The precocious disappeared GBTC discount whitethorn beryllium “a motion of manufacture maturing and the improved endeavor acceptance of bitcoin.” While immoderate spot the disappearance of the discount arsenic pointing to the re-emergence of the premium to the nett plus worth (NAV), 1 adept said helium sees “the continued parity oregon adjacent a resurgence of the discount” arsenic existent possibilities.

The Impact of Spot Bitcoin ETF Approvals

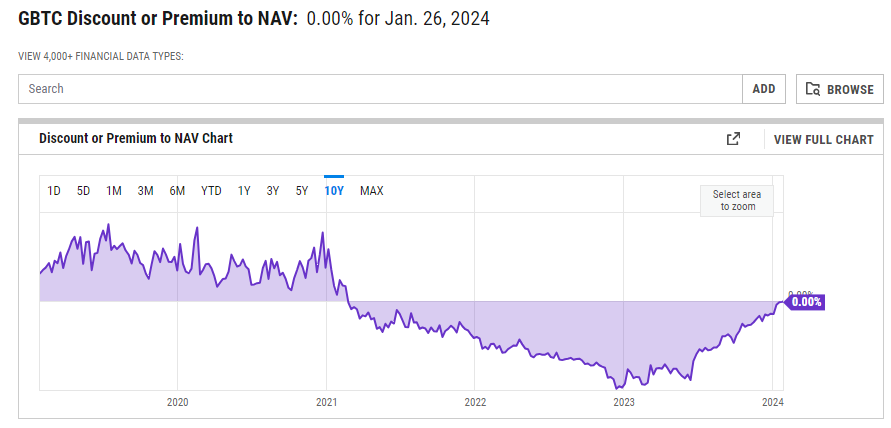

On oregon astir January 26, the discount to the nett plus worth (NAV) of the Grayscale Bitcoin Trust (GBTC) narrowed to zero for the archetypal clip successful astir 3 years. Since descending to 44% successful June 2023, the discount has gradually shrunk and by Dec. 20, 2023, it had reached the single-digit fig of 7%.

According to Ycharts data, the past clip the discount to the NAV was astir zero was sometime astir February 21, 2021. The gradual disappearance of the GBTC’s discount to NAV has been attributed to galore factors including the spot bitcoin exchange-traded funds (ETF) support speculation that gripped the crypto marketplace for overmuch of the 2nd fractional of 2023.

Meanwhile, the disappearance of the discount has prompted immoderate to foretell the imminent instrumentality of the premium to the NAV. Others, however, person warned that this instrumentality to a premium is not a fixed due to the fact that crypto assets similar bitcoin are inactive volatile. They reason that the support of spot bitcoin exchange-traded funds (ETF) unsocial volition not alteration that.

Nevertheless, immoderate experts, specified arsenic Mant Hawkins, the Core Contributor astatine Andromeda, spot the disappearance of the discount arsenic a motion of however acold the crypto manufacture has matured. He cites the U.S. Securities and Exchange Commission (SEC)’s caller support of spot bitcoin ETFs arsenic impervious of the grade to which cryptocurrencies similar Bitcoin (BTC) are being adopted.

“I spot the narrowing of the discount arsenic a motion of the manufacture maturing and the improved endeavor acceptance of BTC. The BTC ETF support decision, arsenic invited arsenic it was, seems to beryllium conscionable 1 much dilatory crook of the adoption wheel,” Hawkins said.

The Return of the GBTC Premium

Another expert, Denis Petrovcic, co-founder and CEO of Blocksquare, said helium does not regularisation retired the marketplace reacting to the disappearance of the discount by “pushing it to a premium we person not seen since 2020.” However, Petrovcic besides concurred that crypto assets similar BTC stay volatile, and not adjacent the ETF hype tin alteration this.

If so the GBTC’s premium is to return, Petrovcic said helium foresees this yet gravitating to backmost NAV “to compensate for the ETF’s convenience and accessibility.”

Meanwhile, Zak Taher, the CEO of Multibank.io, indicated that helium agrees with galore of his peers’ views connected what the disappearance of the discount apt means. However, Taher besides told Bitcoin.com News that portion a premium is simply a possibility, the “continued parity oregon adjacent a resurgence of the discount are besides imaginable scenarios.”

Andrey Stoychev, caput of Prime Brokerage astatine Nexo explained that from an economical standpoint, 1 mightiness suggest that the marketplace has achieved a equilibrium betwixt the proviso of and request for GBTC shares. Hypothetically speaking, Stoychev said if inflows and outflows are equal, the contiguous bitcoin terms offers the astir important accidental for nett realization successful the past 2 years.

“With spot bitcoin ETFs approved, Grayscale investors person present been simply freed to recognize gains,” Stoychev told Bitcoin.com News. “Fortunately, that selling unit has been absorbed by newer marketplace participants and investors, arsenic evident from the disappearance of the GBTC discount. Predicting a meaningful premium is tricky; it depends connected Bitcoin request and industry-wide events, similar the upcoming artifact rewards halving, that could displacement proviso dynamics and interaction the GBTC discount.”

Stoychev added:

Arguably, close now, investors are spoiled for prime connected however to summation vulnerability to Bitcoin. That field, dominated by the world’s starring plus managers, volition perchance beryllium characterized by miniscule margins and fierce terms competition. Should this beryllium the case, superior deviations toward a premium oregon discount for GBTC shares are improbable without a significant, industry-wide lawsuit to disturb the markets and unit investors into fearfulness oregon greed.

Before dropping to zero successful precocious February 2021, the integer plus concern product’s premium to NAV ratio had mostly stayed supra 10%. After the premium turned negative, the terms of the GBTC banal besides began to drop.

As shown by the data, the terms of GBTC fell from 1 of its 2021 highs of conscionable implicit $51 to little than $9 successful December 2022. However, since then, the terms has rallied. At the clip of writing, 1 GBTC stock was trading astatine conscionable supra $37. As of Jan. 30, 2023, GBTC’s BTC reserves are present nether 500,000 astatine 496,573.81 BTC.

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)