The crypto system has slipped nether the $1 trillion people to the $970 cardinal range, arsenic a ample fig of integer currencies person mislaid much than fractional their USD worthy since November 2021. Bitcoin is down 70% from the all-time precocious past year, and a caller study from Glassnode Insights calls the existent carnivore marketplace “a carnivore of historical proportions,” portion highlighting that “it tin reasonably beryllium argued that 2022 is the astir important carnivore marketplace successful integer plus history.”

Glassnode Researchers: ‘Bitcoin Is Currently Experiencing the Largest Capital Outflow Event successful History’

Many radical recognize that the crypto system is presently successful a carnivore marketplace but nary 1 knows wherever it volition pb oregon erstwhile it volition end. Bitcoin and the crypto economy, successful general, person been done respective carnivore markets and a caller Glassnode Insights report claims it conscionable mightiness beryllium the worst connected record. The analytics institution Glassnode provides an investigation of bitcoin’s (BTC) existent terms driblet and however the integer plus slipped beneath the 200-day moving mean (DMA). The 40-week timespan gives traders position connected whether oregon not the existent inclination volition proceed dropping little and it tin besides place imaginable level prices.

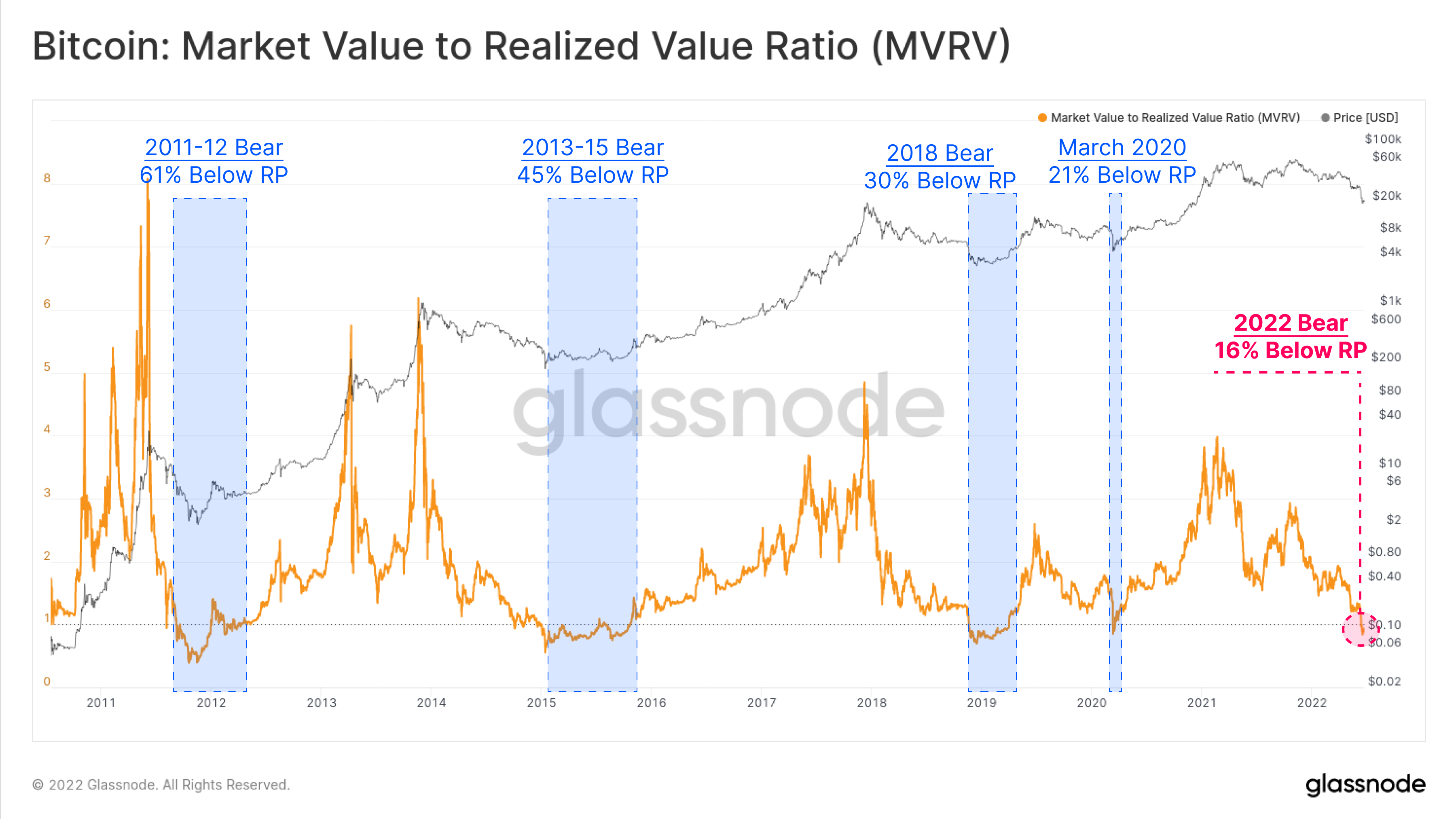

Glassnode’s station describes the Mayer Multiple and the 200DMA and however they tin awesome a carnivore oregon bull market. “When prices commercialized beneath the 200DMA, it is often considered a carnivore market,” Glassnode’s investigation notes. “When prices commercialized supra the 200DMA, it is often considered a bull market.” Additionally, Glassnode leverages information similar “realized price,” “realized cap,” and the marketplace worth and realized worth oscillator (MVRV Ratio).

“The 30-day presumption alteration of the realized headdress (Z-Score) allows america to presumption the comparative monthly superior inflow/outflow into the BTC plus connected a statistical basis,” Glassnode’s blog station explains. “By this measure, bitcoin is presently experiencing the largest superior outflow lawsuit successful history, hitting -2.73 modular deviations (SD) from the mean. This is 1 full SD larger than the adjacent largest events, occurring astatine the extremity of the 2018 Bear Market, and again successful the March 2020 sell-off.”

Glassnode has been researching and discussing the existent carnivore marketplace for rather immoderate clip and connected June 13, it published a video called “The Darkest Phase of the Bear.” The video looks into whether oregon not it is the last signifier oregon last capitulation play successful bitcoin’s terms cycle. Historically, BTC has dropped 80%+ little connected each of its large carnivore markets and an 80% driblet successful terms from $69K is $13,800 per unit. Some crypto investors judge the extremity of the carnivore whitethorn beryllium adjacent portion others deliberation max symptom has not arrived yet. Max pain, the depths of despair, the lowest of lows, oregon the bottommost whitethorn not beryllium successful yet.

Glassnode’s study details that due to the fact that bitcoin got truthful large, the interaction has been magnified. “As the bitcoin marketplace matures implicit time, the magnitude of imaginable USD denominated losses (or profits) volition people standard alongside web growth,” Glassnode’s probe study says. “However, adjacent connected a comparative basis, this does not minimize the severity of this $4+ cardinal nett loss.”

Glassnode researchers besides delve into ethereum (ETH), a coin that often drops little than BTC’s 80% drawdown. “Ethereum prices person spent 37.5% of its trading beingness successful a akin authorities nether the realized price, a stark examination to bitcoin astatine 13.9%,” Glassnode researchers wrote. “This is apt a reflection of the humanities out-performance of BTC during carnivore markets arsenic investors propulsion superior higher up the hazard curve, starring to longer periods of ETH trading beneath capitalist outgo bases.”

Glassnode added:

The existent rhythm debased of the MVRV is 0.60, with lone 277 days successful past signaling a little value, equivalent to 11% of trading history.

Last week, BTC and ETH prices accrued successful worth aft taking a hard deed the week anterior and remained consolidated for astir of the week. BTC prices are inactive down 8.1% during the past 2 weeks and the crypto asset’s USD worth is down 0.3% implicit the past 24 hours. ETH values person slid 0.1% during the past 24 hours and two-week stats amusement ETH is down lone 1.3% against the U.S. dollar. Glassnode’s station shows that the information and studies done constituent to 1 of the astir important crypto carnivore markets successful history.

The Glassnode Insights study concludes by saying:

The assorted studies described supra item the sheer magnitude of capitalist losses, the standard of superior destruction, and the observable capitulation events occurring implicit the past fewer months. Given the extended duration and size of the prevailing carnivore market, 2022 tin beryllium reasonably argued to beryllium the astir important carnivore marketplace successful the past of integer assets.

What bash you deliberation astir Glassnode’s carnivore marketplace report? Would you accidental that this is 1 of the worst carnivore markets connected record? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)