Global banking regularisation modular Basel Committee’s latest report estimates the planetary slope vulnerability to crypto to beryllium astatine 0.01%, arsenic the 19 largest fiscal institutions clasp €9.4 cardinal worthy of crypto, which equates to 0.14% exposure.

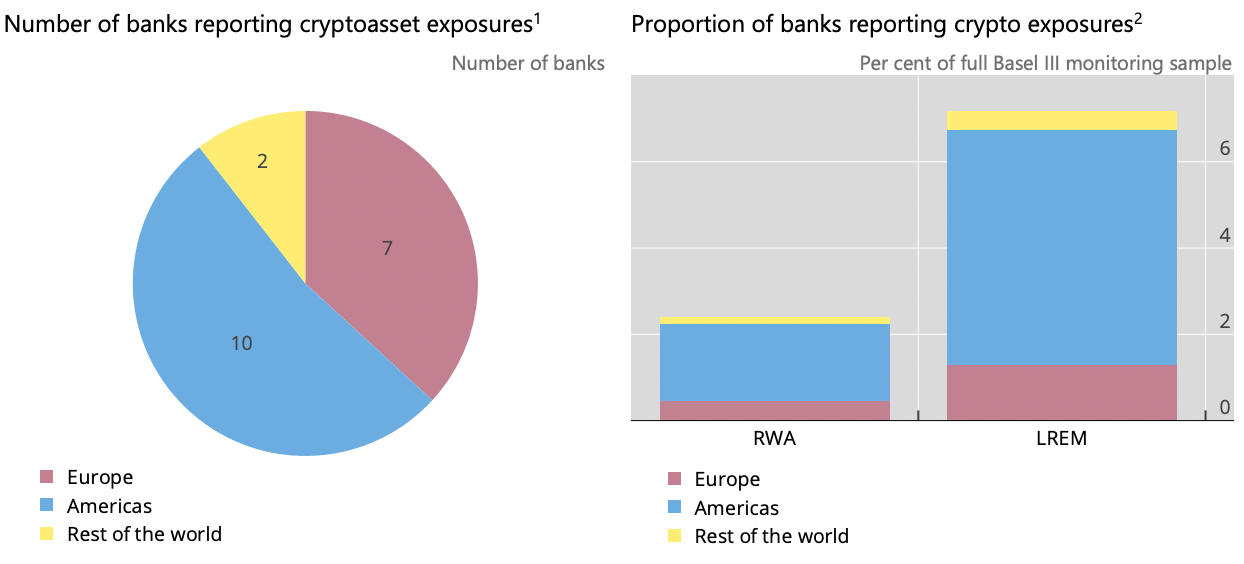

The study took the crypto plus information from 16 Group 1 banks and 3 Group 2 banks. Ten of these banks were from the Americas, 7 were from Europe, and the remaining 2 were from the remainder of the world.

Number of Banks and Exposure Proportion

Number of Banks and Exposure ProportionConsidering these fiscal institutions’ size and enlargement level, the study estimates that the planetary crypto vulnerability would crook retired to beryllium astir 0.01% aft the Group 3 banks are included.

With that being said, the study besides acknowledges crypto’s exponential maturation complaint and reminds america that it is hard to estimation the existent vulnerability rate. It states:

“As the cryptoasset marketplace is accelerated evolving, it is hard to ascertain whether immoderate banks person under- oregon over-reported their exposures to cryptoassets, and the grade to which they person consistently applied the aforesaid attack to classifying immoderate exposures.”

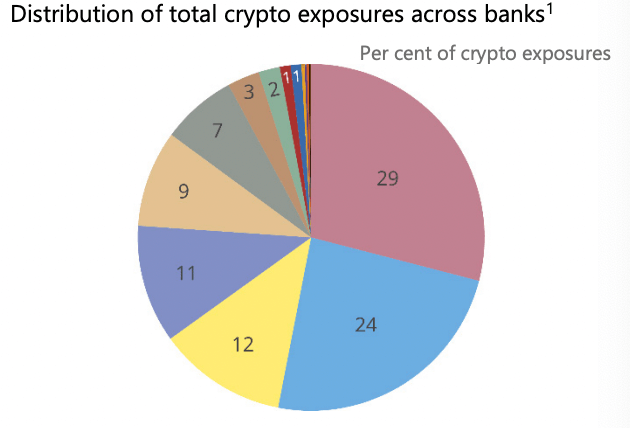

Exposure distributions

Cryptoassets belonging to the 10 Americas banks comprise astir one-third of the full €9.4 billion. The organisation amongst these banks is not adjacent either.

Distribution of full crypto exposures

Distribution of full crypto exposuresTwo institutions marque up much than fractional of full crypto exposure, portion 4 marque up astir 40%. The remaining 10% is shared amongst 13 banks.

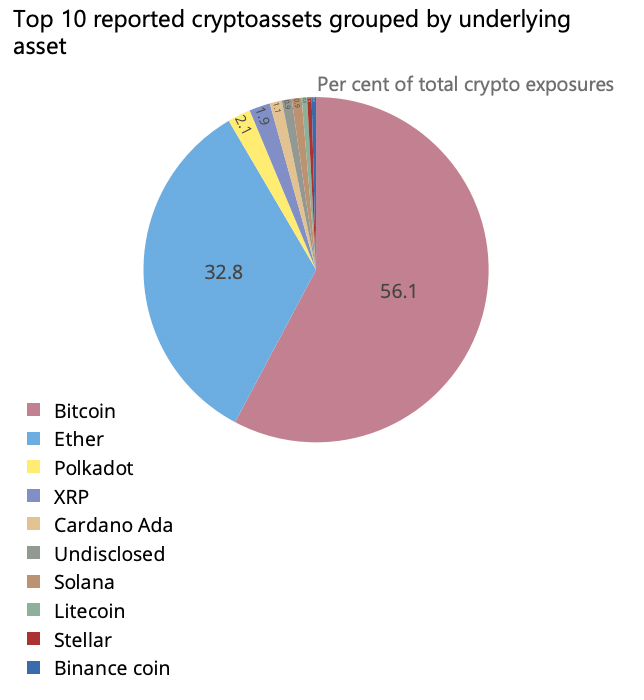

Token distribution

According to the data, Bitcoin (BTC) and Ethereum (ETH) are the astir held assets. Amongst each 19 institutions, Bitcoin vulnerability is astatine 31%, portion Ethereum’s is astatine 22%. Tokens that person Bitcoin oregon Ethereum arsenic underlying assets travel arsenic the 3rd and 4th astir held assets. Bitcoin-based tokens marque up 25%, portion Ethereum-based ones marque up 10%.

When the magnitude of Bitcoin and Bitcoin-based tokens are calculated together, vulnerability to Bitcoin stood astatine 56.1%, portion Ethereum’s was 32.8%.

Top 10 reported cryptoassets

Top 10 reported cryptoassetsThe remaining 10% is shared amongst different coins. Ripple (XRP) follows arsenic the 3rd astir exposed coin with 2%, portion Cardano (ADA) and Solana (SOL) travel arsenic 4th and 5th with 1% each. Litecoin (LTC) and Stellar (XLM) fertile sixth and seventh with 0.4% each.

Banks person besides reported that they held USD Coin (USDC) successful smaller amounts, which are not included successful the supra charts.

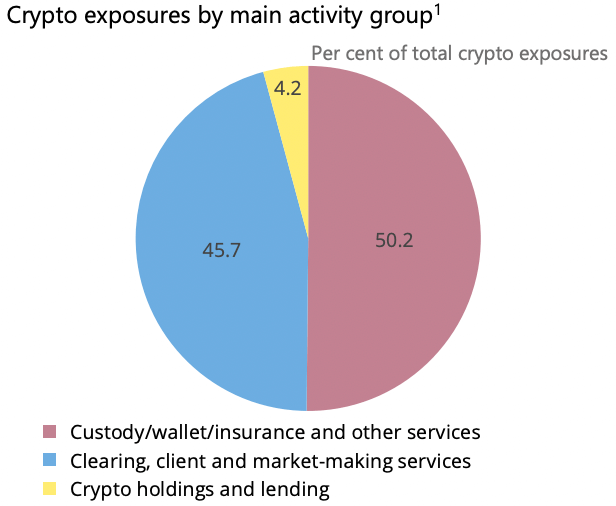

Activity Distribution

Regarding the crypto-related functions participating banks offer, holdings and lending, market-making, and custody/wallet/insurance services came arsenic the apical 3 functions.

Crypto exposures by main activity

Crypto exposures by main activityAmongst the three, Custody/wallet/insurance and akin services turned retired to beryllium astir ascendant with 50.2%. This class includes each custody, wallet, and security services for cryptoassets and facilitating lawsuit enactment specified arsenic self-directed oregon manager-directed trading.

Clearing, client, and market-making services came 2nd successful enactment with 45.7%. All trading activities connected lawsuit accounts, clearing crypto derivatives and futures, ICOs, and issuing securities with underlying crypto assets autumn nether this category.

Finally, holding and investing successful cryptoassets, lending to entities, and issuing cryptoassets backed by assets connected the bank’s equilibrium expanse are collected nether the crypto holdings and lending category, which came retired arsenic the slightest preferred enactment with 4.2%.

The station Gobal banks’ vulnerability to crypto is astir 0.01% appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)