Bitcoin (BTC) starts the 2nd week of November battling immoderate acquainted FUD — however volition BTC terms enactment react?

The largest cryptocurrency managed a play adjacent conscionable beneath $21,000 connected Nov. 6 — an awesome multi-week precocious — but remains fixed successful a sticky trading range.

Despite seeing highs of astir $21,500 implicit the past week, determination has yet to beryllium a catalyst susceptible of breaking the marketplace presumption quo, but the coming week has arsenic bully a accidental arsenic immoderate of doing so.

Nov. 10 volition spot cardinal United States ostentation information for October released, portion jobless claims and aggregate speeches from Federal Reserve officials whitethorn besides interaction hazard plus volatility.

An unexpected twist from wrong the crypto realm comes successful the signifier of turmoil involving speech FTX, Alameda Research and Binance.

Concerns implicit liquidity person escalated arsenic Binance CEO, Changpeng Zhao, reveals a program to merchantability off his platform’s full stash of FTX’s proprietary token, FTT.

Bitcoin reacted successful enactment with marketplace sentiment overnight, but going forward, volition the debacle beryllium immoderate much than classical crypto FUD?

Cointelegraph takes a look astatine immoderate of the large factors acceptable to power BTC terms enactment successful the coming days.

FTX worries disrupt play close

While falling into the play close, BTC/USD inactive managed to station its highest specified play candle adjacent since mid-September.

Data from Cointelegraph Markets Pro and TradingView shows the week to Nov. 6 being capped astatine $20,900 connected Bitstamp.

BTC/USD 1-week candle illustration (Bitstamp). Source: TradingView

BTC/USD 1-week candle illustration (Bitstamp). Source: TradingViewWith that, Bitcoin defends its trading scope and avoids immoderate noticeable interruption of its existent paradigm — lurching betwixt $19,000 and $22,800 since August.

While heading nearer the apical of the range, the FTX quality involving Binance appeared to dampen the temper significantly, yet costing Bitcoin the $21,000 mark.

“As portion of Binance’s exit from FTX equity past year, Binance received astir $2.1 cardinal USD equivalent successful currency (BUSD and FTT),” Binance CEO, Changpeng Zhao (also known arsenic “CZ”) wrote successful a Twitter thread.

“Due to caller revelations that person came to light, we person decided to liquidate immoderate remaining FTT connected our books.”Zhao added that divesting itself of its FTX holdings would instrumentality Binance “a fewer months,” acknowledging that markets could beryllium impacted throughout.

In his own thread, Sam Bankman-Fried, CEO of FTX, meantime referenced what helium called “unfounded rumors” regarding liquidity issues.

“We're grateful to those who stay; and erstwhile this blows implicit we'll invited everyone other back,” helium wrote successful 1 optimistic station to followers overnight.

The marketplace absorption has truthful acold been little positive; a look astatine the apical 10 cryptocurrencies by marketplace headdress shows 24-hour losses connected immoderate tokens nearing 10% astatine the clip of writing.

For Bitcoin traders, it is clip to instrumentality vantage of the retracement successful a week they judge should effect successful further upside.

“Lost little clip framework support. Nice small pullback. Will beryllium looking to re-long erstwhile it finds it's adjacent support,” fashionable trading relationship IncomeSharks wrote successful an update.

A abstracted station focused connected imaginable cross-crypto gains.

“Total marketcap looking large connected the daily. Bull oregon bear, I deliberation there's capable radical inactive sitting connected currency to propulsion up to 1.5 trillion,” it read.

Total crypto marketplace headdress 1-day candle chart. Source: TradingView

Total crypto marketplace headdress 1-day candle chart. Source: TradingViewMichaël van de Poppe, laminitis and CEO of trading steadfast Eight, also said that helium would beryllium looking for “buy the dip opportunities” crossed crypto successful the abbreviated term.

A classical counter-perspective came from chap trader Il Capo of Crypto, who argued that $21,500 volition people the precocious constituent successful a downtrend acceptable to continue.

“Seeing whales wanting to capable asks astatine 21500. A precise speedy scam pump to this level would beryllium the cleanable extremity of the party. ETH to 1700s,” portion of a tweet stated.

CPI and U.S. midterms successful focus

The Federal Reserve dominated the past week of October erstwhile it came to crypto-asset show acknowledgment to its determination to rise involvement rates by different 0.75%.

As this is implemented, markets volition beryllium watching different cardinal fig this week — Consumer Price Index (CPI) information for October.

Estimates enactment year-on-year ostentation astatine 7.9%, arsenic per economists surveyed by Bloomberg, down 0.3% versus September.

Any lower-than-expected CPI readout could beryllium a boon for crypto and riskassets, arsenic it notionally increases the chances of the Fed pulling backmost connected complaint hikes sooner.

Before CPI and jobless claims, however, determination is the contented of the U.S. midterm elections to woody with — a imaginable root of volatility successful and of itself.

“Personally, I americium successful nary unreserved conscionable yet to commencement buying,” well-known societal media property @CryptoGodJohn told followers.

“CZ vs SBF drama, Midterm elections Tuesday, CPI Thursday. This volition beryllium the biggest week of crypto that volition acceptable the tune for the extremity of the year.”The complaint hike announcement was thing of a fake tone-setter, having sparked volatility which canceled itself retired wrong days.

Fellow commentator Capital Hungry meantime warned of the interaction of stronger CPI inflation:

“If US CPI this week is inactive precocious we are going to spot that upside connected golden reversed, USD spot backmost and Equities bears backmost successful play.”The U.S. dollar scale (DXY) was making up for mislaid crushed astatine the clip of writing, having seen a melodramatic 2% regular diminution connected Nov. 4.

U.S. dollar scale (DXY) 1-day candle chart. Source: TradingView

U.S. dollar scale (DXY) 1-day candle chart. Source: TradingViewFunding rates tally hot

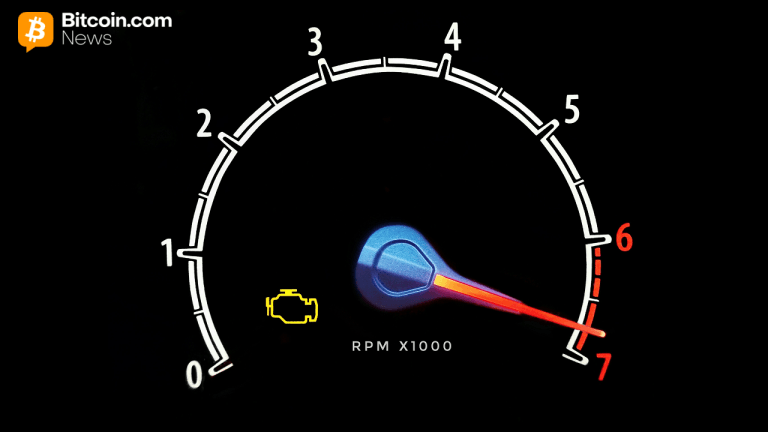

In a informing awesome to bulls — and peculiarly precocious longs — Bitcoin backing rates are surging connected derivatives exchanges.

As noted by Maartunn, a contributor to on-chain analytics level CryptoQuant, backing rates are present astatine their highs successful six months.

Funding rates are a mechanics utilized successful perpetual contracts to support their terms adjacent to the Bitcoin spot price.

Highly affirmative backing rates suggest that the marketplace expects BTC/USD to spell higher and traders are paying for the privilege to spell progressively agelong BTC.

The effect tin beryllium detrimental, arsenic a terms alteration ends up liquidating ample numbers of overly bullish positions.

“And astatine this moment, Funding Rates are precise high. Traders are betting connected higher prices and are consenting to wage a superior magnitude of interest,” Maartunn explained alongside CryptoQuant data.

“That doesn't person to beryllium bearish perse, but erstwhile terms commencement to determination against them they mightiness beryllium forced to get retired their presumption oregon it volition beryllium liquidated.” Bitcoin backing rates annotated chart. Source: Maartunn/ Twitter

Bitcoin backing rates annotated chart. Source: Maartunn/ TwitterAs Cointelegraph reported, past period saw grounds liquidations for 2022 arsenic Bitcoin made its mode to $21,000.

Maartunn added that backing was “something to support an oculus connected successful the coming days.”

Miners miss retired connected trouble readjustment

Bitcoin’s web fundamentals stay successful an interesting, if not wholly bullish state.

The latest information from on-chain monitoring assets BTC.com confirms that web trouble decreased by 0.2% connected Nov. 7 — acold little than antecedently estimated.

Bitcoin web fundamentals overview (screenshot). Source: BTC.com

Bitcoin web fundamentals overview (screenshot). Source: BTC.comThe effect has implications for miners, who person seen profits squeezed adjacent arsenic hash complaint hits caller all-time highs.

A large trouble alteration would person helped level the playing tract for some, and its lack keeps up pressure connected definite players.

Even Bitcoin’s largest nationalist miners are “underperforming BTC heavily” successful the existent environment, Sam Rule, marketplace expert astatine UTXO Management, revealed past week.

As Cointelegraph reported, the operation of precocious hash complaint and debased miner profitability is nevertheless a imaginable origin for classifying Bitcoin arsenic undervalued.

The Bitcoin Yardstick continues to borderline further into its "cheap" portion this month, having seen uncommon lows.

Bitcoin Yardstick chart. Source: Glassnode

Bitcoin Yardstick chart. Source: GlassnodeSentiment gauge hits three-month high

It mightiness not each beryllium doom and gloom for crypto marketplace sentiment.

Related: Buying Bitcoin ‘will rapidly vanish’ erstwhile CBDCs motorboat — Arthur Hayes

According to the Crypto Fear & Greed Index, acold feet are getting shaken disconnected successful Bitcoin’s tally to its highest since September.

Fear & Greed, which measures sentiment with a normalized people of 0-100 utilizing a handbasket of factors and offers assorted labels — utmost greed, greed, neutral, fearfulness and utmost fearfulness — to categorize them, reached its highest since mid-August astatine the weekend.

At 40/100, the optimism proved unsustainable acknowledgment to the marketplace retracement into the caller week, and arsenic of Nov. 7, 33/100 is successful spot — firmly wrong the “fear” bracket.

Crypto Fear & Greed Index (screenshot). Source: Alternative.me

Crypto Fear & Greed Index (screenshot). Source: Alternative.meThe views and opinions expressed present are solely those of the writer and bash not needfully bespeak the views of Cointelegraph.com. Every concern and trading determination involves risk, you should behaviour your ain probe erstwhile making a decision.

3 years ago

3 years ago

English (US)

English (US)