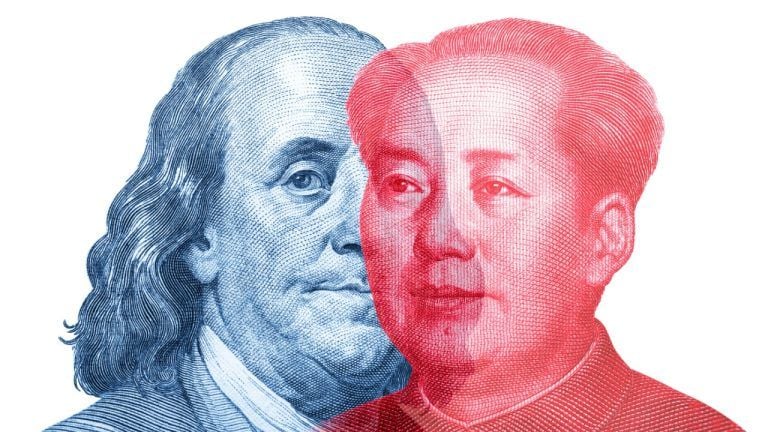

BlackRock’s committedness to advancing its crypto efforts lone lends to the validity of Bitcoin arsenic an plus class, said Michael Sonnenshein.

The caller tsunami of spot Bitcoin (BTC) exchange-traded money (ETF) filings should beryllium seen arsenic a “moment of validation” for Bitcoin, says Grayscale Investments CEO Michael Sonnenshein.

During a July 12 interview connected CNBC’s Last Call, Sonnenshein rejected the conception that BlackRock’s entranceway to the Bitcoin ETF contention made it “uncool.”

“To see, literally, the largest plus manager successful the satellite publically perpetrate to advancing their crypto efforts lone lends to the validity of the plus people and the staying powerfulness it has.”In conscionable the past 4 weeks, astatine slightest 7 large organization firms including BlackRock person applied for a spot Bitcoin ETF successful the United States.

"It's a infinitesimal of validation," says @Grayscale CEO @Sonnenshein connected $BLK aiming to motorboat a $BTC spot ETF. "To spot the largest plus manager successful the satellite publically perpetrate to advancing their crypto efforts lone lends validity to the plus people and the staying powerfulness that it has." pic.twitter.com/agt7emHWt0

— Last Call (@LastCallCNBC) July 11, 2023If approved, some organization and retail investors successful the U.S. would person a simple, legally compliant mode of getting vulnerability to the terms of Bitcoin without really owning any.

“The ETF wrapper is tried and existent and it has go the entree constituent for truthful galore antithetic assets, whether they’re commodities oregon stocks,” said Sonnenshein.

“Bitcoin is an plus that’s not going away. Investors privation and merit entree to it.”Up until this point, Sonnenshein’s Grayscale has been offering U.S. investors a roundabout mode of gaining vulnerability to Bitcoin — by enabling investors to commercialized shares successful trusts holding ample pools of Bitcoin via its Grayscale Bitcoin Trust (GBTC).

Today, our attorneys filed a missive with the DC Circuit highlighting the disparity betwixt the SEC’s support of a leveraged #bitcoin futures ETF portion continuing to contradict support of spot bitcoin ETFs similar $GBTC. Let’s dive deeper. /6 pic.twitter.com/z7WyGBthhT

— Grayscale (@Grayscale) July 10, 2023However, the steadfast wants to person it to a spot Bitcoin ETF too, which would let inventors a acold simpler method to commercialized the terms of Bitcoin without GBTC’s pesky discount to nett plus value.

“To beryllium capable to springiness investors Bitcoin vulnerability done GBTC, similar we bash contiguous has been an unbelievable milestone [...] But moving to an ETF operation volition springiness investors the further extortion that they want.”In June 2022, Grayscale filed a suit against the United States Securities and Exchange Commission implicit the rejection of its 2021 application to person its GBTC.

Related: Grayscale resolves suit with Fir Tree implicit projected changes to Bitcoin Trust

“If we’re palmy successful that challenge, there’s really billions of dollars of capitalist superior that would beryllium unlocked done that,” said Sonnenshein.

The terms of Bitcoin changeable upwards of 20% successful the days aft BlackRock’s filing for a spot Bitcoin ETF connected June 15, reaching a year-high of $31,460 connected July 6. It is presently trading astatine $30,633.

Magazine: Should you ‘orange pill’ children? The lawsuit for Bitcoin kids books

1 year ago

1 year ago

English (US)

English (US)