By Omkar Godbole (All times ET unless indicated otherwise)

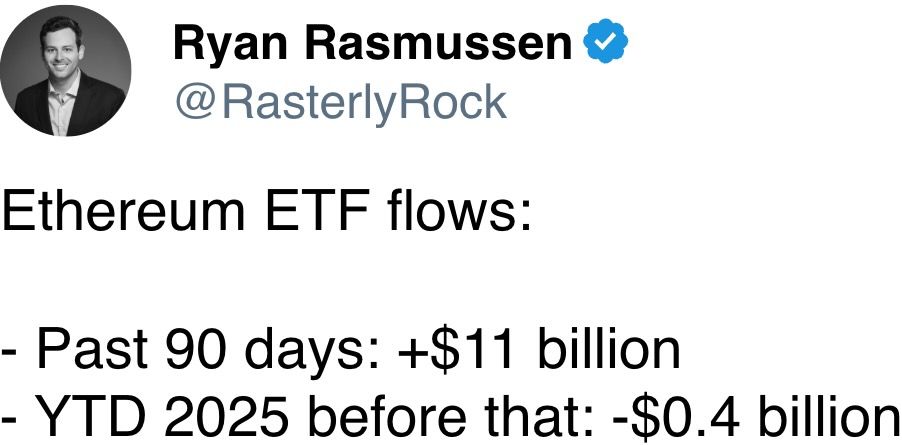

The crypto marketplace enactment has been beauteous muted successful majors, chiefly owed to the quiescent aftermath of Monday's North American holiday. Yet, 2 wide themes are inactive playing retired — golden continues to surge to grounds highs, portion bitcoin (BTC) is struggling to find upward momentum. At the aforesaid time, we're seeing continued rotation of wealth retired of BTC and into ether (ETH).

Gold deed a grounds $3,500 per ounce this morning, buoyed by increasing bets connected Fed interest-rate cuts, a worsening fiscal outlook crossed large economies and accrued governmental meddling with Fed policy. Gold-backed tokens similar PAXG and XAUT followed suit but person since pulled back, arsenic has the metallic itself, successful what appears to beryllium a emblematic breather successful a bull trend.

On the different hand, portion bitcoin bounced to implicit $110,000, it's inactive trading beneath cardinal absorption levels, specified arsenic the Ichimoku cloud. According to Lookonchain, whale code 0xFf15 offloaded 425 BTC, worthy $46.5 million, successful speech for implicit 10,500 ETH successful the past 4 days.

Meanwhile, on-chain information tracked by Alphractal painted a representation of subdued Bitcoin web engagement. Active addresses dropped to 690,000 past week, and transaction fees stay limp. But transportation volumes spiked to $10.8 billion, reflecting "repositioning by ample entities alternatively than wide retail activity," the analytics steadfast said successful Telegram chat.

Meanwhile, Vibes Capital Management's Frank Fetter published an absorbing indicator enactment connected X, stating that an indicator tied to the short-term holder marketplace value-to-realized worth has flashed levels akin to those seen astatine bottoms successful August past twelvemonth and April this year. Could we beryllium seeing a 3rd specified bottom? Time volition tell.

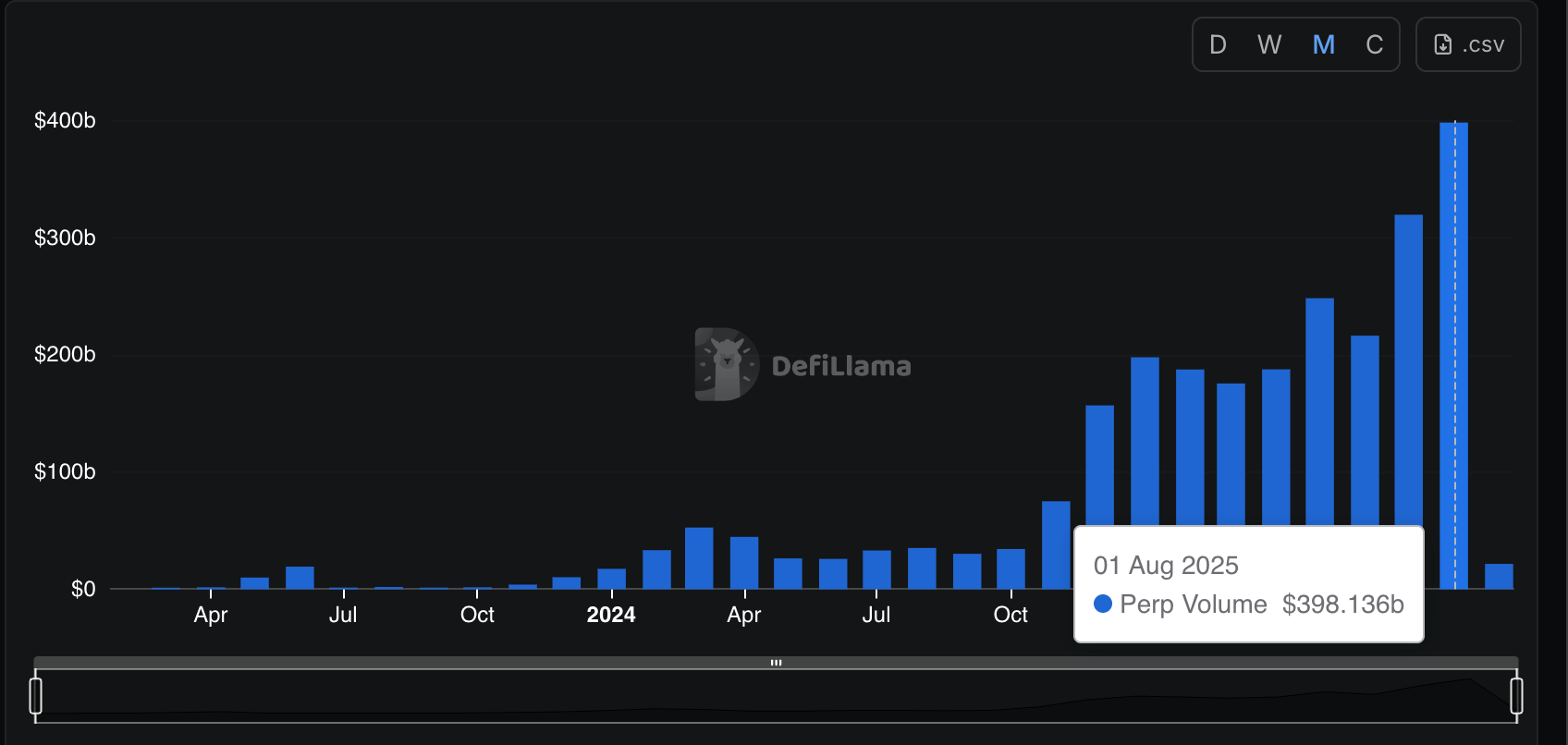

Some altcoins made notable moves. The Trump-linked WLFI token experienced a crisp decline, dropping to 25 cents from 33 cents soon aft its Sunday trading debut. In contrast, Hyperliquid's HYPE token surged implicit 3% aft reaching a grounds $100 cardinal successful gross successful August, with perpetual trading volumes exceeding $400 billion.

Meanwhile, traders connected decentralized betting level Polymarket assigned a 98% accidental that France's Sept. 8 assurance ballot volition fail. Watch retired for a crisp emergence successful peripheral enslaved yields, including those successful France, comparative to those successful Germany, arsenic that could revive memories of the EU indebtedness crisis, weakening the euro against the dollar and perchance putting downward unit connected bitcoin.

In accepted markets, commodity trading advisor (CTA)-positioning successful U.S. equities is max agelong astatine the 100th percentile, signaling utmost bullishness, according to perceiver David Merlin. President Donald Trump is reportedly going to talk aboriginal Tuesday.

The yen weakened aft the Bank of Japan hinted that complaint hikes are connected the horizon, though timing remains uncertain. With a data-heavy week up culminating successful Friday's U.S. non-farm payrolls, volatility is expected to increase. Stay alert!

What to Watch

- Crypto

- Sept. 3, 10:15 a.m.: Tellor (TRB), a decentralized oracle web that operates arsenic an Ethereum layer-2 blockchain, volition upgrade its mainnet to mentation 5.1.1. The upgrade improves web show and node operation.

- Sept. 4: Polygon volition switch its mainnet token to POL from MATIC. Holders of MATIC connected Ethereum, Polygon zkEVM oregon centralized exchanges whitethorn request to instrumentality action.

- Macro

- Sept. 2: U.S. lawmakers instrumentality to Capitol Hill pursuing the August recess to resume legislative work.

- Sept. 2, 8 a.m.: The Brazilian Institute of Geography and Statistics releases Q2 GDP data.

- GDP Growth Rate QoQ Est. 0.3% vs. Prev. 1.4%

- GDP Growth Rate YoY Est. 2.1% vs. Prev. 2.9%

- Sept. 2, 9:30 a.m.: S&P Global releases August manufacturing information for Canada.

- Manufacturing PMI Prev. 46.1

- Sept. 2, 9:45 a.m.: S&P Global releases (final) August manufacturing and services information for United States.

- Manufacturing PMI Est. 53.3 vs. Prev. 49.8

- Sept. 2, 10 a.m.: Institute for Supply Management (ISM) releases August U.S. manufacturing assemblage data.

- Manufacturing PMI Est. 49 vs. 48

- Manufacturing Employment Prev. 43.4

- Manufacturing New Orders Prev. 47.1

- Manufacturing Prices Est. 65.1 vs. Prev. 64.8

- Sept. 2, 1:30 p.m.: The Central Bank of Paraguay releases August user terms ostentation data.

- Inflation Rate YoY Prev. 4.3%

- Sept. 3, 8 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases July concern accumulation data.

- Industrial Production MoM Est. -0.3% vs. Prev. 0.1%

- Industrial Production YoY Est. 0.2% vs. Prev. -1.3%

- Sept. 3, 9 a.m.: S&P Global releases August Brazil information connected manufacturing and services activity.

- Composite PMI Prev. 46.6

- Services PMI Prev. 46.3

- Sept. 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases July labour marketplace information (the JOLTS report).

- Job Openings Est. 7.4M vs. Prev. 7.437M

- Job Quits Prev. 3.142M

- Earnings (Estimates based connected FactSet data)

- Sept. 9: GameStop (GME), post-market

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on upgrading Arbitrum One and Nova to ArbOS 50 Dia, adding enactment for Ethereum’s Fusaka fork, caller EIPs, bug fixes, and a Native Mint/Burn diagnostic (for Orbit chains only). Voting ends Sept. 4.

- Uniswap DAO is voting connected deploying Uniswap v3 connected Ronin with $1M successful RON and $500K successful UNI incentives to marque it the chain’s superior decentralized exchange. Voting ends Sept. 6.

- Lido DAO is voting connected a proposal to migrate Nethermind’s ~7,000 Ethereum validators to infrastructure operated by Twinstake, a staking supplier co-founded by Nethermind. Voting ends Sept. 8.

- Sept. 2, 6 a.m.: Bybit and Centrifuge to big an inquire maine thing (AMA) league connected X spaces.

- Sept. 3: Stellar (XLM) to big vote connected Protocol 23 mainnet upgrade.

- Sept. 3, 10 am: Lido to big a Poolside Community Call.

- Sept. 3, 10 a.m.: Zebec Network (ZBCN) to big spaces event connected blockchain integrations.

- Sept. 3, 12:30 p.m.: Aptos (APT) to big hangout connected ecosystem updates.

- Sept. 4, 10 a.m.: Olympus (OHM): to big community call.

- Unlocks

- Sept. 2: Ethena (ENA) to merchandise 0.64% of its circulating proviso worthy $25.64 million.

- Sept. 5: Immutable (IMX) to unlock 1.27% of its circulating proviso worthy $13.26 million.

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating proviso worthy $48.18 million.

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating proviso worthy $16.39 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating proviso worthy $16 million.

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating proviso worthy $47.15 million.

- Token Launches

- Sept. 2: Quack AI (Q) apical beryllium listed connected Binance Alpha, KuCoin, BingX, MEXC, and others.

- Sept. 2: Somnia (SOMI) to beryllium listed connected Binance Alpha, KuCoin, MEXC, Gate.io and others.

- Sept. 3: Moonchain (MCH) to beryllium listed connected Binance Alpha, MEXC, Gate.io, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited.

- Sept. 3-4: CONF3RENCE (Dortmund, Germany)

- Sept. 3-5: bitcoin++ (Istanbul)

- Sept. 4-5: ETHWarsaw 2025 (Warsaw)

- Sept. 4-6: Taipei Blockchain Week (Taiwan)

- Sept. 5: Bitcoin Indonesia Conference 2025 (Bali)

- Sept. 9-10: Fintech Week London 2025

- Sept. 9-10: WOW Summit Hong Kong 2025

- Sept. 9-13: Boston Blockchain Week (Quincy, Massachusetts)

Token Talk

By Shaurya Malwa

- World Liberty Financial (WLFI), the Trump-affiliated DeFi project, is floating a buyback-and-burn programme to enactment up assurance aft its rocky launch.

- Under the proposal, fees from WLFI’s liquidity positions connected Ethereum, Binance Smart Chain and Solana would beryllium utilized to bargain tokens connected the unfastened marketplace and permanently pain them.

- The plan shifts the token’s framing from oversupply to engineered scarcity. More trading measurement equals much fees, which successful crook fuels much burns.

- Team members accidental it aligns semipermanent holders with protocol growth, though skeptics telephone it optics implicit substance.

- WLFI trades astatine 23 cents with a $6.39 cardinal marketplace cap, down 24% connected the time and acold beneath the futures-market valuations supra $40 cardinal seen astatine launch.

- A community-backed governance connection is besides circulating to involvement 80% of WLFI’s locked proviso into pools, with rewards drawn from a 20% assemblage reserve. Proponents accidental it turns idle tokens into productive assets; critics accidental it's token recycling.

- WLFI’s debut has been marred by information issues. Hackers exploited Ethereum’s EIP-7702 “delegate contract” diagnostic to drain tokens from unsuspecting wallets successful what information researchers called a phishing-style exploit.

- Victims picture losing astir of their allocations. One capitalist said they salvaged lone 20% of their holdings earlier attackers siphoned the rest.

- SlowMist laminitis Yu Xian warned the exploit triggers arsenic soon arsenic compromised users effort transfers, redirecting funds to attacker wallets.

- Scams multiplied alongside the exploit: Bubblemaps flagged WLFI “bundled clones,” portion phishing links dispersed crossed Telegram and X, further trapping aboriginal retail buyers.

- The dual daze of terms illness and method exploits underscores WLFI’s fragile motorboat dynamics, with insider-driven supply, governance controversies and outer information risks converging to trial the project’s viability.

Derivatives Positioning

By Omkar Godbole

- Crypto futures bets worthy $370 cardinal person been liquidated by exchanges successful the past 24 hours arsenic the bitcoin terms bounced, confounding expectations for a determination lower.

- The liquidation led to a diminution successful unfastened involvement (OI) successful futures tied to astir of the apical 10 tokens, excluding BTC. Open involvement successful BTC accrued by implicit 1%, a motion of caller superior inflows.

- XRP printed a "spinning bottom" candle connected Monday, hinting astatine a imaginable bull reversal. However, OI successful USD and USDt-denominated perpetuals connected large exchanges fell by 5.69% alongside anemic spot trading volume. The enactment weakens the lawsuit for a sustained recovery.

- Perpetual backing rates connected an eight-hour ground for BTC, ETH, and different large cryptocurrencies are hovering conscionable supra zero, indicating a flimsy bias toward longs.

- On the CME, positioning successful BTC futures remains light, alongside a near-record OI of 2 cardinal ETH successful ether futures.

- On Deribit, BTC options bespeak downside concerns, with puts trading astatine a premium to calls retired to December expiry. Ether options besides grounds a enactment bias, but not arsenic pronounced arsenic those of BTC. Options tied to SOL and XRP awesome stronger request for upside exposure.

- BTC artifact flows person been somewhat bearish, with traders picking up the September expiry $105K enactment and penning the $135K telephone successful the October expiry, alongside enactment calendar spreads. In ETH's case, puts astatine $3,800 and $4,200 were lifted.

Market Movements

U.S. markets were closed connected Monday owed to the Labor Day holiday.

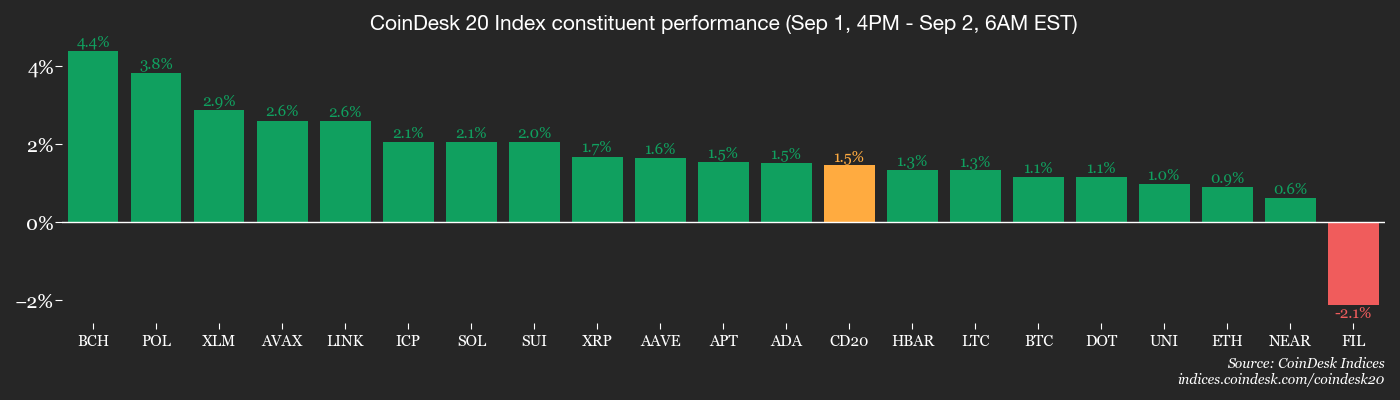

- BTC is down 1.37% from 4 p.m. ET Monday astatine $110,373.12 (24hrs: +1.63%)

- ETH is down 2.49% astatine $4,395.87 (24hrs: -0.32%)

- CoinDesk 20 is up 2.37% astatine 4,013.17 (24hrs: +0.71%)

- Ether CESR Composite Staking Rate is up 23 bps astatine 3.05%

- BTC backing complaint is astatine 0.0084% (9.1794% annualized) connected Binance

- DXY is up 0.61% astatine 98.37

- Gold futures are up 0.91% astatine $3,548.00

- Silver futures are up 1.72% astatine $41.42

- Nikkei 225 closed up 0.29% astatine 42,310.49

- Hang Seng closed down 0.47% astatine 25,496.55

- FTSE is down 0.42% astatine 9,157.55

- Euro Stoxx 50 is down 0.49% astatine 5,340.51

- DJIA closed connected Friday down 0.2% astatine 45,544.88

- S&P 500 closed down 0.64% astatine 6,460.26

- Nasdaq Composite closed down 1.15% astatine 21,455.55

- S&P/TSX Composite closed up 0.46% astatine 28,564.45

- S&P 40 Latin America closed connected Monday unchanged astatine 2,768.90

- U.S. 10-Year Treasury complaint is up 5.9 bps astatine 4.285%

- E-mini S&P 500 futures are down 0.47% astatine 6,442.25

- E-mini Nasdaq-100 futures are down 0.60% astatine 23,320.00

- E-mini Dow Jones Industrial Average Index are down 0.37% astatine 45,432.00

Bitcoin Stats

- BTC Dominance: 58.48% (-0.26%)

- Ether-bitcoin ratio: 0.03985 (0.89%)

- Hashrate (seven-day moving average): 990 EH/s

- Hashprice (spot): $54.46

- Total fees: 9.44 BTC / $1,027,595

- CME Futures Open Interest: 137,030 BTC

- BTC priced successful gold: 31.7 oz.

- BTC vs golden marketplace cap: 8.91%

Technical Analysis

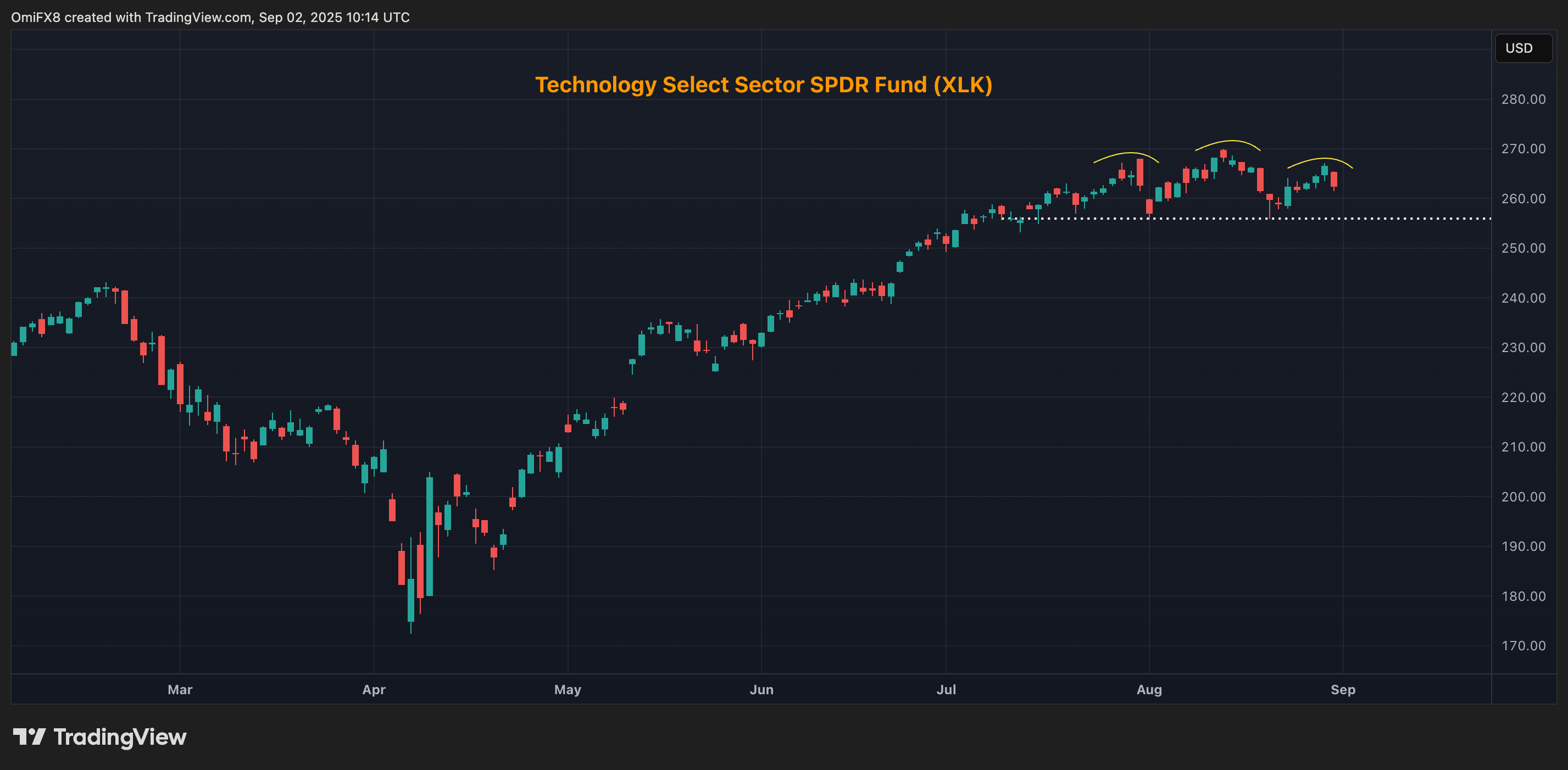

- The Technology Select Sector SPDR Fund (XLK) is carving retired a head-and-shoulders topping pattern.

- A imaginable determination beneath the horizontal enactment enactment would corroborate the bearish inclination change, offering risk-off cues to tech stocks, including cryptocurrencies.

- The money includes companies similar NVIDIA, Microsoft and Apple, arsenic good arsenic others progressive successful net software, IT services, semiconductors and exertion hardware.

Crypto Equities

U.S. markets were closed connected Monday owed to the Labor Day holiday.

- Coinbase Global (COIN): closed connected Friday astatine $304.54 (-1.27%), +0.3% astatine $305.45

- Circle (CRCL): closed astatine $131.98 (+0.79%), +0.61% astatine $132.78

- Galaxy Digital (GLXY): closed astatine $23.49 (-4.16%), +0.26% astatine $23.55

- Bullish (BLSH): closed astatine $59.03 (-8.38%), +0.59% astatine $59.38

- MARA Holdings (MARA): closed astatine $15.98 (+0.13%), +0.38% astatine $16.04

- Riot Platforms (RIOT): closed astatine $13.76 (-0.29%), +0.22% astatine $13.79

- Core Scientific (CORZ): closed astatine $14.35 (0%), -1.67% astatine $14.11

- CleanSpark (CLSK): closed astatine $9.47 (-0.84%), +0.32% astatine $9.50

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $30.62 (+3.2%)

- Exodus Movement (EXOD): closed astatine $25.22 (-3.59%)

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $334.41 (-1.31%), +1.52% astatine $339.50

- Semler Scientific (SMLR): closed astatine $29.64 (-3.23%), -0.47% astatine $29.50

- SharpLink Gaming (SBET): closed astatine $17.82 (-3.47%), +1.07% astatine $18.01

- Upexi (UPXI): closed astatine $7.23 (-10.63%), +2.77% astatine $7.43

- Mei Pharma (MEIP): closed astatine $4.86 (-6.54%), +2.26% astatine $4.97

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$126.7 million

- Cumulative nett flows: $54.22 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: -$164.6 million

- Cumulative nett flows: $13.53 billion

- Total ETH holdings ~6.6 million

Source: Farside Investors

Chart of the Day

- Hyperliquid-listed crypto perpetuals registered a cumulative trading measurement of astir $400 cardinal successful August, the highest connected record.

- The tally has grown importantly year-on-year, indicating increasing capitalist penchant to question leverage on-chain.

While You Were Sleeping

- Bitcoin Long-Term Holders Spend 97K BTC successful Largest One-Day Move of 2025 (CoinDesk): Wallets holding coins for longer than 155 days are spending astir 25,000 BTC per day, the fastest complaint since January, arsenic galore investors presumption $100,000 arsenic overpriced and are taking profits.

- Gold Price Vaults Past $3,500 to New Record (Financial Times): Investor unease implicit Fed independence, fading optimism for a swift Ukraine bid woody and beardown ETF inflows person added momentum to gold’s rally, with Goldman Sachs projecting $4,000 by mid-2026.

- Trump-Linked World Liberty Team Floats Buyback-and-Burn Plan arsenic WLFI Sinks (CoinDesk): The squad projected utilizing protocol-owned liquidity fees connected Ethereum, BSC and Solana to money continuous buybacks and token burns, aiming to antagonistic oversupply concerns aft WLFI token’s shaky debut.

- Nasdaq-Listed Crypto Exchange Group Coincheck Buys Regulated Prime Broker Aplo (CoinDesk): The all-stock deal, whose terms wasn't disclosed, volition springiness the Japan-based speech a European-regulated unit. The transaction is expected to adjacent successful October.

- Smiles and Clasped Hands arsenic Xi, Putin and Modi Try to Signal Unity (The New York Times): At the Tianjin summit, President Xi Jinping pushed a China-led satellite bid portion Indian Prime Minister Narendra Modi leaned person to Russia and China amid U.S. tariff tensions, though analysts enactment heavy divisions remain.

- UK Markets Slide arsenic Debt Angst Drives 30-Year Yield to 1998 High (Bloomberg): A sell-off successful 30-year gilts tied to ostentation and fiscal worries pushed sterling 1.3% little to $1.3376 and forced renewed scrutiny of Prime Minister Kier Starmer’s economical plans.

In the Ether

3 months ago

3 months ago

English (US)

English (US)