Summary:

- Gary Gensler’s SEC rejected Grayscale’s Bitcoin exchange-traded money exertion citing fraud and marketplace manipulation concerns.

- The integer plus manager sought regulatory support to power its BTC spot spot scale to an ETF, changing the product’s operation and reducing a immense discount connected the asset.

- CEO Michael Sonnenshein promised his institution would the SEC for its “capricious and discriminatory decision”.

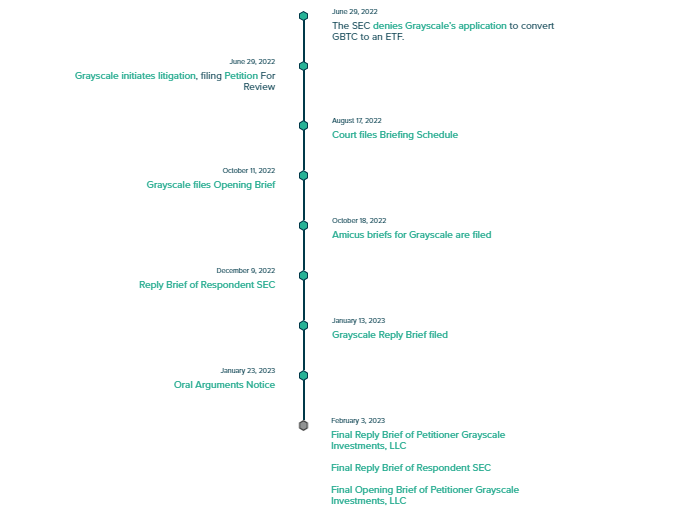

Crypto’s largest integer plus manager Grayscale precocious filed last briefs successful its suit against the U.S. Securities and Exchange Commission for rejecting its Bitcoin spot ETF application. The institution which is simply a subsidiary of Barry Silbert’s Digital Currency Group (DCG) launched its ineligible conflict against Gary Gensler’s bureau backmost successful October 2022.

Last week, Grayscale filed our "final" briefs successful our litigation challenging the SEC's determination to contradict $GBTC conversion to a spot #bitcoin ETF. 🧵

— Grayscale (@Grayscale) February 7, 2023Grayscale Bitcoin Trust (GBTC) was launched successful 2013 arsenic an scale money offering BTC spot vulnerability to customers. The institution filed to person GBTC into an exchange-traded money (ETF), changing the operation of the merchandise and perchance stemming a immense discount connected the asset.

Indeed, the discount connected GBTC shares roseate to astir 40% successful precocious 2022, a grounds precocious for the fashionable Bitcoin merchandise worthy implicit $12 cardinal astatine the time.

SEC Rejects Grayscale Bitcoin ETF Application

Gary Gensler’s SEC rejected Grayscale’s exertion claiming concerns of manufacture fraud and crypto marketplace manipulation. The determination garnered dense backlash from the crypto plus manager who argued that the SEC had approved akin spot-based ETFs and futures products.

Grayscale responded to the SEC’s verdict with a suit connected October 12, 2022, successful enactment with erstwhile promises of ineligible actions from CEO Michael Sonnenshein. Sonnenshein said the institution would writer the SEC if its BTC ETF exertion was rejected again.

APPELLATE PHASE TIMELINE

APPELLATE PHASE TIMELINEDCG Sells Grayscale Shares At Discount

Grayscale’s genitor institution Digital Currency Group (DCG) started selling discounted shares from products issued by its crypto plus manager. DCG decided to offload assets from the $10 billion-strong portfolio to rise cash. The group’s lending and trading limb Genesis declared bankruptcy past twelvemonth and owes implicit $3 cardinal to creditors, Gemini included.

Filing with the SEC showed that DCG has chiefly focused connected selling assets from the company’s Ethereum-based merchandise nether the ticker ETHE. However, DCG mightiness determine to offload GBTC shares earlier the Genesis bankruptcy proceedings are over.

2 years ago

2 years ago

English (US)

English (US)