According to marketplace analysts, the precious metallic golden is officially successful a carnivore marketplace and prices could stay suppressed implicit the adjacent fewer weeks. Moreover, portion the macroeconomic backdrop has been gloomy, the fashionable harmless haven plus has mislaid 17.50% successful worth against the U.S. dollar during the past 4 months.

TD Securities Market Analysts Say Fed Hikes Could Erode Gold’s Price

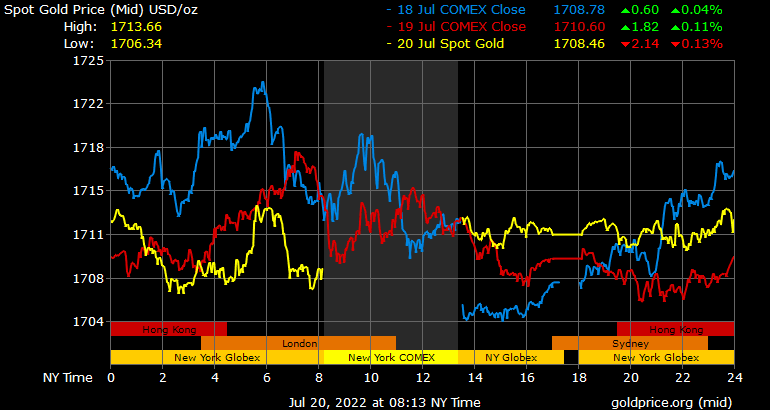

There’s nary uncertainty that the cryptocurrency economy is experiencing a bearish downturn arsenic immoderate of the apical integer currencies person mislaid anyplace betwixt 65% to 90% successful value. The good known harmless haven and concern plus golden has besides been dealing with a downturn, ever since the precious metallic tapped an all-time precocious (ATH) astatine $2,074.60 for 1 ounce of good golden connected March 8, 2022. Gold is presently trading for $1,711 per ounce, arsenic the plus has mislaid 17.50% implicit the people of 134 days.

According to Kitco’s Neils Christensen connected July 18, analysts astatine TD Securities person said that golden has immoderate unit to woody with implicit the adjacent fewer weeks. “Investors chopped nett magnitude by a precise ample 6% of unfastened involvement (3 cardinal oz) arsenic it became precise evident that existent rates connected the abbreviated extremity of the curve volition proceed to summation and determination was small accidental of upside, arsenic nominal argumentation rates jumped higher and ostentation expectations eroded on with the pending economical slump,” the TD Securities marketplace analysts wrote.

The Canadian concern slope and fiscal services supplier added:

Continued Fed hikes and little economical enactment should spot golden magnitude proceed to erode, with prices besides apt to stay nether unit successful the weeks to come.

Bear Market Called Immediately After Gold’s Top, Ukraine Sells Billions successful Gold

Analysts astatine TD Securities are not the lone ones who judge golden is successful a bearish phase, arsenic moneyweek.com’s main commentator connected gold, commodities, currencies, and cryptocurrencies, Dominic Frisby, said golden was successful a carnivore marketplace connected March 31, 2021. “It’s a carnivore market,” Frisby wrote astatine the time. “You get tradable rallies successful a carnivore market, but a carnivore marketplace is simply a carnivore market. They tin spell connected for longer than you think. They tin ‘make nary sense.’ But they don’t spell connected forever.”

On Monday, Kitco’s Christensen further explained that “for the archetypal clip since May 2019, gold’s speculative positioning has turned nett abbreviated by 6,133 contracts.” Société Générale’s commodity analysts person besides stated that the “gold marketplace intelligibly turned bearish.” Additionally, reports enactment that Ukraine has sold billions successful golden reserves since the commencement of the warfare with Russia. Kateryna Rozhkova, the National Bank of Ukraine’s (UNB) lawman governor, told the property that $12 cardinal successful golden was sold to bolster the country’s proviso of goods.

“We are selling (this gold) truthful that our importers are capable to bargain indispensable goods for the country,” Rozhkova elaborate successful a connection connected July 17.

TD Securities Market Strategists: ‘Gold Will Start to Feel the Pain Under a Hawkish Fed Regime’

Furthermore, astatine the extremity of June, the U.S. and a radical of 7 leaders sanctioned caller Russian golden imports successful an effort to onslaught Vladimir Putin. A hawkish Federal Reserve spells doom for gold’s worth according to the investor’s note from analysts astatine TD Securities. ”With golden bugs falling similar dominoes, prices person since slashed done assorted enactment levels connected their mode towards the $1600/oz-handle,” the analysts explained. “With prices present challenging pre-pandemic levels, the largest speculative cohort successful golden volition commencement to consciousness the symptom nether a hawkish Fed authorities arsenic their introduction levels are tested.”

In presumption of leveraged golden positions, TD Securities marketplace strategists judge “these monolithic positions are astir vulnerable, which suggests the yellowish metallic remains prone to further downside still.” Meanwhile, arsenic golden has seen a important downturn, the terms of metallic per ounce has followed the yellowish metal’s fall. The price of silver slipped beneath $20 an ounce for the archetypal clip successful 2 years. Coincidently, arsenic August approaches, gold’s worth is nearing the terms debased it tapped successful August 2021 erstwhile it dropped nether the $1,700 handle.

What bash you deliberation astir analysts saying that golden is successful a carnivore market? Do you expect golden to descend little than the existent value? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)