A ample capitalist shifted funds into tokenized golden this week, and Bitcoin felt the impact. Prices dipped portion a whale softly bought millions successful XAUT, a gold-backed token, signaling a short-term determination toward accepted hedges.

Whales Move Into Tokenized Gold

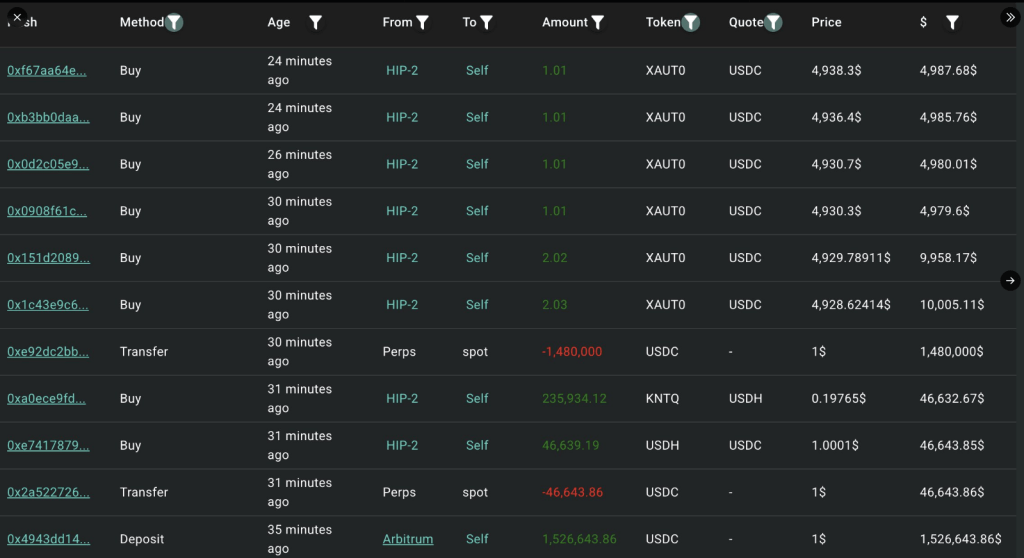

According to on-chain trackers, 1 code moved $1.53 cardinal successful USDC into Hyperliquid to bargain XAUT. Reports enactment that the aforesaid wallet had earlier bought astir 481 XAUT, a acquisition worthy astir $2.38 million.

The code inactive holds adjacent to $1.44 cardinal successful USDC, which suggests much purchases could follow. These moves were picked up connected nationalist blockchains and past flagged by analysts watching ample transfers.

This benignant of enactment tin matter. When large players shuffle cash, smaller traders often instrumentality announcement and hedge their bets. The displacement is not impervious of a semipermanent trend, but it shows that, astatine slightest for now, immoderate ample holders similar gold vulnerability implicit other crypto risk.

Whales are buying gold, not crypto.

~30 mins ago, whale 0x6B99 deposited 1.53M $USDC into Hyperliquid to bargain $XAUT again.

He has already bought 481.6 $XAUT($2.38M) and inactive holds 1.44M $USDC, which whitethorn beryllium utilized to bargain much $XAUT.https://t.co/0uV2kNEiD0 pic.twitter.com/rYA09b1OEn

— Lookonchain (@lookonchain) January 23, 2026

Gold And Silver Hit Fresh Highs

Reports accidental golden has been moving sharply higher, with spot prices climbing adjacent to $5,000 per ounce successful planetary trading this week. Silver besides roseate supra $100 per ounce, with intraday golden prints adjacent $4,988 earlier settling.

Traders necktie the surge to geopolitical tensions and the thought that involvement rates whitethorn ease, which encourages wealth into metal-based stores of value.

A weaker dollar has besides helped. Market chatter points to accrued request arsenic investors question steadier places to parkland superior portion planetary authorities and argumentation choices make much worry.

Bitcoin’s Price Action And Market Mood

Bitcoin traded astir $88,653 astatine 1 stage, slipping astir 1% connected the time and astir 30% beneath its anterior rhythm top. That spread is large. It has marketplace participants questioning whether BTC volition enactment the go-to hedge during times of precocious stress. Some semipermanent holders stay confident. Others are watching liquidity and macro signals much closely.

Reports person disclosed renewed disapproval from economist Peter Schiff, who argued that Bitcoin has underperformed versus golden since 2021.

He highlighted the accidental outgo for investors holding BTC portion metals ascent to grounds prices. Schiff wrote connected societal platforms that precious metals are outperforming and that this anemic tally for Bitcoin weakens its relation arsenic a store of worth successful the eyes of some.

What This Means For Crypto Investors

Short-term rotations similar this often bespeak hazard preferences alternatively than imperishable shifts. Some funds and affluent individuals question lower-volatility assets erstwhile headlines turn louder and argumentation paths look uncertain.

Others inactive presumption Bitcoin arsenic a semipermanent play tied to scarcity and web effects. The existent representation is simply a mix: metals are strong, tokenized golden is drafting attention, and crypto markets are reacting.

Featured representation from Pexels, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)