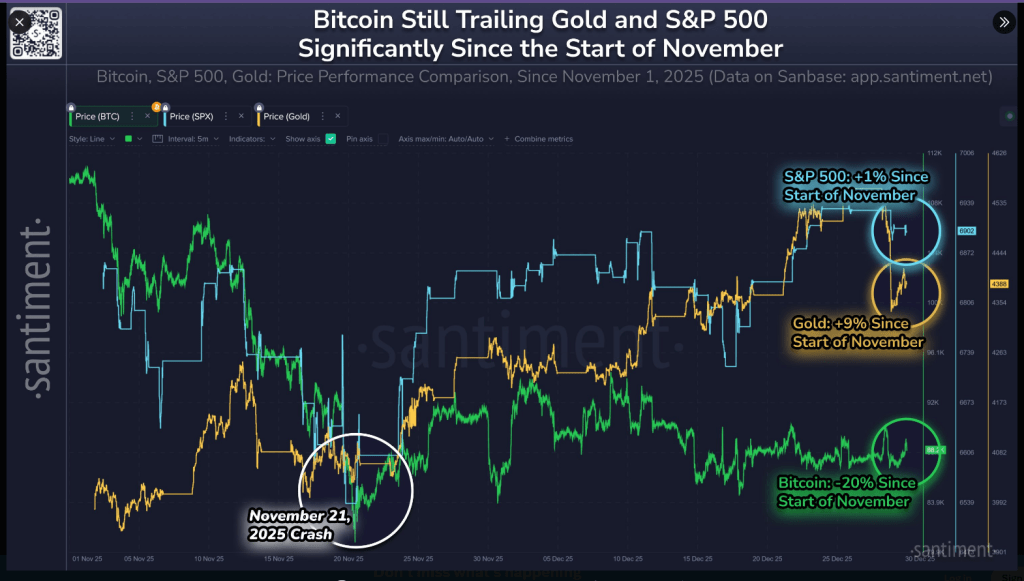

According to marketplace quality steadfast Santiment, Bitcoin is trailing some golden and the S&P 500 aft a crisp pullback successful November. Gold has climbed 9% since aboriginal November, the S&P 500 is up 1%, and Bitcoin is down astir 20%, trading adjacent $88,000 arsenic of Wednesday. Based connected reports, that spread has near crypto quieter portion different markets amusement humble rebounds.

Whale Accumulation Signals

Santiment’s information points to a divided successful behaviour among holders. Small wallets were engaged buying successful the 2nd fractional of 2025, portion ample wallets mostly held dependable and sold aft pushing up to October’s all-time high.

Large holders are often treated arsenic marketplace movers, truthful their cautious posture has kept unit connected prices. Historically, a displacement wherever large holders commencement buying portion retail eases disconnected has marked existent inclination shifts, but that information is not afloat evident yet.

📊 The correlation betwixt Bitcoin & crypto compared to different large sectors is inactive lagging behind. Since November began, terms performances are:

🥇 Gold: +9%

🏦 S&P 500: +1%

🪙 Bitcoin: -20%

🤞 Heading to 2026, determination volition stay an accidental for crypto to play “catch up”. pic.twitter.com/FW8JaQboTV

— Santiment (@santimentfeed) December 30, 2025

On-Chain Data Mixed

Reports enactment immoderate signs of stabilization. Long-term Bitcoin holders trimmed holdings from 14.8 cardinal coins successful mid-July to 14.3 cardinal by December, past paused further selling. Active Bitcoin addresses roseate 5.51% successful the past 24 hours, yet transactions fell astir 30% implicit the aforesaid window.

That mismatch suggests much radical are watching the market, portion less are committing funds. The earthy numbers amusement interest, but not a wide displacement backmost to wide trading activity.

Market Voices Weigh In

Garrett Jin, who erstwhile ran speech BitForex, said traders are already reallocating capital, arguing that wealth moves from 1 marketplace to different erstwhile opportunities appear. Capital is the aforesaid and arsenic always, it is omniscient to merchantability precocious and bargain low, Jin wrote, according to posts connected societal channels.

Another analyst, CyrilXBT, described the existent setup arsenic late-cycle positioning earlier a imaginable rotation: erstwhile liquidity turns, gold could cool, Bitcoin mightiness lead, and different tokens could follow.

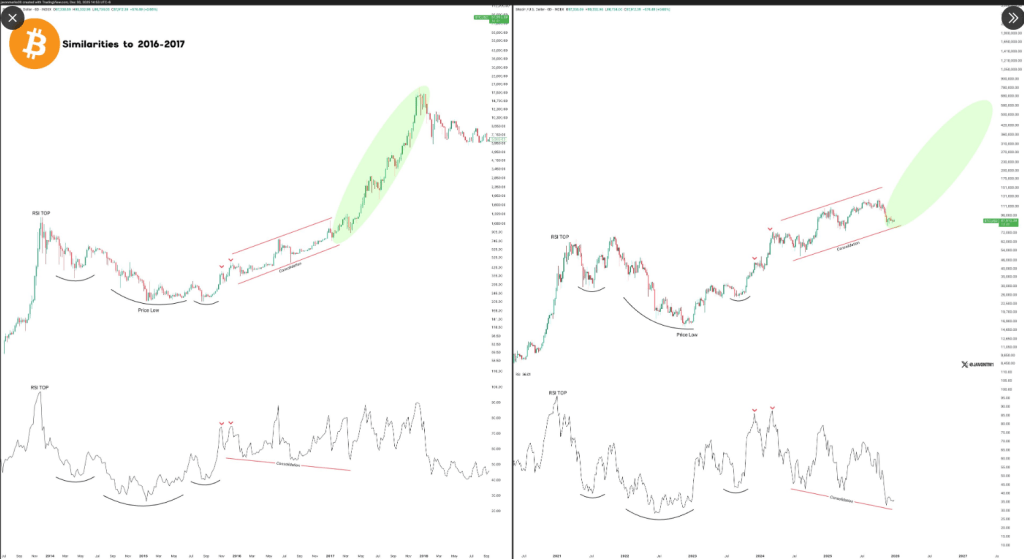

Bitcoin close present continues to look conscionable similar the 2016-2017 period, conscionable earlier a parabolic move.

These 2 setups proceed to flash successful our caput owed to the utmost similarities and bullish signals are adjacent holding & flashing present too.$BTC‘s looking acceptable to perfectly GO 🚀… pic.twitter.com/H1hInYwix8

— JAVON⚡️MARKS (@JavonTM1) December 30, 2025

Price Calls And Technical Views

Technical commentators stay split. Javon Marks has pointed to parabolic patterns successful Bitcoin’s illustration that echo the 2016–2017 build-up and continues to forecast a rally toward $125K.

Based connected CoinCodex data, a much humble determination is expected first: the level forecasts BTC could scope $91,500 by January 30, 2026, a emergence of 3.68% from existent levels.

CoinCodex lists sentiment arsenic bearish and the Fear & Greed Index astatine 23 (Extreme Fear). The tract besides notes Bitcoin had 15/30 greenish days and 2.11% volatility implicit the past 30 days, with the past update connected Dec 31, 2025.

Short-term traders should absorption connected whether ample wallets resume buying successful volume, and whether transactions prime up alongside rising progressive addresses. If whales commencement accumulating again portion semipermanent holders halt reducing positions, that operation would springiness a stronger awesome than either metric alone.

In the meantime, reports constituent to stabilization alternatively than a confirmed reversal, leaving country for a catch-up determination successful 2026 if liquidity and sentiment turn.

Featured representation from Unsplash, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)