Blockchain analytics institution Glassnode’s latest report reveals the 2022 carnivore marketplace arsenic the worst successful past and many investors person sold their Bitcoin (BTC) holdings astatine a discount.

According to the report, Bitcoin’s dip beneath the 200-day moving average, nett realized losses, and antagonistic deviation from realized terms marque this the worst carnivore marketplace successful the past of the cryptocurrency.

The 2022 carnivore marketplace has been brutal for #Bitcoin and #Ethereum investors, realizing monolithic superior losses.

In our latest research, we quantify the severity of this bear, and makes a lawsuit for it being the astir important successful history.

Read more https://t.co/FlSehPo3FB

https://t.co/FlSehPo3FB

— glassnode (@glassnode) June 24, 2022

It continued that this is the archetypal clip connected grounds that BTC and Ethereum (ETH) volition commercialized beneath their ATH successful their erstwhile cycle, which means important unrealized losses successful the market. Every capitalist who bought BTC oregon ETH betwixt 2021 and 2022 is present underwater.

While galore are inactive holding on, the fiscal pressures of constricted liquidity and rising ostentation is pushing respective investors to merchantability astatine a loss.

Bitcoin declines beneath moving average

Per the report, the archetypal motion of a carnivore marketplace is the diminution successful Bitcoin terms beneath its 200-day moving mean and, worse, 200-week MA. Bitcoin is trading astatine little than fractional of the 200-day MA level astatine the existent price.

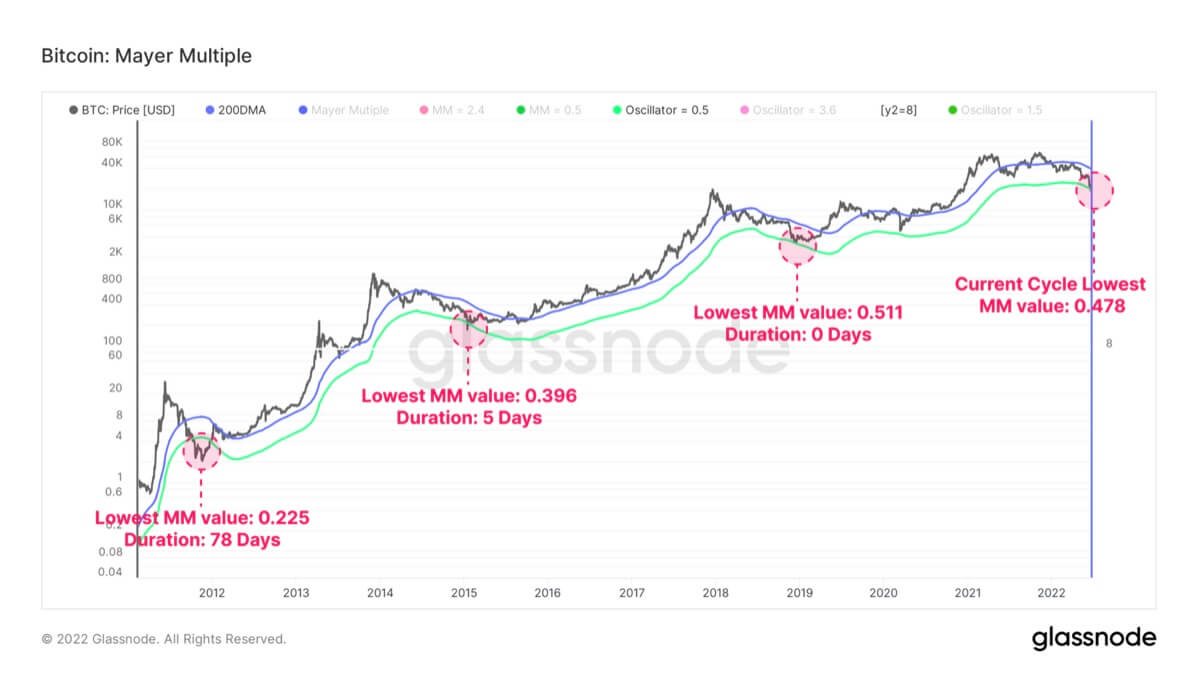

The study besides pointed retired that this is the archetypal clip since 2015 that the Bitcoin terms volition autumn beneath 0.5 Mayer Multiple (MM). The MM for this rhythm is presently 0.487, overmuch little than the past cycle, which was 0.511.

Source: Glassnode

Source: GlassnodeThe Mayer Multiple shows oversold oregon overbought conditions by considering the changes successful the terms supra and beneath the 200-day MA. “Only 84 retired of 4160 trading days (2%) person recorded a closing MM worth beneath 0.5,” the study said.

Additionally, the existent marketplace conditions are beauteous severe, reflecting the spot terms dropping beneath the realized price. Instances similar this are sporadic, and this is lone the 5th clip it has happened since Bitcoin launched successful 2009.

According to Glassnode, lone 13.9% of each Bitcoin trading days person seen spot prices beneath unrealized prices. It further added that the investors locked successful a nonaccomplishment of $4.234 cardinal connected the time Bitcoin dropped beneath $20k.

Like Bitcoin, similar Ethereum

Ethereum isn’t doing amended either. Similar to Bitcoin, those who bought Ethereum successful 2021 and aboriginal this twelvemonth person unrealized losses. Most of the diminution successful Ethereum terms is owed to DeFi deleveraging and its dominance diminution since November 2021.

Additionally, it is trading astatine a 63% discount to its 200-day MA, and its Mayer Multiple has deed 0.37, beneath the 0.6 MM set downside deviation. So far, the token has lone traded beneath this set for 29 days, acold beneath the 187-days successful the 2018 carnivore market.

Based connected each of the disposable data, Glassnode concluded that this existent marketplace capitulation event:

Is 1 of, if not the astir important successful history, some successful its severity, depth, and magnitude of superior outflow and losses realized by investors.

The station Glassnode study shows 2022 carnivore marketplace is the worst successful history appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)