Gold is connected the emergence successful 2023 and successful the archetypal week of the caller twelvemonth alone, the precious metallic has jumped 2.36% against the U.S. dollar. Over the past 65 days, golden has soared 14.55% portion metallic has skyrocketed 22.31% against the greenback since Nov. 3, 2022. According to the caput of metals strategy astatine MKS Pamp Group, determination is simply a “decent magnitude of bullish ‘pent-up’ request that has been carried implicit from past year” for gold.

Central Bank Demand and Ongoing Geopolitical Tensions Continue to Drive Gold’s Ascent

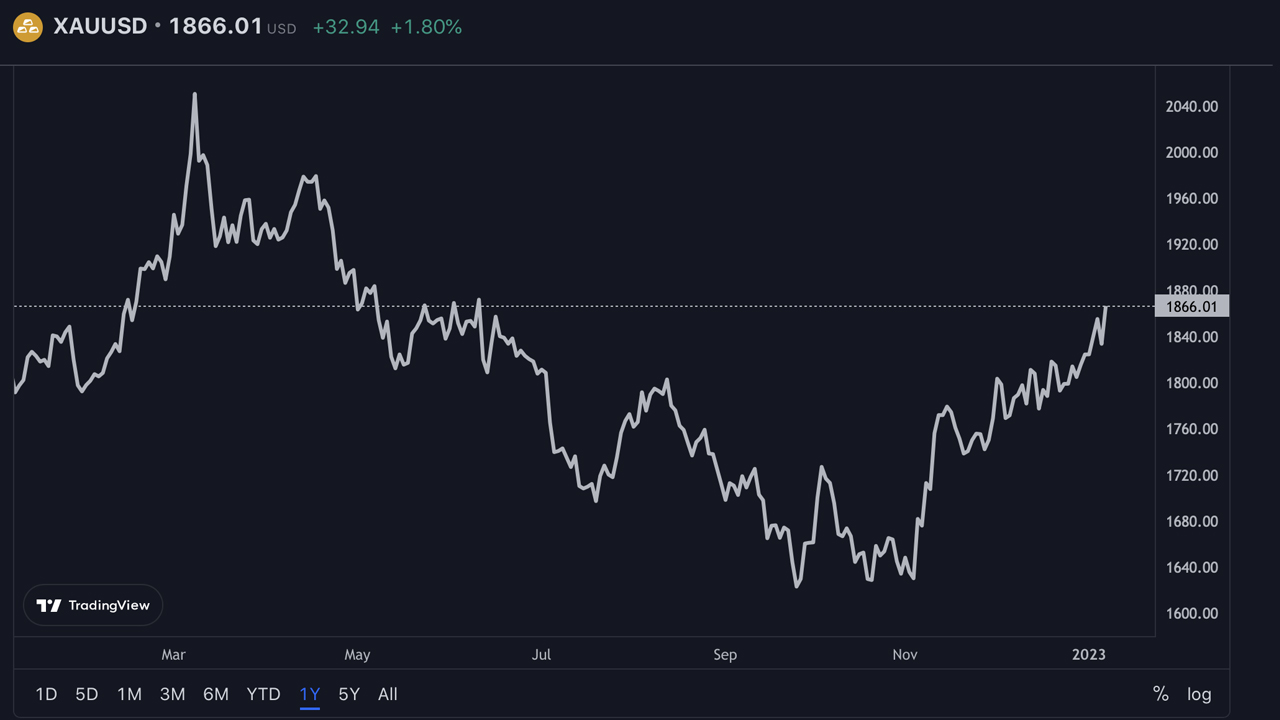

The insistence for golden has continued to emergence according to marketplace prices during the past 7 days. Gold jumped from $1,823 per troy ounce to $1,866 successful that clip frame. While gold is up 2.36% against the U.S. dollar, a troy ounce of good silver is down astir 0.58% since the commencement of the year.

Over the past 2 months, some golden and metallic person risen a large deal, with golden jumping 14.55% and metallic expanding 22.31% against the greenback. With precious metals connected the rise, ‘gold bugs’ judge the yellowish metallic is “set to radiance successful 2023.”

In a two-part series, “Gold Mining Bull,” an writer for Seeking Alpha, argues that golden volition execute amended successful 2023. The writer cites central slope demand and “ongoing geopolitical tensions” arsenic reasons for optimism. Gold Mining Bull is paying peculiarly adjacent attraction to cardinal slope golden purchases this year.

“Central banks astir the world, peculiarly successful China, Turkey, and India, person been buying golden astatine a grounds pace,” the writer explains. “This inclination has been going connected for the past 13 consecutive years, but precocious the gait has accelerated.” The expert adds:

They person been expanding their golden reserves successful caller years arsenic a mode to diversify their overseas speech holdings and trim reliance connected the U.S. dollar.

Furthermore, the writer besides believes determination are six much things that could boost gold’s price, including a rebound successful jewelry demand, the Federal Reserve’s eventual pivot, the escalation of the Ukraine-Russia war, a weaker U.S. dollar, a constricted caller excavation supply, and the anticipation of China invading Taiwan.

Central slope golden purchases person been a peculiarly influential origin successful presumption of golden involvement implicit the past year. According to analysts cited by the Financial Times, Russia and China accumulated the astir golden successful 2022 successful presumption of demand.

MKS Pamp Group’s Head of Metals Strategy Comments connected Gold’s Positive Market Trend

Nicky Shiels, caput of metals strategy and macro for MKS Pamp Group, told Kitco News connected Friday that determination has been pent-up request for gold, which could bespeak a affirmative marketplace trend. Shiels discussed this week’s rising U.S. nonfarm payrolls and said determination is “simply thing recessionary” astir the report.

As for gold, it depends connected whether the precious metallic tin support its play appreciation. “Depending connected whether golden tin clasp its play gains (which is looking progressively likely), it solidifies the violative mode golden has been trading since it established a mild bull inclination since aboriginal November – ever looking for reasons to rally,” she said. Shiels continued:

There’s a decent magnitude of bullish ‘pent-up’ request that has been rolled implicit from past twelvemonth and tin get ignited connected the close information constituent (CPI & PCE) volition beryllium acold much telling.

On Jan. 5, 2023, Shiels besides shared MKS Pamp Group’s 2023 precious metals forecast, which shows an mean terms of $1,880 for golden and $22.50 for silver. According to the forecast, golden could scope a precocious of $2,100 and metallic could scope $28 per ounce successful 2023. ABN AMRO expects golden to beryllium astir $1,900 per ounce successful 2023, and Saxo Bank has detailed that golden could scope $3K per ounce this year.

“2023 is the twelvemonth that the marketplace yet discovers that ostentation is acceptable to stay ablaze for the foreseeable future,” said Ole Hansen, caput of commodity strategy astatine Saxo. Juerg Kiener, managing manager and main concern serviceman of Swiss Asia Capital, thinks golden could perchance adjacent surge to $4K per ounce successful 2023.

Tags successful this story

2022, 2023, ABN AMRO, appreciation, Bullish, China, CPI, Demand, Exchange, geopolitical, gold, Gold Mining Bull, Greenback, holdings, India, jewelry, Juerg Kiener, Macro, Metal, metals, mine, MKS Pamp Group, Nicky Shiels, Nov. 3, Ole Hansen, ounce, PCE, pent-up, pivot, positive, Purchases, recessionary, Reserve, Rise, Russia, Saxo, silver, soar, Strategy&, Supply, Tensions, trend, troy, U.S. dollar, Ukraine - Russia, War, weaker

What bash you deliberation astir the 2023 golden terms predictions? Let america cognize your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

English (US)

English (US)