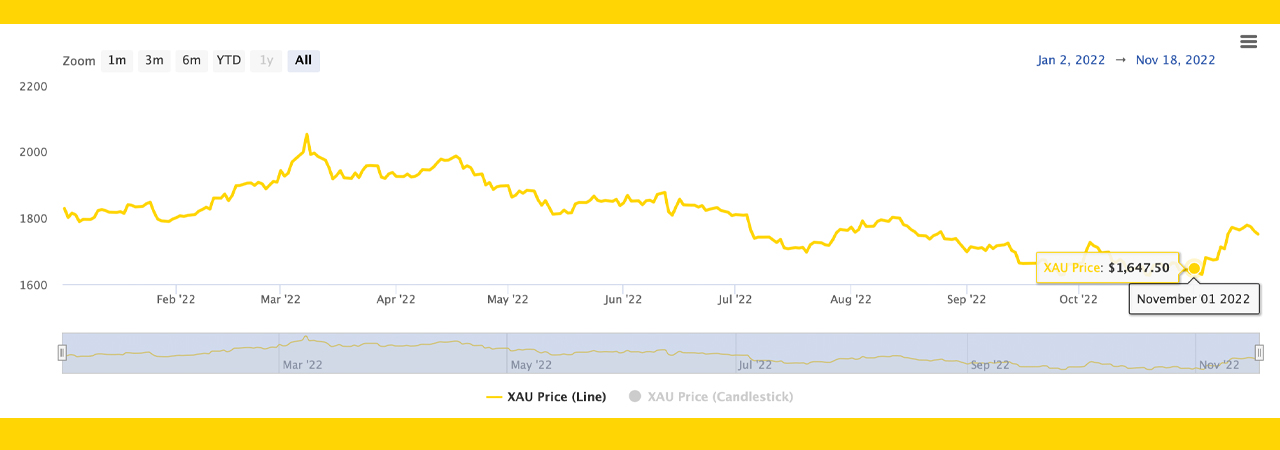

This month, golden has outperformed bitcoin aft crypto markets shuddered from the caller FTX collapse, and the precious yellowish metallic climbed 6.12% since the archetypal of November. The U.S. lodging marketplace has shown weaknesses and October’s U.S. ostentation complaint was little than expected. Analysts judge these economical trends contributed to pushing gold’s terms up by 3.81% against the greenback connected Nov. 10, 2022, aft the U.S. Bureau of Labor Statistics published October’s user terms scale (CPI).

So Far Gold’s Market Performance successful November Has Outpaced Bitcoin’s

Bitcoin has seen amended days arsenic the starring crypto plus is down much than 18% little than it was during the archetypal of November. A large woody of the crypto asset’s USD losses tin beryllium contributed to the FTX illness and the chaotic aftermath that followed.

An ounce of gold, connected the different hand, has risen 6.12% higher than it was trading for connected Nov. 1, 2022. On that day, a troy ounce of .999 good gold’s spot worth was 1,647.50 nominal U.S. dollars. Today, the worth of an ounce of .999 good golden is astir $1,748.49 per unit.

Analysts, golden bugs, and economists are attributing immoderate of gold’s occurrence during the past 2 weeks to the diminution successful U.S. existent property sales. The National Association of Realtors (NAR) reported connected Friday that “existing-home income slumped 5.9% successful October.”

“Existing-home income faded for the ninth period successful a enactment to a seasonally adjusted yearly complaint of 4.43 million. Sales fell 5.9% from September and 28.4% from 1 twelvemonth ago,” the NAR study details. The NAR survey further attributes the falling location prices to the Fed’s assertive complaint hikes that person accrued the 30-year lending complaint a large woody this year.

Most of gold’s emergence started connected Nov. 1, 2022, and it jumped adjacent higher aft the U.S. Bureau of Labor Statistics published October’s user terms scale (CPI). The little ostentation complaint pushed the terms of golden up 3.81% against the U.S. dollar betwixt Nov. 10 done Nov. 13, 2022.

The study besides helped bitcoin (BTC) to immoderate degree, arsenic the FTX illness effect connected crypto markets whitethorn person been worse if the ostentation complaint was higher. BTC’s one-hour candle aft the CPI study published jumped a large woody higher.

An ounce of .999 good golden was trading for $1,647 per ounce connected Nov. 1, 2022, and contiguous it’s up 6% higher than it was connected that date.

An ounce of .999 good golden was trading for $1,647 per ounce connected Nov. 1, 2022, and contiguous it’s up 6% higher than it was connected that date.On Nov. 10, gold’s terms per ounce was coasting on astatine $1,706 per portion and by Nov. 13, 2022, it was trading for $1,771 an ounce. Frank Cholly, the RJO Futures elder marketplace strategist, told Kitco News that golden whitethorn person tally up excessively accelerated and the precious metallic is simply taking a breather.

“Gold got adjacent to $1,800. And present the marketplace is seeing immoderate nett taking. It does look to beryllium rolling over. I americium not acceptable to get bearish yet. We are taking a breather,” Cholly explained connected Friday. However, determination is simply a constituent wherever Cholly could get bearish arsenic the RJO Futures elder marketplace strategist remarked:

If golden closes nether $1,750, I’d commencement to get bearish — At $1,725, things crook sour for gold.

Much similar bitcoin proponents betting connected the Bitcoin halving lawsuit to bolster BTC’s prices, golden bugs deliberation the terms of golden volition beryllium overmuch higher implicit the adjacent 8 years. Traders astatine primexbt.com believe golden volition scope $4,721 per ounce by 2024 and by 2030 the traders foretell golden volition scope $8,732 per ounce.

Tags successful this story

1 ounce of gold, Bitcoin, Bitcoin (BTC), Bitcoin Price, BTC Price, CPI, CPI report, Frank Cholly, FTX collapse, gold, gold price, Gold Prices, inflation rate, Kitco, NAR, National Association of Realtors, Ounce of Gold, Prices of Gold, primexbt.com, primexbt.com traders, Real estate, RJO Futures, troy ounce of .999 good gold, US Housing, US Inflation, US Real estate

What bash you deliberation astir gold’s marketplace show truthful acold this month? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)