Pro-crypto Donald Trump won the U.S. statesmanlike predetermination implicit 4 months ago, and since then, the play has been characterized by fiscal marketplace turbulence and planetary uncertainties surrounding tariffs, geopolitical tensions, and ongoing conflicts successful the Middle East and betwixt Ukraine and Russia.

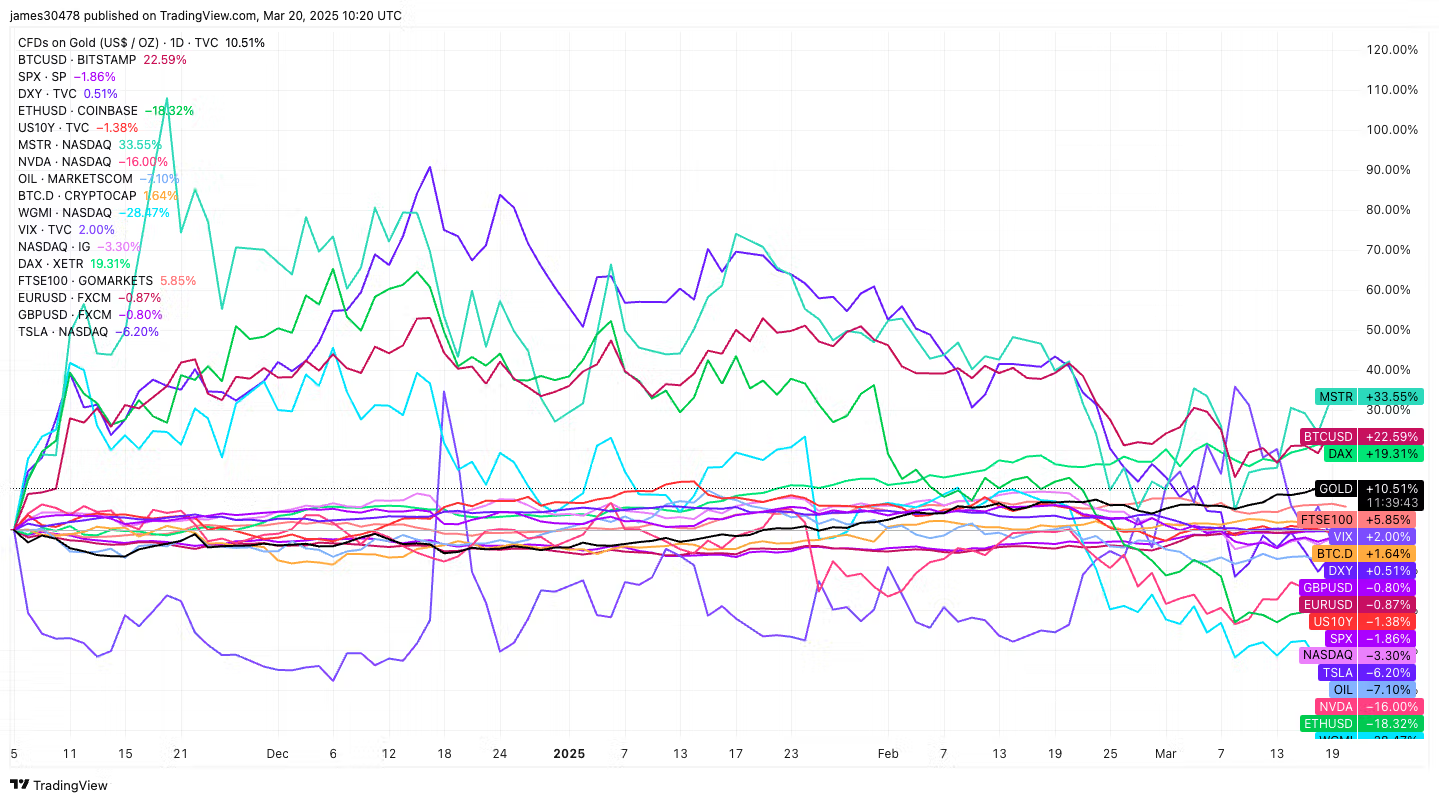

Bitcoin (BTC) has surged implicit 23% since the Nov. 5 election, reaching an all-time precocious of implicit $109K astatine the extremity of January. Despite a consequent 30% diminution from its peak, it remains 1 of the best-performing assets. Strategy (MSTR), often considered a bitcoin proxy, has gained 34%, recovering good nether the Trump medication contempt antecedently dropping astir 60% from its November highs.

Ethereum's ether token (ETH) has fallen by arsenic overmuch arsenic 18%, alongside disappointing enactment successful the broader crypto market. The Valkyrie Bitcoin Mining ETF has besides struggled, dropping astir 30%. Meanwhile, investors person rotated wealth into BTC, pushing its dominance complaint higher by 2% to implicit 61.

European equities person done well, outshining their U.S. counterparts. The German DAX scale is up 20%, and the UK’s FTSE 100 has gained 6%, alongside weaker performances successful the U.S. banal market, wherever the Nasdaq and S&P 500 are some down astir 2%. A recent report from Bank of America highlights a grounds driblet successful U.S. banal allocations. Gold, benefiting from uncertainty, has continued to acceptable caller all-time highs, surpassing $3,030—an 11% increase.

The U.S. Dollar Index (DXY), which measures the dollar's spot against a handbasket of large currencies, remains flat. However, nether Trump, the dollar has weakened significantly, providing immoderate alleviation to hazard assets and large currencies specified arsenic the Euro and the Great British Pound.

Meanwhile, the U.S. 10-year Treasury yield has somewhat declined to 4.2%, a cardinal metric the medication is intimately monitoring. Oil prices person plummeted by astir 7% arsenic the U.S. maintains its stance connected vigor dominance to trim vigor costs.

Notably, immoderate of the alleged "Magnificent 7" stocks person struggled, with NVIDIA (NVDA) down 16% and Tesla (TSLA) declining 6%.

Detox underway?

Recent losses connected Wall Street and successful the crypto marketplace person ignited hopes for the "Trump put," oregon imaginable argumentation support. However, the medication appears willing to endure short-term symptom for semipermanent benefits, believing that this attack volition cleanse the markets of the fiscal spending excesses of the Biden era.

This reset is expected to beryllium characterized little inflation, improved vigor security, and a lower 10-year Treasury yield.

"Scott Bessent’s speech of a “detox period” suggests a controlled downturn mightiness beryllium ahead. If that’s the case, Trump’s playbook seems clear: blasted the recession connected Biden, usage tariffs and crypto narratives to negociate costs, and propulsion for little involvement rates to substance tech and AI growth. Short-term pain, semipermanent gain—that’s the strategy," Gracy Chen, CEO of Bitget, said successful an email to CoinDesk this week.

"Regardless, I don't spot BTC falling beneath 70k, perchance 73-78k which is simply a coagulated clip to participate for immoderate buyers connected the fence. In the adjacent 1-2 years, BTC astatine 200k isn’t arsenic far-fetched arsenic astir would think," Chen added.

9 months ago

9 months ago

English (US)

English (US)