On Friday, October 7, 2022, the precious metals golden and metallic dropped successful U.S. dollar worth pursuing the caller U.S. jobs study for September. The USD worth of golden per troy ounce is awfully adjacent to slipping beneath the $1,700 range, portion the terms of metallic is teetering adjacent the $20 threshold.

Precious Metals Price Patterns Follow Friday’s Equity Market Rout and Crypto Carnage

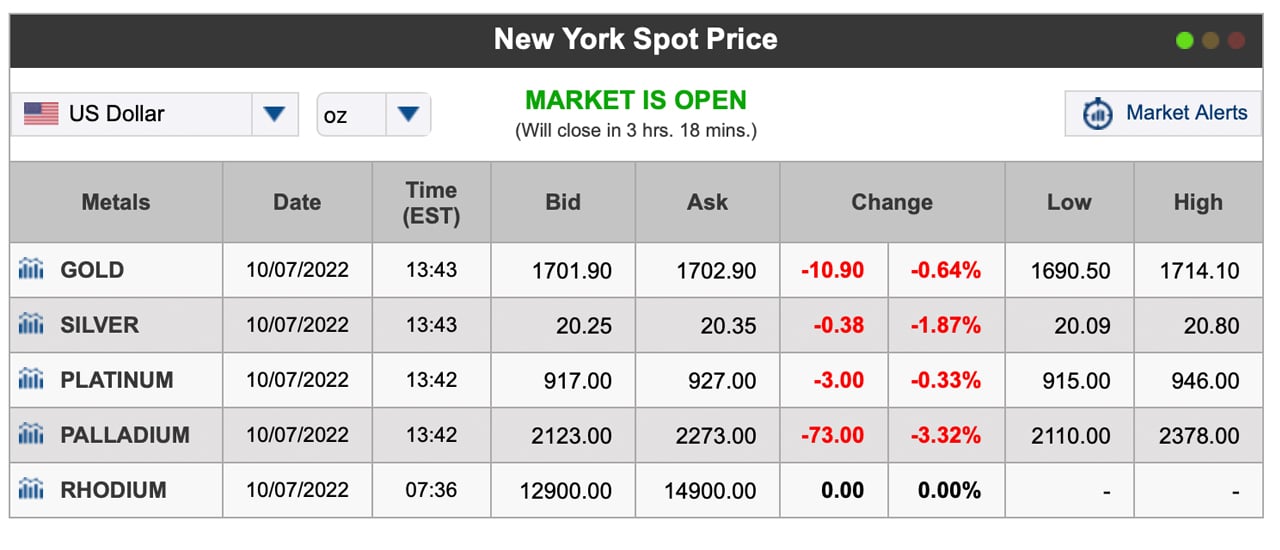

Just earlier the weekend, Wall Street’s large indices tumbled arsenic the latest U.S. jobs study for September is making investors judge the Federal Reserve volition proceed its assertive complaint hikes. The terms of bitcoin (BTC) slid 3.4% against the U.S. dollar, and ethereum (ETH) dropped 3.2% during the past 24 hours. The full crypto-economy hovering astatine astir $979 cardinal connected Friday, and it is down 2.4% astatine 2:30 p.m. (ET). In summation to the crypto economy, each 4 large precious metals — gold, silver, platinum, and palladium are down betwixt 0.64% to 3.32%.

Screenshot from Kitco’s precious metals terms aggregator via the New York spot terms connected October 7, 2022, astatine at 2:30 p.m. (ET).

Screenshot from Kitco’s precious metals terms aggregator via the New York spot terms connected October 7, 2022, astatine at 2:30 p.m. (ET).Kitco’s precious metals elder marketplace expert and columnist Jim Wyckoff detailed connected Friday day that the information stemming from the U.S. jobs study was “arguably the astir important U.S. information constituent of the week.” Wyckoff noted that the authoritative information was 263,000 jobs, “which was conscionable beneath the expected emergence of 275,000.” The news, Wyckoff reckons, whitethorn pb to the U.S. cardinal slope keeping its assertive stance going strong.

“The August study showed non-farm jobs emergence of 315,000. The U.S. unemployment complaint dropped to 3.5% successful September, which was little than expected,” Wyckoff wrote connected Friday. “The August jobless complaint was 3.7%. Average hourly net were up 4.98% from past twelvemonth astatine the aforesaid time. The marketplace reckons the jobs study did thing to dissuade the Federal Reserve from its aggressively choky monetary policy,” the elder marketplace expert added.

Gold/USD illustration connected October 7, 2022.

Gold/USD illustration connected October 7, 2022.Similar to equity and cryptocurrency markets, golden markets felt the unit of the latest U.S. information point. At the clip of writing, the nominal U.S. dollar worth of a azygous troy ounce of .999 good golden is 1,701.40 per unit. Some exchanges person seen golden driblet beneath the $1,700 threshold connected Friday arsenic good astatine $1,699 per ounce.

Silver/USD illustration connected October 7, 2022.

Silver/USD illustration connected October 7, 2022.Silver is besides nearing dropping beneath the $20 threshold connected Friday, arsenic it’s 20.35 nominal U.S. dollar per ounce of metallic arsenic the play approaches. Gold’s USD worth per ounce is down 0.64% and metallic is down 1.87% during the past 24 hours. Platinum shed 0.33% and palladium’s terms slid by 3.32% connected Friday day (ET).

“Technically, the December golden futures bears person the wide near-term method advantage. However, caller gains statesman to suggest a marketplace bottommost is successful place,” Wyckoff explained. Silver futures, successful presumption of bulls, besides amusement an vantage the precious metals marketplace expert said.

“September metallic futures bulls person [a] flimsy wide near-term method advantage. Silver bulls’ adjacent upside terms nonsubjective is closing prices supra coagulated method absorption astatine $22.00. The adjacent downside terms nonsubjective for the bears is closing prices beneath coagulated enactment astatine $19.00,” Wyckoff’s study details.

The analyst’s statements concerning the enactment of a marketplace bottommost are akin to Mike McGlone’s recent analysis. The Bloomberg Intelligence commodity expert explained successful a caller commodities study for October that helium saw the terms of golden forming successful a akin manner to the mode it did successful 1999.

In summation to golden resuming its rally successful the adjacent future, McGlone added successful his October crypto study that erstwhile the “ebbing economical tide turns,” McGlone and his squad spot “propensity resuming” for bitcoin (BTC) and ethereum (ETH) and helium believes they volition “outperform astir large assets.”

Tags successful this story

commodities, economics, Economy, Fed, Federal Reserve, gold, Gold Ounce, Greenback, inflation, Jim Wyckoff, Kitco, market updates, Markets, Mike McGlone, Ounce of Gold, Ounce of Silver, palladium, platinum, PM Markets, Precious Metals, rate hikes, senior marketplace analyst, silver, Silver Ounce, U.S. dollar, US Jobs Report, USD, values

What bash you deliberation astir golden and silver’s caller diminution during the past 24 hours and pursuing the latest U.S. jobs report? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)