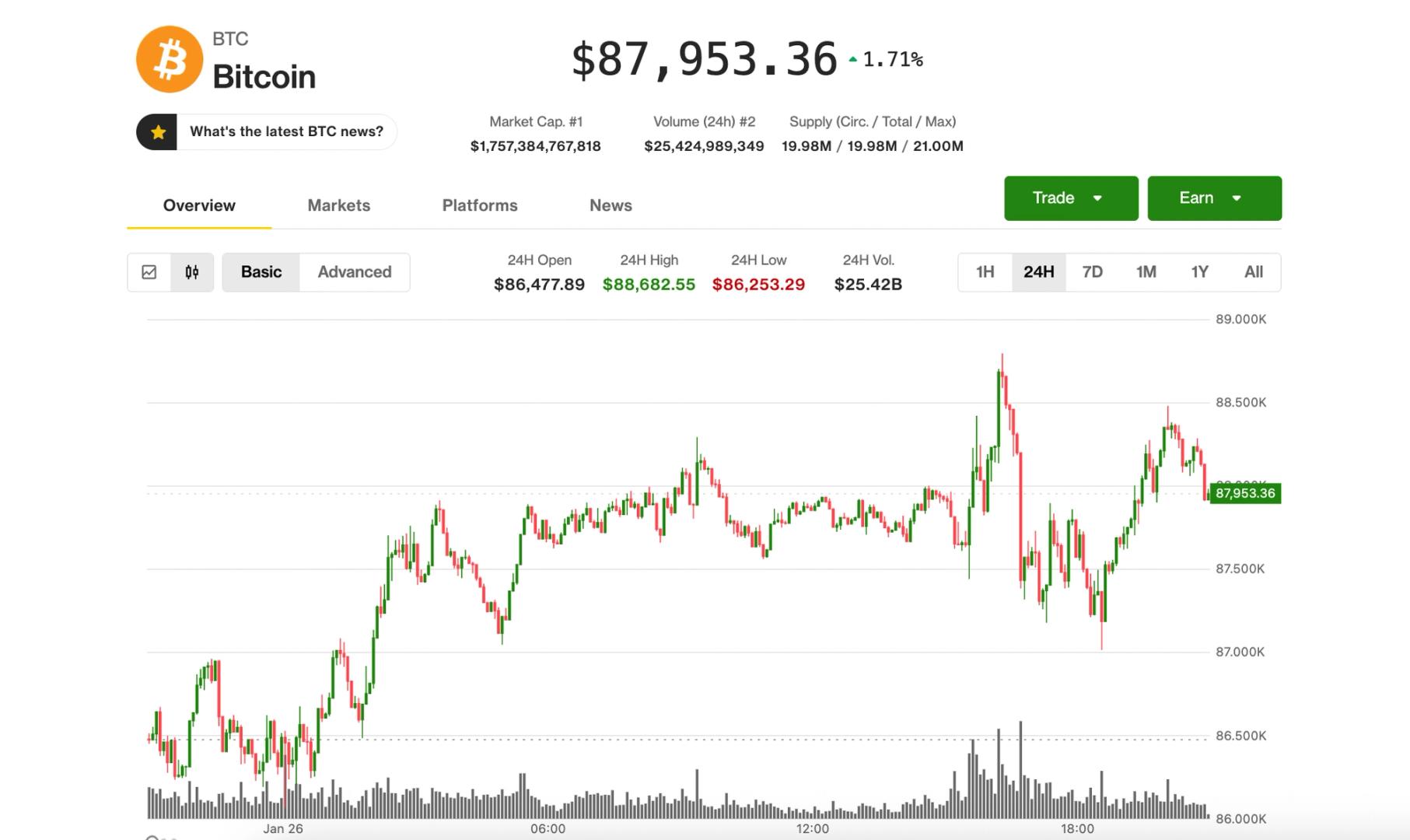

Falling income and diminished Bitcoin gains pressured earnings, with the banal continuing to retrace its little rally successful March.

GameStop missed expert estimates successful the 3rd 4th of 2025, dragging shares down implicit 4% connected Wednesday, arsenic declining halfway income and reduced Bitcoin gains weighed connected the quarter.

The company’s Q3 gross of $821 cardinal fell abbreviated of expert expectations of $987.29 million, according to Seeking Alpha.

GameStop’s Q3 report besides shows that it holds 4,710 Bitcoin (BTC), with unrealized losses during the 4th totaling $9 million, though its BTC presumption remains up $19.4 cardinal for the year.

The institution besides missed expert expectations successful Q1, posting gross of astir $732 million, falling abbreviated of estimates of $754 million.

GameStop continues to conflict contempt adopting a BTC treasury strategy successful March. The determination concisely lifted the banal by astir 12% to $35 per share, but those gains rapidly reversed.

Related: Bitcoin treasury firms participate a ‘Darwinian phase’ arsenic premiums collapse: Galaxy

GameStop sees small alleviation from its Bitcoin treasury strategy

GameStop’s concern exemplary relies connected carnal video games and the reselling of utilized games, which person been impacted by the diminution of carnal media.

The institution raised $1.5 billion successful April to concern Bitcoin purchases and bought 4,710 BTC successful May arsenic portion of its strategical pivot to a integer plus treasury company.

However, GameStop shares slid by 11% the time aft the institution announced the treasury pivot, arsenic investors voiced concerns implicit the integer plus strategy.

In July, GameStop CEO Ryan Cohen said crypto and BTC are hedges against ostentation and teased plans to judge crypto arsenic outgo astatine its stores.

“The quality to really usage crypto wrong transactions is thing that is an opportunity, and it’s thing that we’re looking at,” Cohen said.

He added that the institution is attempting to trim reliance connected carnal hardware and crippled income owed to rising costs and absorption connected collectibles similar trading cards.

The diminution of GameStop’s banal is portion of a broader downturn successful integer plus treasury companies, which is attributed to marketplace saturation and capitalist caution, according to Standard Chartered.

Magazine: Quantum attacking Bitcoin would beryllium a discarded of time: Kevin O’Leary

1 month ago

1 month ago

English (US)

English (US)