Gold has surged to a caller all-time high, surpassing $3,025 per ounce to people an summation of implicit 15% successful since the crook of the year. Meanwhile, bitcoin is lagging (BTC), down 10% year-to-date.

Several factors person contributed to gold’s rally, including important inflows into gold ETFs and its accepted relation arsenic a safe-haven plus during geopolitical uncertainty.

Additionally, discussions of caller tariffs successful the U.S. nether President Trump person further fueled request for U.S. equities. Gold’s historical rally has driven its terms up 40% year-over-year, acold outpacing Bitcoin's 16% gain.

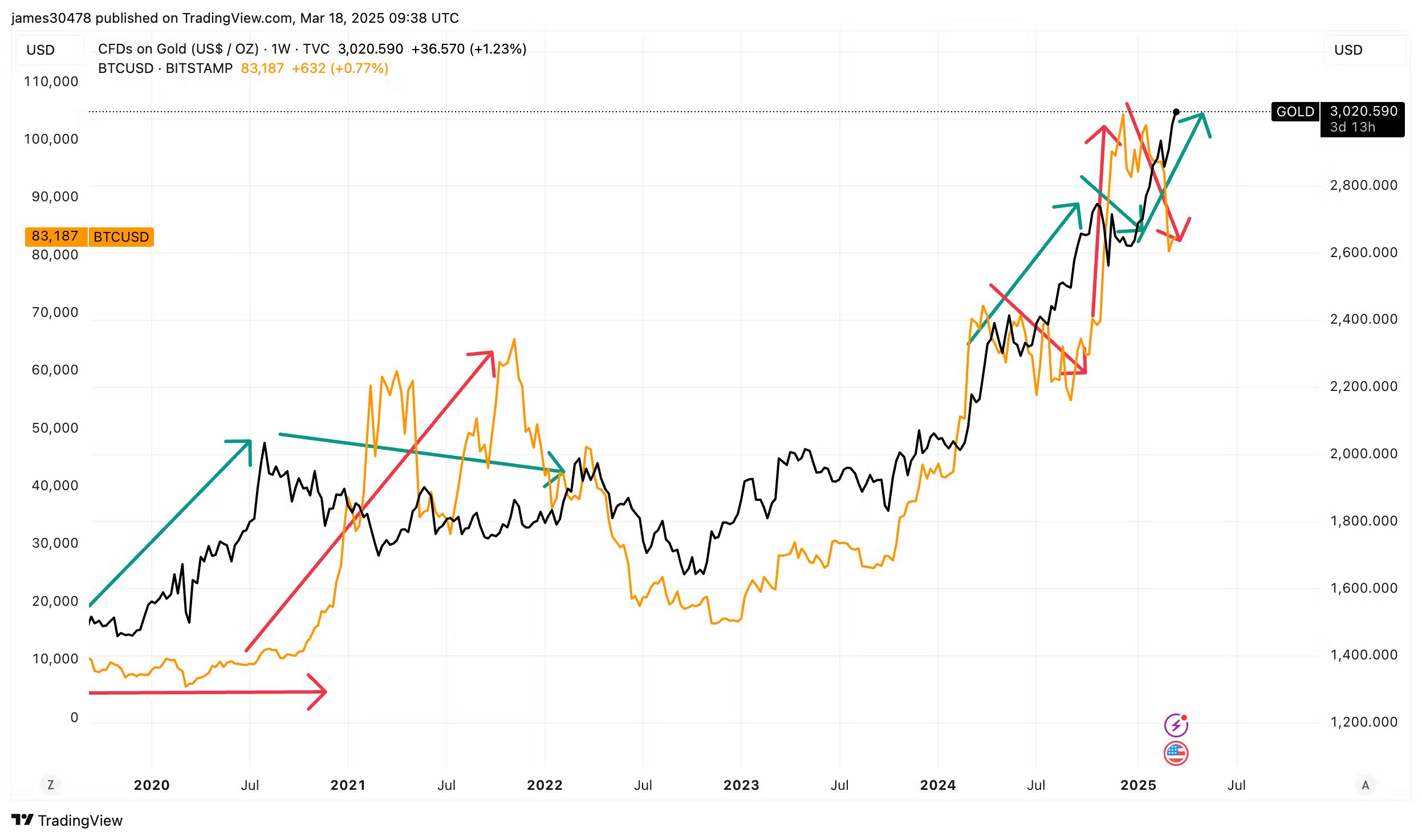

Historically, erstwhile golden enters a bull market, bitcoin often stagnates oregon declines. The 2 assets seldom determination successful tandem, though determination are occasional periods erstwhile some emergence oregon autumn simultaneously.

Between 2019 and Q3 2020, golden experienced a beardown rally portion bitcoin remained mostly flat, coinciding with the covid-19 pandemic. In contrast, bitcoin saw its bull tally successful 2021 portion golden stagnated. By 2022, arsenic planetary involvement rates began to rise, some assets faced unit earlier rebounding successful 2023 and 2024. Now, successful 2025, the marketplace is witnessing a renewed divergence betwixt the two.

ByteTree laminitis Charlie Morris has described this golden rally arsenic a "proper golden rush"—something the marketplace hasn’t seen since 2011.

"Gold supra $3,000, metallic supra $24, and golden stocks gaining momentum—it struck maine that the crypto assemblage has ne'er witnessed a existent golden rush. The past clip this happened was successful 2011, erstwhile Bitcoin was conscionable emerging astatine $20. They volition now."

9 months ago

9 months ago

English (US)

English (US)