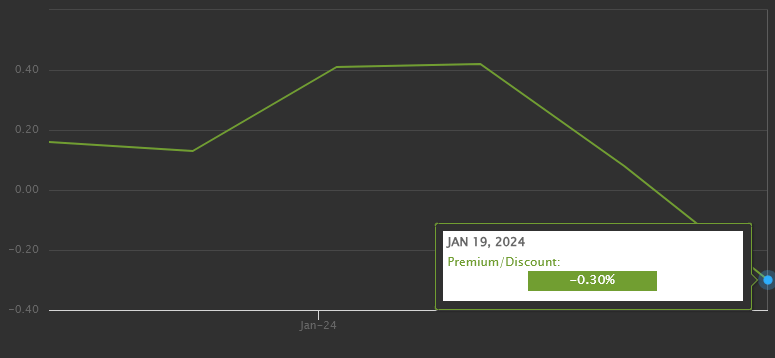

BlackRock’s iShares Bitcoin Trust recorded its archetypal discount to its Net Asset Value (NAV) connected Jan. 19, dropping to a discounted complaint of -0.30%, according to official BlackRock data.

BlackRock discount to NAV

BlackRock discount to NAV“The supra array and enactment graph contiguous accusation astir the differences betwixt the regular closing terms for shares of the money and the fund’s nett plus value. The closing prices are determined by the fund’s listing exchange.” – BlackRock

Conversely, aft a prolonged play astatine a dense discount, Grayscale’s (GBTC) NAV is present somewhat tighter astatine conscionable -0.27%, according to Y Charts data. GBTC saw a staggering 48% discount to NAV connected Dec. 22. However, arsenic anticipation of its conversion to a spot, Bitcoin ETF rose, the discount closed, reaching conscionable -1.55% connected the time it was converted. The discount has continued to adjacent and has surpassed adjacent immoderate of the ‘Newborn Nine’ Bitcoin ETFs, specified arsenic IBIT.

In its archetypal week, the iShares Bitcoin Trust experienced a varied NAV per share, opening astatine $26.59 and seeing a alteration to $23.87 by Jan. 19. The trust’s outstanding shares showed a important summation from 400,000 to implicit 50 cardinal wrong the aforesaid period.

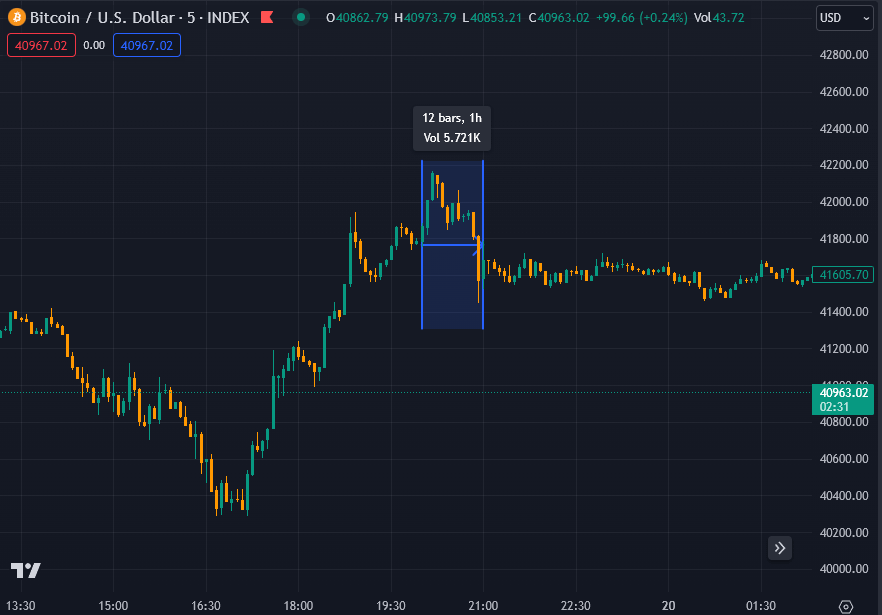

The NAV premium/discount fluctuated modestly, signaling a premium of 0.16% on motorboat day, peaking astatine 0.42% by Jan. 17, earlier declining to a discount. This alteration indicates the investors’ valuation of the shares comparative to the underlying Bitcoin assets held by the trust. A premium suggests shares are valued higher than the NAV, portion a discount indicates a little valuation. The reference rate for Bitcoin utilized was $41,898, calculated betwixt 8 p.m. and 9 p.m. GMT (3 p.m. – 4 p.m. EST), arsenic highlighted successful the illustration below.

CF Benchmarks Index BRRNY

CF Benchmarks Index BRRNYThe underlying Bitcoin terms has declined toward the intelligence enactment of $40,000, trading astatine $40,840 arsenic of property time, portion IBIT shares are trading astatine $23.39 pre-market aft closing astatine $23.80 connected Friday, Jan. 19.

Therefore, IBIT shares person declined 1.72% since Friday’s trading session. In contrast, the underlying asset, Bitcoin, volition person fallen astir 2.5% if it does not retrieve earlier the notation complaint (BRRNY) is calculated aboriginal today. Should IBIT shares commercialized successful enactment with Bitcoin passim Jan. 22, it volition apt reverse the discount and emergence to a premium perchance arsenic precocious arsenic 0.7% based connected existent calculations. However, with the superior marketplace not opening for respective hours, IBIT whitethorn adjacent this spread during authoritative trading hours.

Given the clip lag successful reporting ETF data, the interaction of the reported NAV is limited. In its prospectus, BlackRock said it would people an intra-day indicative nav (IIV). Still, this information is not published connected its authoritative website but should beryllium disposable nether IBIT.IIV done Nasdaq trading terminals.

Since its launch, the Assets Under Management (AUM) of the iShares Bitcoin Trust person reached $1,346,912,907.59, with 33,430 BTC nether management, emphasizing the standard astatine which the spot is operating and the level of concern that it has attracted successful a abbreviated period. Tied with the summation successful outstanding shares, the wide wellness of the spot suggests a increasing capitalist involvement arsenic the fig of shares is much than tenfold.

The station Grayscale NAV flips BlackRock arsenic IBIT records archetypal discount to Bitcoin since launch appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)