Gold-backed cryptocurrencies are outperforming the wider marketplace amid a historical rally for the precious metal, which is up astir 9.7% truthful acold this twelvemonth to a caller grounds of $2,880 per ounce amid increasing commercialized warfare tensions.

PAX golden (PAXG) and Tether golden (XAUT) person benefitted greatly from the precious metal’s rise, some rising astir 10% successful enactment with the spot terms of gold. Each of these tokens is backed by 1 troy ounce of golden stored successful a vault.

Unsurprisingly, successful the accepted market, golden miners' stocks person besides surged. VanEck Gold Miners ETF (GDX), an exchange-traded money (ETF) that tracks golden miners, has risen astir 20% this year, outperforming the S&P 500.

The terms enactment has seen the proviso of these tokens grow, with token mints outpacing burns by millions of dollars weekly. Transfer volumes for gold-backed cryptocurrencies, according to RWA.xyz data, person meantime surged much than 53.7% period implicit month.

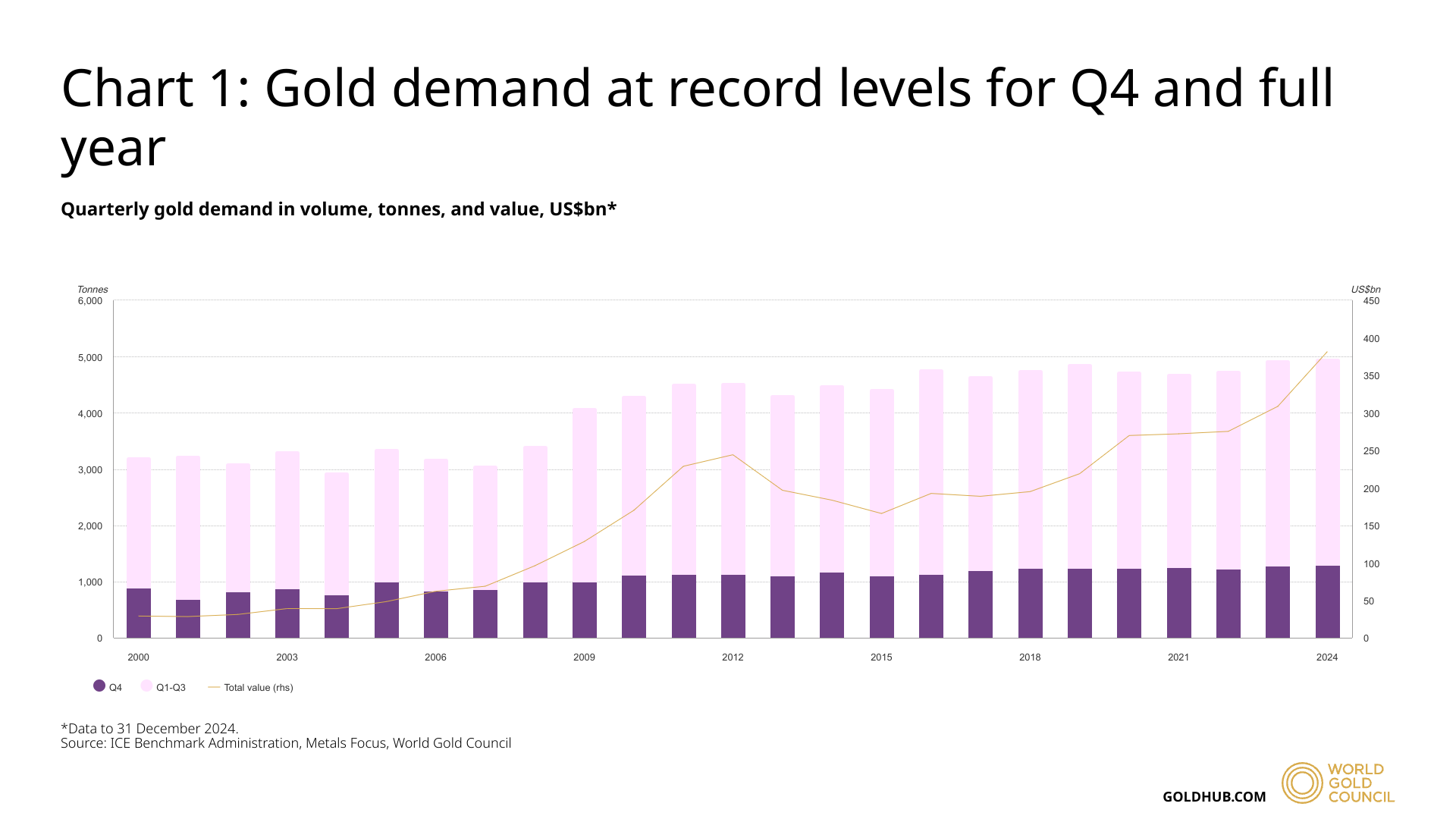

Gold’s terms has risen this twelvemonth implicit tariff threats from some the U.S. and China, the Spring Festival holidays successful the second state and a broader inclination of increasing demand. Last year, request for the precious metallic deed 4,945.9 tons, worthy astir $460 billion, according to the World Gold Council.

Meanwhile, astir large cryptocurrencies person struggled truthful acold this year. Bitcoin saw a humble 3.6% rise, starring the bitcoin-gold ratio to a 12-week low, portion ether is down much than 17.6%. The CoinDesk 20 index is up conscionable astir 0.5%.

“Gold’s rally and bitcoin’s dip aren’t a nonaccomplishment of the 'digital gold' communicative — they’re a setup,” Mike Cahill, halfway contributor to the Pyth Network, told CoinDesk successful a written statement. “Right now, commercialized warfare fears and a beardown dollar are fleeing a formation to accepted harmless havens, but erstwhile liquidity returns and hazard appetite rebounds, bitcoin could drawback up successful a large way.”

“Smart investors cognize BTC is inactive the hardest plus adjacent to gold, and erstwhile Trump’s pro-crypto stance materializes into existent policy, bitcoin stands to payment massively,” helium said.

10 months ago

10 months ago

English (US)

English (US)