Funding rates are an often overlooked yet captious facet of the crypto market. These rates are indispensable successful perpetual futures contracts — fiscal instruments that let traders to stake connected Bitcoin’s terms without an expiration date.

Funding rates assistance align the terms of these contracts with the existent marketplace terms of Bitcoin done periodic payments betwixt buyers and sellers. Buyers wage sellers if the complaint is positive, showing a bullish marketplace mood. Conversely, a antagonistic complaint indicates bearish sentiment, with sellers paying buyers.

Funding rates amusement the market’s leverage absorption and wide sentiment. High backing rates suggest a beardown bullish sentiment, with traders consenting to wage much to clasp onto their bets for rising prices. Meanwhile, debased oregon antagonistic rates hint astatine a bearish outlook, wherever expectations thin towards a terms drop.

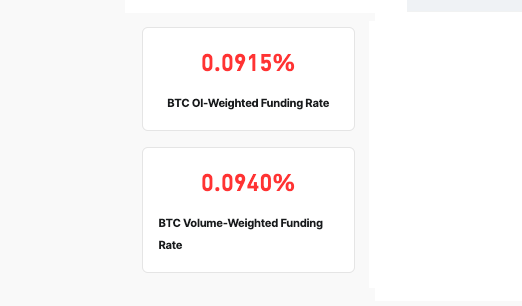

According to CoinGlass data, the unfastened interest-weighted backing complaint of 0.0921% and the volume-weighted backing complaint of 0.0942% showed a precocious outgo for traders holding agelong positions successful perpetual futures anterior to Bitcoin’s March 5 correction. The flimsy quality betwixt these rates comes from the organisation of unfastened involvement and measurement crossed antithetic terms points oregon times, showing a flimsy quality successful marketplace sentiment and leverage.

Screengrab showing the unfastened interest-weighted backing complaint and the volume-weighted backing complaint for Bitcoin perpetual contracts connected March 5, 2024, 15:00 UTC (Source: CoinGlass)

Screengrab showing the unfastened interest-weighted backing complaint and the volume-weighted backing complaint for Bitcoin perpetual contracts connected March 5, 2024, 15:00 UTC (Source: CoinGlass)This precocious outgo of holding agelong positions shows that astir of the marketplace was expecting prices to emergence adjacent further successful the adjacent future. This is particularly important arsenic BTC had been struggling to regain its ATH of $69,000. Bitcoin concisely broke $69,000 connected respective exchanges connected March 5, but a swift correction brought its terms backmost to $59,500 earlier recovering to astir $67,000.

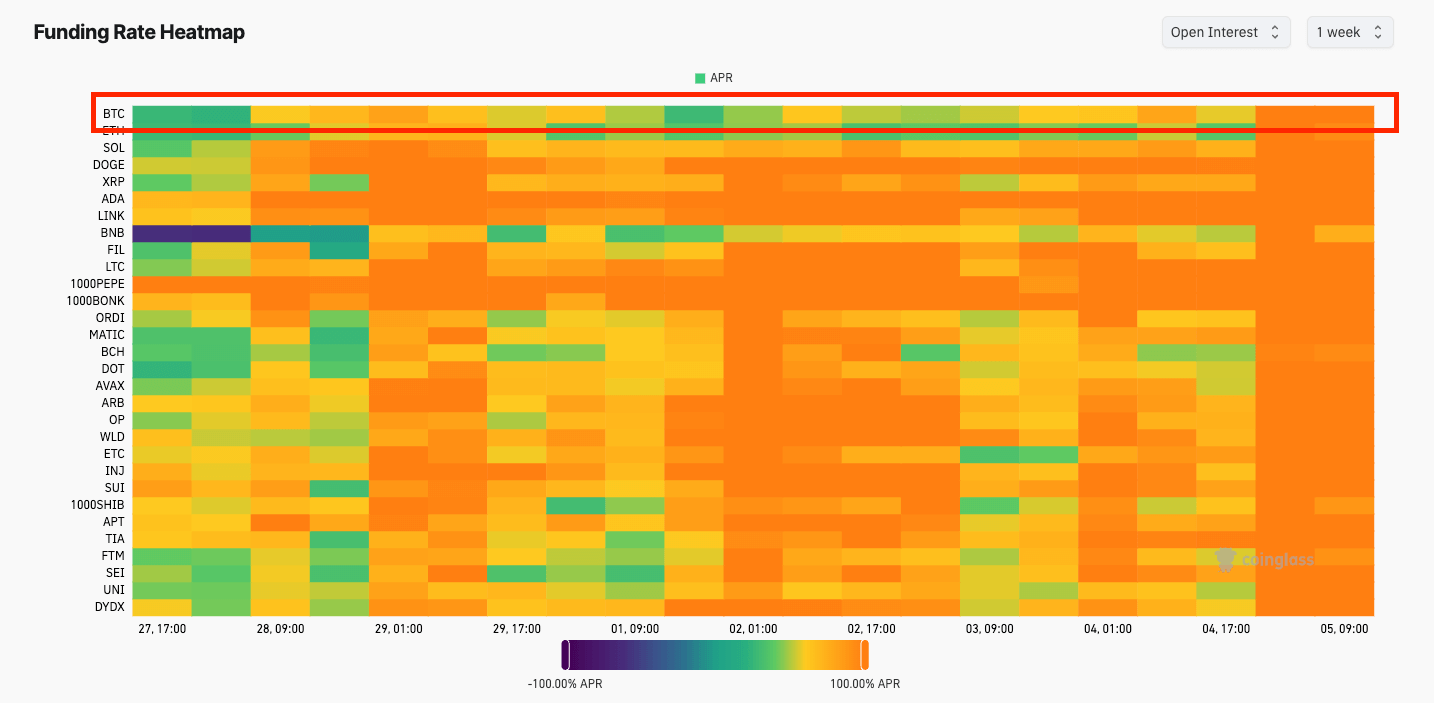

The bullish sentiment was seen successful the melodramatic summation successful the Bitcoin APR. On March 1, Bitcoin’s terms was $61,480, and the backing complaint APR stood astatine 27.72%. And portion an uptick successful APR was seen successful the past fewer days of February, it wasn’t until the opening of March that it picked up momentum. The progression from 27.72% APR connected March 1 to a crisp summation to 117.52% by the greeting of March 5 followed Bitcoin’s terms summation from $61,480 to $68,296 implicit the aforesaid timeframe.

Screengrab showing the Bitcoin backing complaint heatmap from February 27 to March 5, 2024 (Source: CoinGlass)

Screengrab showing the Bitcoin backing complaint heatmap from February 27 to March 5, 2024 (Source: CoinGlass)The summation successful backing complaint APRs, peculiarly the leap observed connected March 5, shows bullish sentiment among traders has intensified. The marketplace is progressively consenting to wage higher premiums to clasp agelong positions successful anticipation of further terms appreciation.

The accelerated escalation successful APR betwixt March 1 and March 5, peculiarly the hourly leap betwixt 01:00 and 09:00 connected March 5, represents the culmination of speculative fervor, perchance driven by FOMO arsenic traders unreserved to capitalize connected the bullish trend. This script often leads to a highly leveraged marketplace wherever the outgo of maintaining agelong positions becomes exceptionally high, reflected successful the surging APR. The fallout of the March 5 terms correction saw the Open Interest weighted backing complaint autumn to 0.0504% arsenic of property clip pursuing $309 cardinal successful BTC liquidations implicit the past 24 hours.

Such conditions summation the market’s vulnerability to volatility and corrections. An over-leveraged marketplace is susceptible to abrupt terms pullbacks, wherever adjacent insignificant sell-offs tin trigger a cascade of liquidations of leveraged positions, starring to crisp terms corrections. Historically, important run-ups successful terms and backing rates person occasionally preceded corrections.

The station Funding rates soared arsenic traders stake large connected Bitcoin’s aboriginal gains earlier correction appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)