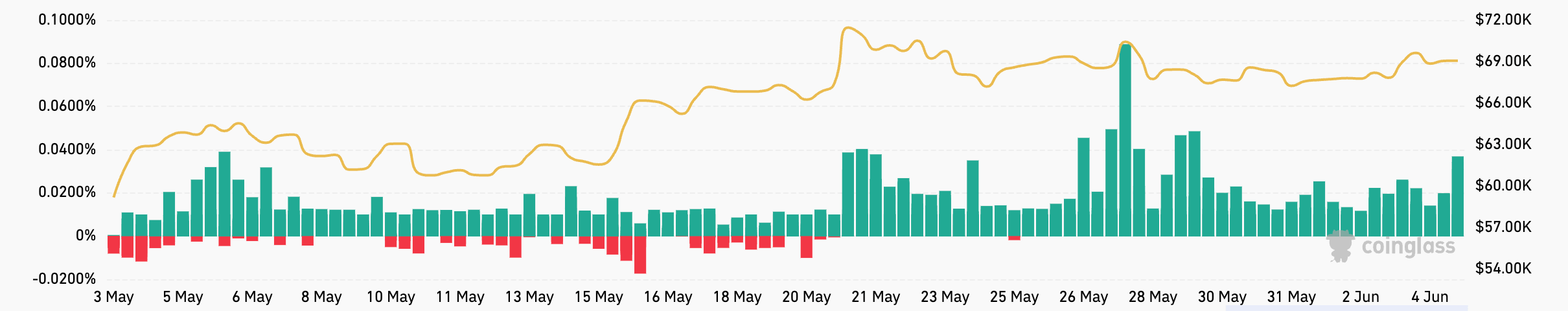

The backing complaint for USDT and USD-margined perpetual futures has been comparatively unchangeable passim May. This is indicative of a comparatively unchangeable marketplace that’s leaning bullish. This stableness was concisely breached connected May 27, erstwhile the backing complaint for USDT and USD-margined perpetual futures connected dYdX spiked to 0.0889%. This was a crisp deviation from the mean complaint of astir 0.0120% crossed different exchanges, indicating a important imbalance betwixt agelong and abbreviated positions. More traders taking connected agelong positions could person resulted from Bitcoin’s little terms spike to implicit $70,000. However, arsenic different exchanges saw little volatility successful their backing rate, determination could person been a peculiar inefficiency that dYdX traders were rushing to exploit.

Chart showing the backing complaint for USDT and USD-margined perpetual futures from May 3 to June 4, 2024 (Source: CoinGlass)

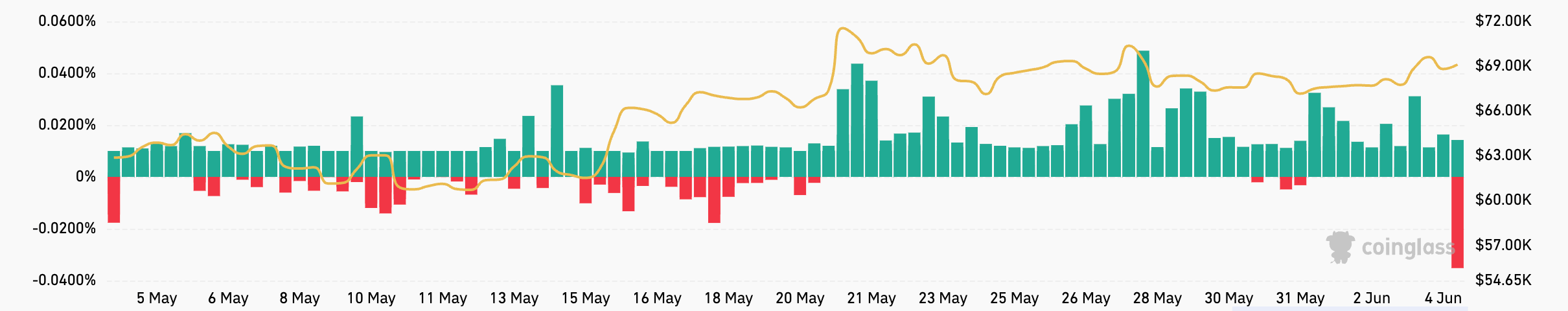

Chart showing the backing complaint for USDT and USD-margined perpetual futures from May 3 to June 4, 2024 (Source: CoinGlass)The backing complaint for token-margined perpetual futures has experienced akin stableness successful the past 30 days, hovering betwixt 0.0100% and 0.0140% passim May. In the aboriginal hours of June 4, Bitmex saw a important driblet successful backing complaint for token-margined perpetual futures from a unchangeable 0.0100% to -0.0352%. Such a crisp driblet successful 24 hours showed a robust bearish sentiment among traders. However, with different exchanges seeing their rates unchangeable astatine 0.0100%, the bearish sentiment seems to beryllium concentrated among Bitmex users alone. Bitmex’s greeting backing complaint was adjacent to the little bounds of -0.0375% acceptable by galore exchanges, which showed utmost positioning successful these contracts compared to USDT oregon USD-margined contracts.

Throughout the day, the backing complaint managed to consolidate astatine astir -0.0150%, further showing the volatility’s short-lived nature.

Chart showing the backing complaint for token-margined perpetual futures from May 3 to the aboriginal hours of June 4, 2024 (Source: CoinGlass)

Chart showing the backing complaint for token-margined perpetual futures from May 3 to the aboriginal hours of June 4, 2024 (Source: CoinGlass)Some of this volatility could beryllium attributed to the speculative quality of token-margined contracts. Exchanges offering token-margined perpetual futures often supply higher leverage than USDT oregon USD-margined contracts. While higher leverage tin amplify imaginable gains, it besides magnifies losses, making token-margined contracts riskier and much suitable for speculative trading strategies.

Token-margined perpetual futures thin to pull a higher proportionality of retail traders and speculators who are much risk-tolerant and whitethorn question higher returns. Institutional investors and nonrecreational traders, who typically prioritize hazard absorption and superior preservation, are much apt to gravitate towards USDT oregon USD-margined contracts, which are perceived arsenic much stable.

Another important origin that could person led to specified a crisp driblet successful the backing complaint connected Bitmex is marketplace depth. Token-margined perpetual futures usually person little liquidity than their USDT oregon USD-margined counterparts. Lower liquidity leads to wider bid-ask spreads, making these markets much susceptible to speculation and volatility.

The unchangeable rates crossed astir exchanges implicit the past 30 days, combined with Bitcoin’s comparatively range-bound terms action, bespeak a play of marketplace uncertainty and indecision. Therefore, the isolated drops and spikes successful backing rates connected circumstantial exchanges successful the past weeks bespeak interior trends and changes much than market-wide ones.

The station Funding complaint volatility shows localized trading imbalances contempt marketplace stability appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)