The motorboat of spot Ethereum ETFs has yet to unrecorded up to the market’s initial optimism, arsenic reflected successful their show implicit the past fewer weeks.

The Ethereum ETFs’ full on-chain holdings presently basal astatine astir 2.81 cardinal ETH, valued astatine astir $7.33 billion, which accounts for astir 2.3% of Ethereum’s full supply.

Despite these important holdings, the nett flows since motorboat person been negative, with a full outflow of 136,700 ETH.

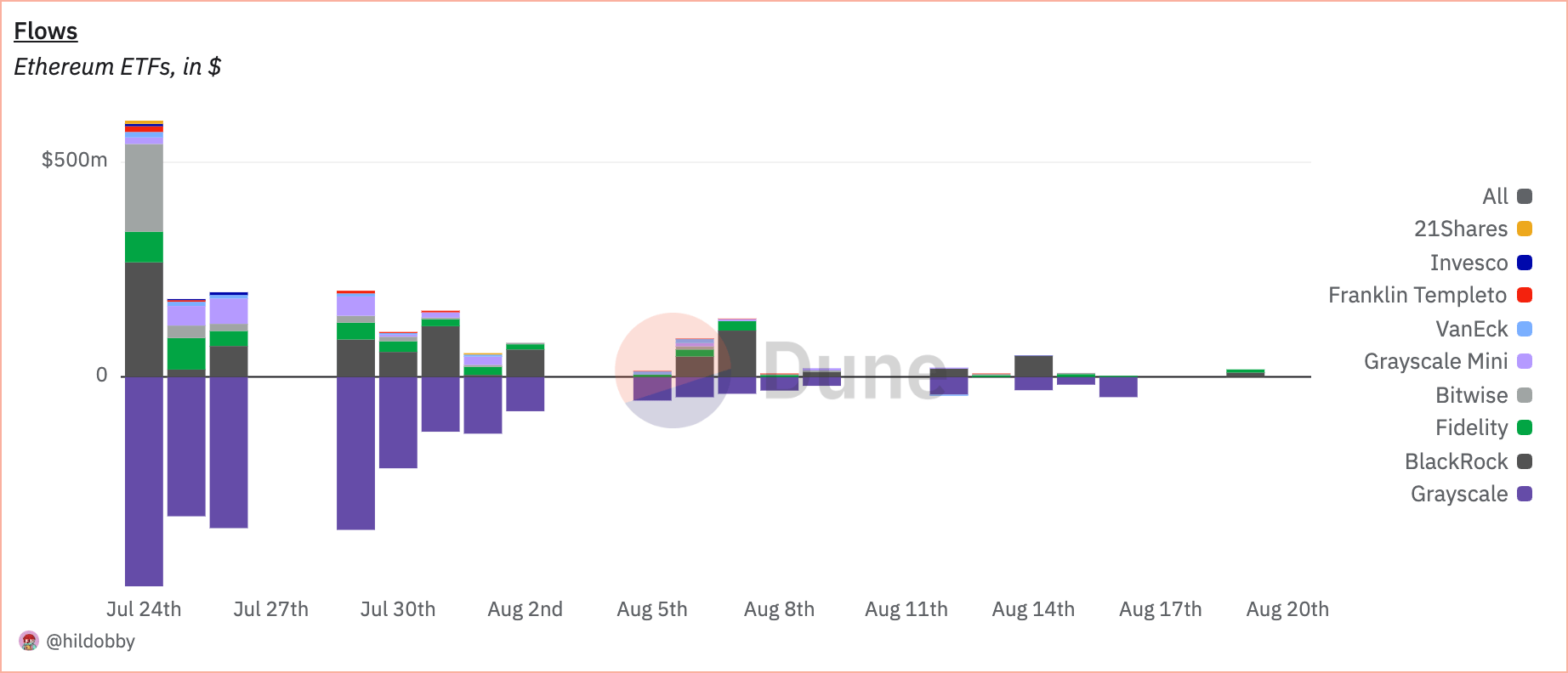

Graph showing spot Ethereum ETF flows from July 24 to Aug. 19, 2024 (Source: Dune Analytics)

Graph showing spot Ethereum ETF flows from July 24 to Aug. 19, 2024 (Source: Dune Analytics)The outflows are chiefly attributable to Grayscale’s ETHE, which recorded a withdrawal of $487.88 cardinal connected the archetypal trading time alone. Other Ethereum ETFs person seen accordant inflows, but these person not been capable to offset the resistance from ETHE.

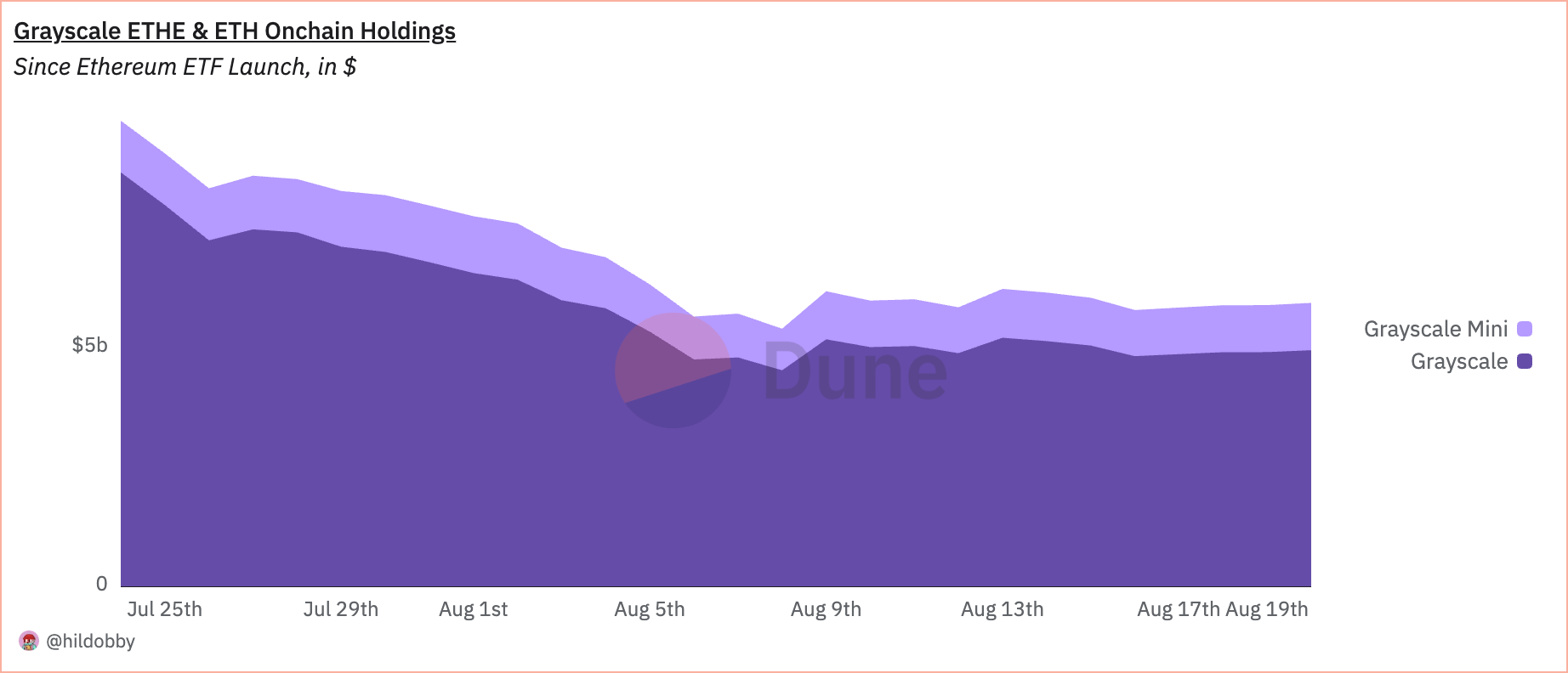

Graph showing Grayscale’s ETHE and ETH holdings from July 24 to Aug. 19, 2024 (Source: Dune Analytics)

Graph showing Grayscale’s ETHE and ETH holdings from July 24 to Aug. 19, 2024 (Source: Dune Analytics)The market’s absorption to these outflows has been reflected successful Ethereum’s price, which has struggled to support momentum post-launch. After an archetypal emergence successful anticipation of the ETF launches, Ethereum’s terms dropped significantly, hitting a debased of $2,338 connected Aug. 7.

Although determination has been immoderate betterment since then, with prices hovering astir $2,600, the wide sentiment remains cautious. The broader marketplace downturn has compounded this uncertainty, starring to a deficiency of wide upward momentum for Ethereum.

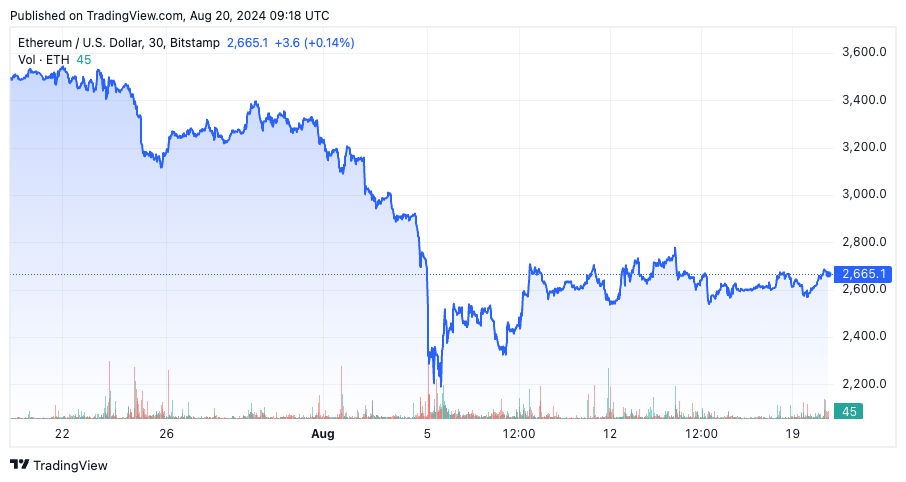

Graph showing the terms of Ethereum from July 20 to Aug. 20, 2024 (Source: CryptoSlate ETH)

Graph showing the terms of Ethereum from July 20 to Aug. 20, 2024 (Source: CryptoSlate ETH)Adding to the complexity, the Ethereum futures marketplace has shown a marked summation successful leverage ratios, signaling heightened risk-taking among traders. This spike successful leverage suggests that portion immoderate investors are betting connected short-term terms movements, the broader sentiment remains volatile. The market’s absorption to these leveraged positions could further exacerbate terms fluctuations, peculiarly if antagonistic sentiment continues to dominate.

Despite these challenges, determination is inactive a important organization involvement successful Ethereum-based fiscal products. BlackRock’s iShares Ethereum Trust (ETHA) has consistently attracted immoderate of the highest inflows among Ethereum ETFs, signaling that not each players are bearish connected Ethereum’s semipermanent prospects.

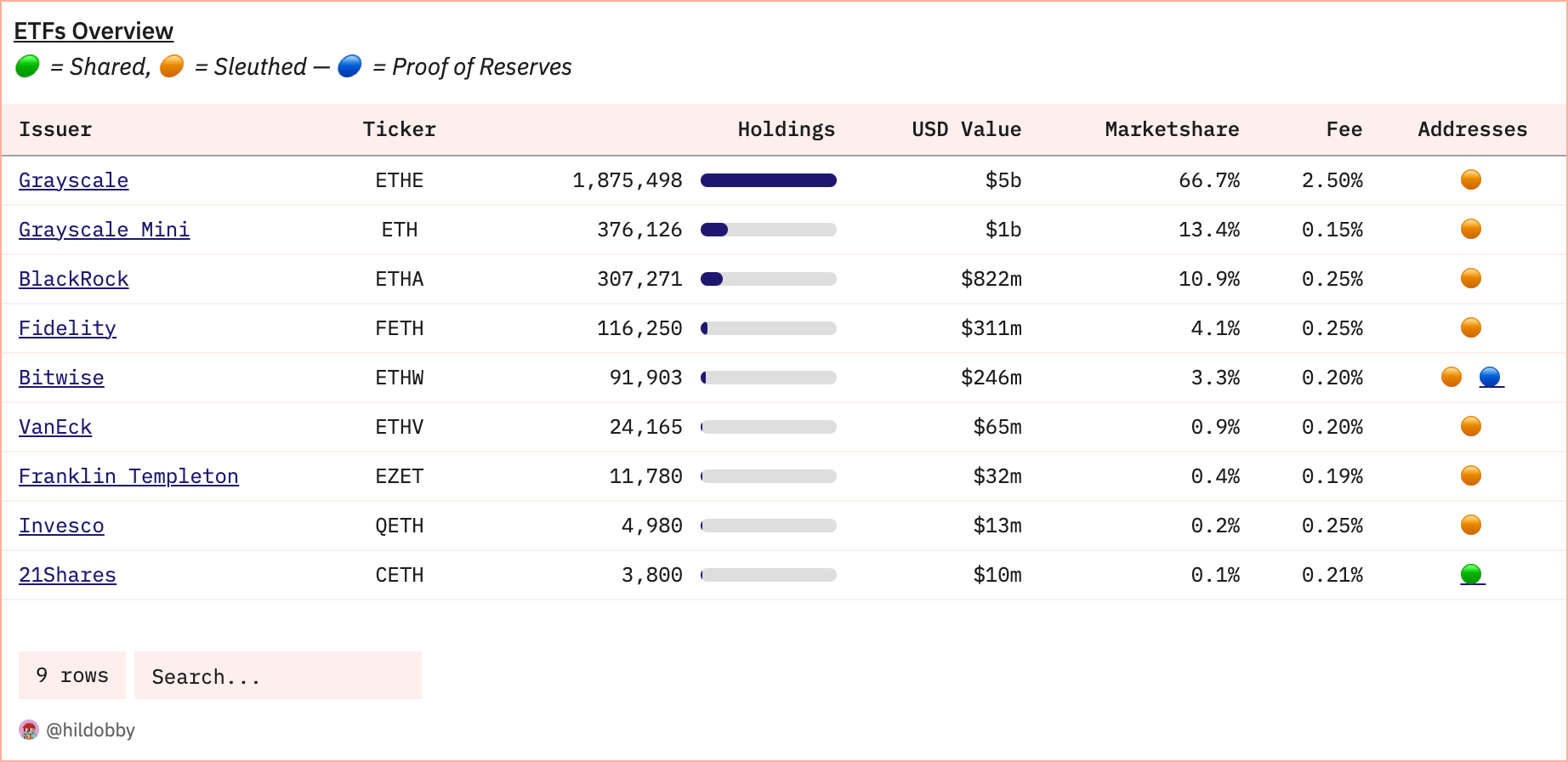

Table showing the full ETH holdings and marketplace stock of spot Ethereum ETFs connected Aug. 19, 2024 (Source: Dune Analytics)

Table showing the full ETH holdings and marketplace stock of spot Ethereum ETFs connected Aug. 19, 2024 (Source: Dune Analytics)Moreover, the wide marketplace for Ethereum ETFs has shown immoderate affirmative movement, with occasional days of nett inflows, peculiarly arsenic outflows from ETHE person begun to slow. This has led immoderate analysts to speculate that the worst of the outflows whitethorn beryllium over, perchance mounting the signifier for a betterment successful some ETF flows and Ethereum’s price.

The existent authorities of Ethereum ETFs shows that the marketplace is inactive uncovering its footing amid broader volatility and circumstantial challenges related to Grayscale’s ETHE.

While the archetypal show has been underwhelming compared to spot Bitcoin ETFs, the slowing outflows from ETHE and continued organization involvement suggest that determination whitethorn beryllium country for optimism successful the mean to agelong term.

However, for now, Ethereum and its ETFs stay successful a precarious position, with its aboriginal show apt tied intimately to broader marketplace trends and the actions of large organization players.

The station Grayscale outflows overshadow Ethereum ETF inflows appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)