The post Gold Eyes $5k/Ounce as Silver Crosses $101 for the First Time: Tom Lee Calls It a Leading Indicator for Bitcoin appeared first on Coinpedia Fintech News

The precious metals industry has continued with a bullish explosion this week, while Bitcoin (BTC), the altcoin market dropped. During the past five days, the gold price surged 6.9% to trade at about $4,975 per ounce at press time.

Silver price gained 9.89% during the past five days to trade above $101 per ounce for the first time in its history. Meanwhile, Bitcoin price has dropped 5.44% to trade at about $90,305 at press time.

Tom Lees Calls Gold and Silver Surge a Leading Indicator for Bitcoin

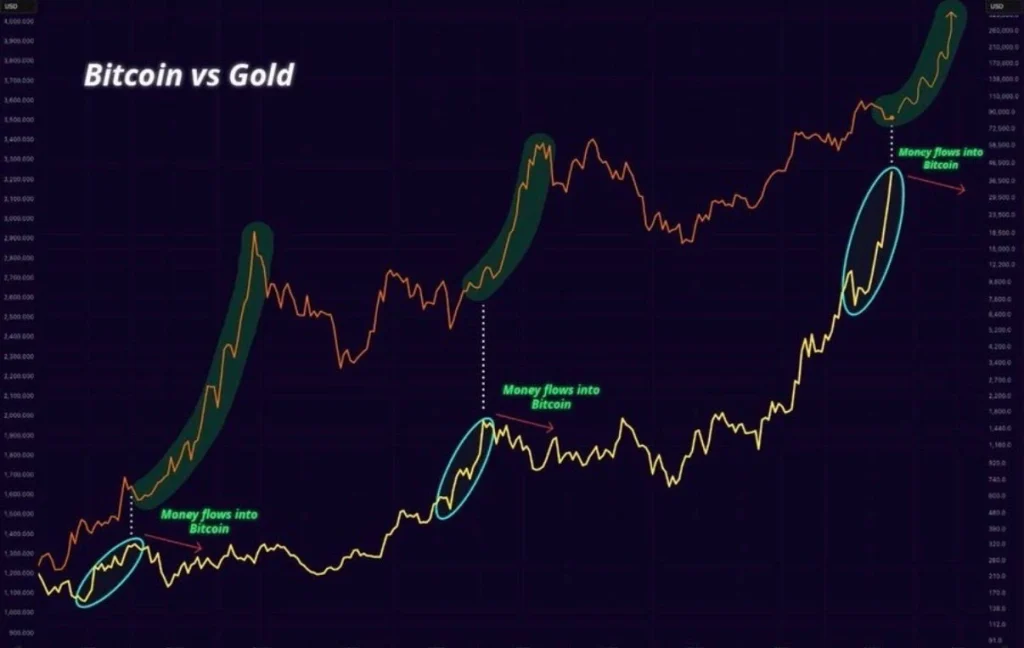

According to Tom Lee, Chairman at BitMine, the parabolic surge of Gold and Silver is a leading indicator for Bitcoin. Lee pointed out the mean reversion principle, which states that a variable that deviates significantly from its historical average will, over time, move back to the same average.

While Gold and Silver have heavily benefited from the global geopolitical tensions, Bitcoin has lagged. The current Bitcoin price action has been compared to the post 2019 period that was heavily influenced by the Federal Reserve’s Quantitative Easing (QE).

What’s Next?

The next phase for Bitcoin and the wider altcoin market will be influenced by the regulatory outlook in the United States. The expected approval and enactment of the Clarity Act in the United States has been described as a major trigger for a bullish outlook in 2026.

Source: X

Moreover, capital rotation from Gold and the wider precious industry has already been kick-started by BlackRock’s IBIT. Since the beginning of 2026, BlackRock’s IBIT has recorded a net cash inflow of over $5 billion.

1 hour ago

1 hour ago

English (US)

English (US)