Both involvement successful Bitcoin and an expanding percent of Short Terms Holders successful nonaccomplishment suggest imaginable for a capitulation event.

Samuel Wan • Mar. 18, 2022 astatine 9:00 americium UTC • 2 min read

Samuel Wan • Mar. 18, 2022 astatine 9:00 americium UTC • 2 min read

Cover art/illustration via CryptoSlate

Search data shows planetary involvement successful Bitcoin has sunk owed to its volatile show implicit the past 5 months.

Google Trends is simply a fashionable instrumentality utilized to gauge wide involvement successful trending topics. In respect of the hunt word “Bitcoin,” it presently shows a worth of 30 for the week ending March 19, 2022.

This marks the lowest level since the commencement of October 2021 and represents a important diminution from mid-May, erstwhile involvement peaked astatine 100.

Source: trends.google.com

Source: trends.google.comOver the past 3 months, Bitcoin has been trading betwixt $33,000 and $45,700. This lull successful terms enactment appears to person driven distant capitalist interest.

Bitcoin Interest has not recovered from Elon Musk’s vigor rant

Searches thin to emergence during periods of utmost volatility, arsenic imaginable investors look for accusation connected bullish oregon bearish marketplace activity.

For example, May 2021’s highest involvement people of 100 occurred erstwhile Elon Musk said Bitcoin Proof-of-Work mining is highly damaging to the environment. This triggered a 50% driblet successful the Bitcoin terms implicit 10 days.

By June 2021, Google searches for Bitcoin had taken a crisp drop, astir halving to 53. This acceptable disconnected further declines successful searches, and contempt posting a caller all-time precocious of $69,000 connected November 10, hunt involvement failed to recapture the aforesaid level seen successful May.

The week successful which Bitcoin posted its caller all-time precocious had an involvement people of conscionable 39. And since May’s downturn, the highest involvement people occurred successful the week of January 23-29, with a worth of 52, a acold outcry from May’s highest of 100.

The supra suggests that short-term “hit and run” investors are diminishing. But what astir short-term holders with unfastened positions?

Short-term holders proceed to decline

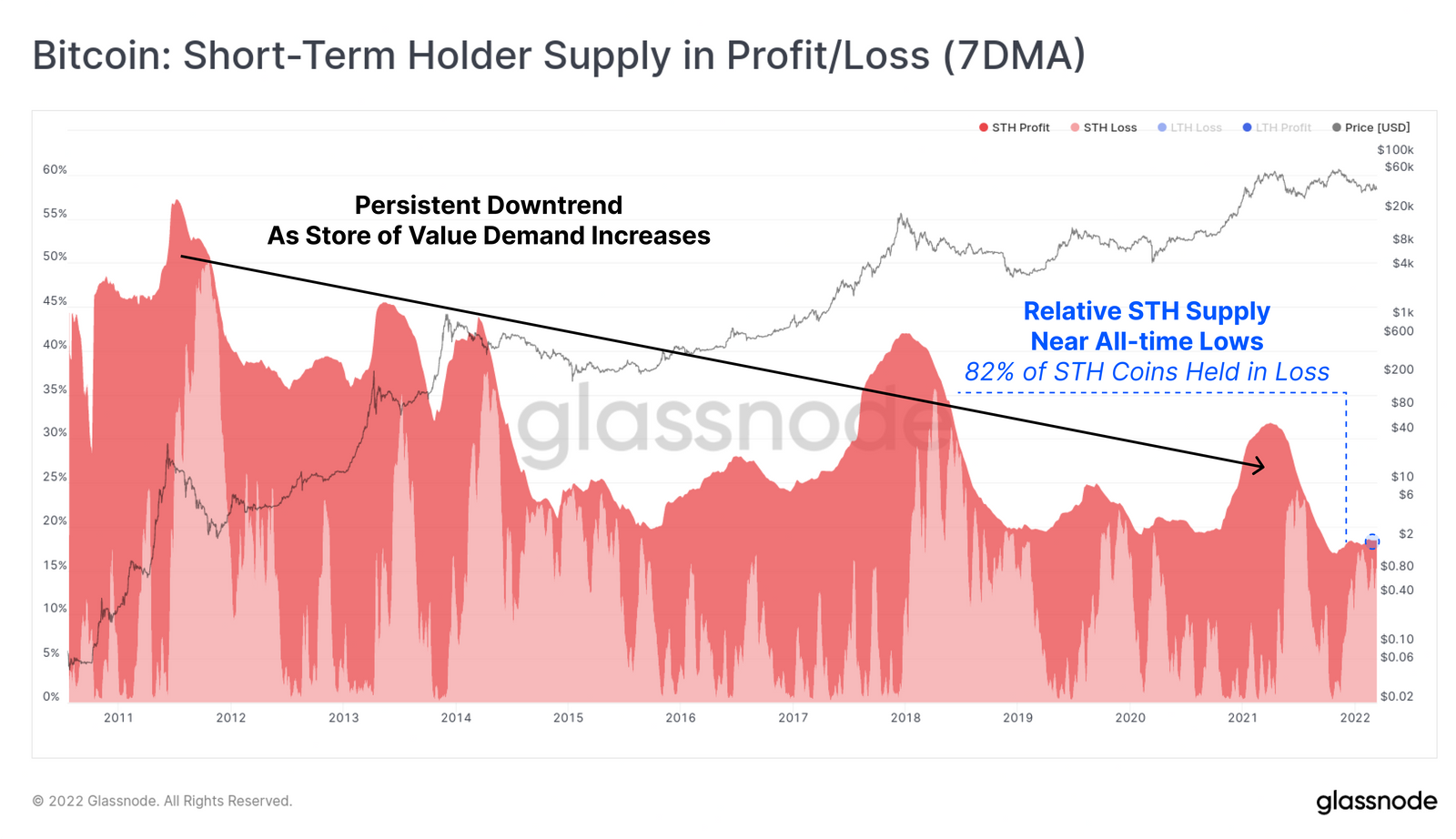

On-chain information from Glassnode shows the percent of Short-Term Holders (STHs), who accumulated wrong the past 155-days, are progressively holding losses. The existent information of STH proviso successful nonaccomplishment is 82%. A persistent downtrend of profitable SHTs adds to sell-side pressure.

Source: insights.glassnode.com

Source: insights.glassnode.com“STH proviso is presently adjacent all-time-lows which is constructive for prices. However, 82% of these coins (2.51M BTC) are presently held astatine a loss, and are successful crook the astir apt root of sell-side pressure.”

Similarly, Glassnode says the magnitude of coin proviso held by STHs is besides connected the decline, which occurs erstwhile coin proviso remains dormant and crosses the 155-day threshold to go classified arsenic Long-Term Holder Supply. STH proviso reaching debased levels is mostly associated with carnivore markets, arsenic buyers nonstop coins to acold retention for the agelong term.

Broader macro and geopolitical risks person dampened short-term accumulation behavior. The information suggests there’s imaginable for further drops successful the Bitcoin terms to come.

Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)