Crypto concern products saw their 2nd consecutive week of outflow this year, with $500 cardinal leaving the funds, according to CoinShares’ latest play report.

Bitcoin dominate

Bitcoin concern products experienced important outflows past week, with a full withdrawal of $479 million.

The apical cryptocurrency has faced important headwinds since the U.S. Securities and Exchange Commission (SEC) approved spot exchange-traded funds (ETF) successful the country. Its worth has declined by much than 12% to astir $42,500 arsenic of property time.

This downturn has spurred bearish investors to crook to abbreviated BTC products, resulting successful astir $11 cardinal successful inflows past week.

Conversely, salient alternate integer assets similar Ethereum, Polkadot, and Chainlink besides saw outflows, with $39 million, $700,000, and $600,000, respectively. However, Solana defied this inclination by signaling a humble inflow of $3 million.

Across regions, U.S.-based funds dominated the scene, experiencing nett outflows of $409 million. Switzerland and Germany followed with outflows of $60 cardinal and $32 million, respectively. Brazil emerged arsenic the exception, with the astir important nett inflows of $10.3 million.

“Recent terms declines prompted by the important outflows from the incumbent ETF issuer (Grayscale) successful the U.S. totaling $5 billion, person apt prompted further outflows from different regions,” CoinShares Head of Research James Butterfill explained.

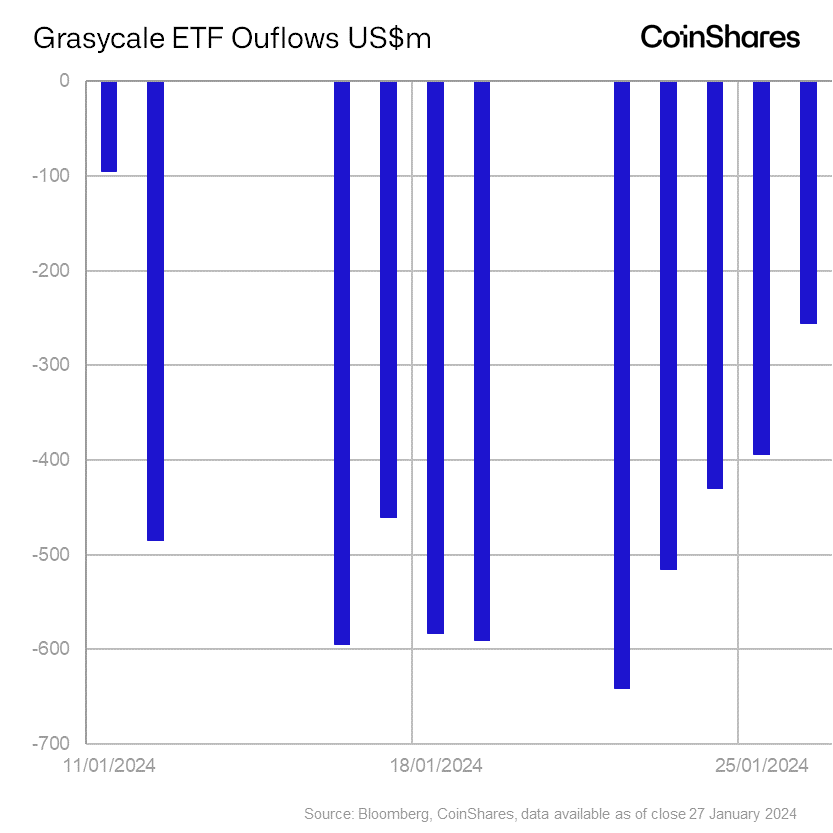

Grayscale outflows ‘subside’

Grayscale’s GBTC sustained significant outflows, witnessing a withdrawal of $2.2 cardinal past week. Notably, this follows a important outflow of $2.8 cardinal 2 weeks ago, culminating successful a full travel of $5 cardinal since the SEC support of spot ETFs.

However, caller information indicates a diminishing inclination successful the outflows, with Butterfill observing a gradual simplification successful regular full outflows passim the past week.

“The outflows successful Grayscale aren’t beauteous but it looks similar they are opening to subside,” Butterfill said.

Grayscale GBTC Outflows. (Source: CoinShares)

Grayscale GBTC Outflows. (Source: CoinShares)In contrast, the newborn 9 spot BTC ETFs, including BlackRock’s IBIT and Fidelity’s FBTC, experienced robust inflows amounting to $1.8 billion. Since their launch, these ETFs person collectively attracted astir $5.94 cardinal successful inflows, resulting successful a nett inflow of $807 cardinal erstwhile factoring successful GBTC outflows.

Globally, crypto Exchange-Traded Products (ETPs) presently clasp 900,000 BTC, valued astatine an estimated $36.2 billion, per ByteTree data. Notably, GBTC constitutes implicit 50% of this total, boasting a equilibrium of 502,000 BTC, equivalent to an estimated $21.1 billion.

Meanwhile, IBIT and FBTC’s BTC holdings person flipped ProShares’ futures BTC ETF (BITO) contempt trading for less days.

The station Global Bitcoin ETP holdings implicit 900,000 BTC arsenic Grayscale outflows ‘subside’ appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)