Bitcoin has breached done the $50,000 mark, trading astatine implicit $52,000 astatine property time, marking a important milestone arsenic it’s the archetypal clip it regained its losses from November 2022. With Bitcoin’s struggles to transverse supra $49,000 this week, it has been peculiarly eventful for the futures market, highlighting a keen involvement from traders and investors alike successful leveraging futures contracts to speculate connected its aboriginal terms movements.

Analyzing futures successful times of volatility is highly important arsenic it sheds airy connected marketplace sentiment, trader behavior, and imaginable terms directions. Futures, agreements to bargain oregon merchantability an plus astatine a aboriginal day astatine a predetermined price, are a instrumentality for investors to hedge against terms risks oregon speculate connected terms movements. Changes successful the futures market, particularly successful times of important terms movements, tin assistance amusement the corporate expectations of marketplace participants.

Bitcoin’s emergence to $50,000 caused a notable summation successful unfastened involvement for futures and perpetual futures contracts.

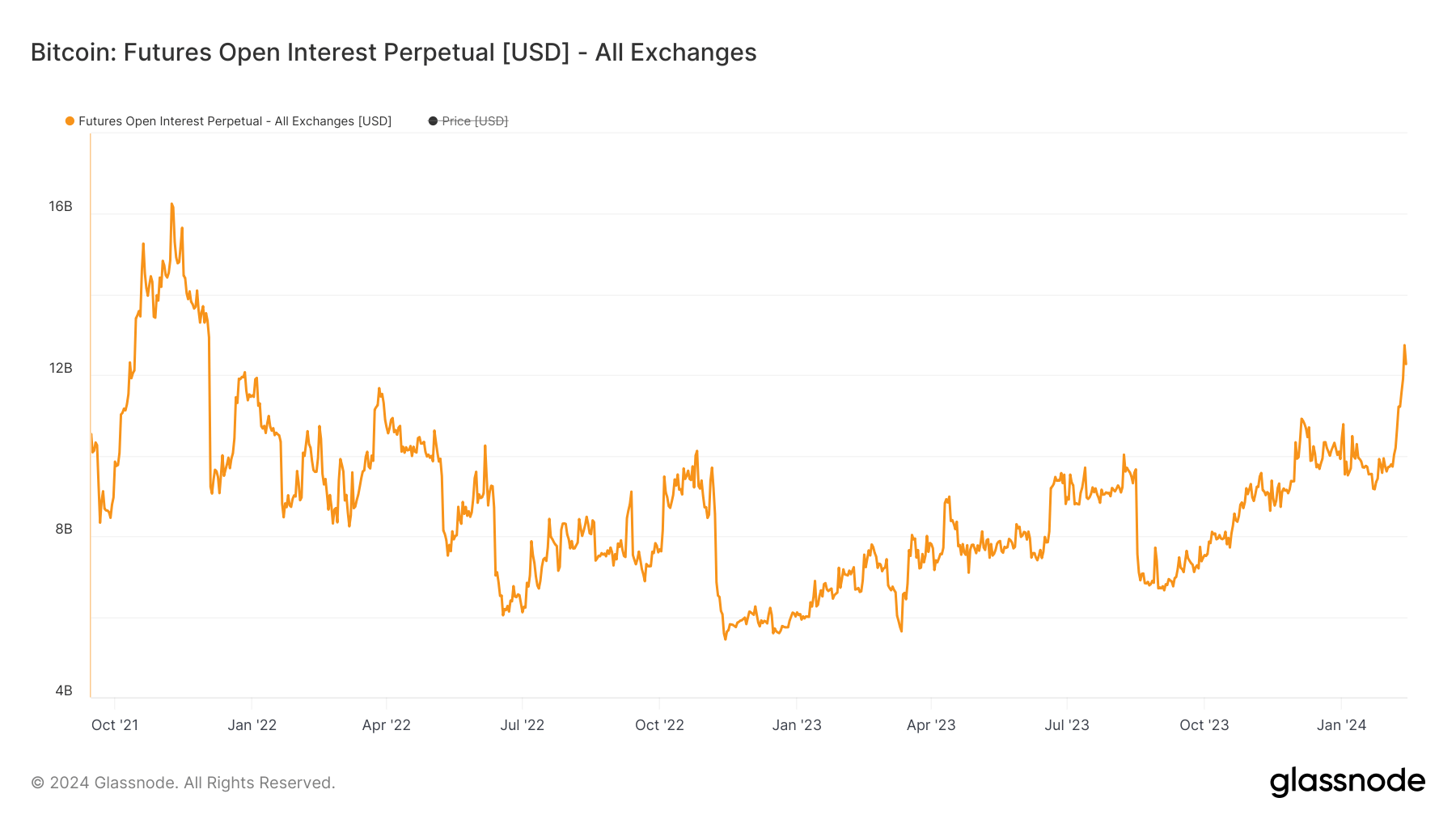

Perpetual futures unfastened involvement experienced a important uptick this month, from $9.716 cardinal connected Feb. 1 to $12.742 cardinal connected Feb. 12 — the highest since December 2021. This emergence shows speculative enactment successful Bitcoin is growing, fixed that perpetual futures—contracts without an expiration date—are commonly utilized for short-term trading strategies. The flimsy alteration connected Feb.13 to $12.273 cardinal mightiness suggest a play of insignificant consolidation, liquidation, and profit-taking pursuing the terms spike.

Graph showing the unfastened involvement successful Bitcoin perpetual futures from September 2021 to February 2024 (Source: Glassnode)

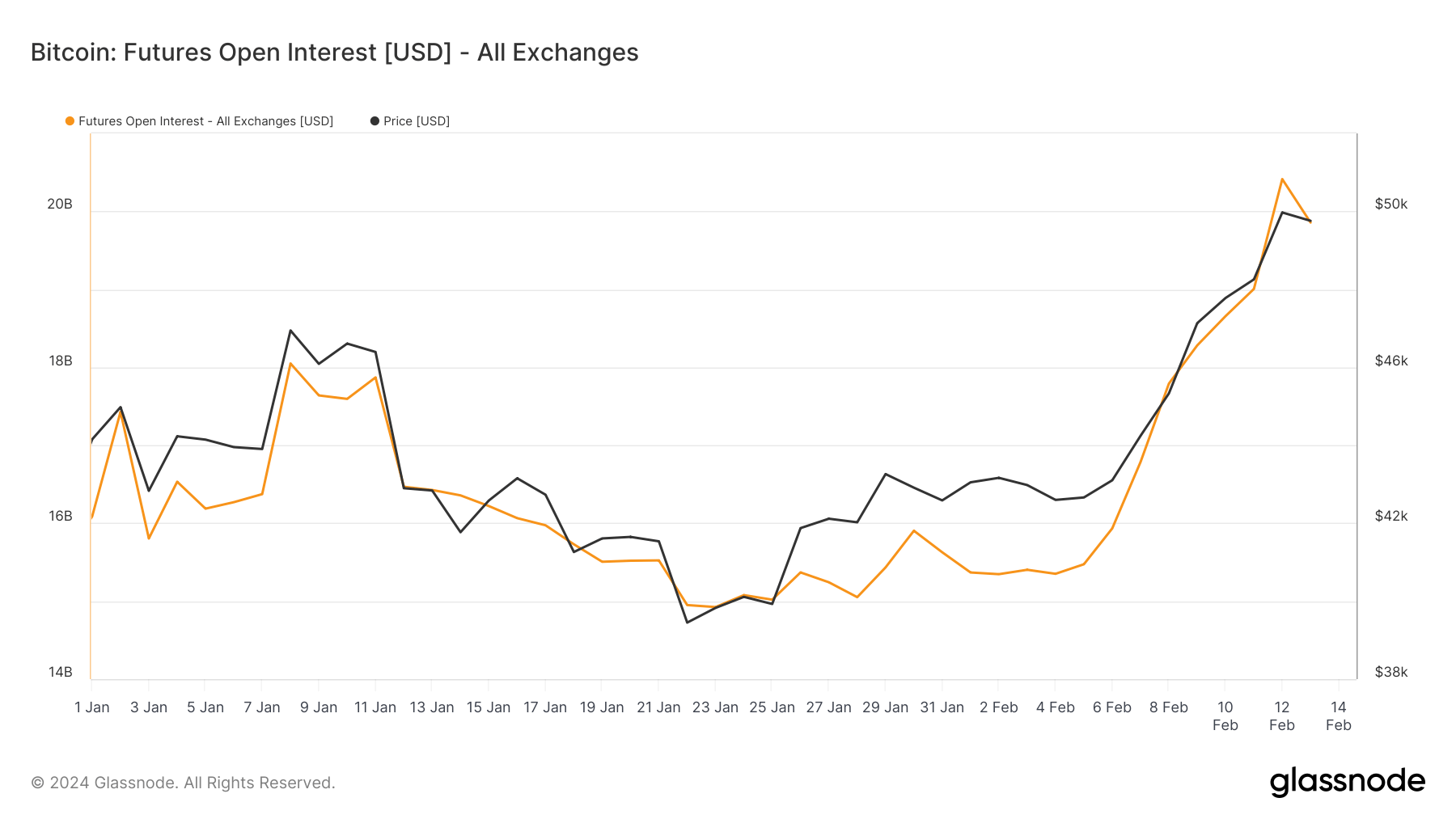

Graph showing the unfastened involvement successful Bitcoin perpetual futures from September 2021 to February 2024 (Source: Glassnode)Bitcoin futures unfastened involvement reached a two-year precocious connected Feb. 12 astatine $20.413 billion.

Graph showing the unfastened involvement connected Bitcoin futures from Jan. 1 to Feb. 12, 2024 (Source: Glassnode)

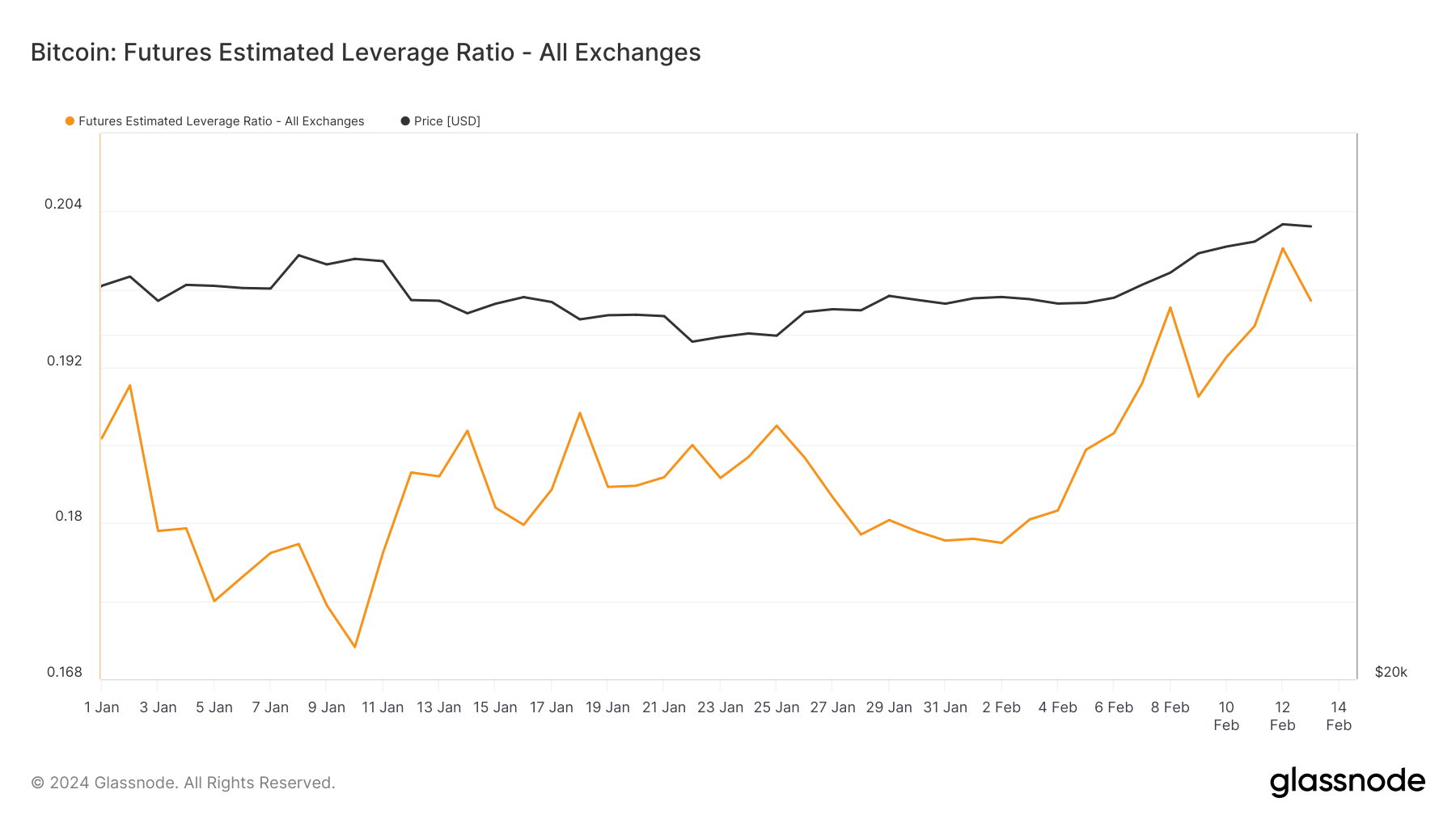

Graph showing the unfastened involvement connected Bitcoin futures from Jan. 1 to Feb. 12, 2024 (Source: Glassnode)The estimated futures leverage ratio, which quantifies the mean leverage utilized by investors successful the futures market, accrued from 0.178 connected Feb. 1 to 0.201 connected Feb. 12. This uptick shows an summation successful risk-taking among traders, arsenic leverage amplifies some imaginable gains and losses, contributing to greater marketplace volatility.

Graph showing the estimated leverage ratio for Bitcoin futures from Jan. 1 to Feb. 14, 2024 (Source: Glassnode)

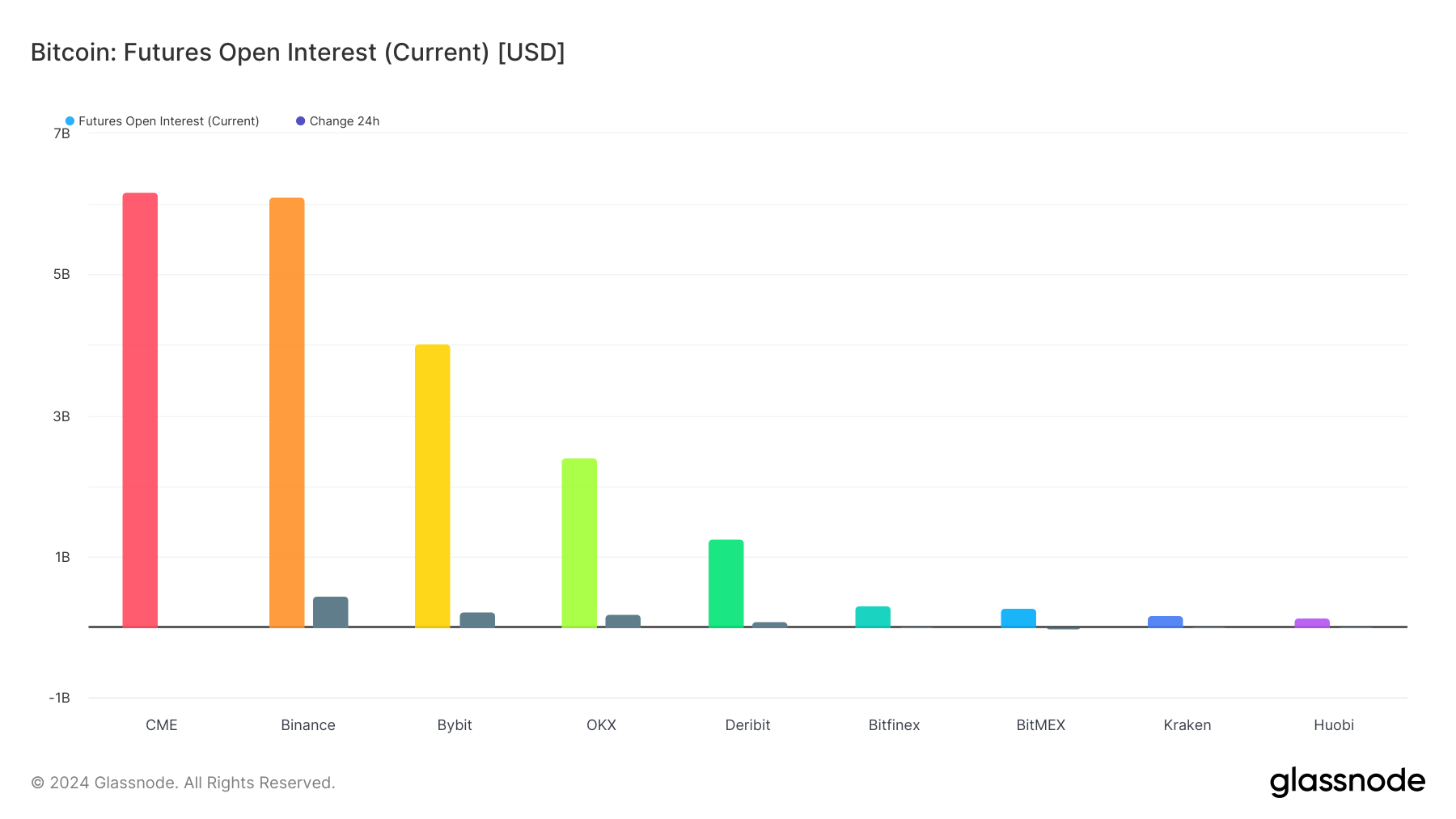

Graph showing the estimated leverage ratio for Bitcoin futures from Jan. 1 to Feb. 14, 2024 (Source: Glassnode)This summation successful perpetual and fixed-date futures contracts shows a surge successful trading enactment and could make greater liquidity successful the market. The organisation of futures unfastened involvement crossed exchanges, with CME and Binance starring connected Feb.12, indicates astir adjacent information from institutions and retail. This is peculiarly noteworthy for Binance, which has been vying to surpass CME arsenic the starring derivatives exchange, marking a important milestone for the speech and the retail market.

Chart showing the unfastened involvement successful Bitcoin futures crossed exchanges connected Feb. 12, 2024 (Source: Glassnode)

Chart showing the unfastened involvement successful Bitcoin futures crossed exchanges connected Feb. 12, 2024 (Source: Glassnode)Given these observations, the existent inclination suggests an progressive and engaged futures marketplace characterized by bullish sentiment and accrued risk-taking. This situation could foster continued terms volatility, driven by speculative trading and leveraged positions.

The station Futures unfastened involvement hits two-year highest with Bitcoin supra $50k appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)