Grayscale has filed with the U.S. Securities and Exchange Commission to person its existing Chainlink Trust into a spot exchange-traded fund.

The projected ETF — if approved — would commercialized connected NYSE Arca nether the ticker GLNK, according to a Monday S-1 registration statement submitted to the regulator. This is 1 of 2 documents required to marque an ETF exertion official.

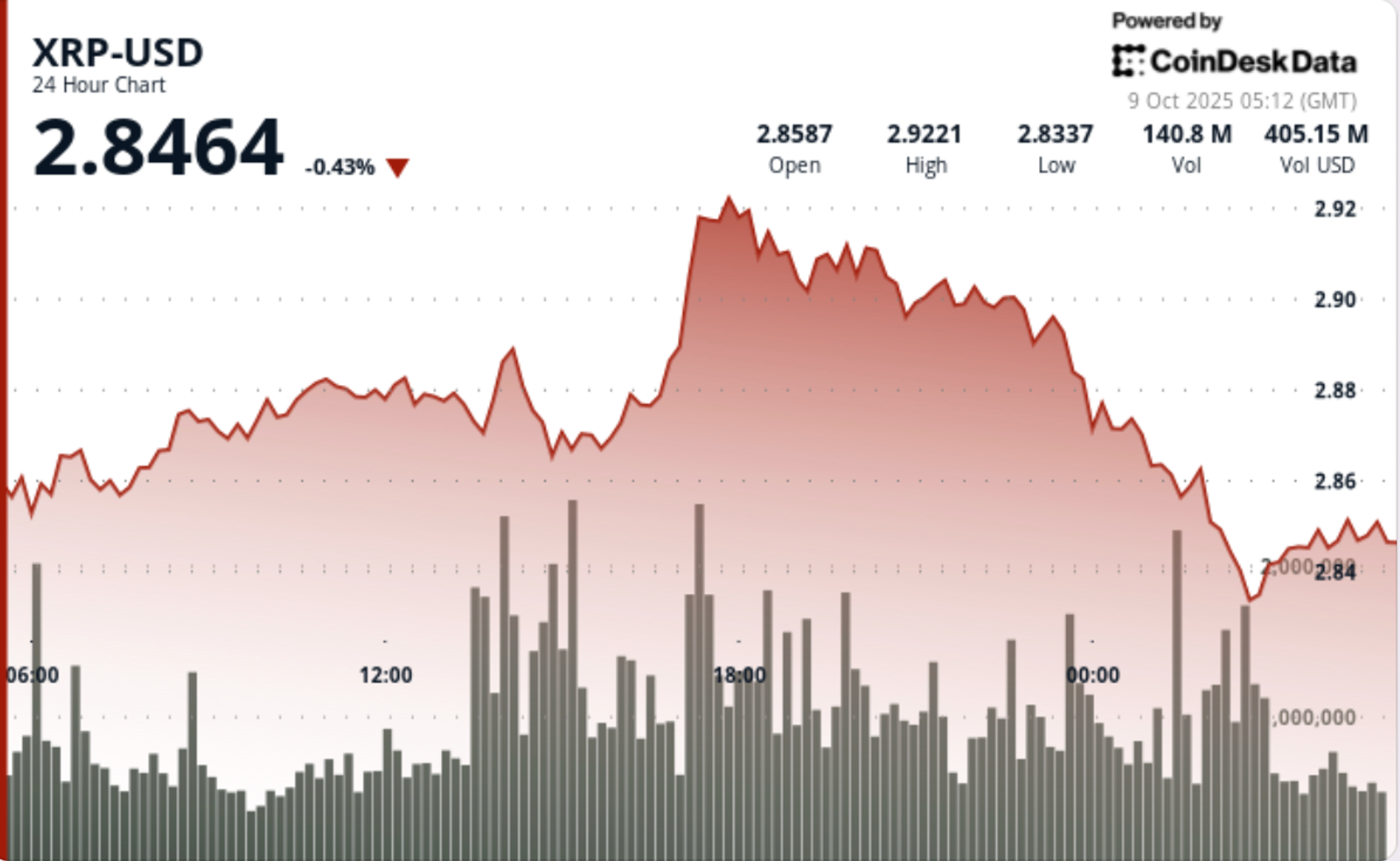

Chainlink's LINK token is higher by 3% implicit the past 24 hours alongside a wide rally successful altcions that's seen XRP adhd 2.6%, SOL 5% and DOGE 7.4%.

Grayscale's filing besides includes a imaginable staking feature. If permitted, the money could usage third-party staking providers portion keeping the LINK tokens successful custodian wallets. Staking rewards could beryllium retained by the fund, distributed to shareholders, oregon sold to screen expenses, depending connected aboriginal regulatory guidance.

The merchandise would person from the Grayscale Chainlink Trust, which has existed since February 2026 and presently manages astir $29 cardinal successful assets. Coinbase Custody Trust Company would service arsenic custodian.

Grayscale said the ETF would process stock creations and redemptions successful cash, mirroring the operation utilized by precocious approved spot bitcoin (BTC) and ethereum (ETH) ETFs. However, the filing allows for the anticipation of in-kind redemptions if aboriginal regulations permit.

The determination is portion of a broader effort by Grayscale to modulation aggregate single-asset crypto trusts into ETFs. Other pending proposals see funds tied to the terms of solana (SOL), dogecoin (DOGE), and XRP.

The SEC nether seat Paul Atkins has yet to o.k. oregon contradict immoderate of these pending applications but that hasn’t stopped firms from preparing products they judge could beryllium among the archetypal successful their plus class.

If approved, the GLNK ETF would springiness accepted investors regulated entree to Chainlink’s terms performance, which powers decentralized information feeds for blockchain applications and astute contracts. The summation of staking could besides supply an income constituent not yet disposable successful astir U.S. crypto ETFs.

For now, the marketplace seems to beryllium reacting optimistically, with LINK posting 1 of the day's stronger gains among large cryptocurrencies.

1 month ago

1 month ago

English (US)

English (US)