In a caller note that has caught the attraction of some accepted fiscal markets and the Bitcoin community, Goldman Sachs economists, including the renowned Jan Hatzius and David Mericle, person made a important prediction regarding the Federal Reserve’s monetary policy. The enactment suggests that the Federal Reserve whitethorn commence a bid of involvement complaint cuts by the extremity of June 2024.

“The cuts successful our forecast are driven by this tendency to normalize the funds complaint from a restrictive level erstwhile ostentation is person to target,” the Goldman economists wrote. This connection underscores the bank’s content that the Federal Reserve’s existent stance connected involvement rates whitethorn beryllium excessively restrictive, particularly if ostentation rates proceed to inclination towards the cardinal bank’s target.

The enactment further elaborates: “Normalization is not a peculiarly urgent information for cutting, and for that crushed we besides spot a important hazard that the FOMC volition alternatively clasp steady.” This cautious code suggests that portion Goldman Sachs is predicting a complaint cut, they besides admit the unpredictability of the Federal Reserve’s decisions.

The caller data, which showed US ostentation rising astatine a slower-than-expected complaint of 3.2%, with the halfway user terms scale astatine a 4.7% yearly pace, further complicates the picture. With the Fed’s benchmark complaint presently acceptable betwixt 5.25% to 5.5%, Goldman Sachs expects it to stabilize astir 3 to 3.25%.

What Does This Mean For Bitcoin Price?

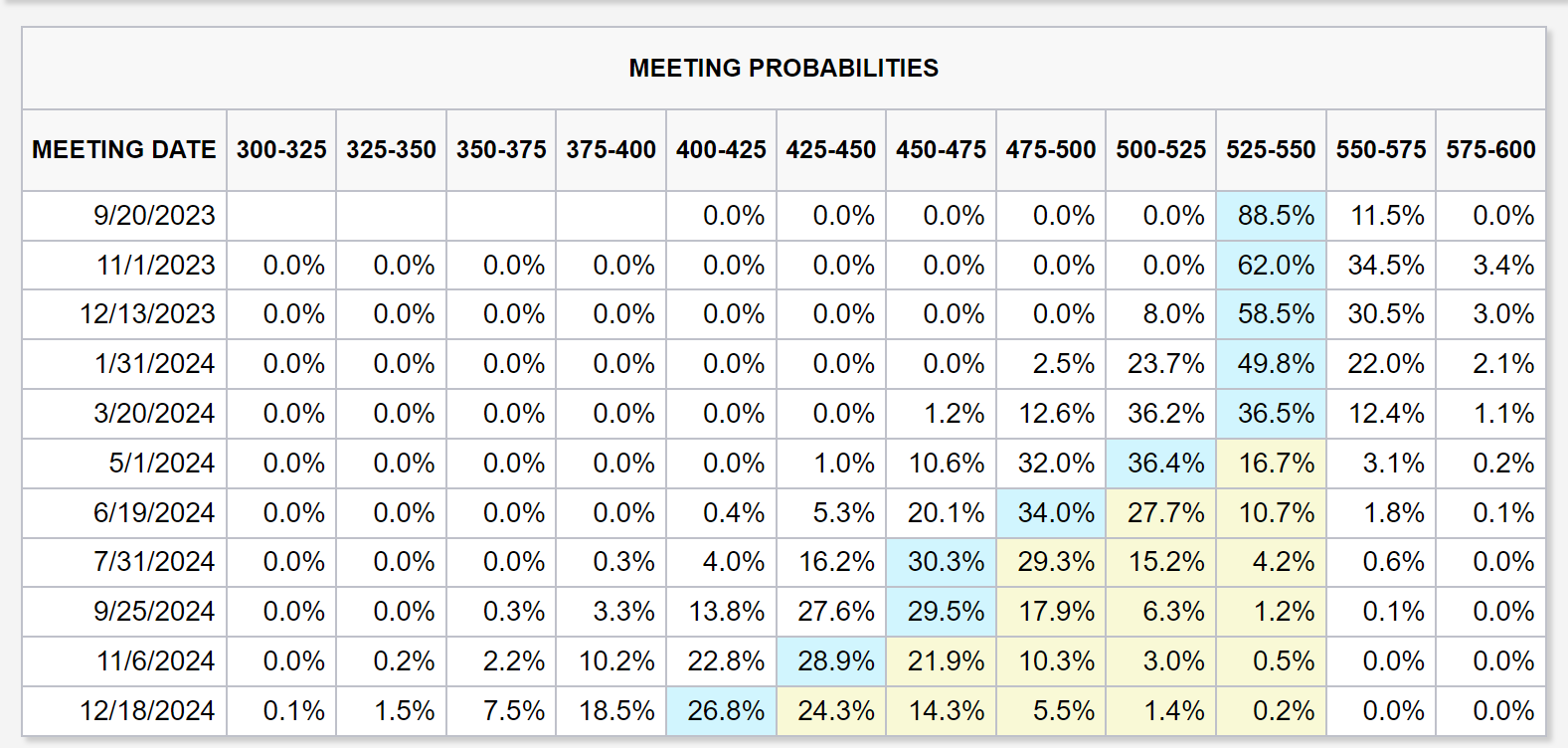

Expectations of a complaint chopped from Goldman Sachs are successful enactment with marketplace expectations according to the CME FedWatch Tool. In May 2024, 68% already expect determination to beryllium astatine slightest a 25 ground constituent (bps) complaint cut.

CME FedWatch instrumentality probabilities | Source: CME Group

CME FedWatch instrumentality probabilities | Source: CME GroupHowever, it remains to beryllium seen whether macro events volition power the Bitcoin terms again. In the past fewer months, BTC progressively decoupled from macro events portion the banal marketplace rallied towards all-time highs and stagnated astir the $30,000 mark.

Interestingly, the timing could beryllium precise affirmative for the Bitcoin market. On the 1 hand, March 15, 2024 is the last deadline for spot Bitcoin ETF filings from BlackRock, Fidelity, Investco, VanEck, and WisdomTree; connected the different hand, Bitcoin halving is coming up astatine the extremity of April (currently expected connected April 26).

The precocious expectations for these 2 events, coupled with a dovish monetary argumentation from the Federal Reserve, could beryllium a monolithic catalyst for the Bitcoin price.

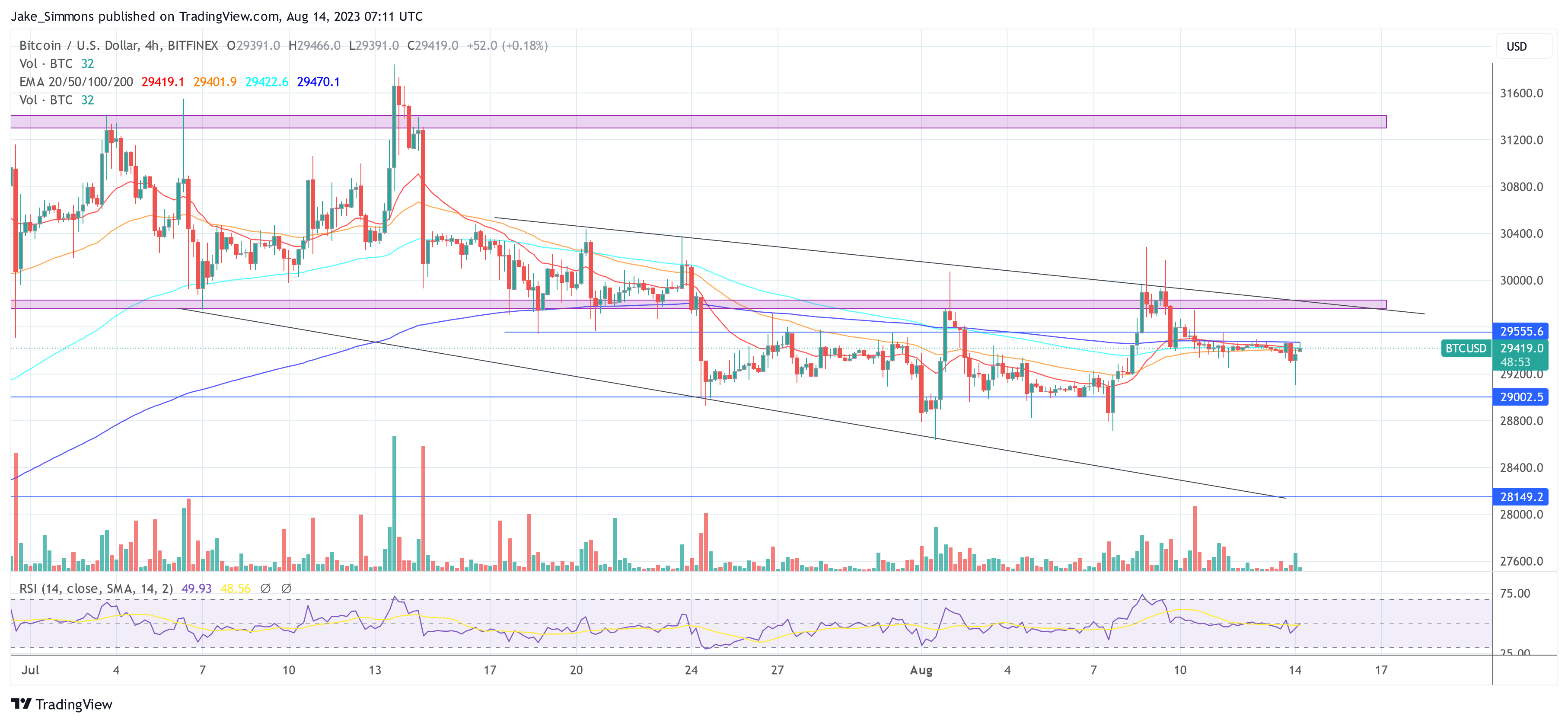

At property time, BTC traded astatine $29,426 and saw different calm play amid the liquidity summertime drought. Breaking supra $29,550 is cardinal to found immoderate bullish momentum to initiate different propulsion towards $30,000.

BTC terms remains beneath $30,000, 4-hour illustration | Source BTCUSD connected TradingView.com

BTC terms remains beneath $30,000, 4-hour illustration | Source BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)